Content

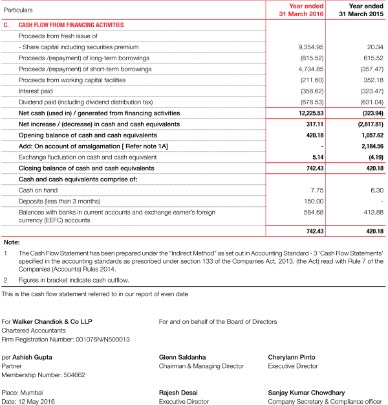

- Cash Flow From Financing Activities

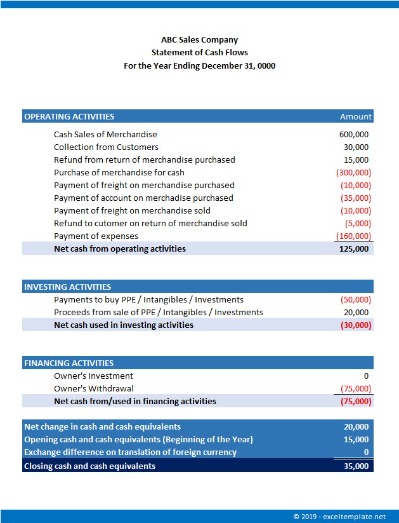

- Get Your Free Excel Cash Flow Statement Template

- Balance Sheet And Income Statement

- The Direct Method Of Calculating Cash Flow

The cash outflow for debt initially having maturity due after one year or beyond the normal operating cycle, if longer. The cash inflow from a debt initially having maturity due after one year or beyond the operating cycle, if longer. Amount of increase in operating assets after deduction of operating liabilities classified as other. The increase during the reporting period in the aggregate amount of obligations related to services received from employees, such as accrued salaries and bonuses, payroll taxes and fringe benefits. Future cash outflow to pay for purchases of fixed assets that have occurred. A key component for any company are the changes in accounts receivable.

Accounting Learn about accounting tools, methods, regulations and best practices. It reveals a business’ liquidity so that companies know just how much cash is on hand, and thus their projected runway to when cash is projected to run out. Brainyard delivers data-driven insights and expert advice to help businesses discover, interpret and act on emerging opportunities and trends. Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. Pilot is a provider of financial back-office services, including bookkeeping, controller services, and CFO services. Darin is a content marketer, wordsmith, storyteller, and former print journalist. He is passionate about helping businesses get their finances in order and demystifying all of the complexities that come with it.

Cash Flow From Financing Activities

It eliminates the effects of different bookkeeping techniques , making it easier for investors to compare multiple firms’ financial performance. Knowing whether your organization is in the black or moving in the opposite direction can help you plan ahead and make informed financial decisions. Cash outflow in the form of capital distributions and dividends to common shareholders, preferred shareholders and noncontrolling interests. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.The cash flow statement reveals the quality of a company’s earnings (i.e. how much came from cash flow as opposed to accounting treatment), and the firm’s capacity to pay interest and dividends. The cash flow statement serves as a bridge between the income statement and the balance sheet by showing how cash moves in and out of a business during a specific period. The balance sheet involves a company’s assets and liabilities from one period to the next while the income statement covers expenses and income over time. The main difference between the direct method and the indirect method of presenting the statement of cash flows involves the cash flows from operating activities.

Get Your Free Excel Cash Flow Statement Template

There are no differences in the cash flows from investing activities and the cash flows from financing activities under either method—the real difference lies in the operating activities. Amount of cash inflow from investing activities, including discontinued operations. Investing activity cash flows include making and collecting loans and acquiring and disposing of debt or equity instruments and property, plant, and equipment and other productive assets. Amount of currency on hand as well as demand deposits with banks or financial institutions.

Does cash flow equal net income?

Net income is carried over from the income statement and is the first item of the cash flow statement. Net cash flow from operating activities is calculated as the sum of net income, adjustments for non-cash expenses, and changes in working capital.Investors look to the cash flow statement for insights into a company’s financial footing. Meanwhile, creditors can use the cash flow statement to gauge liquidity and determine whether a company can fund its operating expenses and pay off its debts. The indirect method takes the net income generated in a period and adds or subtracts changes in the asset and liability accounts to determine the implied cash flow.

Balance Sheet And Income Statement

Amount of income included in net income that results in no cash inflow , classified as other. Lastly, the SCF provides the cash amounts needed in some financial models. Investment bankers and finance professionals use different cash flow measures for different purposes. However, free cash flow has no definitive definition and can be calculated and used in different ways. Cash Flow for Month Ending July 31, 2019 is $500, once we crunch all the numbers.Cash includes, but is not limited to, currency on hand, demand deposits with banks or financial institutions, and other accounts with general characteristics of demand deposits. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period. Amount of cash and cash equivalents, and cash and cash equivalents restricted to withdrawal or usage. Cash flow from operating activities involves any cash flows from current assets and current liabilities.

- The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period.

- Improve the comparability of different firms’ operating performance by eliminating the effects of different accounting methods.

- For businesses using accrual accounting, transactions are recorded when they occur.

- Cash flow might also impact internal decisions, such as budgeting, or the decision to hire employees.

The cash flows from operating activities section provides information on the cash flows from the company’s operations (buying and selling of goods, providing services, etc.). With the most likely used indirect method, the starting point of this section is the company’s net income.

The Direct Method Of Calculating Cash Flow

An increase in an asset account is subtracted from net income, and an increase in a liability account is added back to net income. This method converts accrual-basis net income into cash flow by using a series of additions and deductions. Before this model can be created, we first need to have the income statement and balance sheet statement models built in Excel, since their data will ultimately drive the cash flow statement model. The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. It’s important to note that cash flow is different from profit, which is why a cash flow statement is often interpreted together with other financial documents, such as a balance sheet and income statement.

Essentially, the accountant will convert net income to actual cash flow by de-accruing it through a process of identifying any non-cash expenses for the period from the income statement. The most common and consistent of these are depreciation, the reduction in the value of an asset over time, and amortization, the spreading of payments over multiple periods. The indirect method uses changes in balance sheet accounts to modify the operating section of the cash flow statement from the accrual method to the cash method. This section reports cash flows and outflows that stem directly from a company’s main business activities. These activities may include buying and selling inventory and supplies, along with paying its employees their salaries. Any other forms of in and outflows such as investments, debts, and dividends are not included. Finance can reference both the balance sheet and the income statement while preparing a cash flow statement.

Always Know How Much Cash Is On Hand

From the late 1970 to the mid-1980s, the FASB discussed the usefulness of predicting future cash flows. In 1987, FASB Statement No. 95 mandated that firms provide cash flow statements. In 1992, the International Accounting Standards Board issued International Accounting Standard 7 , Cash Flow Statement, which became effective in 1994, mandating that firms provide cash flow statements. Greg didn’t invest any additional money in the business, take out a new loan, or make cash payments towards any existing debt during this accounting period, so there are no cash flows from financing activities. Cash flow is broken out into cash flow from operating activities, investing activities, and financing activities. The business brought in $53.66 billion through its regular operating activities. Meanwhile, it spent approximately $33.77 billion in investment activities, and a further $16.3 billion in financing activities, for a total cash outflow of $50.1 billion.If you use accounting software, it can create cash flow statements based on the information you’ve already entered in the general ledger. The direct method of creating the cash flow statement uses actual cash inflows and outflows from the company’s operations, instead of accrual accounting inputs. A company’s financial statements offer investors and analysts a portrait of all the transactions that go through the business, where every transaction contributes to its success. The cash flow statement is believed to be the most intuitive of all the financial statements because it follows the cash made by the business in three main ways—through operations, investment, and financing. All three financial reports work together to provide insight into the financial position of the business.

Includes other kinds of accounts that have the general characteristics of demand deposits. Excludes cash and cash equivalents within disposal group and discontinued operation.The cash flow statement is an important document that helps open a wind interested parties insight into all the transactions that go through a company. When it comes to the balance sheet, any changes in accounts receivable must be reflected in cash flow.This section involves cash transactions related to raising money from stock or debt or repaying that debt. When cash flow from financing activities contains a positive number, it’s a sign that there is more cash inflow than outflow. When the number is negative, it may indicate that a company is paying off debt, making dividend payments or buying back stock. Another important item found here is acquisitions of other businesses. A key to remember is that a change in the long-term assets in the balance sheet is reported in the investing activities of the cash flow statement. You use information from your income statement and your balance sheet to create your cash flow statement.

The Indirect Method Of Calculating Cash Flow

When capex increases, it generally means there is a reduction in cash flow. But that’s not always a bad thing, as it may indicate that a company is making investment into its future operations. Companies are able to generate sufficient positive cash flow for operational growth.Amount of cash inflow from sale, maturity, prepayment and call of investment in debt security measured at fair value with change in fair value recognized in other comprehensive income (available-for-sale). Pilot gets you accurate, on-time financial statements each month, and helps you understand how your financial data can help grow your business. Regardless of whether you’re starting your first business or have been in the driver’s seat for a long time, understanding and managing finances is key to your success. The cash flow statement is an important tool to keep your business running smoothly. Meanwhile, the cash at the end of period should represent how much money is actually in your bank account.Meaning, even though our business earned $60,000 in October , we only actually received $40,000 in cash from operating activities. Increase in Inventory is recorded as a $30,000 growth in inventory on the balance sheet. That means we’ve paid $30,000 cash to get $30,000 worth of inventory. Depreciation is recorded as a $20,000 expense on the income statement.

Using A Cash Flow Statement Template

Regardless of your revenue, you must ensure that there’s enough cash on hand for your organization to be financially solvent and cover critical expenses, including taxes and payroll. At the bottom of the SCF is a reference to inform the readers that the notes to the financial statements should be considered as part of the financial statements. The notes provide additional information such as disclosures of significant exchanges of items that did not involve cash, the amount paid for income taxes, and the amount paid for interest. The cash flow statement is required for a complete set of financial statements. Examples of operating activities are cash received and disbursed for product sales, royalties, commissions, fines, lawsuits, supplier and lender invoices, and payroll. When all the adjustments have been made, we arrive at the net cash provided by the company’s operating activities.