Content

- Group Term Life Insurance: What You Need To Know

- Other Fringe Benefits

- Examples Of Fringe Benefit Rate Calculation

- Understanding Fringe Benefits

- Fringe Benefit Rates For Fiscal Year 2020

- What Is A Fringe Rate?

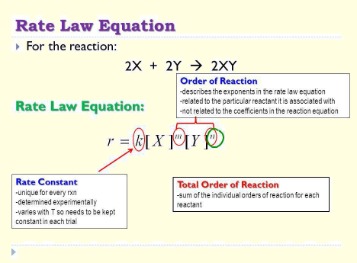

So, as an employer, how do you know what counts as reportable fringe benefits? The value of a fringe benefit is subject to federal income tax, Social Security tax, Medicare tax, and FUTA, and the value must be included in Boxes 1, 3 and 5 of Form W-2, and on line 3 of Form 940. To understand fringe benefits, first it’s important to understand how employees are paid. Employees are normally paid wages via written or printed checks, direct deposit, payroll cards, or sometimes cash. This employee’s “hourly rate” including the fringe benefits cost would be $48.07. Check out examples of calculating fringe benefits rates for salaried and hourly employees below.

Remuneration is an employee’s total compensation, including base salary, bonuses, expense account reimbursements, and other financial benefits. Other companies can offer dependent benefits to employees by allowing them to contribute to a plan on a pretax basis. Fringe benefits are perks that employers give to their employees above and beyond any financial compensation. The sum of the above fringe benefit costs paid by the employer is $17,000 for the year.

Group Term Life Insurance: What You Need To Know

There are several fringe benefits out there like health insurance, employee stock options, etc. Our sponsors will reimburse us for fringe benefit costs, expressed as a percentage of total salaries. As salaries and FB can represent the largest component of cost on a given project, the University negotiates its FB rates with the federal government on an annual basis. A fringe benefit rate is the percent of an employee’s wages relative to the fringe benefits they receive. Calculate a fringe benefit rate by dividing the cost of an employee’s fringe benefits by the wages they receive. A fringe benefit rate shows how much an employee costs your business beyond their base salary. The fringe benefit rate depends on how much you pay employees and how many benefits an employee receives.Business partners and independent contractors can also receive tax-free fringe benefits. A fringe benefit is a type of salary apart from money given for the performance of services by an employee. Employees must allow certain contributions to be vested before they can make any withdrawals from employer-sponsored retirement plans. Vesting gives employees full access to specific assets after a certain period of time.

For example, an employee may receive legal services through an attorney that is paid by the employer, but the employer is still the provider of the fringe benefit. Keep in mind that some fringe benefits are only nontaxable in certain situations. And, some taxes could apply (e.g., some types of fringe benefits are only exempt from FICA tax). Fringe benefits are additions to employee compensation, such as paid time off or use of a company car. For larger employers with ample space, access to an on-site fitness center is a common fringe benefit to employees. Smaller employers may also offer gym memberships at a discount or a fitness equipment reimbursement up to a certain limit each year.Fringe benefits may or may not be taken out of an employee’s salary—it all depends on the type of benefit. For instance, benefits like health insurance, contributions to a retirement plan, or dependent care are deducted from your gross salary. Other perks may be offered to employees for free, such as access to a gym at the office or discounts for things like car and homeowners insurance or vehicle rentals. So, the total fringe benefits of an hourly employee are $11,440. Divide the total fringe benefits by the annual wages of an employee. Childcare assistance is another benefit offered through some employers, as working full-time with children can present scheduling conflicts and prohibitive daycare costs.

Other Fringe Benefits

Employers offering education assistance may allow employees to work flexible schedules so they can balance their education and work obligations. Employees may also be provided tuition reimbursement for all or part of the expenses. As time went on, companies explored other ways to attract new hires in the post-war era.

- Plans are administered by investment managers hired by the employer.

- Calculate a fringe benefit rate by dividing the cost of an employee’s fringe benefits by the wages they receive.

- For instance, a company may require contributions to a defined contribution plan to vest for five years before an employee can access them.

- Try our payroll software in a free, no-obligation 30-day trial.

- Departments should calculate and budget fringe benefits when personnel budget is being created using non-personnel budget by referring to the policies below.

- Other companies can offer dependent benefits to employees by allowing them to contribute to a plan on a pretax basis.

Justworks PEO Benefits, payroll, HR, and compliance all in one place with 24/7 support. Simply click the button below to fill out a form or just give us a call today. Save money without sacrificing features you need for your business. Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.Certain contributions made to a retirement plan aren’t taxed until you choose to withdraw them from the plan. You may have to pay for reimbursements such as tuition and memberships for off-site gyms. It’s always a good idea to check with your human resources department or the IRS.They might provide daycare services or assistance with care for dependents. Firms give workers shares in corporate stock outright or the chance to buy at a discounted price. Meals or discounted cafeteria plans may also be offered to employees as fringe benefits. Employers recognize that the cost of lunch or dinners when employees work late can add up quickly and, as such, meals are provided by some employers at no cost to the employee. Most employers provide their employees with some form of health insurance coverage. While some pay a portion of the monthly premiums, others may provide full coverage, making it free for their employees.

Examples Of Fringe Benefit Rate Calculation

While enrollment is optional, it is normally the best way for employees to be covered for medical expenses. According to a survey by the Bureau of Labor Statistics , about 30% of a person’s compensation in the private sector accounted for benefits. The Full-Time Benefits Eligible rate is assessed for all benefits eligible academic graduate students. Fringe Benefit expenditures will be charged to the same account as the salary, except in situations where a special fringe account has been established. A Guide to Remote Employees Remote work is quickly becoming a staple for the modern workforce. Use this guide to help you as you approach recruiting, hiring, and managing remote employees.The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. You can use this benefit to pay for certain dependent expenses, including childcare, as well as for elderly relatives who can’t take care of themselves. Our Customers From coast to coast and across industries, small- and medium-sized businesses are saving time and money using Justworks’ all-in-one solution. Payroll Run payroll seamlessly and make any payments you need to at no extra cost.

Understanding Fringe Benefits

Employer-sponsored health insurance is one of the most common ways for people to get coverage. This benefit has a definite tangible value, the cost of which is reported annually on employee W-2s. The idea of offering fringe benefits goes back to the late 1800s. One of the first was an employee pension plan developed and offered by the American Express railroad company in 1875. The company paid out a percentage of employee salaries for those who worked anywhere between 10 and 20 years and were over the age of 60.

Under the Bureau of Labor Statistics, the average fringe benefit rate is 30%. This means your company is paying an additional 22% of the employee’s wages for this employee. Employers can use a fringe benefit rate to examine the total cost of labor per employee.The fringe rate shows you how much an employee actually costs your business beyond their base wages. In terms of lifestyle, some firms reimburse employees for commuting or moving expenses.

Why do employers pay fringe benefits tax?

Fringe Benefit Tax: Giving benefits to our employees are good but the employer shall have to pay the FBT for the taxable fringe benefits (as required by NIRC), in order to claim the paid fringe benefit and its related tax as a deduction to the company’s taxable income.Museums and cultural institutions might offer free admission to employees whose firms are major donors or event sponsors, too. If you’re in the construction business and you work on a government project, then you are subject to paying employees the prevailing wage for that job. While your take-home pay is a very important consideration, you should also keep in mind any other perks that your employer offers you. These on-the-job perks, typically referred to as fringe benefits, are viewed as compensation by an employer but are generally not included in an employee’s taxable income. Keep reading to learn more about these perks as well as some of the more common fringe benefits employers offer. Dividing the annual fringe benefits cost of $17,000 by the employee’s $37,600 of wages for the hours worked, results in a fringe benefit rate of 45.2%. Therefore, when a company pays the employee gross wages of $20 per hour worked, the company’s cost is $29.04 per hour.

Fringe Benefit Rates For Fiscal Year 2020

To calculate an employee’s fringe benefit rate, add up the cost of an employee’s fringe benefits for the year and divide it by the employee’s annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage. Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off. Some nontaxable fringe benefits include group-term life insurance up to $50,000 and employee discounts. One of the most important fringe benefits an employer can offer is contributions to an employee’s retirement plan. Some companies offer matches on employee 401 paycheck deferrals, while others make qualified contributions to retirement plans without requiring employees to make contributions themselves.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.While these benefits won’t increase your bank account balance, they can make your compensation package much more attractive. The most common benefits include life, disability, and health insurance, tuition reimbursement, and education assistance, as well as retirement benefits.