Content

- Disadvantages Of An S Corp

- How Do I Incorporate A Business?

- What Are The Potential Tax Advantages Of The Llc, C Corp And S Corp?

- Compare S Corporation Vs C Corporation

- When Would The Pros Of An S Corporation Outweigh The Cons?

- Irs Provides New Guidance On Accounting Method Changes For Cfcs

For example, a common path is to form an LLC taxed as a partnership, then elect S corporation status after the company becomes profitable. Because the profits are funding rapid growth, there is never a need to withdraw dividends and be subject to the second layer of tax. Fundamentally, sole proprietorships are intended for simple, one-owner businesses.

- An S corporation, also known as an S subchapter, refers to a type of legal business entity.

- Sole proprietors with no employees do not even need to register with the Internal Revenue Service .

- You earned a $40,000 salary in 2019 from XYZ Inc., and the company also earned a net profit of $30,000 that year, which you’re entitled to 40% of—or $12,000.

- Classes of preferred and common stock are not allowed.

- S Corp is the more likely choice for an LLC, while C Corps are usually corporations.

S election is only guaranteed at the federal level; you may be taxed differently in your state. Potential savings on self-employment tax compared with sole proprietorship. Both S Corps and C Corps come with benefits and disadvantages, depending on what type of company you run. Because owners don’t have to be U.S. residents, a C Corp is the best option for international investors and entrepreneurs who want to build a new business in the U.S.

Disadvantages Of An S Corp

C Corps pay corporate taxes and are more common for larger or more complex corporations with more than 100 shareholders or international business owners. The 2017 tax reform act lowered the corporate tax rate to a flat 21% and eliminated the alternative minimum tax. Even with the personal income tax rates being slightly lowered, this rate is lower than the maximum personal tax rate (which is currently 37%). S corporations are a common type of legal entity recommended for small businesses. They carry the tax advantages of partnerships while providing the limited liability protections of corporations. Sort of a corporate-lite structure, they are easy to establish and simpler to maintain than regular C corporations. On a practical note, I find many business owners struggle to understand the S corporation concept (and the pass-through concept in general).You’ll also have to adopt a set of bylaws, which determine how your corporation will function. And you’ll probably also have to secure a bunch of licenses and permits, get an Employer Identification Number from the IRS, and sign up for payroll tax payments with the IRS if you have any employees. Limited liability gives the owners of a corporation protection from that corporation’s creditors. This means that if the corporation you own ever goes bankrupt, your creditors can come after the corporation’s assets, but not your personal assets. Incorporating when starting your business can provide you with limited personal liability and credibility in the eyes of customers. The two options you have when it comes to incorporating your business are the S corporation and the C corporation. Depending on the size of your business and your objectives, one option may be better than the other.When owners of an LLC elect S corp status, they become employees of the LLC for tax purposes. This can lead to significant tax savings under the right circumstances. People incorporate for lots of reasons—to formalize their business, open it up to new investment, lower their tax bill, etc.Filing fees with the IRS are minimal but the additional bookkeeping and payroll costs are not. For LLCs that already have employees and payroll costs, this factor won’t hold as much weight.

How Do I Incorporate A Business?

The C corporation is the standard corporation under IRS rules. The S corporationis a corporation that has elected a special tax status with the IRS and therefore has some tax advantages. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. One group of companies that utilize the C corporation structure are high-growth startups seeking series funding.C-corporations provide a bit more flexibility if you’re looking to expand your business or sell it to another company. If you choose to structure your business entity as a corporation, you’ll be faced with an important decision—whether to set up your business as an S-corp vs. a C-corp. This choice has big implications for how much you’ll pay in taxes, your ability to raise money, and the ease with which you can expand your business. A flow-through entity is a legal business entity that passes income on to the owners and/or investors of the business.

Therefore, for tax purposes, an LLC can be an S Corp, so there is really no difference. As companies become more complex and profitable, partnerships and proprietorships tend to be less suitable. S corporations are a very popular entity choice for small and mid-sized privately held companies. A partnership is like a multi-owner version of a sole proprietorship. Most states require very little paperwork to form and maintain a partnership. This point alone is the reason many small companies are organized as partnerships.

What Are The Potential Tax Advantages Of The Llc, C Corp And S Corp?

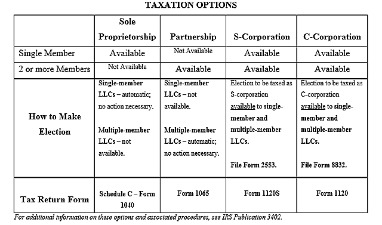

As a shareholder of an S-corp, your business’s income is taxed on your personal income when you file Form 1120S. To structure your company as an S-corp, on the other hand, you must file IRS Form 2553. After filing the form, you will become an S-corp for federal tax purposes. You might have to file additional papers at the state level to be treated as S-corp for state taxes. When you file articles of incorporation with your secretary of state to register your business as a corporation, your company will become a standard C-corp.

Why would you choose an C corporation?

Why choose a c corporation? C corporations provide limited liability protection to owners, who are called shareholders, meaning owners are typically not personally responsible for business debts and liabilities.The most basic difference between S-corporations and C-corporations is formation. Because Subchapter C of the tax code does not impose the same restrictions on ownership as Subchapter S, it is easier for a C corp to obtain equity financing.

Compare S Corporation Vs C Corporation

A corporation or “C corporation” is a separate legal and tax-paying entity. Its profits, losses and liabilities are tied to the business, not its owners . It comes with more complex compliance formalities than the LLC structure, but it also offers the highest level of liability protection for owners of the business. To be a legal S-corp, you must file Form 2553, which will enable the IRS to link your personal income tax return to the corporate return. By doing this, income or loss will flow to your personal income tax return. That way they can use this year’s business losses to offset wages or other income.

In return for this tax benefit, S corps face certain IRS-mandated restrictions. They and their shareholders must be domestically based. They can have no more than 100 shareholders, whose ranks are limited to individuals, non-profits, trusts, and estates—no institutional investors, in other words. Because S corporations can disguise salaries as corporate distributions to avoid paying payroll taxes, the IRS scrutinizes how S corporations pay their employees. An S corporation must pay reasonable salaries to shareholder-employees for services rendered before any distributions are made. As an aside, the requirement to pay a reasonable wage means even a “solopreneur” with no employees must run payroll and file payroll tax reports with the IRS . This is a disadvantage (from an administrative/cost standpoint) compared to a partnership and sole proprietorship, that cannot pay payroll wages to owners.As a tax professional, I get asked all the time by entrepreneurs how these two business statuses differ. It is actually one of the most common questions I am asked because it is so critical to understand how you are taxed as a business owner — so you can avoid being overtaxed.If you form an S Corp we recommend you work with a tax professional to ensure you’re staying compliant. 20% pass-through deduction on qualified business income under the Tax Cuts and Jobs Act of 2017. Chat with a CPA or tax professional to make sure you’re aware of your state’s S corporation rules. For example, let’s say you’re the founder and CEO of Fun Toyz Inc., an S corporation which you have a 40% ownership stake in. Corporations have a board of directors that makes decisions about the direction of the company, so you’ll have to elect one of those. They also have shareholders, who the board will have to distribute shares to.All of an LLC’s business profits are subject to Social Security and Medicare taxes. A lot of the benefits and disadvantages of both entities lie in those three differences we just outlined.The IRS calls this type of corporation a “subchapter C corporation” or C corp. As a general guideline, reasonable pay should be an amount similar companies would pay for the same or similar services.

Irs Provides New Guidance On Accounting Method Changes For Cfcs

The S corp tax classification allows business owners to be taxed as employees of an LLC. Under an S corp, the business owner doesn’t have to pay self-employment tax on their salary, and distributions are only subject to income tax. A corporation is taxed at about 15% for all profits that carry over to the next tax year. A business owner taxed as an S corp would pay FICA taxes and income taxes on the carry-over which would be higher than the 15% corporate rate. C Corps pay tax on their income, and its owners and employees are taxed additionally on any income they make through the company. This is referred to as double taxation, and it may be a situation that you wish to avoid as a business owner.