Content

- Chapter 3: Completion Of The Accounting Cycle

- One More Step

- Recording A Closing Entry

- Step 4

- Cash Flow Statements: Reviewing Cash Flow From Operations

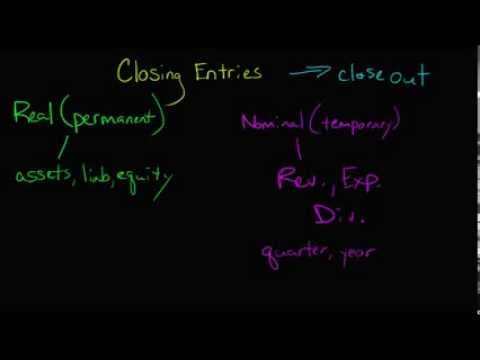

- Closing Entries

- Understanding Closing Entries

So, the ending balance of this period will be the beginning balance for next period. Finally, dividends are closed directly to retained earnings.

An accrued expense is recognized on the books before it has been billed or paid. Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle. He received his masters in journalism from the London College of Communication.

Chapter 3: Completion Of The Accounting Cycle

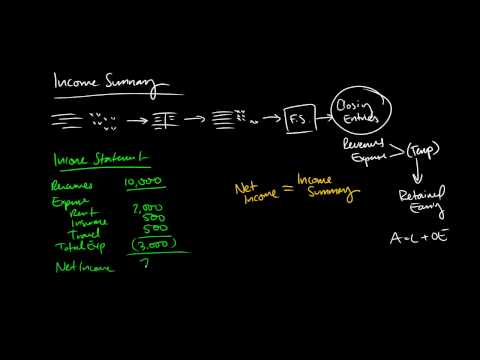

Therefore, the income summary account is closed by debiting income summary account and crediting retained earnings account. Closing entries are an important component of the accounting cycle in which balances from temporary accounts are transferred to permanent accounts.

- It contains all the company’s revenues and expenses for the current accounting time period.

- This prepares the books for the next accounting period to start.

- Accrual accounting is the most common method used by businesses.

- Close the income statement accounts with credit balances to a special temporary account named income summary.

- An accrued expense is recognized on the books before it has been billed or paid.

- This is done through a journal entry debiting all revenue accounts and crediting income summary.

Temporary accounts can either be closed directly to the retained earnings account or to an intermediate account called theincome summary account. The income summary account is then closed to the retained earnings account. The four-step method described above works well because it provides a clear audit trail. For smaller businesses, it might make sense to bypass the income summary account and instead close temporary entries directly to the retained earnings account. If this amount is accurate, you’ll then close Income Summary and transfer the balance to permanent accounts.

One More Step

If any dividend payments need to be made, this is also when they are taken care of by debiting the retained earnings account and crediting the dividend account. The first step will be to close out these accounts and transfer those temporary account balances to the income summary account through journal entries. To do so, we’ll debit revenues and credit expenses. Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings.

What are closing entries and why are they necessary quizlet?

Closing entries are necessary to reduce the balances in nominal accounts to zero in order to prepare the accounts for the next period’s transactions.The retained earnings account is reduced by the amount paid out in dividends through a debit, and the dividends expense is credited. Temporary accounts are used to record accounting activity during a specific period. All revenue and expense accounts must end with a zero balance because they are reported in defined periods and are not carried over into the future.

Recording A Closing Entry

Accrual accounting is the most common method used by businesses. Define accrued expenses and revenues, explore the types of accrued expenses and revenues, and examine practical examples of these two concepts.The accounting cycle, and how it works, is vital to understand. Once any required adjusting journal entries are made and posted to the general ledger, an adjusted trial balance is prepared. Financial statements are subsequently produced from information contained within the adjusted trial balance. At the end of each financial year, temporary general ledger accounts are closed to a zero balance, with the balances in that account closed to income summary. The net balance in income summary is then posted to retained earnings. Close the income statement accounts with debit balances to the income summary account.

Step 4

It contains all the company’s revenues and expenses for the current accounting time period. In other words, it contains net incomeor the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial statements because its only purpose is to be used during the closing process.Discover more about the definition of the adjusted trial balance, including its preparation and the trial balance worksheet, and an example of this step in practice. Adjusting entries are done at the end of a cycle in accounting in order to update financial accounts.

Cash Flow Statements: Reviewing Cash Flow From Operations

The closing of the income statement accounts by transferring their balances to the owner’s capital account or the corporation’s retained earnings account. This is done after the company’s financial statements for the year have been prepared. Locate the revenue accounts in the trial balance, which lists all of the revenue and capital accounts in the company’s ledger. To return them to zero, you must perform a debit entry for each revenue account to move the balance to the income summary account. The expense accounts have debit balances so to get rid of their balances we will do the opposite or credit the accounts. Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary. The total debit to income summary should match total expenses from the income statement.

The financial statements are key to both financial modeling and accounting. DebitCreditCash10,000Accounts Receivable25,000Interest Receivable600Supplies1,500Prepaid Insurance2,200Trucks40,000Accum. Any account listed on the balance sheet, barring paid dividends, is a permanent account. On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. The Business Consulting Company, which closes its accounts at the end of the year, provides you the following adjusted trial balance at December 31, 2015. C. All real accounts are closed but not the nominal accounts. Accounting has many classifications for different accounts.Since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings. Making closing entries means creating a zero balance in all temporary accounts by carrying those balances over to permanent accounts. This prepares the books for the next accounting period to start.As a result, the temporary accounts will begin the following accounting year with zero balances. Account by debiting revenue and crediting income summary. Finally, if a dividend was paid out, the balance is transferred from the dividends account to retained earnings. All income statement balances are eventually transferred to retained earnings. The balance sheet is one of the three fundamental financial statements.All of Paul’s revenue or income accounts are debited and credited to the income summary account. This resets the income accounts to zero and prepares them for the next year. A closing entry is a journal entry made at the end of the accounting period.

Understanding Closing Entries

The end result is equally accurate, with temporary accounts closed to the retained earnings account for presentation in the company’s balance sheet. When an accounting period comes to an end, there are several steps an accountant needs to take to clean up a company’s books and prepare them for the next accounting period. This cyclical process is referred to as the accounting cycle, and one of the last few steps in the process is the act of making closing entries.After all revenue and expense accounts are closed, the income summary account’s balance equals the company’s net income or loss for the period. Below are examples of closing entries that zero the temporary accounts in the income statement and transfer the balances to the permanent retained earnings account. Closing entries, also called closing journal entries, are entries made at the end of an accounting period to zero out all temporary accounts and transfer their balances to permanent accounts.