Content

- Financial Analyst Training

- Definition Of Credit Memo

- Credit Memos From The Bank

- Learn More About Similar Accounting Topics:

- Create A Credit Memo For A Customer

An invoice is a list of items for which a customer or company has to make payments to its suppliers, service providers, or vendors. The accounts payable department receives invoices from the suppliers or vendors and assesses it before processing for payment.Keep in mind that a credit memo should not be mistaken with a debit memo. Debit memos are different types of documents which will be tackled in a different topic. ReliaBills can help you set up a recurring billing strategy that will include credit memo creation and scheduling. ReliaBills and its entire invoicing system are built and designed specifically for recurring billing. It can help create professional-looking invoices, onboard new customers, create specific pricing packages, and automatically bill your customers. Of course, we need to mention first the most fundamental use of a credit memo, which is to acknowledge returned goods. If a customer returns goods that were billed previously, the vendor can issue a credit memo to adjust the amount due from the customer.

Financial Analyst Training

With all the information on the credit memo, it is clear that it is an important document. You need to have the skills to draft it the right way and include all the critical details. Confirm that the credit memo was entered correctly by viewing the customer transaction history or by viewing the Open Balance Report. Click Save & Send to send the credit memo to your customer, or click Save & Close to close this screen and send the credit memo later.

He is the sole author of all the materials on AccountingCoach.com.

Definition Of Credit Memo

Write off account balances, such as reducing an invoice balance to zero due to bad debt. The Invoice Settlement feature is generally available as of Zuora Billing Release 296 .Standalone credit memos can be applied to any invoice or debit memo with a positive balance. To allow the buyer to purchase an item or service from that seller on a future date, i.e. a gift card or store card credit. A credit note or credit memo is a commercial document issued by a seller to a buyer. Credit notes act as a source document for the sales return journal. In other words the credit note is evidence of the reduction in sales. A credit memo, a contraction of the term “credit memorandum”, is evidence of a reduction in the amount that a buyer owes a seller under the terms of an earlier invoice. Rather than generating negative invoices, the bill run creates credit memos populated by any negative charge event resulting from the charge rating process.

Credit Memos From The Bank

Continue reading to learn more about the credit memo and invoice. The credit memo means that the party who made a purchase from the seller will not end up paying the entirety of what was owed at the time of purchase. If you create a credit memo and want to issue a refund instead or vice versa you will need to delete the transaction and recreate it. The purpose of these memos is to adjust specific items in a given invoice. In this case, the memo refers to a specific invoice; the memo items refer to corresponding invoice items. Recurring billing utilizes safe and secure payment gateways that utilize tokenization and follow proper PCI compliance standards.Assume that Seller Company had issued a sales invoice for $400 for 50 units of product that it shipped to Buyer Company at a price of $4 each. Buyer company informs Seller company that one of the units is defective. The first partial month of a new subscription is not billed because the proration credit setting is disabled. In such cases, you can issue a debit memo to increase the amount due on the account balance. Once this happens, a credit memo – otherwise known as a credit note – is issued. There are different reasons a seller will issue a buyer with a credit note. One of the reasons could be a defective item, wrong size, color, or a customer has changed his mind.

- The restaurant and vendor come to an agreement that they’ll discount the original invoice by $200 to compensate for the lost product and the lost revenue.

- Always keep them in mind so that the next time you are creating a credit memo, you’ll know what to include.

- Credit memos are also issued once the client has paid advance payments to the vendor.

- This feature includes Unapplied Payments, Credit and Debit Memo, and Invoice Item Settlement.

- There are different reasons a seller will issue a buyer with a credit note.

The vendor will have to create a seller’s credit memo, and the restaurant will have to create a buyer’s credit memo. The seller, then, must also record the memo as a reduction, but it is a reduction of its accounts receivable . Save time, money, and your sanity when you let ReliaBills handle your bill collection, invoicing, reminders, and automation.. Both of these terms are important as they are your common business terminologies that you come across every day. Getting familiar with both credit memo and invoice will help you have a clearer vision about each term and their practical usage in the world of business.A credit memo, or credit memorandum, is sent to a buyer from a seller. This document is issued to a buyer after an invoice is sent out. A credit memo may reduce the price of an item purchased by a buyer or eliminate the entire cost of an item. When a seller issues a credit memo, it’s put toward the existing balance on a buyer’s account to reduce the total. A customer who receives a refund for a purchase gets actual money back from the seller. Our knowledgeable accountants can help business owners with basic tasks such as issuing credit memos, keeping track of sales, and sending out invoices. Business owners who choose to have their accounting tasks outsourced to Ignite Spot are able to spend more time doing what they do best to boost company profits.

Learn More About Similar Accounting Topics:

We have experience handling many types of bookkeeping tasks for small business owners. Our online services include assistance with accounts payable and receivable as well as credit card management, payroll, and more. Our firm of accountants can even help business owners at tax time.Specify how credit memos are automatically applied during payment runs. Preview credit memos in billing previews, bill run previews, subscription previews, or amendment previews through the REST API. In running a business, there may be activities and transactions that feature terminologies that are quite confusing. However, the confusion shouldn’t stop or hinder daily business operations.It’s essential not only for tracking payables and receivables but also for recordkeeping and inventory tracking purposes. It’s an excellent practice since it clearly states the reason for the credit memo for the return. For instance, both the customer and vendor will know if the product was spoiled or defective, or if the customer was simply unsatisfied with the product. If a buyer has paid the full amount of the invoice, they have two choices to settle a discrepancy in their favor.

How do you write a credit memo?

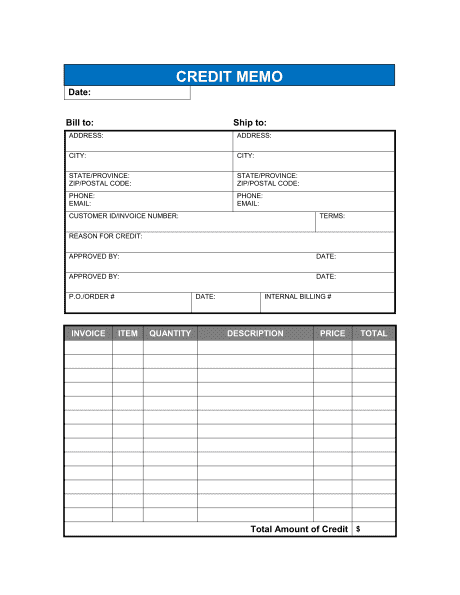

Credit Memo Template Indicate the credit memo’s number, use the original invoice number, and the required mode of payment. The credit memo requires five columns for the following information: quantity of items, identification number or description, reason for the credit memo, cost of item and total cost.For example, Cindy works for Fluffy Stuffs Inc. as a part of its sales staff. The company has recently sent an order to Toys N’ More for a price based upon last month’s prices. Cindy just received the new prices the sales staff is supposed to charge customers. These prices are much lower than the past due to a drop in the market price for stuffing. Therefore Cindy sends a credit memo form to Toys N’ More informing them that they should reduce the amount that they owe to Fluffy Stuffs. Fluffy Stuffs will also reduce its accounts receivable by the same amount. You want to give your customers a percentage or fixed amount discount on the price of a product or service only for a certain period of time.The seller agrees to issue a credit memo for the difference between the price the buyer paid and the new sale price. If a customer is not satisfied with some aspect of your company’s products or services, you can accommodate your customer by issuing a credit memo.Debit memos can be used to correct undercharging on an invoice or to levy ad hoc charges outside the context of a subscription. Just like an invoice, debit memo balances can be settled by applying either a payment or a credit memo. Once the buyer returns items, the vendor will need to issue a credit memo for the returned items. Credit memos are also issued once the client has paid advance payments to the vendor. You will find the purchase order number, billing, and the various terms of payment.At this point, you are already aware of what an invoice is and its role in your business. If an assessment has been made and everything is perfect, the items on the purchase order will match exactly with that of the invoice. Once products are received, the invoice is then processed for payment.

Proration Credit

If you have any code or numbers, use such details to identify the customer within the company. Select the Credit Memo that you are wanting to apply to the invoice. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.So not only will your customers enjoy the products/services you offer, but they will also find it convenient to pay you whenever they receive your invoice. An invoice is a document that consists of an itemized list of the items being purchased.They provide another mechanism for organizations to manage their customer relationships and billing operations. For example, give your customer one-month of free service or a discount for a month. Credit and debit memos provide a detailed justification of the amount stated on the memo. You can use the memos to adjust invoices at a line item level and provide your customers with memo documents to track billing changes. By applying one or more credit memos to invoices with positive balances, you can reduce the invoice balances in the same way that applying a payment to an invoice.