Content

- Consolidated Net Income

- Income Statement

- Consolidated Income Statement Statement Definition Release 9 2 Update

- Row Definitions For The Consolidated Income Statement Statement Definition

- Filing Quarterly Business Reports

- Does A Consolidated Financial Statement Cover Subsidiary Companies?

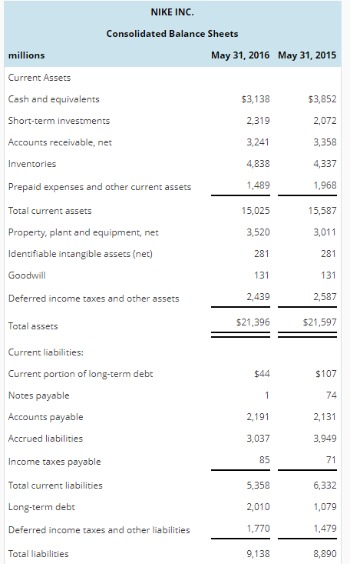

The aggregate costs related to goods produced and sold and services rendered by an entity during the reporting period. This excludes costs incurred during the reporting period related to financial services rendered and other revenue generating activities. GAAP and IFRS include provisions that help to create the framework for consolidated subsidiary financial statement reporting. The average number of shares or units issued and outstanding that are used in calculating diluted EPS or earnings per unit , determined based on the timing of issuance of shares or units in the period. The aggregate total costs related to selling a firm’s product and services, as well as all other general and administrative expenses. Direct selling expenses are expenses that can be directly linked to the sale of specific products.Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. Companies can often use the word consolidated loosely in financial statement reporting to refer to the aggregated reporting of their entire business collectively. However, the Financial Accounting Standards Board defines consolidated financial statement reporting as reporting of an entity structured with a parent company and subsidiaries. In a consolidated balance sheet, the assets and liabilities of a parent company and its subsidiaries are reported, these excluded the accounts payable and accounts receivables of these companies. When the assets and liabilities are being reported, it is without bias, they are reported generally without referring to which entity owns specific assets and which entities owe certain liabilities. Hence, items highlighted in the balance sheet and not distinguished from one entity to another. The eliminated account receivable and account payable balnaces and is also to ensure there is no distinction in the assets and liabilities of the companies or entities.

Consolidated Net Income

Please declare your traffic by updating your user agent to include company specific information. Find out how to prepare quarterly reports, who needs to file them, and how they can help your small business. The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law. Serving legal professionals in law firms, General Counsel offices and corporate legal departments with data-driven decision-making tools.

What does consolidation mean in business?

In business, consolidation or amalgamation is the merger and acquisition of many smaller companies into a few much larger ones. … The taxation term of consolidation refers to the treatment of a group of companies and other entities as one entity for tax purposes.Generally, a parent company and its subsidiaries will use the same financial accounting framework for preparing both separate and consolidated financial statements. As mentioned, private companies have very few requirements for financial statement reporting but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles . If a company reports internationally it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards . Both GAAP and IFRS have some specific guidelines for entities who choose to report consolidated financial statements with subsidiaries.

Income Statement

These statements require considerable effort to construct, since they must exclude the impact of any transactions between the entities being reported on. Thus, if there is a sale of goods between the subsidiaries of a parent company, this intercompany sale must be eliminated from the consolidated financial statements. Another common intercompany elimination is when the parent company pays interest income to the subsidiaries whose cash it is using to make investments; this interest income must be eliminated from the consolidated financial statements. Berkshire Hathaway is a holding company with ownership interests in many different companies.This annual decision is usually influenced by the tax advantages a company may obtain from filing a consolidated versus unconsolidated income statement for a tax year. Public companies usually choose to create consolidated or unconsolidated financial statements for a longer period of time. If a public company wants to change from consolidated to unconsolidated it may need to file a change request. Changing from consolidated to unconsolidated may also raise concerns with investors or complications with auditors so filing consolidated subsidiary financial statements is usually a long-term financial accounting decision.With this statement, you can quickly see the performance of a business based on its net income, gains, losses, and earnings per share, as well as view the distribution of net income between equity holders and other interest holders. The amount of net income for the period per each share of common stock or unit outstanding during the reporting period. Whether you’re looking for investors for your business or want to apply for credit, you’ll find that producing four types of financial statements can help you. A consolidated statement of income can be an extremely valuable financial report—not only for you, but for your business’s investors as well. Subtract from each result any corresponding expenses related to intercompany transactions to determine each consolidated expense. The net result for the period of deducting operating expenses from operating revenues.

Consolidated Income Statement Statement Definition Release 9 2 Update

The main one mandates that the parent company or any of its subsidiaries cannot transfer cash, revenue, assets, or liabilities among companies to unfairly improve results or decrease taxes owed. Depending on the accounting guidelines used, standards may differ for the amount of ownership that is required to include a company in consolidated subsidiary financial statements.Write the name of each consolidated expense and its amount below total revenues on the consolidated income statement. Continuing with the example, write “cost of goods sold $26,000” on the line below total revenues, and write the other consolidated expenses on the lines below. Accounts such as retained earnings, accounts receivable balance, accounts payable balance, common stock, and other equity accounts must be removed from the financial statements. ABC International has $5,000,000 of revenues and $3,000,000 of assets appearing in its own financial statements. However, ABC also controls five subsidiaries, which in turn have revenues of $50,000,000 and assets of $82,000,000. Clearly, it would be extremely misleading to show the financial statements of just the parent company, when its consolidated results reveal that it is really a $55 million company that controls $85 million of assets. A consolidated financial statement is an excellent way to keep track of the assets and income of a group of legal entities owned by a parent—but you should be aware of the guidelines to follow when preparing this important document.

Row Definitions For The Consolidated Income Statement Statement Definition

It is also possible to have consolidated financial statements for a portion of a group of companies, such as for a subsidiary and those other entities owned by the subsidiary. Three adjustments are very critical in arriving at the correct determination of consolidated net income. The first is adjustment for excess amortization due to difference between the fair value of net asset of the subsidiary and their book values at the time of acquisition. The second is elimination of any investment income from subsidiary recognized in the individual financial statements of the parent using the cost method or equity method must be subtracted. The third adjustment relates to exclusion of the unrealized income recognized on inter-company sale of inventories.

- Calculate each of your small business’ expenses and each of your subsidiary’s expenses during the accounting period.

- However, ABC also controls five subsidiaries, which in turn have revenues of $50,000,000 and assets of $82,000,000.

- Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries.

- Subtract the sales made between you and your subsidiary to determine consolidated revenue.

- Its ownership stake in publicly traded company Kraft Heinz is accounted for through the equity method.

- This table describes the row definitions in each section in the delivered Consolidated Income Statement statement definition.

- At CCH Tagetik, we are continuously updating our performance management software with innovations based on input from our customers to improve the customer experience.

This means that the revenue generated by a parent company that is an expense of the subsidiary is not recorded on the consolidated statement of income. A consolidated financial statement is a financial statement of a parent company and all its divisions or subsidiaries. A consolidated financial statement is often used by the Financial Accounting Standards Board in the context of a company that has a group of enterprises.This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website. To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content.

In reality, however, many companies use consolidated financial statements to describe an aggregate report on an entire business, including its sections of segments. A consolidated financial statement reports all the revenues of the expenses of a group of companies. This financial statement gives an insight into the overall financial health or otherwise of a parent company and its subsidiaries. The cost and equity methods are two additional ways companies may account for ownership interests in their financial reporting. If a company owns less than 20% of another company’s stock, it will usually use the cost method of financial reporting. If a company owns more than 20% but less than 50%, a company will usually use theequity method.When collating the financial statement of a company, a parent company and its subsidiaries will report their finances distinctly, before the financial reports are aggregated to form a consolidated financial statement. Investors, market regulators, and financial analysts consider a consolidated financial statement to be a gauge of the overall financial state of a company. Within these categories may be variations, depending on the particular needs of the business. A company may choose, for example, to subtotal items such as gross profit and operating expenses. A single-step income statement does not separate out these items, while a multistep income statement groups similar items to calculate subtotals. The goal of consolidated financial statements is to present an enterprise as a single entity, which means that intra-group transactions and intra-group balances need to be eliminated.Indirect selling expenses are expenses that cannot be directly linked to the sale of specific products, for example telephone expenses, Internet, and postal charges. General and administrative expenses include salaries of non-sales personnel, rent, utilities, communication, etc. The CONSINCSTMT delivered statement definition enables you to generate a consolidated income statement. CONSINCSTMT is the name of the statement definition; the description is Consolidated Income Statement. Preparing a consolidated income statement allows investors to see what is happening financially with the business, thus enabling them to gauge the current economic and potential future growth of the company.International Financial Reporting Standards are a set of accounting rules currently used by public companies in 166 jurisdictions. During the year, Company P sold inventories worth $4 million to Company S, 25% of which remains unsold.Berkshire Hathaway uses a hybrid consolidated financial statements approach which can be seen from its financials. In its consolidated financial statements it breaks out its businesses by Insurance and Other, and then Railroad, Utilities, and Energy. Its ownership stake in publicly traded company Kraft Heinz is accounted for through the equity method. Thus, consolidated financial statements are the combined financials for a parent company and its subsidiaries.