Content

- Importance Of Asset Classification

- Listing Assets On A Balance Sheet

- Fixed Asset Vs Current Asset: What’s The Difference?

- Is Inventory A Current Asset Or Noncurrent Asset?

- Assets

- Cash And Cash Equivalents

- Why Is Inventory A Current Asset?

For example, an auto manufacturer’s production facility would be labeled a noncurrent asset. The portion of ExxonMobil’s balance sheet pictured below displays where you may find current and noncurrent assets.

Are split into two categories – current and non-current (long-term or capital assets). Current assets are all assets that a company expects to convert to cash within one year. We note from above that Google’s Prepaid revenue share, expenses, and other assets have increased from $3,412 million in December 2014 to $37,20 million in March 2015. That will provide coverage for the entire month, the company will record a $10 million prepaid expense to account for the insurance expense it will show in the month that it already paid for. Certificate Of DepositsA certificate of deposit is an investment instrument mostly issued by banks, requiring investors to lock in funds for a fixed term to earn high returns. CDs essentially require investors to set aside their savings and leave them untouched for a fixed period. However, unsold and excess inventory can become a liability for the business as there are costs that the business may have to incur to store it.

Importance Of Asset Classification

Because these assets are easily turned into cash, they are sometimes referred to as liquid assets. Current assets represent the value of assets that are either cash or can be converted into cash to pay for short-term financial operations and fund operational expenses. On the balance sheet, the current assets are listed in the order of their liquidity. Cash and cash equivalents are the most liquid, followed by short-term investments, etc.

What are liquid current assets?

A liquid asset is an asset that can easily be converted into cash in a short amount of time. Liquid assets include things like cash, money market instruments, and marketable securities. … For the purposes of financial accounting, a company’s liquid assets are reported on its balance sheet as current assets.It is a measure of how dependent a company is on borrowing rather than equity. Accrued expenses are payroll and payroll taxes which are due for the work done by employees but which have not yet been paid. Notes payable and loans are money due to lenders within the next year. Below is a sample balance sheet, with definitions and descriptions of the key elements. Examples include food products which can eventually spoil and technology that can become obsolete. Inc. has vendor non-trade receivables of $ 17,799 Mn in 2017, which increased to $ 25,809 Mn in 2018.

Listing Assets On A Balance Sheet

The company either validates or denies the claim based on their assessment and nature of the incurred losses. Raw material inventory, work in progress inventory, and finished goods inventory. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Contact a qualified business attorney to help you address the finances vital to your business.

What are examples of current assets quizlet?

Current assets include: cash, marketable securities, receivables, inventory, and prepaid items. Include items such as notes receivable, government bonds, bonds and capital stock of corporations, and other securities.”Quick” assets are cash, stocks and bonds, and accounts receivable (i. e. , all current assets on the balance sheet except inventory). 0 are usually considered satisfactory if receivables collection is not expected to slow. …basic categories of investments are current assets and fixed assets. Examples of fixed assets are buildings, real estate, and machinery.

Fixed Asset Vs Current Asset: What’s The Difference?

On a balance sheet, assets will typically be classified into current assets and long-term assets. Current assets, explained as some of the most useful assets in a company, are very valuable.

The cash ratio is a conservative debt ratio since it only uses cash and cash equivalents. This ratio shows the company’s ability to repay current liabilities without having to sell or liquidate other assets. The current ratio is one of the most basic measurements that you can make with a balance sheet, and it’s calculated by dividing the current assets by the current liabilities. This tells you how many times over the current assets could cover liabilities. In other words, it’s a liquidity ratio that gives you a snapshot of a company’s liquidity.

Is Inventory A Current Asset Or Noncurrent Asset?

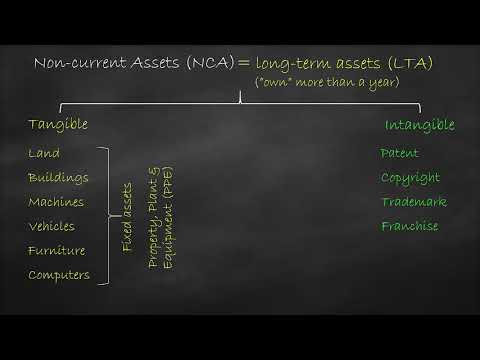

These are highlighted in blue, and represent Exxon’s long-term investments like oil rigs and production facilities that come under property, plant, and equipment (PP&E). Current liabilities include accounts payable, notes payable, accrued expenses such as wages and salaries, taxes payable, and the portion of long-term debts due within one year from the date of the balance sheet.Net Identifiable Assets consist of assets acquired from a company whose value can be measured, used in M&A for Goodwill and Purchase Price Allocation. The net account receivables for Apple Inc. increased from $ 17,874 Mn to $ 23,186 Mn from 2017 to 2018, respectively. Insurance ClaimsAn insurance claim refers to the demand by the policyholder to the insurance provider for compensating losses incurred due to an event covered by the policy.In addition, the resource allocation function is concerned with intangible assets such as goodwill, patents, workers, and brand names. The “quick” or “acid-test” ratio is another liquidity ratio that is more conservative than the current ratio. Rather than comparing all current assets to the current liabilities, the quick ratio only includes the most liquid of assets. Noncurrent assets, on the other hand, are long-term assets and investments by a business that cannot be liquidated easily. Current assets include cash, accounts receivable, securities, inventory, prepaid expenses, and anything else that can be converted into cash within one year or during the normal course of business.

- As you learned in the previous section, another major category of current assets is inventory.

- Current assets on the balance sheet include cash, cash equivalents, short-term investments, and other assets that can be quickly converted to cash—within 12 months or less.

- Since there’s reasonable expectation that the inventory will be used up or sold off for cash within the next twelve months or within the accounting period, it is always listed as a current asset in the balance sheet.

- Current assets also include prepaid expenses that will be used up within one year.

- This means that the company has rendered services or deliver the product to the customer.

- Cash and equivalents may be used to pay a company’s short-term debt.

- Current assets include cash and assets that are expected to turn to cash within one year of the balance sheet date.

Inventory is another type of current asset; it refers to the goods or raw materials a company has on hand that it can sell or use to produce products for sale. Since there’s reasonable expectation that the inventory will be used up or sold off for cash within the next twelve months or within the accounting period, it is always listed as a current asset in the balance sheet. While inventory is less liquid than other short-term investments such as cash and cash equivalent, it is considerably more liquid than assets such as land and equipment. Inventory is a current asset when the business intends to sell them within the next accounting period or within twelve months from the day it’s listed in the balance sheet.The total current assets for Walmart for the period ending January 31, 2017, is simply the addition of all the relevant assets ($57,689,000). Inventory is reported as a current asset as the business intends to sell them within the next accounting period or within twelve months from the day it’s listed in the balance sheet. Current assets are balance sheet items that are either cash, cash equivalent or can be converted into cash within one year. The Cash Ratio is a liquidity ratio used to measure a company’s ability to meet short-term liabilities.

Cash and equivalents may be used to pay a company’s short-term debt. Accounts receivable consist of the expected payments from customers to be collected within one year. Inventory is also a current asset because it includes raw materials and finished goods that can be sold relatively quickly. A balance sheet communicates the state of your business to you and to others, and is key in business valuation and assessing the financial health of your company. The balance sheet uses a standard accounting format showing the same categories of assets and liabilities no matter the size or type of business. The reason for this standardization is the ability to compare the financial statements of different companies and to compare the financial strength of your company from quarter to quarter.Accounts ReceivablesAccounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment. They are categorized as current assets on the balance sheet as the payments expected within a year. You may think of current assets as short-term assets, which are necessary for a company’s immediate needs; whereas noncurrent assets are long-term, as they have a useful life of more than a year. Here, they are highlighted in green, and include receivables due to Exxon, along with cash and cash equivalents, accounts receivable, and inventories. These assets may include patents, royalty arrangements, copyrights, goodwill, and life insurance on officers and key employees.For example, a company might place money in instruments such as auction-rate securities, a sort of variable-rate bond, which they treat as safe cash alternatives. But the market for these instruments could dry up and it could take weeks or months—or even longer—to be able to convert them back into cash, making them unexpectedly illiquid.The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. The total current assets of the Company increased by 2.09% from $ 128,645 Mn to $ 131,339 Mn in 2017 and 2018, respectively.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.