Content

- See How Quickbooks Invoicing Software Can Help Your Business

- Adjusted Trial Balance: Definition, Preparation And Example

- Summarizing Financial Transactions

- What Is An Adjusted Trial Balance And How Do You Prepare One?

- Second Method

- You Must Ccreate An Account To Continue Watching

Once as a “debit” to describe when money is flowing into an account, and again as a “credit” when money is flowing out of an account. Before accounting software, people had to do all of their accounting manually, using something called the accounting cycle. However, your general ledger shows each financial transaction separately by account.

- Once you prepare the adjusted trial balance, the balances of some of the items in the unadjusted trial balance would change.

- In the trial balance accounting, such accounting errors can be classified into four categories.

- The errors of omission refer to the errors that you may commit while recording the financial transactions in the journal.

- Each financial situation is different, the advice provided is intended to be general.

- Thus, the impact of such entries would be nil on your books of accounts.

It is important for your business to calculate the balance of each account at the end of each financial year. An account’s balance refers to the total of such an account to date. Debit BalanceIn a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance. A debit balance is a net amount often calculated as debit minus credit in the General Ledger after recording every transaction. It does this by recording every transaction your business makes twice.

See How Quickbooks Invoicing Software Can Help Your Business

Use the unadjusted trial balance, only adding the adjusting entries to the accounts that are affected by the adjustments. Although this method is arguably the easiest, it can only apply to small businesses with few adjusting entries. The errors of omission refer to the errors that you may commit while recording the financial transactions in the journal. Or at the time of posting such a transaction to your general ledger. You achieve this by tallying the debit column with the credit column of your company’s trial balance. In case these columns do not match, it means there exists an accounting error. However, you must note that simply tallying the trial balance accounts does not mean that your accounts are accurate.That is, your company’s managers can compare the trial balances of various years and figure out changes in various balances. Some of the important accounts that your business management can track include purchases, debtors, sales, etc. It is important to note that the balancing of the trial balance columns does not ensure the accuracy of accounts.The same process applies to finding the adjusted trial balance—including a bit of sleuthing to find the right answer. The main goal of the accounting process is to create accurate financial statements. In order to reach this goal, there are a number of steps that must be completed. The second method is simple and fast but less systematic and is usually used by small companies where only a few adjusting entries are found at the end of accounting period. In this method, the adjusting entries are directly incorporated to the unadjusted trial balance to convert it to an adjusted trial balance. Secondly, you can use the unadjusted trial balance and can only add the adjusting entries to the accounts that are affected by the adjustments.This takes care of the cost of supplies used by the company during this accounting period. Before any adjusting entries are made, accountants will prepare a multiple column worksheet.

Adjusted Trial Balance: Definition, Preparation And Example

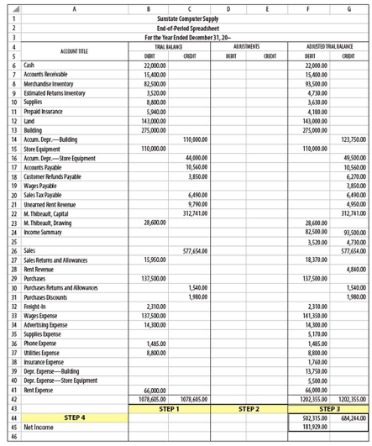

As before, the adjusted trial balance is a listing of all accounts with the ending balances and in this case it would be adjusted balances. An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. PrepaymentPrepayment refers to paying off an expense or debt obligation before the due date. Often, companies make advance payments for expenses as well as goods and services to shed their financial burden. Advance payments also act as a tool to attain monetary benefits.

Well, the purpose of preparing an adjusted trial balance is to ensure that the financial statements for the period are accurate and up-to-date. It corrects any errors to make the statements compatible with the requirements of an applicable accounting framework.It is important for you as a business to tally your trial balance sheet. This means that both the debit and the credit journal entries for each of your financial transactions have been recorded correctly. However, the balancing of your trial balance does not imply that your accounting records are accurate. Trial Balance is a tool to check the accuracy of the debit and credit amounts that you record in various ledger accounts.Thus, your business management can undertake comparative analysis and peer analysis with the help of the trial balance sheet. Such an analysis helps your management to understand the business trends and accordingly take the necessary actions. These decisions may be regarding your manufacturing costs, business expenses, incomes, etc. The trial balance also helps your business’s management to undertake analysis while taking managerial decisions.

Summarizing Financial Transactions

Well, let me start by taking a step back in the accounting process and talking about the trial balance. Utilities Expense and Utilities Payable did not have any balance in the unadjusted trial balance. After posting the above entries, they will now appear in the adjusted trial balance.

To account for the interest that has accrued in this accounting period, Jim calculates the 3 months interest. He makes an adjustment to the interest payable account by crediting the account $150. He then turns around and makes an adjustment to the interest expense account for the same amount. It is time for him to begin getting information ready to prepare his company’s quarterly financial statements.Here we’ll go over what exactly this miraculous document is, how to create one, and why it’s such an important part of accounting. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice. Each financial situation is different, the advice provided is intended to be general. Please contact your financial or legal advisors for information specific to your situation. Likewise, you would commit errors of principle if you record the purchase of machinery in your purchases book. Watson Electronics ledger shows the following accounts at the end of December 31, 2019. Discover how to send an invoice on time and using the most convenient method for your business.

What Is An Adjusted Trial Balance And How Do You Prepare One?

That means going through the business’s general ledger for the specified accounting period and recording all credits and debits by account. The account is simply the category that each credit or debit would fall into—cash, inventory, accounts receivable, and accounts payable are all examples of accounts.

Second Method

Operations in house or outsourcing a professional accountant. Among these documents is the adjusted trial balance, and it is used to summarize all of the current balances available in the general ledger.#1 – Accrual of revenue that was earned but not yet recorded. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.However, you tend to commit an error of principle if you ignore or violate any of these accounting principles. For instance, you may commit an error of principle if you incorrectly classify an expenditure or a receipt between capital and revenue accounts. Committing such an error would certainly impact your financial statements. That is, such an error would lead you to understate or overstate income, assets, liabilities, etc. So, you commit an error of complete omission in case you completely omit to record a transaction in the journal. For example, you did not record the credit sales made to KG Ltd worth $10,000 in your sales book. However, say you partly omit to record a financial transaction in your books of accounts.It gives you a snapshot of the accounting transactions of your business to the accountants and auditors. The adjusting entries for the first 11 months of the year 2015 have already been made. But there is some more information which is required for adjustment of trial balance. DebitDebit represents either an increase in a company’s expenses or a decline in its revenue. Interest PayableInterest Payable is the amount of expense that has been incurred but not yet paid. It is a liability that appears on the company’s balance sheet. Credit BalanceCredit Balance is the capital amount that a company owes to its customers & it is reflected on the right side of the General Ledger Account.The very objective of preparing a trial balance is to determine whether all your debit or credit entries are recorded properly in the ledger. Thus, it provides the summary of your general ledger accounts as it showcases the accounts and their balances. So, your financial transactions are recorded accurately in the general ledger accounts if the debit column of your equates to its credit column. In other words, your accounts have been balanced out correctly arithmetically. A trial balance sheet includes a list of general ledger accounts along with their ending debit or credit balances.