Content

- Opening Entries

- Software Features

- You Get Paid By A Customer For An Invoice

- Sage 50cloud Accounting

- What Are Debits And Credits?

- Want A Free Month Of Bookkeeping?

Financial statements are the key to tracking your business performance and accurately filing your taxes. They let you see, at a glance, how your business is performing. A revenue accrual relates to work that has been performed or products that have been delivered but for which the customer has not been invoiced. As explained above, depreciation occurs every period, and hence the organization is bound to consider it in their books. When creating a reserve for obsolete inventory, debit cost of goods sold and credit the reserve for obsolete inventory. When inventory is actually disposed of, debit the reserve and credit inventory.It’s crucial to accurately enter complete journal data so that the general ledger and financial reports based on this information are also accurate and complete. With modern accounting software, recurring journal entries may be templatized and automatically executed, minimizing the potential for error.

- In the example above, insurance expense and prepaid insurance are the two accounts in this journal entry.

- The insurance account is an expense account that will appear on the income statement (P&L) as an increase to total expenses.

- When shares in a business are repurchased, debit treasury stock and credit cash.

- See some examples and explore the generic process to create recurring journals in any automated system.

- When recognizing payroll expenses, debit the wages expense and payroll tax expense accounts, and credit the cash account.

Example – every 2 weeks on Tuesday will create the journal entry every other Tuesday. Example – every 1 week on Tuesday will create the journal entry every Tuesday. Every # of week on a specific day will create journal entry on that day every designated number of weeks. End by specific date – journal entry will be created until date is reached.

Opening Entries

If you’re totally new to double-entry accounting and you don’t know the difference between debits and credits, pause here. It’ll teach you everything you need to know before continuing with this article. As accounting grows in complexity and journal entries grow in number, tracking becomes more difficult, especially in manual entry systems.When specific bad debts are identified, you then debit the allowance for doubtful accounts and credit the accounts receivable account. When goods or services are sold on credit, debit accounts receivable and credit sales.Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. To move data to the proper place in the general ledger, journal entries must be easily trackable so the information can be found and copied as needed.

Software Features

The insurance account is an expense account that will appear on the income statement (P&L) as an increase to total expenses. The prepaid insurance account is an asset and will appear on the balance sheet report as an increase to total assets. These are typically used to record the most usual transactions that occur every period. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. Without adjusting entries to the journal, there would remain unresolved transactions that are yet to close.

However, the company still needs to accrue interest expenses for the months of December, January, and February. It is used for accrual accounting purposes when one accounting period transitions to the next.The Accrued wages account is a liability account, which means it will appear on the balance sheet report as an increase to total liabilities. Accounting software makes it easy to record accounting journal entries.

You Get Paid By A Customer For An Invoice

This is useful when accounts can be pre-determined and amounts will be based on some logic or pre-defined formula. A good example of this scenario could be defining salesmen accounts as the pre-determined accounts. The commission is to be paid to these salesmen as a fixed percentage of sales made by each salesman during the month and sales for each salesman are recorded in separate accounts. In the example above, salaries expense and accrued wages are the two accounts in this journal entry. The salaries account is an expense account and it will appear on the income statement (P&L) as an increase to total expenses.

What is timing difference in accounting?

Timing differences are the intervals between when revenues and expenses are reported for financial statement and income tax reporting purposes. … When there are timing differences, the amount of reported taxable income could vary significantly from the amount reported on the income statement.An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. When a transaction is started in one accounting period and ended in a later period, an adjusting journal entry is required to properly account for the transaction. In the example above, depreciation expense and accumulated depreciation are the two accounts in this journal entry. Depreciation expense is an expense account that will appear on the income statement (P&L) report as an increase to total expenses. The accumulated depreciation account is a contra asset account, and it will appear on the balance sheet report as a reduction of the asset that is being depreciated. As discussed previously, every journal entry includes at least two accounts—a debit and a credit—to stay in balance. In the adjusting journal entry example, the accounts we used were depreciation expense and accumulated depreciation.

Sage 50cloud Accounting

To make a journal entry, you enter details of a transaction into your company’s books. In the second step of the accounting cycle, your journal entries get put into the general ledger. It’s important to prepare journal entries properly to ensure transactions are accurately recorded.If a sale is for cash, then the debit is to the cash account instead of the accounts receivable account. Post the monthly journal entries using the Balance Sheet Lessee Accounting batch program for February and then for March of 2019. An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality. Contra accounts are accounts that have the opposite balance of the normal account balance.The best way to demonstrate debits and credits is to use a T-account. Whether we use a T-account or we are preparing a journal entry, the basic rule of thumb is that debits belong on the left side and credits belong on the right side. If you spent $150 at the store, you’ll be creating an expense for your office supplies account while reducing the amount of cash in your bank account.Depending on the company, it may list affected subsidiaries, tax details and other information. These are the journal entries that need manual entry by bookkeepers to report them in business books. One case of this is the varying lease payments in which periodical payments such as principal and interest vary with time, but their nature remains the same.

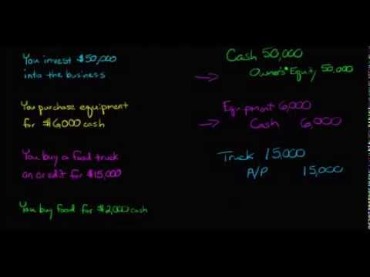

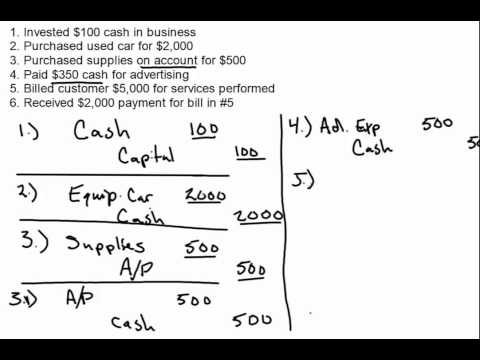

In the image above, the account types that are similar in how debits and credits impact them are coded with the same color. For example, a debit to income, liabilities, and equity accounts will decrease these accounts and a credit will increase these accounts. Debits and credits have the opposite effect on assets and expenses. Assets and expenses increase when you debit these accounts and they decrease when you credit these accounts.

Want A Free Month Of Bookkeeping?

For example, accumulated depreciation is a contra asset account because its credit balance is the contra to the debit balance of an asset. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. As a small business owner, one of the jobs you typically assume is that of a bookkeeper or accountant. Then, credit all of your expenses out of your expense accounts.When recognizing prepaid expenses as expenses, debit the applicable expense account and credit the prepaid expense account. When petty cash is to be replenished, debit the expenses to be charged, as stated on received vouchers, and credit the cash account for the amount of cash to be used to replenish the petty cash box. When setting up or adjusting a bad debt reserve, debit bad debt expense and credit the allowance for doubtful accounts.

What Is The Difference Between Cash Accounting And Accrual Accounting?

See some examples and explore the generic process to create recurring journals in any automated system. The reason why we do journal entries is to ensure all of a business’ transactions that occur during the accounting period are accurately reflected in the financial statements. Failing to record all financial transactions could affect your ability to get a bank loan or lead to inaccurate tax returns that can result in interest and penalties. Each of the accounts that we record in a journal entry impact one or more financial statement. Assets, liabilities, and equity accounts affect the balance sheet report, and income and expense accounts impact the Income statement, also known as the profit and loss (P&L) statement.Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses. This is useful when the same accounts need to be used every period however the amounts get changed every time. In this scenario, the template is defined with no amounts, and amounts are entered manually every accounting period for which the entry needs to be generated. Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs versus when payment is received or made. Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used. Unearned revenue, for instance, accounts for money received for goods not yet delivered.An expense accrual refers to an expense reported in an accounting period before it is actually paid. An example is electricity used by a plant in the month before the utility issues a bill for the company to pay. All financial reporting is based on the data contained in journal entries, and there are various types to meet business needs.