Content

- What Is An Example Of A Liquidity Ratio?

- Compare By Credit Needed

- Solvency Ratio Vs Liquidity Ratios: What’s The Difference?

- Want More Helpful Articles About Running A Business?

- Car Insurance

- Formula And Calculation For The Current Ratio

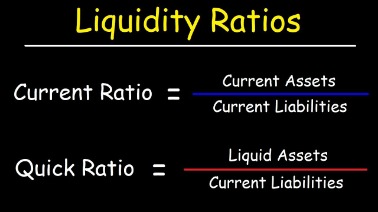

So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities. It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula can be used to easily measure a company’s liquidity.

- The more liquid your business is, the better equipped it is to pay off short-term debts.

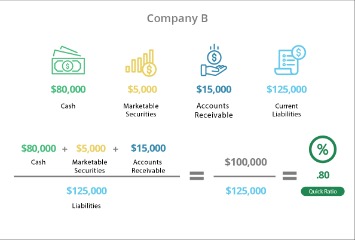

- The cash asset ratio, or cash ratio, is also similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities.

- In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation.

- Learn more about how you can improve payment processing at your business today.

- If they have $50 million in current assets and $50 million in current debt, the current ratio is 1.

To put it simply, they’re “in the red.” If you see a ratio near 1, you’ll need to take a closer look at things; it could mean that the company will have trouble paying its debts and may face liquidity issues. This means that a company has a limited amount of time in order to raise the funds to pay for these liabilities. Current assets like cash, cash equivalents, and marketable securities can easily be converted into cash in the short term. This means that companies with larger amounts of current assets will more easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets. Current assets are all assets listed on a company’s balance sheet expected to be converted into cash, used, or exhausted within an operating cycle lasting one year. Current assets include cash and cash equivalents, marketable securities, inventory, accounts receivable, and prepaid expenses. The current ratio is used to evaluate a company’s ability to pay its short-term obligations, such as accounts payable and wages.

What Is An Example Of A Liquidity Ratio?

First, the trend for Claws is negative, which means further investigation is prudent. Perhaps it is taking on too much debt or its cash balance is being depleted—either of which could be a solvency issue if it worsens. The trend for Horn & Co. is positive, which could indicate better collections, faster inventory turnover, or that the company has been able to pay down debt. These ratios assess the overall health of a business based on its near-term ability to keep up with debt. Lydia Kibet is a freelance writer specializing in personal finance and investing. She’s passionate about explaining complex topics in easy-to-understand language. Her work has appeared in Investopedia, The Motley Fool, GoBankingRates, Investor Junkie, and Green Market Report.

If they have $8 million in current assets and $10 million in current debt, the current ratio is 0.8. A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments. However, when evaluating a company’s liquidity, the current ratio alone doesn’t determine whether it’s a good investment or not. The resulting figure represents the number of times a company can pay its current short-term obligations with its current assets. The current ratio weighs up all of a company’s current assets to its current liabilities. Net Working Capital is the difference between a company’s current assets and current liabilities on its balance sheet.

Compare By Credit Needed

Company A also has fewer wages payable, which is the liability most likely to be paid in the short term. To calculate the ratio, analysts compare a company’s current assets to its current liabilities.However, the revenue generated by the sale of the net assets in the market might be different from their recorded book value. Current assets are a balance sheet item that represents the value of all assets that could reasonably be expected to be converted into cash within one year. Current liabilities are a company’s debts or obligations that are due to be paid to creditors within one year.To many stakeholders, it serves as a test of a firm’s present financial strength, liquidity, and ability to meet its short-term obligations. There are several other liquidity ratios that you may encounter when researching the current ratio, but it’s important to remember that these ratios measure slightly different things. The quick ratio is used to determine whether your company’s quick assets are enough to pay off your current liabilities. The cash asset ratio, or cash ratio, is also similar to the current ratio, but it only compares a company’s marketable securities and cash to its current liabilities. The more liquid the current assets, the smaller the balance sheet current ratio can be without cause for concern. When the balance sheet current ratio nears or falls below 1, this means the company has a negative working capital, or in other words, more current debt than current assets.In the first case, the trend of the current ratio over time would be expected to harm the company’s valuation. An improving current ratio, meanwhile, could indicate an opportunity to invest in an undervalued stock amid a turnaround.The ratio indicates the extent to which readily available funds can pay off current liabilities. It is often used by lenders and potential creditors to measure business liquidity and how easily it can service debt. A good current ratio is between 1.2 to 2, which means that the business has 2 times more current assets than liabilities to covers its debts. A current ratio of less than 1 means the company may run out of money within the year unless it can increase its cash flow or obtain more capital from investors.

Solvency Ratio Vs Liquidity Ratios: What’s The Difference?

Financial modeling is performed in Excel to forecast a company’s financial performance. Notes payable are written agreements in which one party agrees to pay the other party a certain amount of cash. Shobhit Seth is a freelance writer and an expert on commodities, stocks, alternative investments, cryptocurrency, as well as market and company news.

How do you calculate current and quick ratio?

Calculating the Quick Ratio You can subtract inventory and current prepaid assets from current assets, and divide that difference by current liabilities.She currently writes about insurance, banking, real estate, mortgages, credit cards, loans, and more. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

Want More Helpful Articles About Running A Business?

Working capital management is a strategy that requires monitoring a company’s current assets and liabilities to ensure its efficient operation. The cash asset ratio is the current value of marketable securities and cash, divided by the company’s current liabilities. In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position. An investor can dig deeper into the details of a current ratio comparison by evaluating other liquidity ratios that are more narrowly focused than the current ratio. A ratio under 1.00 indicates that the company’s debts due in a year or less are greater than its assets—cash or other short-term assets expected to be converted to cash within a year or less. A current ratio of less than 1.00 may seem alarming, although different situations can negatively affect the current ratio in a solid company.

Since Charlie’s ratio is so low, it is unlikely that he will get approved for his loan. The current ratio measures a company’s capacity to pay its short-term liabilities due in one year.If the cash ratio is less than 1, there’s not enough cash on hand to pay off short-term debt. Businesses with an acid test ratio less than one do not have enough liquid assets to pay off their debts. If the difference between the acid test ratio and the current ratio is large, it means the business is currently relying too much on inventory. However, because the current ratio at any one time is just a snapshot, it is usually not a complete representation of a company’s short-term liquidity or longer-term solvency. The current ratio helps investors understand more about a company’s ability to cover its short-term debt with its current assets and make apples-to-apples comparisons with its competitors and peers. The current ratio compares all of a company’s current assets to its current liabilities.

The liquidity ratio has an impact on the credit rating as well as the credibility of the business. The more liquid your business is, the better equipped it is to pay off short-term debts. The higher ratio, the higher is the safety margin that the business possesses to meet its current liabilities. The liquidity ratio is commonly used by creditors and lenders when deciding whether to extend credit to a business. Think twice about investing in firms with a balance sheet current ratio of below 1 or well above 2. If they have $50 million in current assets and $50 million in current debt, the current ratio is 1.

Formula And Calculation For The Current Ratio

By the same token, current liabilities are debts that are due within a year, and would cause a firm to convert its current assets to liquid in order to pay them off. They might include money owed for payroll and other payables, debt from bills, or unearned income .A good current ratio is typically considered to be anywhere between 1.5 and 3. Gain the confidence you need to move up the ladder in a high powered corporate finance career path. Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.