Content

- Prepare And File Business Taxes

- See For Yourself How Easy Our Accounting Software Is To Use!

- How Much Do Accounting And Bookkeeping Services Cost?

- Steps To Take Before You Prepare Your Taxes

- Let’s Find Your Next Accountant

Without great records, no one can prepare an accurate tax return and we can’t provide you with great tax strategies that will actually be impactful because we’d just be guessing. Accounting service fees vary depending on the services you need. Bookkeeping fees are the cheapest because the service is very basic. Landlords can expect to pay $200 per month per property for the average property. By hiring an accountant focused on your accounting and financial needs, you’ll be able to focus more on your business’s core goals and grow your brand. Whether you’re starting, running, or growing your business, having an accountant in your court can be beneficial. Accountants can help with a wide array of business-related tasks to save you time.

Although you might be able to perform some of these tasks yourself, or with the help of your accounting software, there might be valid reasons to turn to an accountant for assistance. Some of the most common reasons are for business taxes and audits. These processes can be complex, time-consuming, and they’re certainly instances where you don’t want to make errors. Choosing to work with an accountant, who is certified and has experience with these processes, can be a life-saver.For this benefit, multiply the hours you spend on bookkeeping by your hourly rate. Your accountant can help you create the financial projections necessary for your business plan, but they can also use real data to help you track your progress and plan for the future.

Prepare And File Business Taxes

Moreover, accountants can come up with accurate audit reports, financial statements, and other accounting documentation required by government regulation and lending institutions. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good.

- Instead, prices depend on factors like the size of your business, the services required, the accountant’s expertise, and the length of time you plan to work with them.

- That’s why Xendoo offers this pricing structure to our clients.

- Jayne Thompson earned an LLB in Law and Business Administration from the University of Birmingham and an LLM in International Law from the University of East London.

- However, accountant fees may be based on experience, location of the business, and job requirements.

This has made filing taxes more complicated, even for those familiar with the tax code. DIY software allows you to import transactions from your bank accounts so you can categorize and track your income and expenses. They can also automatically prepare important financial statements, like a balance sheet or cash flow statement, based on the information you enter. The software is only as reliable as the information you enter. If you only need an accountant for an occasional project, like tax preparation or an audit, you can ask for an estimate of the total cost before they begin work. Often, the project rate will be the accountant’s hourly rate multiplied by the number of hours they believe it will take to complete the project. Before hiring an accountant, take the above points into consideration when budgeting your cost.

See For Yourself How Easy Our Accounting Software Is To Use!

This would be the most expensive option, as you would pay the individual a salary and add them onto your business’s payroll. But, what happens if you enter a number incorrectly and don’t notice it? An accountant can catch problems with your numbers, helping you avoid penalties. Easy to budget for; and it can cost less than half what you would pay an hourly accountant for the same amount of service. A Certified Public Accountant can prepare an audited financial statement, or act as a taxpayer or company representative in discussion with the IRS. A Certified Public Accountant will analyze and report on financial data.If you’re a new business owner, don’t forget to factor accounting costs into your budget. If you’re a veteran owner, it might be time to re-evaluate accounting costs. If you’re a small business owner, managing your financial books is not an expense you want draining your bank account. But, it can be difficult to know if your accounting costs are on track. If your accounting is a mess, you can expect to pay your CPA team extra to clean up your books and develop a presentable financial statement. Contrary to popular belief, accounting and tax preparation are two completely different services.

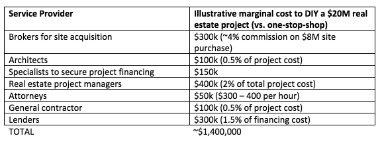

You enter amounts into the software, and the program computes totals for you. In some cases, payroll software for accountants allows your accountant to offer payroll processing for you at very little additional cost. We see syndications make huge mistakeswhen budgeting for accounting fees. Often we will see a budget contain only $800 for the entire year for all accounting and tax preparation services. This mistake and will have horrible consequences if you can’t keep up with financial reporting on your own (because you’re going to be doing it on your own with that budget). If there is one area you don’t want to skimp our on when managing other people’s money, it’s your accounting fees.Accountants and CPAs help with more advanced tasks, such as filing small business taxes, generating statements, analyzing costs, and giving advice. If you’re still unsure whether you need to hire an accountant and furthermore, if you can shoulder the cost of small business accounting services, a cost-benefit analysis can help. A cost-benefit analysis is an accounting concept where you list and estimate all the costs of an action, in this case, hiring an accountant. Generally, you assign a time frame to the costs and benefits—in this case, a three-year period might be reasonable. That being said though, how do you actually know whether or not you should hire an accountant for your small business?

How Much Do Accounting And Bookkeeping Services Cost?

You’re also paying too much if a junior accountant is spending hours and hours on complicated tasks that a CPA could do quickly. Because fixed rates are so risky for accounting firms, they’re usually reserved for very straightforward bookkeeping jobs. Small businesses with relatively simple books are the most likely to negotiate such a rate. However, some firms also offer introductory fixed rates to attract new clients. The number of hours a firm spends on your accounting and bookkeeping is entirely dependent on the complexity of the task. There are steps you can take to reduce the complexity and save money and we’ll get to those a little later on. Your financial service fee depends on the work you need to be done.Form 4506 is an IRS document that is used to request exact copies of prior years’ tax returns. Form 1040-X is used by taxpayers who need to amend an error in a previously filed annual federal tax return. The accountant might require you to invest in new software to help facilitate the job. While there are some basic financial tasks you can handle yourself, there are others that it’s best to leave to a professional. If you enter a number incorrectly and fail to notice it, you’ll end up with inaccurate financial reports and no clear insights into your business’s performance. If you’ve ever had tax problems, you will have some estimate of how much these can cost.

Steps To Take Before You Prepare Your Taxes

Keep in mind that some accountants who have higher prices might be able to complete tasks in less time than accountants with lower prices, which could save you money if they charge hourly. Nearly half of small business owners pay more than $5,000 each year on administrative costs, internal expenses, and legal fees involved with accounting. You don’t have to spend a ton of money on accountants and software to maintain clean books. You just have to be diligent about keeping up with your own accounting records and maintaining an accounting system if you choose to do it yourself.As a trusted financial adviser, an accountant might also suggest ways to increase revenues, reduce costs and improve a company’s profitability. Hiring a business accountant might seem unnecessary at first, especially with the existence of accounting software. For most business taxes, problems are not new, but this is avoidable with the help of an accountant.

Hiring A Business Accountant: The Bottom Line

Budget small business expenses, it’s important to know how an accountant will benefit your company. Hiring an accountant can have a heavy influence on your day-to-day processes and the overall financial health of your business. The smaller your overhead costs, the more profits you get to keep. You don’t want to cut corners, but you should look for cost-effective solutions that fit your business’s needs. The average cost of hiring a tax professional ranges from $146 to $457. A new accountant might ask that you invest in particular accounting software that they prefer. An in-house accountant can be part-time or full-time, depending on your business needs.

How much should I pay a bookkeeper?

Bookkeeper rates vary depending on the business size, industry, and financial services needed. In-house bookkeepers can charge anywhere from $18-23 per hour, with variations depending on experience. Outsourced bookkeepers can be another solution with monthly bookkeeping fees starting from $99 per month.As with the hiring of a regular accountant, there is no standard industry pricing. A bookkeeper’s main responsibility is in the area of data management. This is the recording and processing of all of a company’s income and expense transactions.Therefore, accounting service’s total cost depends on the workload, accountant fees, and how frequently you need their services. Some costs and benefits are easier to quantify than others; in many cases, you’ll be using estimates or averages. There are steps you can take to lower the total cost of accounting and bookkeeping services. The best thing you can do is to keep your financial records as organized as possible.

Im On A Budget, What Services Would You Recommend I Spend My Limited Money On?

The average monthly accounting fees for a small business will rise as you add more services and the tasks get harder. We do a great job lowering accounting fees by outsourcing the data entry and bookkeeping allowing our team to focus on Controller and CFO services for the client. At the end of the day, hiring an accountant can be the start of a fruitful relationship with a financial consultant. Purchasing tax accounting software can be a less expensive option; it can be free and for more complex filing options, it will generally cost less than $130. Both TurboTax or H&R Block offer reasonably priced options for tax accounting software. If you’re just starting your business, you might need help selecting a business structure. Whether it’s a sole proprietorship, partnership, or corporation, your business structure will define how you protect assets, leverage costs, and pay taxes.