Content

- You Must Register With State If You Make Taxable Sales

- Annual Interest Rates

- How Does Amazon Charge Taxes On Products?

- Check On Sales Tax Exemptions

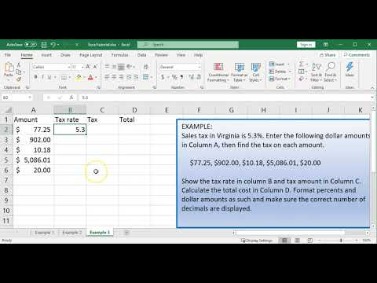

The license will only apply to the event for which it is issued and cannot be used for any other event. Packing and crating that is subject to Colorado sales tax is any tangible personal property furnished to prepare tangible personal property purchased at retail for delivery to a location designated by the purchaser. However, you may be required to furnish a deposit or a surety bond as part of the registration process. Many states require new sellers to post such deposits or bonds to secure the timely payment of their taxes. Oregonians purchasing goods or services online don’t generally owe sales tax to another state, but exceptions may exist for other taxes.

- If a retailer neglects or refuses to file a return, the Department may estimate the tax due, based upon the information that may be available.

- Additionally, every retailer must keep and preserve for a period of three years all invoices of goods and merchandise purchased for resale.

- The consideration exchanged in a sale may include money in any form, property, the rendering of a service, or the promise of any of these things.

- A special event organizer may elect to obtain a special event license in order to file and remit taxes on behalf of some or all of the sellers participating in the event.

- California is the only state with a state general sales tax rate above 7.0 percent, but the state general sales tax rate is exactly 7.0 percent in Indiana, Mississippi, Rhode Island, and Tennessee.

- The taxable purchase price includes the gross value of all material, labor, and service, and the profit thereon included in the price charged to the user or consumer.

- The total service fee a retailer may retain for any filing period may not exceed $1,000, even if the retailer has multiple business locations or makes sales at different locations in the state.

The Department recommends that retailers verify the validity of such purchasers’ licenses or certificates online at Colorado.gov/RevenueOnline. Anyone making retail sales at one or more special sales events must obtain a special event license, unless the event organizer has obtained a license to file returns and remit tax on behalf of sellers participating in the event. A retailer who maintains a place of business in Colorado is subject to all Colorado sales tax licensing and collection requirements for as long as the retailer maintains that place of business. If a retailer ceases to maintain any place of business in Colorado, the retailer may no longer be doing business in Colorado, depending on its other activities within Colorado, as described below in Retailers with no physical location in Colorado. The following is a list of statutes, regulations, forms, and guidance pertaining to taxable sales. Since there are less than 90 days remaining in the current year after the retailer’s cumulative sales in Colorado exceeded $100,000, all of the retailer’s sales in the current year will be sourced using the origin sourcing rules.If the retailer’s average or estimated monthly state sales tax collection is less than $300, the retailer will be required to file returns and remit tax on a quarterly basis. If the retailer’s average or estimated monthly sales tax collection is $15 or less, the Department may grant the retailer permission to file on an annual basis. The following is a list of statutes, regulations, forms, and guidance pertaining to sales tax collection. The following is a list of statutes, regulations, forms, and guidance relevant in evaluating a retailer’s obligation to collect Colorado sales tax. A retailer who qualifies for origin sourcing based on prior year sales will nonetheless transition to destination sourcing if the retailer’s total retail sales in Colorado in the current year exceed $100,000. This publication is designed to provide retailers with general guidance regarding sales tax licensing, collection, filing, remittance, and recordkeeping requirements prescribed by law.

You Must Register With State If You Make Taxable Sales

We’re using the term “sales permit” here in a generic sense to refer to the document a seller must secure before making taxable sales in a state. Depending on the state, such document may be referred to as a “permit,” “license,” or “certificate of registration.” You must charge sales tax if you sell online to customers who are located in your state. If you are engaged in business within a tax district, you are liable for the state sales tax and any additional taxes levied by the tax district in which your business is located. Here is a brief review of the sales and use tax and then we will break down how California sets its sales tax rate and the various elements that impact the rate.

When retailers collect sales taxes from customers the taxes collected are recorded as?

When retailers collect sales taxes from customers, the taxes collected are recorded as: Sales or Sales Taxes Payable.If you file monthly, your return is due on the last day of the month following the taxable month. For example, you would file sales taxes for February 2017 by March 31, 2017.

Annual Interest Rates

Consequently, the retailer must obtain a Colorado sales tax license and begin collecting sales tax on any retail sale the retailer makes in Colorado no later than October 1st of the current year. The following is a list of statutes, regulations, forms, and guidance pertaining to sales, retail sales, and the sourcing of sales. In general, leases of tangible personal property are considered retail sales and are subject to Colorado sales tax. However, a lease for a term of 36 months or less is tax-exempt if the lessor has paid Colorado sales or use tax on the acquisition of the leased property.Sales taxes are imposed on individuals and businesses which sell goods within the State of California. The amount is calculated by the CDTFA as the total receipt of sales minus any non-taxable sales. If a purchaser asserts that the sale qualified for exemption and the tax was collected by the retailer in error, the retailer may claim a refund or credit on behalf of the purchaser, but is not required to do so. In making any such claim, the retailer must demonstrate that the amount claimed, including any interest on the refund, has been or will be paid by the retailer to the purchaser. In the case of a sale to a tax-exempt organization or governmental entity, the retailer must also verify that the purchase is made directly from the funds of the organization or entity claiming the exemption. This requirement is satisfied if payment is made with a credit card or check in the name of the tax-exempt organization or governmental entity claiming exemption.

However, the exemptions can appear complicated because the CDTFA looks at a variety of items that may not seem to be food but are related in a way that allows tax exemption. The current tax rate in California is 7.5 percent statewide, and is due to decrease to 7.25 percent at the end of 2016.

How Does Amazon Charge Taxes On Products?

However, even if a business does not collect a general sales tax on an online transaction, the consumer is still required to pay the tax because states levy use taxes in addition to sales taxes. That is, consumers are subject to use taxes in their home state on all goods purchased outside their state of residence for consumption in their home state. The use tax rate is the same as the sales tax rate, but few consumers are aware of the tax and actually pay it. Most states with both a sales tax and an individual income tax give taxpayers a chance to pay use taxes on their income tax returns. State and local governments collected a combined $411 billion in revenue from general sales taxes and gross receipts taxes, or 12 percent of general revenue, in 2018. General sales taxes provided less revenue than property taxes and roughly the same amount as individual income taxes.The Colorado Department of Revenue administers not only state sales tax, but also the sales taxes imposed by a number of cities, counties, and special districts in Colorado. However, the Department does not administer and collect sales taxes imposed by certain home-rule cities that instead administer their own sales taxes.

Check On Sales Tax Exemptions

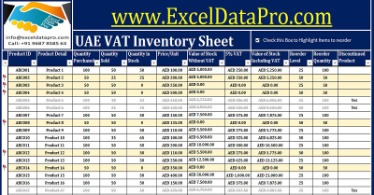

Correctly account, within their return, for all state and state-administered local sales tax due. If a retailer is engaged in a seasonal business , the retailer may request permission to file returns and remit tax only for the months of the year that the business operates. The retailer may make such request with its license application or by submitting such request to the Department in writing. The retailer must immediately notify the Department if the retailer operates its business in any month outside of the previously established period of seasonal operation. A special event organizer may elect to obtain a special event license in order to file and remit taxes on behalf of some or all of the sellers participating in the event.As a general rule, discounts that are known and taken at the time of sale are excluded from the tax base. However, the states are split as to whether a discount that is taken after the sale, such as a prompt payment trade discount, may reduce the tax base. Our solutions for regulated financial departments and institutions help customers meet their obligations to external regulators. We specialize in unifying and optimizing processes to deliver a real-time and accurate view of your financial position. These charge a percentage of the value added at every level of production of a good. Put differently; this is a tax on the company’sgross margins, rather than just the end user. In California, this means every retailer engaged in business within the state for the purpose of commerce according to the clause of the U.S.California state sales and use tax is administered by the California Department of Tax and Fee Administration and applied as a base percentage rate (currently 7.25 percent in California) plus any local and district tax. If you are a reseller, you may also apply for a California Resale Certificate, which allows you to buy goods within California for resale without paying sales tax on those goods. Other examples of exempt sales include sales of certain food plants and seeds, sales to the U.S. The list of exemptions is long and detailed, so if you are not sure if your business falls under those headings, you may wish to clarify with the DOE. There are a number of exemptions to the obligation to remit sales and use taxes. Some of these exemptions exist in an attempt to promote certain types of industry or consumer choices.

Among the states with a statewide general sales tax, Vermont relied the least on general sales tax revenue in 2018. Ten other states with a statewide general sales tax collected less than 10 percent of state and local general revenue from the tax that year. To remit the sales taxes due for the tangible personal property acquired as part of the sale. The sales taxes are due by the 20th day of the month following the month in which the business assets were sold. The following is a list of statutes, regulations, forms, and guidance pertaining to recordkeeping requirements. If a retailer neglects or refuses to file a sales tax return for any period for which the retailer has an open sales tax account, the Department will estimate the tax due based upon the best available information.Since the sales tax regulations vary across different states, it’s common for businesses to have separate sales tax liability accounts for each state. If a wholesaler or retailer make a tax-free wholesale purchase of an item for resale, but subsequently withdraws that item from inventory for their own use, they will owe use tax on that item. Please see the Colorado Consumer Use Tax Guide for additional information about filing and remittance requirements for consumer use tax. The taxable purchase price includes the gross value of all material, labor, and service, and the profit thereon included in the price charged to the user or consumer. However, meals provided to employees of the establishments and businesses listed above at no charge or at a reduced charge are not subject to sales tax. Additionally, sales tax applies to prepared food and drink sold by restaurants, bars, and other similar establishments. Short-term rentals of rooms and accommodations are also subject to Colorado sales tax.The information in this publication pertains only to state and local sales taxes administered by the Colorado Department of Revenue. Copies made by mailing business for customers – Private mailing businesses often have a separate area where the business makes copies for customers.

To avoid paying the sales tax, the yarn maker must obtain a resale certificate from the government saying that it is not the end user. The yarn maker then sells its product on to a garment maker, which must also obtain a resale certificate. Finally, the garment maker sells fuzzy socks to a retail store, which will charge the customer sales tax along with the price of said socks. After you have received your sales tax permit, you can begin collecting sales tax from customers.The amount of tax that is owed on taxable sale is determined by applying the applicable tax rate to the total sales price. The tax generally applies to the total amount received for the property or service, without any deductions for the its cost to you, or any materials, labor or service costs. In other words, the tax base doesn’t necessarily bear any relation to the actual profit you may have realized on the sale. This means that the sales taxes collected by a retailer will not be reported on its income statement.

How To Account For Sales Tax?

If a retailer does not file a required return, there is no limit on the time for the Department to estimate the tax due and issue a notice of the estimated tax due to the retailer. If the seller relies on a physical copy of the license or certificate for verification, the seller must retain a copy of the document for their records. Any retailer requesting such permission must make such request to the Department in writing. A retailer that makes sales or takes orders at special events located in Colorado is deemed to maintain a place of business in Colorado at the location of the special event for the duration of the special event. If the purchaser transfers intangible property or performs services in exchange for tangible personal property, the fair market value of the intangible property or service is not excluded from the purchase price. The following examples demonstrate the application of the small retailer threshold for determining whether origin or destination sourcing rules apply. Recent ballot initiatives, legislation, and lawsuits have all attempted to set Arizona individual income tax rates.

What Type Of Account Is Sales Tax Payable?

The total service fee a retailer may retain for any filing period may not exceed $1,000, even if the retailer has multiple business locations or makes sales at different locations in the state. The organizer must inform each seller participating in the event of the various taxes and tax rates that apply to retail sales made at the event. Additionally, the organizer must provide a list of the sellers participating in the event to the Department. The list must include the names, addresses, and special sales event license number, if any, of each seller participating in the event.