Content

- Outstanding Check

- Inflated Balance

- Accountingtools

- How To Avoid Outstanding Checks

- What Are Outstanding Checks?

This means the balance remains in the payor’s account. If the payor doesn’t keep track of his account, he may not realize the check hasn’t been cashed. This may present the false notion that there is more money in the account available to be spent than there should be. If the payor spends some or all of the money that should have been held in reserve to cover the check and then said check is later cleared, the account ends up in the red.In this lesson, you will learn how costs are transferred in a job order costing system. Checks that remain outstanding for long periods of time run the risk of becoming void. Once you send payment, reach out to the payee to notify them that the check is on its way. You can also request that they contact you when they receive the check to verify that it made it to them safely.

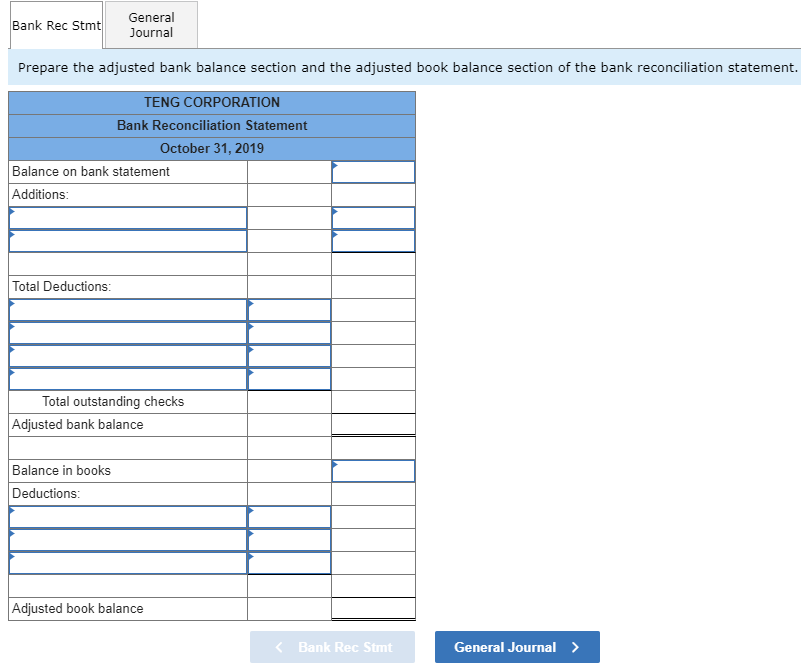

Banks use debit memoranda to notify companies about automatic withdrawals, and they use credit memoranda to notify companies about automatic deposits. To the bank, however, a company’s checking account balance is a liability rather than an asset. Therefore, from the bank’s perspective, the terms debit and credit are correctly applied to the memoranda. The ending balance on a bank statement almost never agrees with the balance in a company’s corresponding general ledger account. After receiving the bank statement, therefore, the company prepares a bank reconciliation, which identifies each difference between the company’s records and the bank’s records. The normal differences identified in a bank reconciliation will be discussed separately. These differences are referred to as reconciling items.

Outstanding Check

The depositor should also check carefully to see that the bank did not combine the transactions of the two accounts. To do this, the company will need to make changes to their bank statement’s final cash balance, also known as their “balance per bank”. Accountants regularly complete bank reconciliations, which is the balancing of a company’s cash account balance with a corresponding bank account balance.

- The cash is deducted from the check owner to the check holder.

- In accounting, the general journal records every financial transaction of a business.

- Typically, when you notify a company of something like this, the charge gets fixed in a few days.

- Current liabilities are financial obligations that need to be fully paid within a year.

- A credit memorandum attached to the Vector Management Group’s bank statement describes the bank’s collection of a $1,500 note receivable along with $90 in interest.

Once you have those two items, use a pencil or highlighter to mark off all the items that appear on both the bank statement and the check register. If an item appears on both, that means that the item was properly recorded and has cleared. After going through all the items, anything that remains unmarked is a an item that will need to be dealt with in the reconciliation.

Inflated Balance

Being confident in the bank side helps resolve errors on the book side. Void the check and add the amount to your checkbook balance. There are certain terms which are important to understand in relation to invoices and payments. Learn about the importance of the due date when payments are required, possible discounts for timely payments, and end of month invoices that must be paid by the 30th or 31st of the given month. Inventory valuation methods are ways that companies place a monetary value on the items they have in their inventory. Discover different inventory valuation methods, including specific identification, First-In-First-Out , Last-In-First-Out , and weighted average. When a company uses its payroll it is formulating a system to distribute paychecks to its employees for the hours worked in the week.

How do you record an outstanding check in a bank reconciliation?

Bank Reconciliation Procedure Deduct any outstanding checks. This will provide the adjusted bank cash balance. Next, use the company’s ending cash balance, add any interest earned and notes receivable amount. Deduct any bank service fees, penalties, and NSF checks.Outstanding checks are those issued by a depositor but not paid by the bank on which they are drawn. The party receiving the check may not have deposited it immediately. Once deposited, checks may take several days to clear the banking system. Determine the outstanding checks by comparing the check numbers that have cleared the bank with the check numbers issued by the company. Use check marks in the company’s record of checks issued to identify those checks returned by the bank. Checks issued that have not yet been returned by the bank are the outstanding checks.This is a difference of $360 (5,843 – 5,483) and since we did not take enough cash we need to reduce cash by $360. Account reconcilement is the process of confirming that two separate records of transactions in an account are equal. You can also call or write to remind the payee that the check is outstanding. This may encourage them to deposit or cash the check.

Accountingtools

The supplier did not present a check at the bank yet, so our cash balance remains the same. By canceling the check, we need to debit back cash in our balance sheet.

Then on the next reconciliation you perform, you can clear the old uncleared checks and the journal entry that offsets the checks . Other Unrecorded Items – With the number of transactions that occur digitally or automatically, it’s easy to forget to record transactions, especially if they occur infrequently. Look for remaining items that cleared the bank that have not been recorded on the books.Other unrecorded items can be either deposits or withdrawals. All other unrecorded items should be recorded on the book side of the reconciliation.

How To Avoid Outstanding Checks

Let’s look at the journal entries and financial impacts for two types of derivatives designed to take some of the risk out of business. One is a futures contract and the other is an interest rate swap. The correct amount of the equipment purchase was $5,843. It’s understated by $360 right now because of the recording error, and cash is overstated because we didn’t record the check correctly. We need to decrease cash and increase the asset Equipment. Watch the following video example and then we will continue by looking at bank statement and records of MY COMPANY for a printable copy.Debit memos reflect deductions for such items as service charges, NSF checks, safe-deposit box rent, and notes paid by the bank for the depositor. Credit memos reflect additions for such items as notes collected for the depositor by the bank and wire transfers of funds from another bank in which the company sends funds to the home office bank. Check the bank debit and credit memos with the depositor’s books to see if they have already been recorded. Make journal entries for any items not already recorded in the company’s books. A check that a company mails to a creditor may take several days to pass through the mail, be processed and deposited by the creditor, and then clear the banking system. Therefore, company records may include a number of checks that do not appear on the bank statement. These checks are called outstanding checks and cause the bank statement balance to overstate the company’s actual cash balance.

What Are Outstanding Checks?

This can lead to the check writer spending money that has yet to be withdrawn, resulting in overdrawn bank accounts and bounced checks. If he hasn’t recorded the money going into the bank, then your trial balance can’t be correct. If your bank rec doesn’t work, your trial balance isn’t right either. If it’s QBO, the payments are probably sitting in undeposited funds and need to be deposited. Let’s imagine that you recorded a check for $715, but the bank cleared that check for $751.If the bank does not return checks but only lists the cleared checks on the bank statement, determine the outstanding checks by comparing this list with the company’s record of checks issued. Sometimes checks written long ago are still outstanding. Checks outstanding as of the beginning of the month appear on the prior month’s bank reconciliation.This should provide real-time information about the total dollar amount of checks outstanding and the total dollar balance present in the account. If the payee doesn’t deposit the check right away, it becomes an outstanding check.Deposits in Transit – A deposit in transit is a deposit that has been submitted to the bank but has not get been recorded by the bank. The account holder has recorded the deposit in his records but the bank has not. This occurs because a deposit was submitted after the bank closed for the day or because of lag in electronic deposits. Within the internal control structure, segregation of duties is an important way to prevent fraud. One place to segregate duties is between the cash disbursement cycle and bank reconciliations.The company already reflect this transaction in the accounting record, however, the supplier has not yet cashed out the check with the bank due to various reason. One of the ways of making payment for a transaction is by check.