Content

- How Are Accrued Expenses Accounted For?

- What Are Accrued Expenses? Definition And Examples

- What Does Accrued Expenses Mean?

- Examples Of Accrued Liabilities

- What Are Accrued Expenses In Accounting?

- How Accrued Expenses Work

- Types Of Accrued Expenses And Revenues

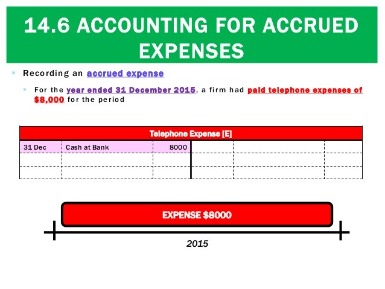

Accrual accounting requires revenues and expenses to be recorded in the accounting period that they are incurred. Accrued expenses are expenses a company accounts for when they happen, as opposed to when they are actually invoiced or paid for.

It is typically presented as a short-term asset, since most prepaid expenses will be consumed within a short period of time. He or she has been working all week, so you presently incur payroll costs; however, your accounts payable clerk receive wages until the following week after payroll processes. Accrued expenses are recorded under the accrual basis of accounting, therefore the transactions are recorded immediately at the time of happening. This reduces the chances of mistakes or errors to almost zero. Examples of accrued expenses include monthly costs of rent and utilities, employee wages, and certain products and services if you are using them but have not yet been billed for them. Accrued expenses, such as accounts payable, are costs your business has incurred for goods and services but for which you have not yet been billed. Because the bill has not arrived, no money has yet changed hands.Accrued expenses are only the estimate of the expenses, the real expense may vary from the accrued one which will arrive on the future date. The accrual concept presents a better picture of the profits generated during a given time frame. Accrued revenues are revenues earned in one accounting period but not received until another. The most common forms of accrued revenues recorded on financial statements are interest revenue and accounts receivable. Interest revenue is money earned from investments, while accounts receivable is money owed to a business for goods or services that haven’t been paid for yet.A balance sheet shows what a company owns (its “assets”) and owes (its “liabilities”) as of a particular date, along with its shareholders’ equity. Accounts payable , sometimes referred simply to as “payables,” are a company’s ongoing expenses that are typically short-term debts, which must be paid off in a specified period to avoid default. Accrued expenses are considered to be current liabilities because the payment is usually due within one year of the date of the transaction. Recording accrued liabilities lets you anticipate expenses in advance. The accrual method gives you an accurate picture of your business’s financial health. But, it can be hard to see the amount of cash you have on hand. So as you accrue liabilities, remember that that is money you’ll need to pay at a later date.If you use the accrual accounting method, you will have accounted for all those expenses before they are paid out. Accrual accounting is the most common method used by businesses. Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts. By contrast, imagine a business gets a $500 invoice for office supplies. When the AP department receives the invoice, it records a $500 credit in the accounts payable field and a $500 debit to office supply expense. As a result, if anyone looks at the balance in the accounts payable category, they will see the total amount the business owes all of its vendors and short-term lenders. The company then writes a check to pay the bill, so the accountant enters a $500 credit to the checking account and enters a debit for $500 in the accounts payable column.

How Are Accrued Expenses Accounted For?

Routable can help you automate your AP process, reduce manual data entry, and give you the flexibility to scale transactions in the future. Ensure that your accounting data is accurate, save time for your team, and make easy business payments a reality by requesting a demo. DateAccountNotesDebitCreditX/XX/XXXXAccrued LiabilityXCashXWhen you reverse the original entry to show that you paid the expense, you must also remove it from the balance sheet. And because you paid it, your income statement should show a decrease in cash. Would you like to learn more about accrued revenues and accrued expenses? Well, just follow me, and I will teach you a few more things that you may need to know. In the reporting period of March, the company should record its cash payment on March 25 for its utility bill.A liability is something a person or company owes, usually a sum of money. EisnerAmper’s Tax Guide can help you identify opportunities to minimize tax exposure, accomplish your financial goals and preserve your family’s wealth. Under this, all obligations of the company are clearly visible along with the dates clearly indicating the date at which the liability will be due. Interest on loan incurred during the month but installment has not fallen due. Credit $31,000 to “Wages Payable” (this would show up under “Short Term Liabilities” on the balance sheet). A local repairman comes in to assess the problem, and requests that the company order in a special replacement part from New York.This will allow the company to make better decisions on how to spend its money. You might be thinking that accrued liabilities sound a whole lot like accounts payable. Accrued expenses and accounts payable are similar, but not quite the same. Accrued expenses, sometimes called accrued liabilities, are costs incurred by the business without an invoice. Accrued expenses are accounted for more readily in the accrual accounting method than in the cash accounting method. Accrued expenses are costs you already have incurred but for which you have not yet paid or documented payment.

What Are Accrued Expenses? Definition And Examples

Accounts payable is generally used in respect of trading commodities whereas accrued expense is an umbrella terminology where any incurred but not paid expenses will be recognized and presented. Both are recorded in the balance sheet under the head current liabilities. Common examples of accrued expenses are regular costs such as rent, electricity, and wages.

Thus, if the amount of the office supplies were $500, the journal entry would be a debit of $500 to the office supplies expense account and a credit of $500 to the accrued expenses liability account. An accrued expense can be an estimate and differ from the supplier’s invoice that will arrive at a later date. Following the accrual method of accounting, expenses are recognized when they are incurred, not necessarily when they are paid. When getting familiar with your balance sheet, there are two easy to confuse yet very different liability accounts – accrued expenses and accounts payable. Accounts payable are tracked, invoiced payments to creditors that previously made credit-based sales to your company.This often is because the supplier’s invoices have not yet been received but includes other instances like payroll. They fall within the category of current liabilities, as they are often due within a year. These can be looked at as the opposite of a prepaid expense – expenses made prior to receiving services or items. Representing your obligation to pay for some good or service in the future, keeping accurate track of these can help you show a more accurate and future-conscious record.In order to figure out how much is an accrued expense for the first quarter of the year, we’ll need to divide the two-week payroll amount by 2. The total amount of accrued expense that will be reported for salaries payable is $18,900. We did that because only one week of the payroll was owed when the books closed for the quarter. On the balance day, the accrued expense of utility is treated as a current liability owed to the utility company, and an expense incurred by the company in February. Conversely, accounts payable should represent the exact amount of the total owed from all of the invoices received.There is time to make payment for the purchases of these goods. It helps the owners and other stakeholders to understand better, the performance and financial position of the business. It helps in correctly stating the company’s profit in absence of which income would have been overstated. This requirement is part of the federally mandated Generally Accepted Accounting Principles, known as GAAP, and it’s considered an important way to maintain ethical accounting practices. The utility is consumed in one month, and the bill is received in the next month. Goods and services have been consumed, but bills have not yet been received. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out.Until 31 July the company is not going to have the invoice which could be processed and is not going to pay the interest of $5,000 until 31 July. Salaries are not paid to employees until the end of the payment period. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa. Charlene Rhinehart is an expert in accounting, banking, investing, real estate, and personal finance. She is a CPA, CFE, Chair of the Illinois CPA Society Individual Tax Committee, and was recognized as one of Practice Ignition’s Top 50 women in accounting. GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today.

What Does Accrued Expenses Mean?

This journal entry records the rental costs for the month as well as the amount of month that Calvin owes his landlord at the end of the year. A company pays its employees’ salaries on the first day of the following month for services received in the prior month. So, employees that worked all of November will be paid in December.

- Then, at the start of the next accounting period, the entry will be reversed.

- Below, we go into a bit more detail describing each type of balance sheet item.

- If you use the accrual accounting method, you will have accounted for all those expenses before they are paid out.

- Realistically, the amount of an expense accrual is only an estimate, and so is likely to be somewhat different from the amount of the supplier invoice that arrives at a later date.

Your company gets the benefit of space, heat, and employee labor for up to a month before you receive an invoice or pay for them. If you are using an accrual method of accounting, you’ll record those expenses as you receive the benefits you’ll be paying for.

Examples Of Accrued Liabilities

“EisnerAmper” is the brand name under which EisnerAmper LLP and Eisner Advisory Group LLC provide professional services. Eisner Advisory Group LLC and its subsidiary entities are not licensed CPA firms. The entities falling under the EisnerAmper brand are independently owned and are not liable for the services provided by any other entity providing services under the EisnerAmper brand. Our use of the terms “our firm” and “we” and “us” and terms of similar import, denote the alternative practice structure conducted by EisnerAmper LLP and Eisner Advisory Group LLC. Jumbo Inc. borrowers a $5,00,000 loan on 1 March for business purpose from the bank. The loan agreement requires Jumbo Inc.to to repay the $5,00,000 loan on 31 July along with a $5,000 interest for the five months from March to July.An accrued expense, also known as accrued liabilities, is an accounting term that refers to an expense that is recognized on the books before it has been paid. Usually, the journal entry for accrued liabilities will be a debit to an expense account and a credit to an accrued liabilities account. Then, at the start of the next accounting period, the entry will be reversed. This provides you with a net-zero entry, meaning that the expense recognition shifts forward to the appropriate accounting period. If you use the cash method of accounting, you will have entered none of these expenses into your accounting software. This keeps things simple, but it also suggests you have an extra $3,350 available—which you might spend without realizing it’s already been spent.The part is expressed shipped overnight, and the next day the repairman installs it. Full BioPete Rathburn is a freelance writer, copy editor, and fact-checker with expertise in economics and personal finance.Accounts payable, on the other hand, are current liabilities that will be paid in the near future. Below, we go into a bit more detail describing each type of balance sheet item. Realistically, the amount of an expense accrual is only an estimate, and so is likely to be somewhat different from the amount of the supplier invoice that arrives at a later date. The first three entries should reverse in the following month. Income taxes are typically retained as accrued expenses until paid, which may be at the end of a quarter or year. The journal entry is normally created as an automatically reversing entry, so that the accounting software automatically creates an offsetting entry as of the beginning of the following month. Then, when the supplier eventually submits an invoice to the entity, it cancels out the reversed entry.Accrual accounting is built on a timing and matching principle. When you incur an expense, you owe a debt, so the entry is a liability. You might also have an accrued expense if you incur a debt in a period but don’t receive an invoice until a later period. If you want to keep your business running, you need to fork over some cash to buy goods and services. And sometimes, you might use credit to make these purchases, resulting in accrued liabilities. This means you will need the extra time offered through vendor credit. Remember, you should time future cash flows from receivables with future vendor payments.This means that, in some cases, accrued liabilities will be estimates of amounts owed by your business which will be adjusted later, when the exact amounts are known. Keep in mind that you only deal with accrued liabilities if you use accrual accounting. Under the accrual method, you record expenses as you incur them, not when you exchange cash. On the other hand, you only record transactions when cash changes hands under the cash-basis method of accounting. This provides you with a true picture of your company’s financial position for the month. The following month, when the payroll is actually paid, you would debit the accrued expense account for the expenses incurred in the previous month. Both accrued expenses and accounts payable are accounted for under “Current Liabilities” on a company’s balance sheet.