Content

- Cost Of Debt

- Is Pre Tax Or After Tax Cost Of Debt More Relevant?

- Calculating After Tax Cost Of Debt Simplified

- How To Calculate Cost Of Debt

- How To Lower Your Cost Of Debt

Take the time to stop by and review the tools and information we have for you there. You will have access to a world of data that can help you thrive personally or business sense. The Creditry store would be best if you want to learn how to boost your credit or you need to apply for a loan. Another thing you will need to do is to try to gain access to additional funds that you can use to pay your debt down. You may want to consider working a second job or selling items of value that you no longer need. Paying your debts down as much as possible is another thing you should do to move toward debt-free living.The effective pre-tax interest rate your business is paying to service all its debts is 5.3%. One way to stay debt-free is to try to do without it as much as possible. That means making a more active effort to find other ways to finance your projects. For example, you can apply for business grants to fund your ventures instead of business loans. You can request assistance from family members, business acquaintances, and interested parties when you need to embark on a new journey. Accumulating debt isn’t always the best option, and it shouldn’t be your first option all the time. The cash flow in the final period may have to be adjusted to smooth out capital expenditure and depreciation , but that is a story for another day.Therefore, the after tax cost of debt is the interest paid on a company’s debt minus the amount of money that such a business would save on their income taxes. The process of figuring out your after-tax cost of debt would require you to partake in a several-step process. But often, you can realize tax savings if you have deductible interest expenses on your loans. That’s where calculating post-tax cost of debt comes in handy. The other approach is to look at the credit rating of the firm found from credit rating agencies such as S&P, Moody’s, and Fitch. A yield spread over US treasuries can be determined based on that given rating.

Cost Of Debt

WACC is the average after-tax cost of a company’s various capital sources, including common stock, preferred stock, bonds, and any other long-term debt. In other words, WACC is the average rate a company expects to pay to finance its assets. Why do we use aftertax figure for cost of debt but not for cost of equity? There is no difference between pretax and aftertax equity costs.

- Cost of debt formula is a tool which helps one to know that loan availed is profitable for business or not as we can compare the cost of debt with income generated by loan amount in business.

- In the calculation of the weighted average cost of capital , the formula uses the “after-tax” cost of debt.

- If you have high interest payments on one or more loans, consider consolidating at a lower rate.

- Therefore, the final step is to tax-affect the YTM, which comes out to an estimated 4.2% cost of debt once again, as shown by our completed model output.

- You can reach out to us by telephone or inquiry form to ask for help.

- The term debt equity could be confusing, but is basically referring to a loan.

The number of periods is used to determine how many periods of DCFs there will be before adopting the terminal value for further periods. My downloadable Excel file will calculate for up to 20 periods, even allowing for a shorter first period . In the image above, the number of periods has been set to eight . In the downloadable file, you can find this input in cell G33 of the “Pre-Tax Cost of Equity Example” worksheet. If you have more than four periods in your DCF, there’s a mathematical result from a topic called Galois theory that proves you cannot solve this formulaically (I’ll leave you to prove that!). We have to “guess” the answer, and to do that we’ll need to use Excel’s Goal Seek functionality if we are using Excel as our valuation software of choice. The current market price of the bond, $1,025, is then input into the Year 8 cell.Some valuers will use a different discount rate for this calculation, but this is highly debatable (I will use the same rate — the WACC — throughout). The three most common assumptions are at the start, the middle, and the end of the period in question. Each assumption will obviously vary the overall valuation as a consequence. If you have ever been involved in a valuation, you will appreciate that a financial model is never far away. No matter what the technique used, access to valuation software is crucial. And Excel is probably the most common software for this purpose.

Is Pre Tax Or After Tax Cost Of Debt More Relevant?

If the cost of debt is less than that $2,000, the loan is a smart idea. But if it’s more, you might want to look at other options with lower interest cost. On the other hand, you might still decide to take out that loan, even if you spend more on interest than you save in tax deductions, if you need the money to grow your business. With debt equity, a company takes out financing, which could be an SBA loan, merchant cash advance, invoice financing, or any other type of financing.If you only want to know how much you’re paying in interest, use the simple formula. Simple interest is a calculation of interest that doesn’t take into account the effect of compounding. In many cases, interest compounds with each designated period of a loan, but in the case of simple interest, it does not.

You can have myriad reasons for wanting to conduct this simple calculation, and you should use it whenever you feel you need to. The next piece of information you will need is your tax rate. The tax rate is a percentage that your business has to pay on your taxable income. Once you have all of those figures in front of you, you can go ahead and start to calculate the after-tax cost of the debt you have. You may have heard the term “cost of debt” at one time or another. For example, you will need to pay something other than the exact loan figure if you need to borrow money. Your loan will have an interest rate attached to it, for one.The total interest expense upon total debt availed by the company is the expected rate of return . The timing of the cash flows can be start, middle, or end, as discussed earlier. Consequently, three discount rates have been computed, as shown below. The tax delay assumption is used to build in a delay for the payment of tax.The effect of this deduction is a reduction in taxable income and resulting reduction in income tax. The reduction in income tax due to interest expense is called interest tax shield. Due to this tax benefit of interest, effective cost of debt is lower than the gross cost of debt. In the example, the net cost of debt to the organization declines, because the 10% interest paid to the lender reduces the taxable income reported by the business. The after-tax rate is more relevant because that is the actual cost to the company. I.e. once you factor in the deduction of interest payments from your tax.

Calculating After Tax Cost Of Debt Simplified

You have the right to dispute any of the information on your credit report. Therefore, you should do so if you feel as though a piece of your information is wrong. A debt consolidation is another great idea if you want to free yourself from debt. A consolidation will reduce the interest rate for you and also make your debt more manageable. Many people have seen positive results from partaking in debt consolidations. As stated earlier, the TV Tolerance just checks that the terminal value , when considered in its present value form, is not an excessive amount of the total NPV. The face value of the bond is $1,000, which is linked with a negative sign placed in front to indicate it is a cash outflow.The $3,000 figure is the amount of savings that you will receive on your taxes. What you need to do now is subtract the cost of debt from the savings you’ll receive to calculate your after-tax cost of debt. In the above-mentioned example, you would need to deduct $3,000 from $10,000 to get a $7,000 figure. The $7,000 figure is the amount that the debt will cost you after you receive your tax deductions.That yield spread can then be added to the risk-free rate to find the cost of debt of the company. This approach is particularly useful for private companies that don’t have a directly observable cost of debt in the market. Simply put, a company with no current market data will have to look at its current or implied credit rating and comparable debts to estimate its cost of debt. When comparing, the capital structure of the company should be in line with its peers. If the corporation has a loan of $100,000 with an annual interest rate of 10%, the interest paid to the lender will be $10,000 per year.As model auditors, we see this formula all of the time, but it is wrong. Pre-tax cash flows don’t just inflate post-tax cash flows by (1 – tax rate). Some cash flows do not incur a tax charge, and there may be tax losses to consider and timing issues. It’s the rate that generates the correct pre-tax WACC so that the pre-tax and post-tax NPVs are equal. A company’s cost of debt is the effective interest rate a company pays on its debt obligations, including bonds, mortgages, and any other forms of debt the company may have. Because interest expense is deductible, it’s generally more useful to determine a company’s after-tax cost of debt. Cost of debt, along with cost of equity, makes up a company’s cost of capital.

How To Calculate Cost Of Debt

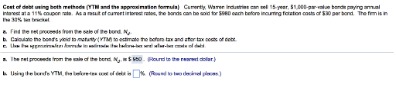

The only thing missing is the pre-tax cost of equity, so, given there are more than four periods, this will have to be solved for using Excel’s Goal Seek feature. Suppose a company named AIM Marketing has taken a loan for business expansion of $500,000 at the rate of interest of 8%, tax rate applicable was 30%, here we have to calculate after-tax cost of debt. You may hear the term APR and think it’s the same thing as cost of debt, but it’s not quite. APR—or, annual percentage rate—refers to how much a loan or business credit cards will cost a debt holder over one year. The effective interest rate is your weighted average interest rate, as we calculated above. In the next section, we’ll look at examples using these formulas. In simplified terms, cost of debt is the interest expense you pay on any and all loans your business has taken out.Goal Seek should then compute the correct Pre-Tax Cost of Equity rate to make the two values equal. In our example above, this is 22.55%, which is 5.41% higher than using the incorrect gross-up of the post-tax rate (17.14%).It could be long term acquisition by the business such as real estates, machinery, industries, etc. The total interest expense incurred by a firm in any particular year is its before-tax Kd. Keep in mind that this isn’t a perfect calculation, as the amount of debt a company carries can vary throughout the year. If you’d like a more reliable result, then you can use the average of the company’s debt load from its four most recent quarterly balance sheets. Cost of debt can be useful when assessing a company’s credit situation, and when combined with the size of the debt, it can be a good indicator of overall financial health. Then, you should set the PreTax_NPV output to the value in the PostTax_NPV cell by changing the Pre_Tax_Cost_of_Equity input .Since the interest rate is a semi-annual figure, we must convert it to an annualized figure by multiplying it by two. Next, we’ll calculate the interest rate using a slightly more complex formula in Excel. On the Bloomberg terminal, the quoted yield refers to a variation of yield-to-maturity called the “bond equivalent yield” . Gain the confidence you need to move up the ladder in a high powered corporate finance career path. You can usually find these under the liabilities section of your company’s balance sheet. Would provide an accurate picture of the overall returns from the funding activity.Secondly, you may have to pay processing fees, finance charges, and other individuals fees, depending on the provider. In business, the cost of debt usually refers to the interest the organization has to pay for a specific loan product to mature. The costs don’t usually include the other expenses mentioned previously. However, you may use those figures if you want to get a more accurate picture of what a loan product truly costs you. It’s the required rate of return for the shareholders, and there are several methods of estimating it. The most frequently used is the capital asset pricing model .

Know These 8 Things Before You Get A Business Credit Card

You need to try the best you can to pay at least the minimum amount due plus the interest for each month. Furthermore, you should consider doubling up on your debt payments. Another way to get the most out of your taxes is to have a professional do them for you. Tax professionals have the latest resources and tools to help you maximize your business deductions. If you’re an individual, then a tax preparer will have the necessary tools to get you the largest refund. That’s because when we use dates and periods of unequal lengths, the Excel function XNPV may not always give the right answer.