Content

- Industry Fixed Assets

- What Information Is Available About Fixed Assets?

- Where Do You Find Fixed Assets Data?

- Financial Analyst Training

- Related Terms

- Accountingtools

Securities trading is offered through Robinhood Financial LLC. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

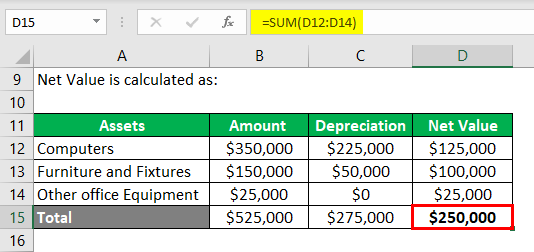

This avoids fluctuations in its financial statements every time a new fixed asset is purchased and thus gives a more realistic view of the business’ overall performance. Fixed assets are particularly important to capital-intensive industries, such as manufacturing, which require large investments in PP&E.Fixed assets can include buildings, computer equipment, software, furniture, land, machinery, and vehicles. For example, if a company sells produce, the delivery trucks it owns and uses are fixed assets. If a business creates a company parking lot, the parking lot is a fixed asset.

Industry Fixed Assets

Except for land, the fixed assets are depreciated over their useful lives. Fixed assets are different from current assets, such as cash or bank accounts, because the latter are liquid assets. In most cases, only tangible assets are referred to as fixed.

A hard asset is a physical object or resource owned by an individual or business. An impairment in accounting is a permanent reduction in the value of an asset to less than its carrying value. These statistics are updated once a year, typically in August. Simplifies month and year-end processes when asset data is up to date.

What Information Is Available About Fixed Assets?

Fixed assets are tangible assets that a business expects to own for more than a year. Non-current assets are intangible assets that a business also expects to own for more than a year.

- A fixed asset shows up as property, plant, and equipment (a non-current asset) on a company’s balance sheet.

- He educates business students on topics in accounting and corporate finance.

- Let’s calculate the total fixed assets for The Home Depot using the value of the assets in the company’s balance sheet for the fiscal year that ended February 2, 2020 .

- A company’s balance sheet statement includes its assets, liabilities, and shareholder equity.

- Company-owned fixed, tangible assets that are not easy to liquidate.

- The IRS decides the rate that different types of assets depreciate.

Still, BEA tracks consumer durables in our fixed assets and consumer durables statistics. The asset must generate revenue for the company; for example, a piece of equipment owned by a company but is not currently in use might fail this test. Let’s calculate the total fixed assets for The Home Depot using the value of the assets in the company’s balance sheet for the fiscal year that ended February 2, 2020 . Intangible assets are fixed assets because they typically take over 12 months to turn into cash or provide a benefit, or they have a useful life of over a year. Current assets are meant to be used or converted to cash in the short term, defined as less than one year, and are not depreciated. Current assets include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses.That said, all assets are the same in that they have financial value to a business . “Leasehold Assets” – assets used by owner without legal right for a particular period of time. A fixed asset is also known as Property, Plant, and Equipment. A fixed asset does not necessarily have to be fixed (i.e. stationary or immobile) in all senses of the word. Fixed assets are most commonly referred to as property, plant, and equipment.

Where Do You Find Fixed Assets Data?

A company’s balance sheet statement includes its assets, liabilities, and shareholder equity. Assets are divided into current assets and noncurrent assets, the difference for which lies in their useful lives. Current assets are typically liquid, which means they can be converted into cash in less than a year. Noncurrent assets refer to assets and property owned by a business that are not easily converted to cash and include long-term investments, deferred charges, intangible assets, and fixed assets. When a company purchases a fixed asset, they record the cost as an asset on the balance sheet instead of expensing it onto the income statement. A fixed asset shows up as property, plant, and equipment (a non-current asset) on a company’s balance sheet. An example of a company’s fixed asset would be a company that produces and sells toys.

What are the 3 types of assets?

Common types of assets include current, non-current, physical, intangible, operating, and non-operating. Correctly identifying and classifying the types of assets is critical to the survival of a company, specifically its solvency and associated risks.Past performance does not guarantee future results or returns. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.A fixed asset that appears on the balance sheet is the book value (historical cost/purchase price – depreciation). Equipment given to a small-business owner as a gift would not appear on the balance sheet and would fail this test because there is no historical cost. The principal difference between fixed assets and current assets is the time it takes to turn into cash or the length of the useful life. A fixed asset is property with a useful life greater than one reporting period, and which exceeds an entity’s minimum capitalization limit. A fixed asset is not purchased with the intent of immediate resale, but rather for productive use within the entity. Also, it is not expected to be fully consumed within one year of its purchase.

Financial Analyst Training

Fixed assets are long-term assets that a company has purchased and is using for the production of its goods and services. Fixed assets are items that a company plans to use over the long term to help generate income. Speak to an expert about how best to manage your fixed assets. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital.

Although the list above consists of examples of fixed assets, they aren’t necessarily universal to all companies. In other words, what is a fixed asset to one company may not be considered a fixed asset to another.

Related Terms

GoCardless is used by over 60,000 businesses around the world. Learn more about how you can improve payment processing at your business today. Current assets are not subject to depreciation or amortisation because they are expected to be used within a year. A fully depreciated asset has already expended its full depreciation allowance where only its salvage value remains.Investment, net stocks, depreciation, and more are shown for types of fixed assets, such as medical equipment, agricultural machinery, or custom software. Over time, fixed assets decline in value due to physical deterioration, normal obsolescence, or accidental damage. A piece of machinery begins to wear out or a patent approaches its expiration.

What type of asset is air conditioner?

Typical fixed assets include buildings, furniture, large pieces of equipment, and systems such as lighting and heating, ventilating, and air conditioning (HVAC). Fixed assets are usually one-time investments and have longer life spans.A fixed asset appears in the financial records at its net book value, which is its original cost, minus accumulated depreciation, minus any impairment charges. Because of ongoing depreciation, the net book value of an asset is always declining. However, it is possible under international financial reporting standards to revalue a fixed asset, so that its net book value can increase. Second, depreciation allows a business to account for the cost of an item over two or more years.Fixed assets includeproperty, plant, and equipment (PP&E) and are recorded on the balance sheet. Fixed assets are also referred to as tangible assets, meaning they’re physical assets. Alternatively, when the fixed assets section isn’t available, you can assume that all items listed after the total current assets and before the total assets amount are fixed assets. For example, let’s use The Home Depot’s balance sheet for the fiscal year that ended February 2, 2020 . When a publicly traded company reports financial statements to shareholders, the company often lists fixed assets as non-current assets on its balance sheet.Please see our privacy policy for more information about how MRI Software handles your personal information. The $4,000 will be shown as an expense for the company on the income statement annually for the next 25 years. When a fixed asset loses value, a company may need to depreciate, amortize, or impair it, as appropriate. Business property not permanently connected to a building, such as office furniture, partitions, and equipment used in the operations of a company. A cash flow Statement contains information on how much cash a company generated and used during a given period. An understanding of what is and isn’t a fixed asset is of great importance to investors, as it impacts the evaluation of a company. Collectables such as art and antiques are likewise not eligible to be depreciated.

Fixed Asset Vs Current Asset: What’s The Difference?

5 Important Questions for Your Gig-Based Business To determine if outsourcing to a payroll provider could benefit your freelance business, consider the following questions. Use Workforce Analytics to Drive Strategic HR Decisions To make tactical human resource decisions that positively shape your company, make Big Data your friend. Workforce analytics – which apply statistical models to worker-related information – give companies of all types the ability to derive insight from selected HR parameters. Discover how U.S. companies nationwide are leveraging the power of in-depth analytical software. Aka unearned revenue – is money that a company receives in good faith from customers before they actually deliver the paid for goods or services. Gain the confidence you need to move up the ladder in a high powered corporate finance career path. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.Current assets are those a business expects to own for at most a year. Property, plant, and equipment (PP&E) are long-term assets vital to business operations and not easily converted into cash. The acquisition or disposal of a fixed asset is recorded on a company’s cash flow statement under the cash flow from investing activities. The purchase of fixed assets represents a cash outflow to the company while a sale is a cash inflow .