Content

- About Form 1040, U S Individual Income Tax Return

- What Is Form 1040?

- Do Tax Brackets Include Social Security?

- Other Tax Forms You May Need

- Filing Requirements

- Who Needs To File Form 1040?

They are often used to verify income and tax filing status when applying for loans and government benefits. The tax return deadline was original set at March 1.

However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately. Paper forms can be filled and saved electronically using a compatible PDF reader, and then printed.

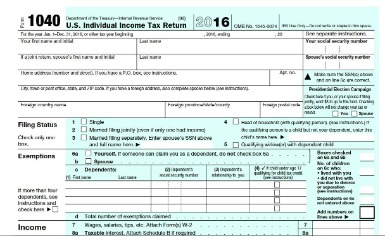

About Form 1040, U S Individual Income Tax Return

Form 1040 consists of two pages not counting attachments. The first page collects information about the taxpayer and dependents. In particular, the taxpayer specifies his/her filing status on this page. Altogether, 142 million individual income tax returns were filed for the tax year 2018 , 92% of which were filed electronically. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.This is a statement accompanying a taxpayer’s payment for any balance on the “Amount you owe” line of the 1040 or 1040-NR. Taxpayers in certain situations may need to file a different variant of the 1040 form instead of the standard version. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. No pressure, no credit card required.

What Is Form 1040?

Or, a taxpayer and spouse – if married filing jointly – had church employee income of $108.28 or more. Or, does not have to file Form 1040 with the United States. Instructions For Bona Fide Residents Of Puerto Rico Who Must File 1040 or 1040-SR Income Tax Return. With the Current Tax Payment Act of 1943, income tax withholding was introduced.It calculates the amount of tax you owe or the refund you receive. In addition to the listed schedules, there are dozens of other forms that may be required when filing a personal income tax return. Typically these will provide additional details for deductions taken or income earned that are listed either on form 1040 or its subsequent schedules. The new 1040 uses what the IRS terms a “building block” approach and allows taxpayers to add only the schedules they need to their tax return. Many individual taxpayers, however, only need to file a 1040 and no schedules. The Form 1040 is the base IRS income tax form – and first page – of a Federal or IRS income tax return for a given tax year; the 1040 form changes by tax year. An income tax return is filed or e-Filed annually, usually by April 15 of the following year of the tax year – for 2021 Returns, the due date is April 18, 2022.Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Interest you received or paid on securities that were transferred between interest payment dates. Use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Employers must file a Form W-2 for each employee from whom Income, social security, or Medicare tax was withheld. Emancipated Minor means you are a child under 21 years of age who no longer lives with their parents and is not financially dependent on them. We require a court or legal document of an approved emancipation. Starting with the 2020 Federal Tax Return, there are SIX new NUMBERED schedules that may accompany the Form 1040.

How do I attach w2 to 1040?

For supporting statements, arrange them in the same order as the schedules or forms they support and attach them last. n Attach a copy of Forms W-2, W-2G and 2439 to the front of Form 1040. Also attach Forms 1099-R if tax was withheld. n Use the coded envelope included with your tax package to mail your return.However, payments that are due must be paid immediately. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication.

Do Tax Brackets Include Social Security?

If filing jointly with a spouse, both must sign and date. If a return is submitted electronically, individuals must use either a Self-Select PIN or Practitioner PIN.

- To obtain the Verification of Non-Filing Letter, visit the IRS website.

- Each state has separate tax codes in addition to federal taxes.

- Complete and sign the form online on eFile.com.

- Emerald Cash RewardsTMare credited on a monthly basis.

- See your Cardholder Agreement for details on all ATM fees.

- There are a handful of other taxes that will require you to also complete Schedule 2.

- Investopedia requires writers to use primary sources to support their work.

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only.

Other Tax Forms You May Need

One can use a tax professional who has been accepted by the IRS for electronic filing. You’ll calculate your tax on the second page of Form 1040. The Form 1040 Instructions include tables for help with the calculations, but tax software can handle that for you. Check out the IRS Form 1040 Instructions for more information on the types of income and adjustments that go on Schedule 1. We believe everyone should be able to make financial decisions with confidence.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Above, we’ve listed a few common forms and schedules you may need to attach to Form 1040, but there are several more you may need to complete. Review the IRS Instructions for Form 1040 for any other forms you need. On the second page of Form 1040, you’ll calculate your tax liability. If you’re preparing your return by hand, you’ll need to consult the IRS Instructions for Form 1040 to determine your tax using the tax tables.The Individual Income Tax Act of 1944 created standard deductions on the 1040. The taxable income was calculated starting from gross income, subtracting business-related expenses to get net income, and then subtracting specific exemptions (usually $3,000 or $4,000).Make the check or money order payable to the United States Treasury. Download yourstate’s tax forms and instructions for free. In this Case, IRS agents who had calculated Mr. Lawrence’s tax liability had made an error and it was discovered that Mr. Lawrence owed less taxes than originally determined. Lawrence asked the trial court to order the government to reimburse him for his legal fees, to which the trial court ruled against him. In most situations, other Internal Revenue Service or Social Security Administration forms such as Form W-2 must be attached to the Form 1040, in addition to the Form 1040 schedules.This gives Congress time to make last-minute changes to tax law and gives the IRS time to update tax forms to reflect those changes. Some people may not have to file any of these schedules. Form 1040-SR adds up your income for the year, as well as all the deductions you’d like to claim.Taxpayers who receivedividendsthat total more than $1,500, for example, must file Schedule B, which is the section for reporting taxable interest andordinary dividends. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. Also, if you’re not a sole proprietor, you may need to file a separate tax return for the business. A one stop shop for bookkeeping and tax filing is a reality with Bench.The reason for March 1 was not explained in the law, but was presumably to give time after the end of the tax year to prepare tax returns. The two-week extension from March 1 to March 15 occurred after the Revenue Act of 1918 was passed in February 1919, given only a few weeks to complete returns under the new law.

Get Copies And Transcripts Of Your Tax Returns

This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding.