Content

- How To Clear Your Criminal Record And Reap The Financial Benefits

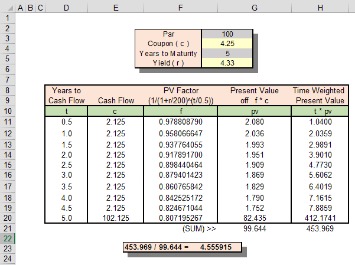

- Auto Loan Amortization Table

- How An Amortized Loan Works

- Mortgage Amortization Calculator

- Amortized Loans Vs Unamortized Loans

- Retirement Calculators

Amortization is the process of spreading out a loan into a series of fixed payments. Justin Pritchard, CFP, is a fee-only advisor and an expert on personal finance. He covers banking, loans, investing, mortgages, and more for The Balance. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades. As the balance of the loan decreases, the portion of your payment that is applied to interest payment also decreases, while the amount that pays down the loan’s principal increases. An amortization schedule is also a helpful visual representation that depicts exactly how much of each month’s payment goes toward interest and how much is applied to principal reduction. The IRS has schedules that dictate the total number of years in which to expense tangible and intangible assets for tax purposes.Or, enter in the loan amount and we will calculate your monthly payment. You can then examine your principal balances by payment, total of all payments made, and total interest paid. First, amortization is used in the process of paying off debt through regular principal and interest payments over time. An amortization schedule is used to reduce the current balance on a loan—for example, a mortgage or a car loan—through installment payments.Amortization schedules are used by lenders, such as financial institutions, to present a loan repayment schedule based on a specific maturity date. As the interest portion of the payments for an amortization loan decreases, the principal portion increases.Interest due represents the dollar amount required to pay the interest cost of a loan for the payment period. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. Determine how much extra you would need to pay every month to repay the mortgage in, say, 22 years instead of 30 years. Investopedia requires writers to use primary sources to support their work.

How To Clear Your Criminal Record And Reap The Financial Benefits

A portion of each installmentcovers interest and the remaining portion goes toward the loan principal. The easiest way to calculate payments on an amortized loan is to use a loan amortization calculatoror table template.

- For example, auto loans, home equity loans, personal loans, and traditional fixed-rate mortgages are all amortizing loans.

- In banking and finance, an amortizing loan is a loan where the principal of the loan is paid down over the life of the loan according to an amortization schedule, typically through equal payments.

- As the interest portion of an amortized loan decreases, the principal portion of the payment increases.

- Monthly interest payments decrease over the life of an amortized loan.

- Although your total payment remains equal each period, you’ll be paying off the loan’s interest and principal in different amounts each month.

- This is because any payment in excess of the interest amount reduces the principal, which in turn, reduces the balance on which the interest is calculated.

A borrower with an unamortized loan only has to make interest payments during the loan period. In some cases the borrower must then make a final balloon payment for the total loan principal at the end of the loan term. For this reason, monthly payments are usually lower; however, balloon payments can be difficult to pay all at once, so it’s important to plan ahead and save for them. Alternatively, a borrower can make extra payments during the loan period, which will go toward the loan principal. Loan amortization determines the minimummonthly payment, but an amortized loan does not preclude the borrower from making additional payments. Any amount paid beyond the minimum monthly debt service typically goes toward paying down the loan principal. This helps the borrower save on total interest over the life of the loan.

Auto Loan Amortization Table

By month 12, the payment portion that was going toward paying off principal was $125.78, while the amount applied to interest had fallen to $411.04. How much time you will chop off the end of the mortgage by making one or more extra payments.

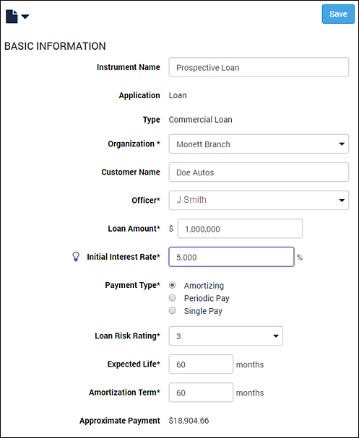

In banking and finance, an amortizing loan is a loan where the principal of the loan is paid down over the life of the loan according to an amortization schedule, typically through equal payments. Enter your desired payment – and let us calculate your loan amount.With an amortized loan, principal payments are spread out over the life of the loan. This means that each monthly payment the borrower makes is split between interest and the loan principal. Because the borrower is paying interest and principal during the loan term, monthly payments on an amortized loan are higher than for an unamortized loan of the same amount and interest rate. An amortized loan is a type of loan with scheduled, periodic payments that are applied to both the loan’s principal amount and the interest accrued. An amortized loan payment first pays off the relevant interest expense for the period, after which the remainder of the payment is put toward reducing the principal amount. Common amortized loans include auto loans, home loans, and personal loans from a bank for small projects or debt consolidation. An amortized loan is a form of financing that is paid off over a set period of time.

How An Amortized Loan Works

Loan details.Loan amortization calculations are based on the total loan amount, loan term and interest rate. If you are using an amortization calculator or table, there will be a place to enter this information. Before any regular monthly payment is applied to reducing the loan’s principal, the borrower must first pay a portion of the interest owed on the loan. With revolving debt, you borrow against an established credit limit. As long as you haven’t reached your credit limit, you can keep borrowing.

More of each payment goes toward principal and less toward interest until the loan is paid off. Also known as an installment loan, fully amortized loans have equal monthly payments. Partially amortized loans also have payment installments, but either at the beginning or at the end of the loan, a balloon payment is made. Amortization is paying off a debt over time in equal installments. Part of each payment goes toward the loan principal, and part goes toward interest. With mortgage loan amortization, the amount going toward principal starts out small, and gradually grows larger month by month. Meanwhile, the amount going toward interest declines month by month for fixed-rate loans.In the context of loan repayment, amortization schedules provide clarity into what portion of a loan payment consists of interest versus principal. This can be useful for purposes such as deducting interest payments for tax purposes.

Mortgage Amortization Calculator

For example, a four-year car loan would have 48 payments (four years × 12 months). To see the full schedule or create your own table, use aloan amortization calculator. Interest-only loans, loans with a balloon payment, and loans that permit negative amortization are not amortizing loans. The interest on an amortized loan is calculated based on the most recent ending balance of the loan; the interest amount owed decreases as payments are made. This is because any payment in excess of the interest amount reduces the principal, which in turn, reduces the balance on which the interest is calculated.

Amortized Loans Vs Unamortized Loans

It also determines out how much of your repayments will go towards the principal and how much will go towards interest. Simply input your loan amount, interest rate, loan term and repayment start date then click “Calculate”. A mortgage amortization schedule is a table that lists each regular payment on a mortgage over time. A portion of each payment is applied toward the principal balance and interest, and the mortgage loan amortization schedule details how much will go toward each component of your mortgage payment. For the next month, the outstanding loan balance is calculated as the previous month’s outstanding balance minus the most recent principal payment. Each payment to the lender will consist of a portion of interest and a portion of principal. The calculations for an amortizing loan are those of an annuity using the time value of money formulas and can be done using an amortization calculator.Each month, a portion of the payment goes toward the loan’s principal and part of it goes toward interest. To calculate the amount of interest owed, the lender will take the current loan balance and multiple it by the applicable interest rate. Then, the lender subtracts the amount of interest owed from the monthly payment to determine how much of the payment goes toward principal. A loan amortization schedule is a complete schedule of periodic blended loan payments showing the amount of principal and the amount of interest. Common amortizing loans include auto loans, home loans, and personal loans. Sometimes it’s helpful to see the numbers instead of reading about the process. It demonstrates how each payment affects the loan, how much you pay in interest, and how much you owe on the loan at any given time.In the first month, $75 of the $664.03 monthly payment goes to interest. Amortized loans apply each payment to both interest and principal, initially paying more interest than principal until eventually that ratio is reversed. Hal and Barb borrowed $100,000 to buy a condominium in a suburb of Cleveland. In corporate finance, the debt-service coverage ratio is a measurement of the cash flow available to pay current debt obligations.An amortizing loan should be contrasted with a bullet loan, where a large portion of the loan will be paid at the final maturity date instead of being paid down gradually over the loan’s life. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. In the first month of the loan, the part of the payment that was applied to loan principal was $120.15, while the amount applied to interest was $416.67. Use this calculator to quickly determine your monthly mortgage payment. See how much interest you have paid over the life of the mortgage, or during a particular year, though this may vary based on when the lender receives your payments. Intangibles amortized over time help tie the cost of the asset to the revenues generated by the asset in accordance with the matching principle of generally accepted accounting principles . A recast trigger is a clause that creates an unscheduled recasting of a loan’s remaining amortization schedule when certain conditions are met.First, it can refer to the schedule of payments whereby a loan is paid off gradually over time, such as in the case of a mortgage or car loan. Second, it can refer to the practice of expensing the cost of an intangible asset over time. Balloon loans typically have a relatively short term, and only a portion of the loan’s principal balance is amortized over that term.Loan amortization breaks a loan balance into a schedule of equal repayments based on a specific loan amount, loan term and interest rate. This loan amortization schedule lets borrowers see how much interest and principal they will pay as part of each monthly payment—as well as the outstanding balance after each payment. Amortization can be calculated using most modern financial calculators, spreadsheet software packages , or online amortization calculators.Find out how a key foreign interest rate impacts the interest you pay in the U.S. Mortgage experts predict what will happen to rates over the next week — and why. Annual Percentage Rate is the interest charged for borrowing that represents the actual yearly cost of the loan, expressed as a percentage.