Content

- The Skinny On General Ledger Vs Trial Balance

- A Beginner’s Guide To General Ledgers

- Using Accounting Software With General Ledgers

- General Ledger Accounting: What Is It And How Does It Affect Reporting?

- An Income Statement Transaction Example

- Accountingtools

- General Ledger Vs Trial Balance Comparative Table

Match the beginning balance in the account to the ending reconciliation detail from the prior period. While keeping a GL accurate and up-to-date takes effort, the return is real-time insights for the business.

- For example, if a company makes a sale, its revenue and cash increase by an equal amount.

- The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total.

- No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

- Trial balances are a financial tool specific to double-entry bookkeeping.

- In accounting, expenses and assets are increased by debits and decreased by credits.

- In Business Economics from UC Irvine in 2011 and further went on to receive his M.B.A. from the University of Redlands in 2013.

The term “balance the books” comes from double-entry bookkeeping. To maintain financial health, your total debit balances must equal your total credit balances. The money your business earns and spends is organized into subsidiary ledgers (also called sub-ledgers, or general ledger accounts). Sub-ledgers are like notebooks you use to write down business transactions as they happen.Reconciliation is an accounting process that compares two sets of records to check that figures are correct, and can be used for personal or business reconciliations. In this instance one asset account is increased by $200, while another asset account is reduced by $200. The net result is that both the increase and the decrease only affect one side of the accounting equation. The trial balance is a report that lists every general ledger account and its balance, making adjustments easier to check and errors easier to locate. Revenue is the business’ income that is derived from the sales of its products and/or services. Revenue can include sales, interest, royalties, or any other fees the business collects from other individuals or businesses.”Accounts payable” refers to an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers. I don’t pay for much with checks anymore, but when I do write one to pay rent every month, I always write down the check number and the amount in the little paper ledger at the front of my checkbook. Stay up to date with the latest marketing, sales, and service tips and news. This article and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

The Skinny On General Ledger Vs Trial Balance

Operating RevenuesOperating revenue is defined as revenue earned by an individual, corporation, or organization from the core activities that they undertake on a regular basis. There are several methods to earn revenue, but operational revenue is earned by the core business activities that the organization undertakes in its daily operations. Credit BalancesCredit Balance is the capital amount that a company owes to its customers & it is reflected on the right side of the General Ledger Account. Usually, Liability accounts, Revenue accounts, Equity Accounts, Contra-Expense & Contra-Asset accounts tend to have the credit balance. Sage 50cloud Desktop accounting software connected to the cloud. What’s more, the general ledger is a part of the accounting process that can benefit greatly from technologies. Match transactions within accounts to the individual transactions.While the trial balance shows a baseline of where money is coming and going, the general ledger gives the whole picture. When reviewing your books at the end of the month, use your trial balance. The trial balance sheet details the basic information necessary to perform a wellness check on your books. A ‘balanced book’ also provides the foundation for checking every other financial statement.

At the same time, the trial balance is a statement that records the general ledger ending balances. General ledger accounts encompass all the transaction data needed to produce the income statement, balance sheet, and other financial reports. The general ledger details all financial transactions of all accounts so as to accurately account for and forecast the company’s financial health. Think of the general ledger as the main database of a company’s financial records and information, with other financial documents being derived from the information recorded in the general ledger. If individual assets and accounts are trees, the general ledger is the forest. It’s a finance team’s master document that shows all of the business’ transactions—accounts payable and receivable, cash on hand, capital assets, inventory, investments, liabilities, equity and more.

A Beginner’s Guide To General Ledgers

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial. Your general ledger tells the bank the financial information they need to move forward with a loan application. During an audit, you have to produce a lot of information to make sure your books are in order. Typically, you pull your general ledger during a routine audit.

What is a general ledger balance?

A general ledger is a record of all of the accounts in a business and their transactions. Balancing a general ledger involves subtracting the total debits from the total credits. … For a general ledger to be balanced, credits and debits must be equal.An auditor issues a report about the accuracy and reliability of financial statements based on the country’s local operating laws. The chart of accounts is a listing of all accounts to which transactions can be posted. There are five account types (Assets, Liabilities, Equity, Revenue & Expenses). Under each of these, there are primary accounts and subaccounts. If you’re more of an accounting software person, the general ledger isn’t something you use but an automated report you can pull. Your software of choice will probably have an option to “View general ledger,” which will show you all the journal entries you’ve entered . To get the most out of your general ledger , set up the company’s structure properly.

Using Accounting Software With General Ledgers

A general ledger is the foundation of a system employed by accountants to store and organize financial data used to create the firm’s financial statements. Transactions are posted to individual sub-ledger accounts, as defined by the company’s chart of accounts. The general ledger is used as a data source for other financial documents, including the balance sheet. The general ledger tracks transactions and keeps a record of all data for the company so that other financial documents can be accurately compiled. Inconsistencies, accounting errors and losses can be tracked through the general ledger.

Companies that use accounting software may be able to consolidate active subledgers, meaning there are fewer general ledger elements to reconcile. Corporate Finance Institute says these adjustments are made for accruals and deferrals, as well as estimates or to correct accounting mistakes.

General Ledger Accounting: What Is It And How Does It Affect Reporting?

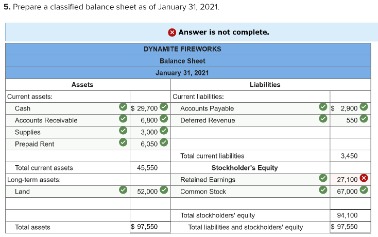

It is possible for an accounting transaction to impact both the balance sheet and the income statement simultaneously. The accountant would enter this transaction into the accounting ledger by posting a $500 debit to accounts receivable and a $500 credit to revenue, which is an income statement account. Debits and credits both increase by $500, and the totals stay in balance. The chart of accounts provides a framework for organizing financial data in the general ledger. Transactions recorded in the GL include account codes that provide additional information, such as whether the transaction relates to assets, liabilities, equity, expenses or revenue. To produce the financial statements, the accountant generates a trial balance that lists each account and the current balance. You can use an adjusted trial balance to generate financial reports.Then, you summarize that information in a master notebook—the general ledger. That’s because all of your company’s financial reporting—including its balance sheet—are prepared using information in the general ledger. A general journal is a record of every business transaction in chronological order. The general journal is a good place to review all accounting transactions. Small businesses that don’t issue stock use an account called owner’s equity, instead of common stock. The owner’s equity is the total cash and other assets that owners contribute.Hire an accountant or bookkeeper, or learn how to set up the chart of accounts and classifications for your company’s accounting system. The chart of accounts is a list of all of the accounts used to record transactions. The number of accounts in the chart of accounts may be greater than the number of accounts in the general ledger. Accounts with zero balances or no recent entries are often omitted from the general ledger. Purchases made on January 1 and January 5 decrease the cash account. Journal entry #1 indicates that inventory is debited by $10,000, and cash is credited by $10,000. If you checked the inventory general ledger account, you’d also find journal entry #1.They are categorized as current assets on the balance sheet as the payments expected within a year. Have final balances for all accounts available in trial balance so that they can do their job more efficiently. They use the general ledger to trace balances back to individual transactions of each head. The general ledger is considered to be a database of information about accounting transactions, while the trial balance is really just a report that is derived from the general ledger. Posting is the process of recording amounts as credits , and amounts as debits , in the pages of the general ledger.Think of your general ledger as growing the wheat before you make the bread that is your financial statements. It provides bookkeepers with the information they need to generate any reports. Every business must strive to maintain accurate accounting records to generate reliable financial statements. Prior to recording something in the general ledger, accountants must first enter records into ledgers. These journal entries provide an in-depth look at specific areas of accounting, while the general ledger provides a holistic view of financial performance. With journal corrections in mind, balances in the general leger are compared against financial data, such as bank statements. If discrepancies are found, reconciliation requires investigating for unusual transactions, or otherwise explaining the error.These categories stay in place, regardless of the business’s accounting method. You can use the account balances in the general ledger to generate the trial balance. A trial balance lists every account and the current account balance. The dollar amount of total debits must equal total credits in the double-entry accounting system. Preparation of general ledger and trial balance are two primary actions in the accounting cycle. The critical difference is that general ledger is a set of accounts that contain detailed transactions conducted.

General Ledger Vs Trial Balance Comparative Table

Accounts PayableAccounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services. It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. Contains all accounts of an organization with its transactions. Whereas the trial balance only provides the ending balance of each of those accounts. Accounting TransactionsAccounting Transactions are business activities which have a direct monetary effect on the finances of a Company.