Content

- Prepare A Depreciation Journal Entry

- Free Accounting Courses

- Disposition Of Depreciable Assets

- Find The Depreciable Value

- What Is Depreciation?

If you prefer to opt out, you can alternatively choose to refuse consent. Please note that some information might still be retained by your browser as it’s required for the site to function. For freelancers and SMEs in the UK & Ireland, Debitoor adheres to all UK & Irish invoicing and accounting requirements and is approved by UK & Irish accountants. Salvage value (also often referred to as ‘scrap value’ or ‘residual value’) is the value of an asset at the end of its useful life.

What is salvage value quizlet?

Salvage value is an estimate of an asset’s value at the end of its benefit period.After all, the purchase price or initial cost of the asset will determine how much is depreciated each year. It represents the depreciation expense evenly over the estimated full life of a fixed asset. You can use a basic straight-line depreciation formula to calculate this, too. The IRS requires you to depreciate most property put into service after 1986 using the modified accelerated cost recovery system, though you can elect to exclude certain properties from MACRS. This system determines the depreciable lifetime of your property and offers its own set of depreciation methods. Accountants use several methods to depreciate assets, including the straight-line basis, declining balance method, and units of production method.When businesses buy fixed assets — machinery, cars, or other equipment that lasts more than one year — you need to consider its salvage value, also called its residual value. Depreciated cost is the original cost of a fixed asset less accumulated depreciation; this is the net book value of the asset. With accounting and invoicing software like Debitoor, entering an asset and applying depreciation is simple. When you designate an expense as an asset, the software automatically applied straight-line depreciation based on the purchase value, allowing you to determine the eventual salvage value. Because the salvage value is based on the worth of the product at the end of the period it is used for your business, tracking the depreciation of the value begins with the purchase price. Suppose a $90,000 delivery truck with a net book value of $10,000 is exchanged for a new delivery truck. The company receives a $6,000 trade‐in allowance on the old truck and pays an additional $95,000 for the new truck, so a loss on exchange of $4,000 must be recognized.Say you own a chocolate business that bought an industrial refrigerator to store all of your sweet treats. You paid $10,000 for the fridge, $1,000 in sales tax, and $500 for installation. Once you’ve determined the asset’s salvage value, you’re ready to calculate depreciation. The company estimates that the computer’s useful life is 4 years. This means that the computer will be used by Company A for 4 years and then sold afterward. The company also estimates that they would be able to sell the computer at a salvage value of $200 at the end of 4 years.

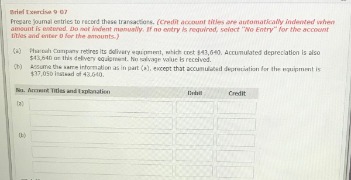

Prepare A Depreciation Journal Entry

If we assume the value to be zero, then there would be no chance of a reduction in the depreciation amount. This, in turn, would mean no chances of inflating profit due to depreciation.

- When this happens, a loss will eventually be recorded when the assets are eventually dispositioned at the end of their useful lives.

- The carrying value of an asset as it is being depreciated is its historical cost minus accumulated depreciation to date.

- The financial statements are key to both financial modeling and accounting.

- We may receive compensation from partners and advertisers whose products appear here.

- Both declining balance and DDB require a company to set an initial salvage value to determine the depreciable amount.

Therefore, they depreciate the total cost of the asset over the number of years for which the asset is in use in the business. Salvage value is an asset’s estimated worth when it’s no longer of use to your business. Say your carnival business owns an industrial cotton candy machine that costs you $1,000 new.

Free Accounting Courses

Gains on similar exchanges are handled differently from gains on dissimilar exchanges. On a similar exchange, gains are deferred and reduce the cost of the new asset.There have been several cases when people underestimate or overestimate salvage value to inflate or deflate their income and tax. Analysts and tax experts see this approach as more practical and conservative. Some assets are truly worthless when they’re no longer of use to your business.Most businesses opt for the straight-line method, which recognizes a uniform depreciation expense over the asset’s useful life. However, you may choose a depreciation method that roughly matches how the item loses value over time. You can use different methods to accelerate depreciation — that is, take larger deductions in the early years of ownership. The declining balance method can use different rates of depreciation, up to twice the rate as that provided by the straight-line method.If there’s no resale market for your asset, it likely has a zero salvage value. At the end of the accounting period — either a month, quarter, or year — record a depreciation journal entry. Be careful not to consider a similar asset’s asking price since, in most used-asset markets, things will sell below their asking price. If you’re unsure of your asset’s useful life for book purposes, you can’t go wrong following the useful lives laid out in the IRS Publication 946 Chapter Four.

We may receive compensation from partners and advertisers whose products appear here. Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. News Learn how the latest news and information from around the world can impact you and your business. Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy.

Disposition Of Depreciable Assets

Keeping track of the depreciation of your assets has a clear significance in your business finances. It is a crucial part of evaluating the value of your business, especially when you sell or write-off the asset as it is generally marked as a gain and has an impact on your tax filing. There are several different methods for tracking the depreciation of an asset. The most common method is known as ‘straight-line depreciation’. For example, electronics depreciate faster than other types of assets due to the rapid pace of advancements.It may lead to undervaluation or overvaluation of the equity of the company in the balance sheet. As per the IRS , a company must estimate a “reasonable” salvage value.” The value primarily depends on the number of years that the company plans to use and the way the company uses the asset. Salvage Value is the amount that a company expects to get at the end of the useful life of an asset. There are various terms for salvage value such as residual value, scrap value, and disposal value. Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team.For example, if a company sells an asset before the end of its useful life, a higher value can be justified. Another example of how salvage value is used when considering depreciation is when a company goes up for sale. The buyer will want to pay the lowest possible price for the company and will claim higher depreciation of the seller’s assets than the seller would. This is often heavily negotiated because, in industries like manufacturing, the provenance of their assets comprise a major part of their company’s top-line worth.

What is the total loss formula?

The total loss formula (TLF) is another common method for determining when a car is a total loss. It equals the fair market value of a vehicle minus its salvage value. If the cost of repairs exceeds the TLF outcome, your auto insurer can declare it a total loss.The $99,000 cost of the new truck equals the $12,000 trade‐in allowance plus the $89,000 cash payment minus the $2,000 gain. If the company exchanges its used truck for a forklift, receives a $6,000 trade‐in allowance, and pays $20,000 for the forklift, the loss on exchange is still $4,000. The cost of the new truck is $101,000 ($95,000 cash + $6,000 trade‐in allowance). If an asset is sold for cash, the amount of cash received is compared to the asset’s net book value to determine whether a gain or loss has occurred. Suppose the truck sells for $7,000 when its net book value is $10,000, resulting in a loss of $3,000.

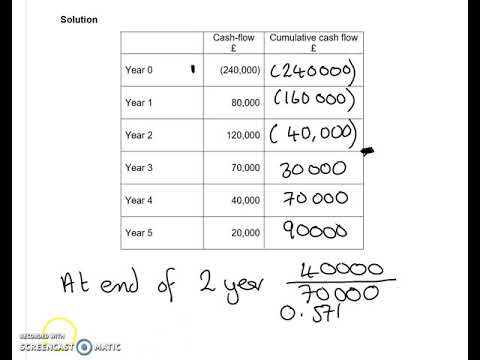

Find The Depreciable Value

The carrying value of an asset as it is being depreciated is its historical cost minus accumulated depreciation to date. Your company may purchase long-lived assets such as property, plant and equipment that you depreciate over their useful lives. Depreciation is how the Internal Revenue Service allows you to expense part of an asset’s cost over a number of years. Salvage value is an estimate of the residual amount you will receive when you dispose of the asset.

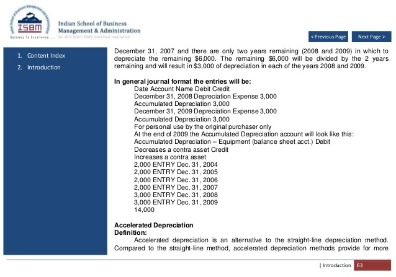

The straight-line depreciation method makes it easy for you to calculate the expense of any fixed asset in your business. With straight-line depreciation, you can reduce the value of a tangible asset. One of the first things you should do after purchasing a depreciable asset is to create a depreciation schedule.At this point, the company has all the information it needs to calculate each year’s depreciation. It equals total depreciation ($45,000) divided by useful life , or $3,000 per year. This is the most the company can claim as depreciation for tax and sale purposes. Regardless of the method used, the first step to calculating depreciation is subtracting an asset’s salvage value from its initial cost. Salvage value is the amount for which the asset can be sold at the end of its useful life.

For example, if a construction company can sell an inoperable crane for parts at a price of $5,000, that is the crane’s salvage value. If the same crane initially cost the company $50,000, then the total amount depreciated over its useful life is $45,000. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time. Note that the straight depreciation calculations should always start with 1. However, it costs another $100 to ship the copier to the office. Talking of a real-world example, a company by the name Waste Management, Inc did several frauds between 1992 and 1997 by misusing salvage value.Instead, simply depreciate the entire cost of the fixed asset over its useful life. Any proceeds from the eventual disposition of the asset would then be recorded as a gain. Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation. Retirement occurs when a depreciable asset is taken out of service and no salvage value is received for the asset. In addition to removing the asset’s cost and accumulated depreciation from the books, the asset’s net book value, if it has any, is written off as a loss.Companies take into consideration the matching principle when making assumptions for asset depreciation and salvage value. The matching principle is an accrual accounting concept that requires a company to recognize expense in the same period as the related revenues are earned. If a company expects that an asset will contribute to revenue for a long period of time, it will have a long, useful life.Salvage value is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. On the other hand, accountants and income tax regulations usually do not take salvage value into consideration.