Content

- Posting In General Ledger

- Free Debits And Credits Cheat Sheet

- Step 4: Unadjusted Trial Balance

- Step 8: Closing The Books

- Adjust Entries

- The Accounting Period

- Step 2: Prepare Business Document

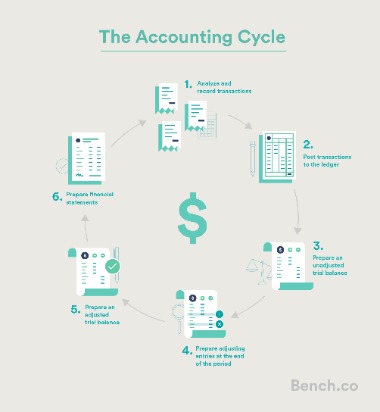

Debits are used to indicate money spent and credits are used for money that is received. Is to keep track of the full accounting cycle from start to finish. The cycle repeats itself every fiscal year as long as a company remains in business. Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations.

What is cost accounting cycle?

The cost accounting cycle is a process performed during the accounting period in recording data, classifying, determining total cost, determining product cost, determining selling price, controlling cost and decision making.Cynthia needs to ensure that the debits and credits in the general ledger are balanced. For every debit entry, there should be a credit entry that keeps the books in balance. Cynthia works as an accountant for a medium-sized company that manufactures toys. Cynthia’s job is to process the financial information of her company and prepare financial statements. These financial statements will be reviewed by management to help make business decisions. In order to perform her work, Cynthia follows a series of steps for the collection, processing and reporting of financial transactions called the accounting cycle.

Posting In General Ledger

The accounts are closed out to make sure that revenue and expenses for the past accounting period are not mixed with the revenue and expenses for the current period. The net balances from the closed accounts are transferred to the owners’ equity account. The only accounts with balances that are carried forward to the next accounting period are the asset, liability and owners’ equity accounts. Closing entries are the entries that are completed after the financial statements have been prepared. The purpose of these entries is to close out temporary items by transferring income and expense items to the balance sheet. The general ledger is a set of numbered records that holds information pertaining to all financial transactions within a business.

- Following are the major steps involved in the accounting cycle.

- So it acts as a stepping stone or base for financial statements.

- It is important that the balance of assets is aligning with the balance of liabilities.

- This stage assures that all existing credits and debits balance in their respective accounts.

- One of the most commonly referenced accounts in the general ledger is the cash account that details how much cash is available.

Try it now It only takes a few minutes to setup and you can cancel any time. Recording reversing entries in order to cancel temporary adjusting entries as applicable. If you want more tips on how to manage your cash flow, thenclick here to access our 25 Ways to Improve Cash Flow whitepaper. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

Free Debits And Credits Cheat Sheet

An accrued expense is recognized on the books before it has been billed or paid. Accounting cycle involves a systematic process which is as follows.

In the end, the accountant closes accounts related to revenue and expenses. Preparation of the financial statements and recording, analyzing and summarizing of all the transactions comes under the purview of closing the books. They reflect the position specific to the accounting year. The concerned person makes the accounts nil for the next accounting year. Further, a new accounting year will start and the accountant repeats all the steps related to the accounting cycle mentioned above.

Step 4: Unadjusted Trial Balance

Many companies will use point of sale technology linked with their books to record sales transactions. Beyond sales, there are also expenses that can come in many varieties.The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company’s books. The accounting cycle is used comprehensively through one full reporting period. Thus, staying organized throughout the process’s time frame can be a key element that helps to maintain overall efficiency. Most companies seek to analyze their performance on a monthly basis, though some may focus more heavily on quarterly or annual results. This trial balance should contain zero balances for all temporary accounts.Show bioShawn has a masters of public administration, JD, and a BA in political science. As a member, you’ll also get unlimited access to over 84,000 lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed.

Step 8: Closing The Books

Learn the role of each of these steps and discover examples of this process. The very first step in the accounting cycle is to gather all the documents that are related to financial transactions of the organization.This part of the qualitative analysis assures that a transaction is important to the accountant and her work. After the financials are prepared, the next period opens and the cycle starts over again. Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received. Depending on each company’s system, more or less technical automation may be utilized. Typically, bookkeeping will involve some technical support, but a bookkeeper may be required to intervene in the accounting cycle at various points.

Adjust Entries

This will include additional information which was not otherwise in the statements. John loves to place as much useful information as possible in his statements. Create a new trial balance, after you adjust the entries for accrued and deferred entries.Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement. The final step in the accounting cycle is for Cynthia to prepare a post-closing trial balance. Cynthia will make sure that all revenue and expense accounts have been closed and that the balance sheet accounts consisting of assets, liabilities and owners’ equity are in balance. An accounting cycle typically includes all the accounts, journal entries, T Accounts, debits and credits of the business that correspond to the particular accounting period.

An accounting period is the duration during which an accounting cycle commences and completes; in other words, it is the specific period of time in which financial statements are prepared. Accounting periods vary widely from company to company, and are influenced by several different factors. Internal financial reports typically consider monthly accounting periods, while some businesses prefer to have four-week accounting periods, or 13 accounting periods per year.

The Accounting Period

There are major three activities that come under the preparation of a cash flow statement namely operating activities, financial activities, and investing activities. After doing the journal entries of the transaction, the accountant posts entries to individual general ledger where one can summaries all the transactions related to that account. Thus it is a holistic approach beginning with when the transaction takes place, recording it in relevant documents and closing the accounts with the end of the accounting year.Such transactions may also be posted directly to the general ledger. The required steps in the accounting cycle are listed in random order below. The financial statements generated through the accounting cycle will be used by management to determine the financial position of the business and as a tool for decision making. Once all the entries have been recorded in the general journal, Cynthia will then post the transactions to the general ledger, which is organized by account.

Step 2: Prepare Business Document

These documents, called source documents, are things like receipts, bank statements, checks, and purchase orders. They are the items that describe what a transaction was for. Here, financial statements are created from the adjusted trial balance. The eight-step accounting cycle is important to know for all types of bookkeepers. It breaks down the entire process of a bookkeeper’s responsibilities into eight basic steps. Many of these steps are often automated through accounting software and technology programs.However, the annual period is by far, the most common type of accounting period. Accounting periods are crucial for investors since they enable them to compare the results of a company over successive time periods. However, today these steps are occurring with electronic speed and accuracy within sophisticated yet inexpensive accounting software.Point of sale technology can help to combine steps one and two, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind, accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale. Thus, the accounting cycle is a systematic process acting as a base of all the financial statements. It becomes very important to maintain the it on a regular basis, which starts with identifying the transaction and ends with closing the books.