Content

- Step 3: Track Your Spending In 3 Budget Categories Or Less + Track Your Net Income

- Loan For Small Business

- Budgeting Methods

- Budget Categories: How To Optimize Your Family Budget And Cut Your Expenses As Much As Possible

- How Personal Budget Categories Can Help You Manage Your Expenses

- Detailed List Of Budget Categories

- Liquid Net Worth: Your Key To Staying Out Of Debt

Don’t worry; budgeting isn’t really that difficult once you get started. While there will be a little work required upfront, once you’ve built your budget, it’s just a matter of tracking than anything else.Make sure you think of the bigger financial picture; that may mean two-stepping between savings and debt repayment to accomplish your most pressing goals. Tracking fixed expenses like your mortgage payment just clutters your budget . It becomes a distraction to the information that will ultimately help you spend less money and save more of it.The first place to start when outlining your monthly budget is your income. Other categories, like debt, child care, or tuition, can be added in depending on if these expenses apply to you. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month.It would include all discretionary spending, anything you could cancel, or places you could spend less money if you wanted to. Your income will likely be the easier of the two broad categories to compile.

Step 3: Track Your Spending In 3 Budget Categories Or Less + Track Your Net Income

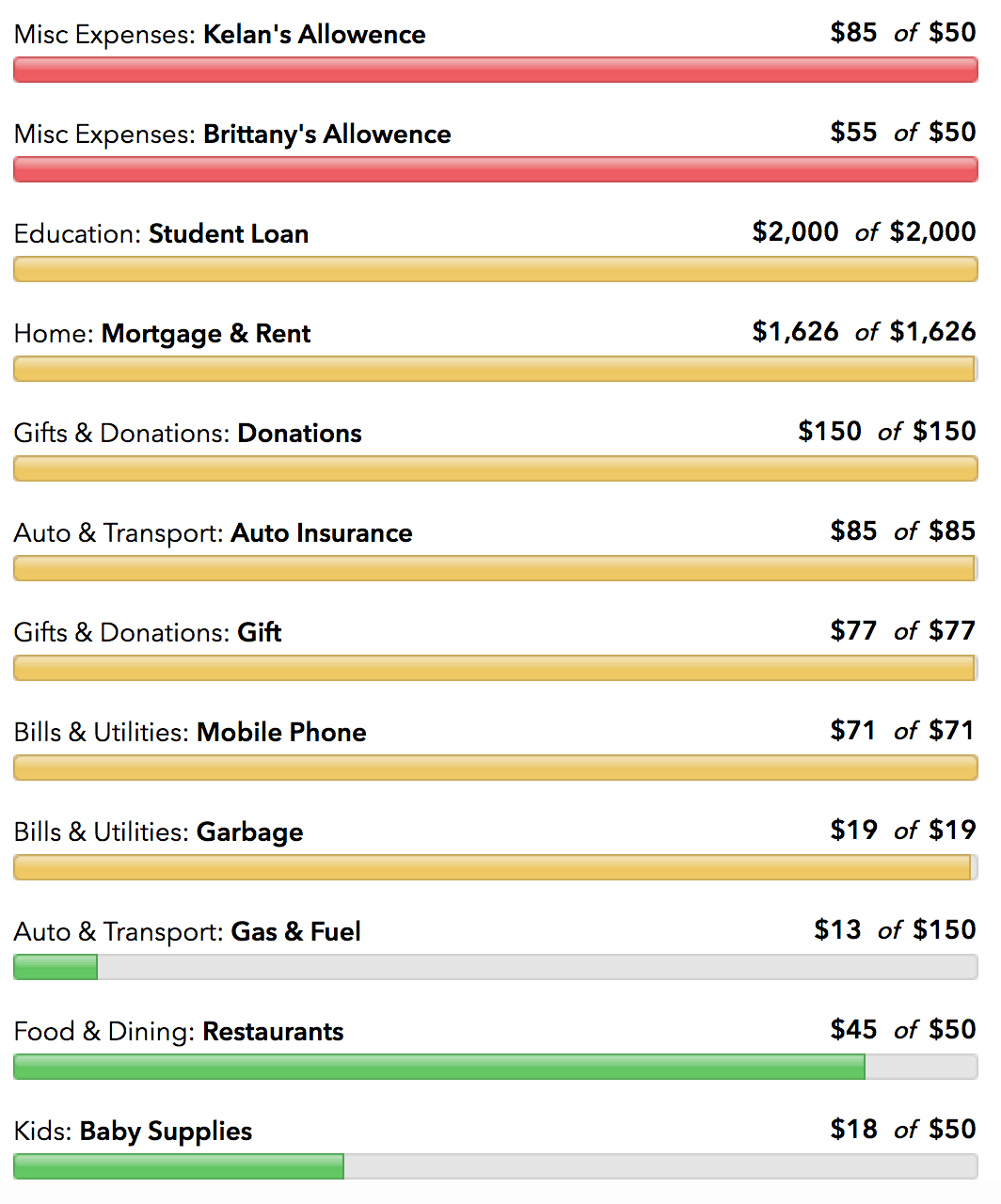

We recommend breaking your insurance costs down into their monthly amount, so you make sure you allocate enough. For many, debt is another large monthly hit to the expense side of their budget. As with income, it’s important to break your debts down into individual loans and their minimum monthly payments, so you know exactly where you stand with each. We’ve broken things down into income and expenses, along with smaller categories within each and individual budget items to consider within each category. While budgeting isn’t that difficult, it can be tedious, and you can find yourself unpleasantly surprised if you haven’t accounted for all the different things that can take your money. You see, many people build a budget and allocate their money based on the major expenses and do well for a time. But if you’re hit with an unexpected expense you didn’t budget for, you could find yourself in financial trouble.Try to estimate the most you’d pay every month for each utility, so you’re not surprised by a higher than normal bill. One way of doing this is to take the average you paid for the past year and allocate that amount in your monthly budget.

- We’ll start with items that fall into this grey area and then move onto truly non-essential items.

- I have put together the ultimate list of budget categories so you can avoid this common mistake.

- Even if you keep track of your income and fixed expenses, a budget is still an important thing to have for a couple of reasons.

- Your small business budget isn’t set in stone—you need some flexibility to respond to changing market conditions and take advantage of unexpected opportunities.

- As long as what you’re mailing or shipping is business-related, you can deduct the cost of packaging supplies, postage, envelopes, and delivery services like FedEx or UPS.

- ELIMINATE items are not at all aligned with your values and priorities.

One person could own a home and a car, and the other could be splitting their rent with a roommate while walking to work everyday. Of course, if you’re one of those people who loves to see everything laid out, feel free to make your spreadsheet as detailed as you want. And if you try to follow a budget that isn’t realistic for your situation, all it does is make you fail and give up.Tawnya and co-blogger Sebastian have a wealth of knowledge and information about personal finance, retirement, student loans, credit cards, and many other financial topics. They teach people how to save money, make money, and understand money. The last of the major budgeting categories you need to be aware of is gifts. This is definitely a non-essential item, as well as an irregular item. If you have the disposable income in your budget to allocate funds to this category, you should set aside a little every month to buy gifts. These tend to be large-ticket items and can be quite the hit to the budget if you’re not prepared. You can either allocate a chunk of money each month to a generic maintenance/non-regular expenses category or start a sinking fund for each item that applies to you.

Loan For Small Business

If you have other types of income — perhaps you make money from side gigs — subtract anything that reduces it, such as taxes and business expenses. It is important to break out all of your income individually rather than just including a lump sum. Include your take home income after taxes, health insurance, etc. If you have an irregular income, list the least amount you expect to earn. Insurance is a cost of doing business for most small business owners. You can deduct the cost of general liability, professional liability, commercial property, commercial car insurance, and workers compensation insurance. If you offer health insurance to employees, you can deduct those premiums as well.

Fixed costs are easiest to budget for because they’re predictable and regular. The interest you pay on business loans and business credit cards is a deductible business expense as long as you took on the debt for a business purpose. One way to handle this category is to list all the essential birthdays/holidays and those you will need to get gifts for. You can then create a monthly gift fund allotment based on how much you want to spend for each holiday/birthday. You could also allot a set amount of money each month to this category and spend on gifts based on what’s in the fund.A 2019 survey by Charles Schwab found that 60% of American adults who follow a formal financial plan feel financially stable. Ryan Luke is a father of three, husband, financial coach, and full-time police lieutenant. His inspirational story about his struggle to make ends meet, to paying off his home in less than 10 years, has been featured on MarketWatch, Fox Business, MSN, and other media outlets. The numbers are far worse for budgets extending beyond the standard month-to-month format and tend to favor those who make more than the average income.An emergency fund is something that everyone should have and something everyone should allocate money to in their budget. However, because it isn’t necessary for monthly survival, we have included it with non-essential expenses. Housing expenses include your mortgage or rent but could also include HOA dues, property taxes , and home warranties. While there are plenty of other expenses that come with owning or renting, we’ll include those in other categories as irregular expenses. 60% of your budget should be your essential expenses, which includes food, housing expenses, bills, taxes and loan payments. While this might seem like an onerous restriction, it has the added benefit of preventing you from spending money that will be needed to carry you through the end of life. Variable expenses are recurring expenses that change depending on how many goods you produce or services you provide to customers.That means you are allocating all of your money towards something- and every last dollar is working towards your goals. To set a realistic budget for yourself, you’ll need your budget to include enough money for all the expenses you can reasonably expect to incur. You can deduct the expenses for a vehicle you use in your business. If the car or truck is used only for business, all expenses are deductible. If you use it for both business and personal trips, you can deduct only the business portion. Suppose you rent a designated office space, warehouse, or equipment for use in your business.

Budgeting Methods

The dues you pay to networking organizations, such as professional and trade organizations or your local chamber of commerce, are deductible business expenses. You’re in a great position — a really great position — if you’ve built an emergency fund, paid off toxic debt and are socking away 15% toward a retirement nest egg.

Here are the major healthcare and medical costs I could think of. Consider adding these categories to your budget to manage your costs. While many of these costs relate to your appearance, they can be very important to some budgeters.

Budget Categories: How To Optimize Your Family Budget And Cut Your Expenses As Much As Possible

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Government-imposed fines and penalties typically aren’t deductible, regardless of the amount.It would be better served building your net worth than spending it on something you don’t care about all that much. It’s helpful to start with a comprehensive list of budget categories to make sure you don’t miss anything. Finally, I’ll give you my bare minimum, 3 step budget system as a way to organize and track your spending that has proven to get my clients great results.No one likes paying for it, but you’re glad you have it when you need it. If you have any wiggle room in your budget, giving is a powerful way to budget your money.

Liquid Net Worth: Your Key To Staying Out Of Debt

The time and effort you put forth into building your initial budget can be time-consuming. However, once you build your personal budget, managing it regularly is going to be relatively easy. Of course, having to keep track of every single item you spend money on may not sound exciting. Keep in mind that the exact way you categorize your budget using this approach will depend on your lifestyle.That said, the largest chunks of cash will likely be towards the things you need to survive or those necessary to keep making money. Essential expenses that center on your shelter, nutrition, transportation, and health are vital to maintaining a stable life and should take up a significant portion of your budget. Picking the best budgeting method for you and your family will depend on your financial situation and your goals for the future.