Content

- How To Complete Form 1099

- Get The Latest On Monthly Child Tax Credit Payments Here

- Things You Should Know About Form 1099

- You Are Leaving H&r Block® And Going To Another Website

Most taxpayers are exempt from backup withholding. If you have no idea what the IRS is talking about here, you’re probably exempt. If you aren’t exempt, the IRS will have notified you, and the company paying you needs to know because it is required to withholdincome taxfrom your pay at a flat rate of 24% and send it to the IRS. An unscrupulous or financially struggling employer might try to classify an employee as an independent contractor to save money. If you’re classified as an independent contractor, your employer’s tax “savings” will come out of your pocket as self-employment tax.

How much taxes will I pay on a W9?

If your income from a W-9 arrangement is subject to backup withholding, the current flat rate set by the IRS is 28%. So, to calculate how much you can expect to be withheld, simply multiply your W-9 income by 0.28.Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. If you need to supply the person or business paying you with account information such as a bank or brokerage account that pertains to the request for the W-9. When beginning to work as either an independent contractor or an employee, you should expect to fill out some paperwork providing your personal identifiable information. The individual or business you are doing business with uses the W-9 to collect some of your personal information, the most important of which is your taxpayer identification number .

How To Complete Form 1099

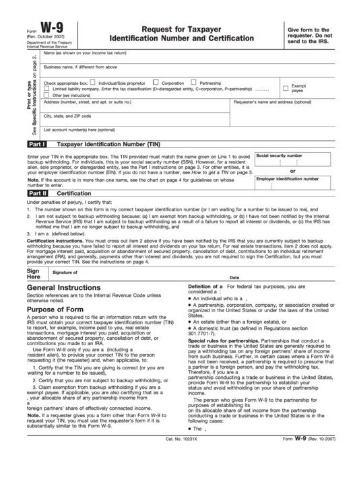

Taxpayers use the W-9 tax form to verify their correct taxpayer identification number and to certify that they are not subject to backup withholding. How long do you keep my filed tax information on file? How do I update or delete my online account?

If you’re unincorporated and share ownership of your business with one or more other people, you’re probably a partnership. Sole proprietor/single-member LLC. If you’re doing business, don’t have a business partner and haven’t incorporated your business, you’re probably a sole prop. Available at participating offices and if your employer participate in the W-2 Early AccessSM program. Learn more about letter 484C, why you received it, and how to handle an IRS 484C letter with help from the tax experts at H&R Block. Emerald Card The best in digital banking, with a prepaid debit card. Finances Emerald Advance Access to a line of credit, with no W-2 required to apply.State e-file not available in NH. E-file fees do not apply to NY state returns. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

Get The Latest On Monthly Child Tax Credit Payments Here

See Cardholder Agreement for details. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. The tax identity theft risk assessment will be provided in January 2019.If you’re unable to complete the challenge, please take a screenshot of this page and email it to our Security team at security- We’ll do our best to figure it out. The tax code is roughly 4 million words long. You don’t need to learn and understand it all, but knowing about the W9 form can serve you well. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Some certified public accountants consider it best practice to ensure the completion of Form W-9 by payees before issuing any payments. Signing and dating this section certifies that all of the information you’re entering here is correct.

- Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit.

- All tax situations are different.

- If you’re a guest on “Ellen” during her “12 Days of Giveaways” promotion, and the talk show producers ask you to fill out a W-9 before you leave, it’s safe to assume the request is legitimate.

- A sole proprietorship or sole trader is an unincorporated business with a single owner who pays personal income tax on profits earned from the business.

- You can usually prevent backup withholding by supplying the correct information when requested and paying an appropriate amount of taxes each year.

- Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics.

Has the IRS sent you a letter telling you that you are subject to mandatory backup withholding? This might have happened if you didn’t report all your interest and dividends on a previous tax return. If you haven’t received this letter, and if you provide your tax identification number to the requester of Form W-9, then you are not subject to backup withholding. If you are subject to backup withholding, cross out item two in part two of Form W-9 before submitting it. You sign and date the form in this field, declaring the information you have provided is accurate to the best of your knowledge.To fill out Form 1099-MISC, the business may need to request information from the contractor, for which Form W-9 is used. The business does not send Form W-9 to the IRS. It requests the name, address, and taxpayer identification information of a taxpayer . Because the W-9 also requires a Social Security number or tax ID, it should be guarded carefully to protect from identity theft.

Things You Should Know About Form 1099

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra. State e-file available for $19.95. Do you have additional questions about IRS Form W-9 or need help filing your return?

Which is better W-2 or W9?

If you worked as an employee for a company in the previous year, you should receive a W-2. When you work as an independent contractor or freelancer, you should fill out and submit a W-9. Independent contractors or freelancers who require a W-9 form are also required to earn $600 or more during their contract.With similar concerns, one should be hesitant if they receive a W-9 form from a source they don’t know. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Exemptions– This section of the W-9 tax Form applies only to certain entities, not to individuals. Entities that are exempted from backup withholding should enter the appropriate code found in the Instructions section.

You Are Leaving H&r Block® And Going To Another Website

H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Form W-9 tells you to cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. What if your business is new and doesn’t have an EIN? You can still fill out a W-9 form. The IRS says you should apply for your number and write “applied for” in the space for the TIN. You’ll want to get this number as quickly as possible because, until you do, you’ll be subject to backup withholding.Rather, businesses who hire independent contractors are required to provide this form to the contractors, who in turn fill it out and return it to the contracting business. The business in turn uses the information provided by the form to fill out a 1099-MISC form, which will be sent to the IRS if the contractor is paid $600 or more by that business in a tax year.

You’re generally only required to sign it if the IRS has notified you that you previously provided an incorrect TIN. Technicalities aside, however, the person who asked you to fill out Form W-9 will probably consider it incomplete or invalid if you haven’t signed it. The W-9 differs from a W-4 Form—which is more commonly supplied by employees to direct employers—in that the W-9 does not inherently arrange for the withholding of any taxes due. The W-9 is an official form furnished by the IRS for employers or other entities to verify the name, address, and tax identification number of an individual receiving income. It isn’t always clear whether a worker is an employee or independent contractor, but in general, the more control the business has over what workers do and how they do it, the more likely it is that they are employees. If your Spidey sense starts tingling when someone who hired you calls you an independent contractor, that’s a good sign, and you should investigate the situation further.

Small Business

Substitute teacher deductions can lead to a much lower tax bill. Learn from our tax expert about what substitute teachers can write off. On the right, you will find a field called “Requester’s name and address”. This is optional, but it could be a good idea to keep track of who you’re sending this Form W-9 to. This applies to you if you’re doing business but don’t have a business partner (you’re acting as an individual) and in case you haven’t incorporated your business. Keep in mind this form is only used if you are not hired as an employee.Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan.

Financial Services

If someone other than a client, bank or other financial institution asks you for a W-9 form, you might want to think twice about sending one. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.

Who Needs To Fill In Irs Form W

Backup withholding is money taken out of your pay and paid to the IRS from income payments which otherwise wouldn’t be subject to withholding. Payers may be required to withhold taxes to ensure that the IRS will receive income taxes that are owed to them. The W-9 form is an IRS tax form that is filled out by providing information about a freelancer or contractor including the name, address and taxpayer identification number . The business that employs freelancers and contractors uses the information to prepare Form 1099-MISC and report to the Internal Revenue Service the amount of income that is paid to the contractor or freelancer. If a contractor has been told by the IRS that they’re subject to “backup withholding,” that means the businesses paying their invoices have to withhold income tax at a flat 24% from the invoice and remit it to the IRS.