Content

- Past Due Invoice

- Business Proposal

- What Is An Invoice Id?

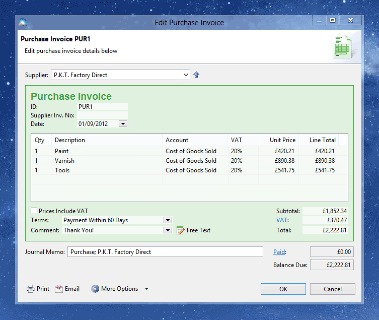

- What Does An Invoice Look Like?

- Electronic

- How To Manage Your Small Business Payroll Taxes The Easy Way

A timesheet invoice may also be generated by Operated equipment rental companies where the invoice will be a combination of timesheet based charges and equipment rental charges. Invoices are the backbone of the accounting system for small businesses. An invoice tells your client how much they owe you, when the payment is due and what services you provided. Vendors usually refer to an invoice as a sales invoice because it records the sale made the customer. Customers, on the other hand, refer to this a purchase invoice because it records the goods that were bought from the seller.The United Nations standard for electronic invoices (“INVOIC”) includes standard codes for transmitting header information and codes for transmitting details for each of the line items . The “INVOIC” standard can also be used to transmit credit and debit memos. Electronic Invoicing is not necessarily the same as EDI invoicing. Electronic invoicing in its widest sense embraces EDI as well as XML invoice messages as well as other formats such as pdf. Keep in mind that a sales invoice is not the same thing as a receipt. The sales invoice is the mechanism by which to initiate collection of payment, whereas a receipt is a confirmation that payment was made and received.An invoice ID, also referred to as an invoice number, is a unique number that’s assigned to each invoice a business generates. The invoice number is a crucial invoice element because it allows a business to easily identify and refer to individual transactions with clients. For example, a local coffee shop wants to buy five cases of espresso from their favorite distributor. The coffee shop owner might sign a purchase order when they buy the product. As you create an invoice, keep these tips in mind to ensure both parties are clear on payment expectations. Additionally, invoices can help you protect your company in the event of an audit, as they help to create a paper trail. Detailed invoices will show the IRS exactly where your money came from should they question your tax returns.

Past Due Invoice

At Invoice Simple our goal is to make it as easy as possible to make invoices. It’s easy to use, very professional looking and printable invoices. Every invoice must have a unique identifier like an invoice number, purchase order number, or reference number to distinguish it from the rest of the seller’s invoices. Specialized SaaS companies ensure that invoicing is now automated, secure, and instant, so you can invoice on the move. Invoices and records of transactions were made as early as 5000 BC in Mesopotamia. The merchants used to carve details of transactions on clay or stone tablets using the earliest form of math. The archaeological discovery of what amount to ancient Mesopotamian invoices — insignia sealed in clay — underscores the economic and utilitarian roots of writing and reckoning.Both invoices and receipts are ways of tracking purchases of goods and services. In general the content of the invoices can be similar to that of receipts including tracking the amount of the sale, calculating sales tax owed and calculating any discounts applied to the purchase. Invoices differ from receipts in that invoices serve to notify customers of payments owed, whereas receipts serve as proof of completed payment. An invoice and a bill are essentially the same thing, but the two terms are typically used by different parties involved in the same business transaction. A past due invoice is an unpaid invoice that is past its due date. When an invoice is past due, it means your customer or client hasn’t paid you according to the agreed payment terms. Past due invoices can impact cash flow, and collecting overdue invoices can cost business owners time and energy.It’s important to remember that 30 days is not equivalent to one month. If your invoice is dated March 9, clients are responsible for submitting payment on or before April 8. Businesses may also set invoice terms to Net 60 or even Net 90, depending on their preferences and needs. Within an invoice, you must provide your business contact information, including name, address, phone number, and email address, along with your client or buyer’s information.

The last thing included on most invoices is the name of the preparer. With QuickBooks Payments invoicing features, you can accept payments, send custom invoices, and take advantage of automatic matching to streamline your bookkeeping. Financial statements update in real time, immediately reflecting shifts in your accounts receivable and bank account balances. Sometimes customers may disagree with an invoice they’ve been issued. When this happens you’ll need to begin the process of resolving the invoice dispute. This starts with a conversation between you and the customer to determine which elements of the invoice the customer disagrees with.

Business Proposal

In this post, we’ll explore the purpose of invoices and provide an example. We also have an invoice generator so that you can set up invoices for your small business needs. An invoice is a document used to itemize and record a transaction between a vendor and a buyer. Trade Payables – Payables arising from the purchase of merchandise inventory and outside services. Fiscal Year – An accounting year that ends at any other date than December 31.

What does invoice include?

It includes the cost of the products purchased or services rendered to the buyer. Invoices can also serve as legal records, if they contain the names of the seller and client, description and price of goods or services, and the terms of payment.Electronic Data Interchange standards such as the United Nation’s EDIFACT standard include message encoding guidelines for electronic invoices. The EDIFACT is followed up in the UN/CEFACT ebXML syntax cross industry invoice. For all GST purposes, a seller must issue a tax invoice to the buyer regardless of whether the sale involves cash or credit. Hence a tax invoice in Australia serves as an invoice as well as a receipt in the conventional sense.

What Is An Invoice Id?

Your payment terms should specify the amount of time the buyer has to pay for the agreed-upon purchase. Cash Flow – Actual changes in cash as opposed to changes in account revenues and expenses. It has been proven that companies who adopt electronic invoicing over paper systems see an increase in cash flow. Bookkeeping – The recording of a company’s transactions into the accounts contained in the general ledger. All parties will benefit from keeping copies of invoices for bookkeeping purposes.It is crucial that a business has a system in place that keeps track of which sales invoices still need to be paid and which invoices have been completed. Invoice accounting is crucial for keeping track of cash flow efficiency and delinquent customers.To invoice your clients, you should create and send an invoice as soon as you’ve completed work on a project. That way, the details of the work will be fresh in your mind and you should receive payment as quickly as possible. Make sure your invoice includes all the details your clients will need to pay you, including your business name, the invoice due date and the total amount due. A quote provides the client with a fixed price for a project, whereas an estimate provides an estimate of the fees that will be incurred for a project, which could change. A quote is usually subject to a specific time frame, for example, many businesses will stipulate that a quote is only valid for 30 days from the day it’s issued.Invoicing became cheaper, easier, and faster with electronic invoices. Within the European Union, an invoice is primarily legally defined by the EU VAT directive as an accounting voucher and secondly as a Civil law document.

While similar information is included in sales receipts and invoices, they are not the same. An invoice is issued to collect payments from customers, and a sales receipt documents proof of payment that a customer has made to a seller. Receipts are used as documentation to confirm that a customer has received the goods or services they paid for, and as a record that the business has been paid.

What Does An Invoice Look Like?

It is still common for electronic remittance or invoicing to be printed in order to maintain paper records. Standards for electronic invoicing vary widely from country to country.

What is invoice in Accounting with example?

The definition of an invoice is a detailed list of products or services showing the money owed for each item. An example of an invoice is a list of an artist’s contributions to a magazine for the month. … The goods or services itemized in an invoice.That’s because the costs a business incurs to produce its goods or provide its services can fluctuate over time. Invoices are an essential tool that business owners can use to keep records of sales. By crafting clear, informative invoices and following an invoicing process, you can appropriately represent yourself to the IRS in the event of an audit. And you can increase the likelihood of getting paid on time, every time. An invoice shows the actual time taken and actual cost of a job or transaction. For a customer, the invoice is a “purchase invoice.” For a supplier, it’s called a ‘sales invoice’. Evaluated receipt settlement – ERS is a process of paying for goods and services from a packing slip rather than from a separate invoice document.In a few cases, a pro forma invoice is issued to request advance payments from the buyer, either to allow production to start or for security of the goods produced. Pro forma invoices are issued to a customer before a product or service is delivered. Businesses use pro forma invoices to help customers understand the scope and cost of an upcoming project. Pro forma invoices are sent before a formal invoive is issued to give customers an estimate of how much a product or service will cost once delivered. The terms in a pro forma invoice may need to be adjusted as a project progresses, but they can be a helpful tool to ensure businesses and customers are on the same page before work begins. N invoice is a document given to the buyer by the seller to collect payment. It includes the cost of the products purchased or services rendered to the buyer.

- The archaeological discovery of what amount to ancient Mesopotamian invoices — insignia sealed in clay — underscores the economic and utilitarian roots of writing and reckoning.

- Invoices are the backbone of the accounting system for small businesses.

- You might also consider a customer’s credit history when developing payment terms, particularly for large sales.

- Modern invoicing software products from SaaS companies enable you to automate, speed up, and manage the invoicing process so that you get paid on time.

Sage Intacct Advanced financial management platform for professionals with a growing business. They may not require details on invoices other than those referred to in Articles 226, 227 and 230. Article 226b of the EU VAT Directive is a concise definition of receipts within the EU member-states. An invoice may be transmitted electronically or as a paper document.Inventory – A current asset whose ending balance should report the cost of a merchandiser’s products waiting to be sold. The inventory of a manufacturer should include the cost of its raw materials, work in progress and finished goods. Many manufacturers use their invoices as documentation to help keep track of their inventory. Modern invoicing software products from SaaS companies enable you to automate, speed up, and manage the invoicing process so that you get paid on time. It helps both the seller and the buyer to keep track of their payments and amounts owed. Organizations purchasing goods and services usually have a process in place for approving payment of invoices based on an employee’s confirmation that the goods or services have been received.Writing clear invoices that are easy to understand may help reduce the risk of an invoice being past due. Offering a variety of payment options may also help reduce past due invoices. For example, business owners may consider using pay-enabled invoices that allow customers to pay their bills right from the online invoice. A good invoice isn’t just a sales receipt, but a legal document that protects your business against errors and risks. The right invoicing tools can help you streamline your invoicing process, improve your cash flow, and even simplify your accounting. A mobile-friendly SaaS invoicing system is an easy modern upgrade for any business that’s stuck in the stone invoicing age.A retainer invoice is sent to a customer if they make an advance payment for a product or service. This amount is then deducted from the customer’s final payment on delivery or completion of work. A proper invoice is legal proof of an agreement between the buyer and seller on a set price. An invoice is a document that charges a customer for goods or services you’ve provided. Also called a bill, an invoice shows all the information about a transaction.The invoice tells the buyer how much they owe the seller and sets up payment terms for the transaction. However, the purchaser of the goods or services might refer to the invoice received from the vendor or supplier as a purchase invoice. Statement – A periodic customer statement includes opening balance, invoices, payments, credit memos, debit memos, and ending balance for the customer’s account during a specified period. A monthly statement can be used as a summary invoice to request a single payment for accrued monthly charges. When it comes to helping companies plan and budget their finances, a sales invoice is a vital tool. This is because the sales invoice provides information as to the revenue that it can expect to receive in a future period. If a company knows that it has a lot of revenue coming in soon, then it can make business investments, such as purchasing more inventory.