Content

- Items Included In The Balance Sheet

- Understanding The Cash Flow Statement

- How To Calculate Assets In A Company

- Related Terms

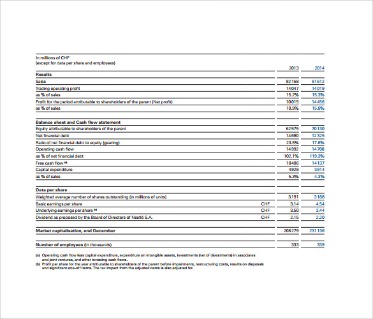

- Ratio Analysis

The purpose of MD&A is to provide investors with information that the company’s management believes to be necessary to an understanding of its financial condition, changes in financial condition and results of operations. It is intended to help investors to see the company through the eyes of management. It is also intended to provide context for the financial statements and information about the company’s earnings and cash flows. It’s management’s opportunity to tell investors what the financial statements show and do not show, as well as important trends and risks that have shaped the past or are reasonably likely to shape the company’s future. Theincome statementshows the revenue and expenses of the company over a period of time. Most companies issue annual income statement, but quarterly and semi-annual income statements are also common. Users can analyze the income statement to see if companies are operating efficiently and producing enough profit to fund their current operations and growth.

- Typical sources of cash flow include cash raised by selling stocks and bonds or borrowing from banks.

- They are categorized as current assets on the balance sheet as the payments expected within a year.

- When an investor exercises a warrant, they purchase the stock, and the proceeds are a source of capital for the company.

- To have a more thorough look at how double-entry bookkeeping works, head to FreshBooks for a gallery of income statement templates.

- Managers can look at the value of the assets that a business currently holds and decide if they can afford to purchase more.

Stock warrants are options issued by a company that trade on an exchange and give investors the right to purchase company stock at a specific price within a specified time period. When an investor exercises a warrant, they purchase the stock, and the proceeds are a source of capital for the company. This is done to find the change in cash from the beginning of the period to the end of the period. Business activities are activities a business engages in for profit-making purposes, such as operations, investing, and financing activities. Investing activities generated negative cash flow or cash outflows of -$10,862 for the period. Additions to property, plant, and equipment made up the majority of cash outflows, which means the company invested in new fixed assets. Other income could include gains from the sale of long-term assets such as land, vehicles, or a subsidiary.

Items Included In The Balance Sheet

Regardless of your sector or industry, it’s likely that your financial department is the beating heart of your entire operation. Without financial fluency, it’s difficult for an organization to thrive, which means that keeping your monetary affairs in order is essential. Bond ratings are representations of the creditworthiness of corporate or government bonds.

What is a weekly financial report?

A weekly financial statement serves to help your business monitor all your short-term financial activities in weekly increments. It should be created and reviewed each week and provides a comprehensive look at the short-term performance of your business.Outside stakeholders use it to understand the overall health of an organization as well as to evaluate financial performance and business value. Internal constituents use it as a monitoring tool for managing the finances of the organization. It is important to consider that an income statement will not tell you more detailed information about your finances such as how much money your company has in total or how much debt you have. For this purpose, there is another type of report called balance sheet and we will see it more in detail in our next financial statement example. These financial reporting examples offer a more panoramic view of an organization’s financial affairs, serving up elements of information covered in our daily and weekly explanations. By offering the ability to drill down into metrics over a four-week period, the data here is largely focused on creating bigger, more long-term changes, strategies, and initiatives. Cash from financing activities include the sources of cash from investors or banks, as well as the uses of cash paid to shareholders.It’s the money that would be left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the shareholders, or the owners, of the company.Although laws differ from country to country, an audit of the financial statements of a public company is usually required for investment, financing, and tax purposes. These are usually performed by independent accountants or auditing firms. Results of the audit are summarized in an audit report that either provide an unqualified opinion on the financial statements or qualifications as to its fairness and accuracy. The audit opinion on the financial statements is usually included in the annual report. A cash flow statement reports on a company’s cash flow activities, particularly its operating, investing and financing activities over a stated period. Other ExpensesOther expenses comprise all the non-operating costs incurred for the supporting business operations.Operating revenue is the revenue earned by selling a company’s products or services. Theoperating revenue for an auto manufacturer would be realized through the production and sale of autos. Operating revenue is generated from the core business activities of a company. Financial statements are written records that convey the business activities and the financial performance of a company. The growth of the Web has seen more and more financial statements created in an electronic form which is exchangeable over the Web.Shareholder equity is a company’s total assets minus its total liabilities and represents a company’s net worth. Steady growth in a business’s shareholders’ equity because of increasing retained earnings, as opposed to expanding shareholder base, means higher investment returns for current equity shareholders. This is important because a company needs to have enough cash on hand to pay its expenses and purchase assets. While an income statement can tell you whether a company made a profit, a cash flow statement can tell you whether the company generated cash. Moving down the stairs from the net revenue line, there are several lines that represent various kinds of operating expenses. Although these lines can be reported in various orders, the next line after net revenues typically shows the costs of the sales. This number tells you the amount of money the company spent to produce the goods or services it sold during the accounting period.Interim financial statements are most commonly issued quarterly or semi-annually, but it is not uncommon for companies to issue monthly reports to creditors as part of their loan covenants. Quarterly statements, as the name implies, are issued every quarter and only include financial data from that three-month span of time. Likewise, semi-annual statements include data from a six-month span of time. The cash flow statement measures how well a company generates cash to pay its debt obligations, fund its operating expenses, and fund investments. The cash flow statement complements thebalance sheetandincome statement. Usually the company’s chief executive will write a letter to shareholders, describing management’s performance and the company’s financial highlights. Reported assets, liabilities, equity, income and expenses are directly related to an organization’s financial position.

Understanding The Cash Flow Statement

Companies issue different types of business financial statements for a variety of reasons at a variety of times during the year. Public companies are required to issue audited financial statements to the public at least every quarter. These regulated reports must meet SEC and PCAOB guidelines and often must be reported in a consolidated fashion. For instance, the balance sheet shows the debt levels of the company, but it can’t show what the debt coverage costs. Both the balance sheet and the income statement are needed to calculate the debt coverage ratio for investors and creditors to see a true picture of the debt burden of a company. Dupont analysis is to synthetically analyze enterprise’s financial condition with the relationship among several major financial ratios. This analysis method is first used by the United States Dupontt, therefore the Dupont analysis.The cash flow statement begins with the net income and adjusts it for non-cash expenses, changes to balance sheet accounts, and other usages and receipts of cash. Shareholders’ equity is a company’s total assets minus its total liabilities. Shareholders’ equity represents the amount of money that would be returned to shareholders if all of the assets were liquidated and all of the company’s debt was paid off. Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period .

How To Calculate Assets In A Company

There is almost no limit to the amount of ratios that can be combined for analysis purposes. As an effective financial warning system, F-score model has been recognized by many companies. It fully considers the cash flow changes on the basis of Z-score model and establishes a new model of financial crisis prediction when Z-score model is modified. The financial report is the disclosure of financial information of an organization to its stakeholders and the public over a specified period of time. Basically, the report is the key function of the financial controller with the assistance of the investor’s relations officer if the organization is publicly held. Data-driven, dashboard reporting is the way forward, and if you embrace its power today, you’ll reap great rewards tomorrow and long into the future.

By doing these simple calculations you can quickly see how profitable your company is and if your costs and income are being managed properly. By examining a sample balance sheet and income statement, small businesses can better understand the relationship between the two reports.

Related Terms

Such payments like rent, insurance and taxes have no direct connection with the mainstream business activities. The income statement and the balance sheet report on different accounting metrics related to a business’s financial position. By getting to know the purpose of each of the reports you can better understand how they differ from one another. Most income statements include a calculation of earnings per share or EPS.

To have a more thorough look at how double-entry bookkeeping works, head to FreshBooks for a gallery of income statement templates. We know that accounting isn’t everyone’s favorite pastime, so we’ve broken down the important information into balance sheet basics to guide you through the process. Stock options – The notes also contain information about stock options granted to officers and employees, including the method of accounting for stock-based compensation and the effect of the method on reported results. The next line is money the company doesn’t expect to collect on certain sales. This could be due, for example, to sales discounts or merchandise returns. The vertical analysis looks at the vertical effects line items have on other parts of the business and also the business’s proportions.A company’s profits are reported in the income statement but provide no direct information on the company’s cash exchange. A company incurs cash inflows and outflows during a period from non-operating activities, namely investing and financing. Cash from all sources, not revenue from operations, is what pays investors back. That’s why a cash flow statement is an important statement for an investor to review. The cash flow statement shows the exchange of cash between the company and the outside work during a period of time. By reviewing this statement, investors can know if a company has enough cash to pay for expenses and purchases. The information on a balance sheet is a snapshot of a company’s assets, liabilities and quite at the end of a financial period.

What is the first item presented in the notes to financial statements?

The first note to the financial statements is usually a summary of the company’s significant accounting policies for the use of estimates, revenue recognition, inventories, property and equipment, goodwill and other intangible assets, fair value measurement, discontinued operations, foreign currency translation, …Financial statements follow standard presentation formats and apply GAAP to assure consistency. This makes it easier for creditors, investors and management to analyze the statements and make comparisons over time to other companies. This figure includes revenues from all sources and nets out any discounts given to customers.Accounts PayableAccounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. The end goal of the income statement is to show a business’s net income for a specific reporting period. Your balance sheet will be separated into two main sections, cash and cash equivalent assets on the one side, and liabilities and equity on the other. Documenting the financial details of your business will give you a thorough understanding of available cash flows so that you can make informed decisions about the viable future of your business. Accurate financial reporting helps reduce their tax burden and helps them ensure that all their resources are not depleted in a short amount of time.Financial statements like the balance sheet address provide detailed information about the company’s asset investments and outstanding debt and equity components. Investors and creditors can use this information to better understand the company’s position and capital mix. Financial reporting uses financial statements to disclose financial data that indicates the financial health of a company over during a specific period of time. The information is vital for management to make decisions about the company’s future and provides information to capital providers like creditors and investors about the profitability and financial stability of the company. Once you understand all of these aspects of a company, you can gauge its relative financial health and determine whether it is worth investing in or loaning money to. Although this brochure discusses each financial statement separately, keep in mind that they are all related.Net income is the final calculation included on the income statement, showing how much profit or loss the business generated during the reporting period. Once you’ve prepared your income statement, you can use the net income figure to start creating your balance sheet. You’ve probably heard people banter around phrases like “P/E ratio,” “current ratio” and “operating margin.” But what do these terms mean and why don’t they show up on financial statements? Listed below are just some of the many ratios that investors calculate from information on financial statements and then use to evaluate a company. A balance sheet shows a snapshot of a company’s assets, liabilities and shareholders’ equity at the end of the reporting period. It does not show the flows into and out of the accounts during the period. A company’s balance sheet is set up like the basic accounting equation shown above.The Shareholders’ Equity Statement on the balance sheet details the change in the value of shareholder’s equity from the beginning to the end of an accounting period. Cash And Cash EquivalentsCash and Cash Equivalents are assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Cash and paper money, US Treasury bills, undeposited receipts, and Money Market funds are its examples.