Content

- What Is Responsibility Accounting ?

- Type 2: Revenue Center

- Meaning And Definition Of Responsibility Accounting:

- Requisites Of Effective Responsibility Accounting

- Software Features

- Assigning Cost And Revenue To An Individual

The responsibility accounting system is based on the idea that proper management should take place as closely to the departments as possible. The officer and executive level should not be in charge of the day-to-day operations of the individual departments. This would be inefficient and not cost effective because the executives don’t have first hand experience dealing with the problems of each department. Examples include branches operating in different geographic locations. The performance of profit centers are evaluated by measuring segment income . As is evident from the above description, the notion of controllability is prime in a system of responsibility accounting. A responsibility centre is accountable for controllable factors only.

What is the most important for responsibility accounting?

One of the most important phases of responsibility accounting is establishing standard costs and evaluating performance by comparing actual costs with the standard costs.Suppose a company is unable to identify and share the triggers and variances to the manager timely. Delayed sharing or half-cooked figures will create more issues than it may solve. Duty of care is a fiduciary responsibility that requires company directors to make decisions in good faith and in a reasonably prudent manner. All accountants must perform their duties following all applicable principles, standards, and laws.

What Is Responsibility Accounting ?

Subordinates sometimes dislike control because they take them as restraints. The best responsibility accounting system enlightens employees about the positive side of control. Instead it is to evaluate the performance and provide feedback so that future operations can be improved’. Goals and objectives are achieved through people and, hence, responsibility accounting system should motivate people. This unit is only responsible for generating revenues, and not any other business function. The sales and marketing department are an example of a revenue center. Accountant responsibility varies slightly based on the accountant’s relationship with the tax filer or business in question.

- We can say every department in a company gets a report that includes its monthly budget, as well as the actual amount for the most recent month.

- Periodically, the top-level reviews the performance of the lower-level management.

- As your business adds employees, it becomes increasingly challenging to track how each employee is performing unless they’re held to a standard.

- Individuals perform various tasks that frequently change, and work on multiple teams with different team-based tasks and supervisors.

- This would be inefficient and not cost effective because the executives don’t have first hand experience dealing with the problems of each department.

The women’s clothing, men’s shoes, and home furnishings sections are profit centers with their own business budgets, expenses, and revenues. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money.It has extensive reporting functions, multi-user plans and an intuitive interface. Since it’s improbable that the leasing manager has no role in some part of the hiring process, you can’t separate the leasing manager’s sales responsibilities from the costs he or she manages. Each report will look like an income statement that breaks down business profits by pizzaiolo. Let’s implement a responsibility accounting system at Kimberly’s Pizza Palace, which employs two pizzaiolos and two cashiers. Large organizations have too much going on for the C-suite to follow each employee closely.

Type 2: Revenue Center

A leasing office incurs many costs, including the salaries and commissions for leasing agents. If you can’t decide whether a certain area of your business is a profit center, ask whether the department can fill out its own profit and loss statement. If there’s only one manager responsible for these goods, you can still benefit from thinking of your business as separate departments. You can maximize profitability by gleaning what types of inventory are earning the most. Even if you can count your employees on your own 10 fingers, there’s still value in using responsibility accounting. On small teams, each employee has a significant role to play in the success of your company.An accountant’s responsibility may vary depending on the industry and type of accounting, auditing, or tax preparation being performed. QuickBooks Online is the browser-based version of the popular desktop accounting application.The difference in controllable and uncontrollable costs may only be in relation to a particular person or level of management. For example, if Mr. A, the manager of a department, prepares the cost budget of his department, then he will be made responsible for keeping the budgets under control. A will be supplied with full information of costs incurred by his department. In case the costs are more than the budgeted costs, then A will try to find out reasons and take necessary corrective measures. A will be personally responsible for the performance of his department. Fixing or assigning responsibility goes with a clearly defined organizational structure.Timely action is taken to take necessary corrective measures so that the work does not suffer in future. The directions of the top level management are communicated to the concerned responsibility centre so that corrective measures are initiated at the earliest. If the actual performance of a department is less than the standard set, then the variances are conveyed to the top management. The names of those persons who were responsible for that performance are also conveyed so that responsibility may be fixed.

Meaning And Definition Of Responsibility Accounting:

Responsibility accounting cuts down on executives’ oversight time and keeps their eyes on the business’s long-term strategy. Responsibility centers make you look at your business in a new way. By creating artificial silos within your business, you glean new information about the performance of specific aspects of your business. Under this approach, a business owner pays special attention to areas of the business that are underperforming or overperforming. Responsibility centers are created until every revenue and expense on your profit and loss statement has been assigned to an employee.Activity-based responsibility accounting avoids the after-the-fact rationalizations, finger pointing, gamesmanship, defensive actions, and myopic behavior produced by traditional responsibility accounting. Using the new forms of activity accounting and control offered by ABC, managers can learn about the interrelationships and interdependences between activities, and change management’s role in the organization. However, for effective control, a large firm is, usually, divided into meaningful segments, departments or divisions. These sub- units or divisions of organisation are called responsibility centres. A responsibility centre is under the control of an individual who is responsible for the control of activities of that sub-unit of the organisation. It is a unit in a company that has control over the cost only, such as the production department. The cost center does not exercise control over other functions, such as revenues or investments.

From there, you can decide how many hours each pizzaiolo works and what to pay them. Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Accounting AccountEdge Pro AccountEdge Pro has all the accounting features a growing business needs, combining the reliability of a desktop application with the flexibility of a mobile app for those needing on-the-go access.

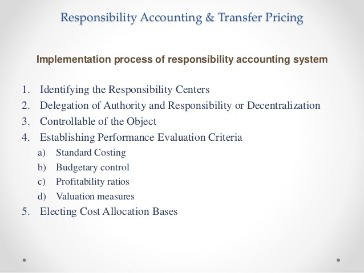

Requisites Of Effective Responsibility Accounting

Responsibility accounting is different from cost accounting in the sense that the future lays emphasis on cost control whereas the latter lays emphasis on cost ascertainment. Exhibit 3 shows the major differences between traditional responsibility accounting and the activity-based approach that recognizes the need to manage interdependence. Interdependence is defined as “the integration of activities across functional and departmental lines”.The purpose of all these steps is to assign responsibility to different individuals so that the performance is improved. In case the performance is not up to their targets set, then responsibility may be fixed for it.The end goal is that employees are only measured against results they can control, and each business function has a manager who can answer for its performance. Responsibility accounting creates a structure that ties an employee to the performance of every business function. For effective implementation of responsibility accounting, the following must be met.Hence, for the successful implementation of responsibility accounting, clarity of organization structure is very crucial. Similarly, a company must develop this accounting system to be in-line with the organization structure. Keep in mind; lower-level department managers don’t have full control over all expenses and costs in their area. Typically the RAS only allows department heads the ability to control and allocate controllable costs—not all costs. However, they do have to record all costs and report them in the system.

What does responsibility accounting mean and why is it used?

Definition: A responsibility accounting system is an accounting program that gathers and provides information for management to evaluate how well department managers are performing. In other words, it’s a system that is used to gauge how well departments are managing expenses and controlling costs.Independent accountants with some clients see confidential information, ranging from personal Social Security numbers to business sales data, and must observe accountant-client privilege. They cannot share private personal or business data with competitors or others. If nothing else, bringing a responsibility accounting system to your business adds a level of structure to your company and clears up expectations for each employee. Investment center’s have the highest level of autonomy as they can determine the level of inputs, outputs and additional investments. Managers are generally evaluated based on cost control and reduction as they have no delegation to increase sales generation. Relevant and up to the minutes information is made available which can be used to estimate future costs and or revenues and to fix up standards for departmental budgets.

Software Features

Further, responsibility accounting system must be so designed as to suit the organisation structure of the organisation. It must be founded upon the existing authority- responsibility relationships in the organisation.

A point to note is that a manager responsible for any cost center is only responsible for the controllable costs, and not uncontrollable costs. Typical examples of responsibility centers are the profit center, cost center and the investment center. However, the general guideline is that “the unit of the organisation should be separable and identifiable for operating purposes and its performance measurement possible”.Responsibility accounting will certainly act as control device and it will help in improving the overall performance of the business. This accounting system only works with controllable costs but does nothing about uncontrollable costs. Data on the target, as well as the actual performance, is fundamental to evaluate the performance of a responsibility center. Effective implementation depends on the accuracy of information relating to inputs and outputs.If the person has authority over both the acquisition and use of the services, he should be charged with the cost of these services. In the absence of an effective reporting system, this accounting method may fail to give accurate results. If a company is unable to communicate the goals and responsibility to the person properly, then the system may fail to give accurate results.

Assigning Cost And Revenue To An Individual

Effective responsibility accounting requires both planned and actual financial information. It is not only the historical cost and revenue data but also the planned future data which is essential for the implementation of responsibility accounting system.