Content

- What Is The Accounting Breakeven Point?

- How To Calculate For Break

- Stocks Warren Buffetts Berkshire Hathaway Is Buying Or Selling

- Are Your Fixed Costs Too High?

Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. We’re here to take the guesswork out of running your own business—for good. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. The higher the variable costs, the greater the total sales needed to break even. If your price is too high, you might be falling short of your break-even point because customers won’t buy at that price. Lowering your selling price will increase the sales needed to break even. But this can be offset by the increased volume of purchases from new customers.She was a university professor of finance and has written extensively in this area. Learn how to critically look at your business using a SWOT matrix. We’ll walk you through how to identify strengths, weaknesses, opportunities and threats.Some common fixed costs are your rent payments, insurance payments and money spent on equipment. These costs will stay the same regardless of whether you sell one unit or a million units.For example, the total revenue curve is simply the product of selling price times quantity for each output quantity. The data used in these formula come either from accounting records or from various estimation techniques such as regression analysis.

What Is The Accounting Breakeven Point?

Once you crunch the numbers, you might find that you have to sell a lot more products than you realized to break even. Use your break-even point to determine how much you need to sell to cover costs or make a profit. And, monitor your break-even point to help set budgets, control costs, and decide a pricing strategy. Typically, the first time you reach a break-even point means a positive turn for your business. When you break-even, you’re finally making enough to cover your operating costs. Earnings mean the gross amount of money earned by the company before taxes and expenses are taken out. First step would be to calculate the earnings before taxes, preferred dividend payments, taxes and interest expenses.

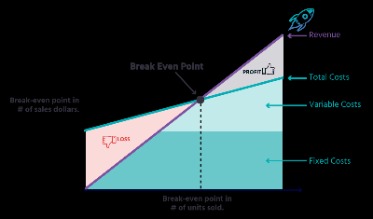

Determine the break-even point in sales by finding your contribution margin ratio. The break-even point allows a company to know when it, or one of its products, will start to be profitable. If a business’s revenue is below the break-even point, then the company is operating at a loss. It assumes average variable costs are constant per unit of output, at least in the range of likely quantities of sales. This could be done through a number or negotiations, such as reductions in rent payments, or through better management of bills or other costs. Understanding the framework of a financial analysis can help you determine profitability and future earnings potential for your business.In either case, it is important to understand the fundamentals of break-even analysis for your small business or your own personal budgeting. Profitability may be increased when a business opts for outsourcing, which can help reduce manufacturing costs when production volume increases.

How To Calculate For Break

Fixed expenses are costs like rent and salaries that remain the same regardless of how much product the company sells. In our lemonade stand example, the cost to rent the space we put our lemonade stand would be a fixed expense. Variable expenses increase or decrease based on sales activity, and include things like commission and shipping expenses. The cost of the lemons, water, and sugar are the variable expenses in our lemonade stand example.

To further understand the break-even point calculation, check out a few examples below. Learn financial modeling and valuation in Excel the easy way, with step-by-step training. For Plan 1, the break-even point is 0 as there is no interest expense and preference dividend. Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She has consulted with many small businesses in all areas of finance.

Stocks Warren Buffetts Berkshire Hathaway Is Buying Or Selling

This means that you’re bringing in the same amount of money you need to cover all of your expenses and run your business. Although this is true in the short run, an increase in the scale of production is likely to cause fixed costs to rise. A business’s break-even point is the stage at which revenues equal costs. Once you determine that number, you should take a hard look at all your costs — from rent to labor to materials — as well as your pricing structure. The break-even point in dollars is the amount of income you need to bring in to reach your break-even point.

- Or, we can also call it the minimum EBIT that a company should earn to meet its fixed commitments.

- In terms of priority, a business first pays out the interest on loans, then dividends on preference shares and then uses the remaining for the equity shareholders and retained earnings.

- Or, we can say, it is the level of EBIT that equals the fixed financial costs for the company, such as interest on the debt, preference dividend and more.

- Learn how to critically look at your business using a SWOT matrix.

- This revenue could be stated in monetary terms, as the number of units sold or as hours of services provided.

- Bankrate.com does not include all companies or all available products.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. For more cost cutting ideas, check out our guide of 25 ways to cut costs. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com.

Are Your Fixed Costs Too High?

Break-even points can be useful to all avenues of a business, as it allows employees to identify required outputs and work towards meeting these. From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price. Poor cash flow management accounts for 82 percent of business failures, so performing a regular cash flow analysis can help you make the right decisions. A break-even analysis allows you to determine your break-even point.For a coffee shop, the variable costs would be the beans, cups, sleeves, and labor used to produce one cup of coffee. Your fixed costs are the expenses that don’t change with your sales volume.The hard part of running a business is when customer sales or product demand remains the same while the price of variable costs increases, such as the price of raw materials. When that happens, the BEP also goes up because of the additional expense. Aside from production costs, other costs that may increase include rent for a warehouse, increases in salaries for employees, or higher utility rates. Accounting Breakeven is the simplest form of analysis to know the number of units that a company needs to sell in order to equal the cost. Every unit sold after the break-even unit will result in a profit for the company. Calculating the accounting break-even is easy as it requires fixed cost, cost per unit and variable cost. If we generate $50 in revenue for the week, $30 has to go toward our fixed expenses.

Want More Helpful Articles About Running A Business?

Therefore, understanding when the company will generate enough profit after covering fixed financial charges is very crucial. There is one more difference between the financial break-even point and the operating or accounting break-even point. The latter calculates the unit sales that a firm needs to achieve for zero operating margins. Financial break-even, on the other hand, deals with the bottom line of the company’s income statement. Or, we can say, the financial break-even point attempts to find EBIT that results in zero net income. Financial risk related to investing in a company’s stock grows as the breakeven point increases. For calculating a financial breakeven point, it is mandatory to include Interest expense and dividend on preference shares.Fixed costs are expenses that remain the same, regardless of how many sales you make. These are the expenses you pay to run your business, such as rent and insurance. You can use the break-even point to find the number of sales you need to make to completely cover your expenses and start making profit. If you sell more than your break-even point, you’re making a profit. But if you sell less, your sales revenue won’t cover your expenses and you’ll operate at a loss. Alternatively, you could develop a “cash” breakeven point where the fixed cost portion of the calculation only includes costs recorded under the cash basis of accounting.The break-even point is the amount of product or service sales a business needs to make to begin earning more than you spend. You measure the break-even point in units of product or sales of services.