Content

- What Are Liabilities On A Balance Sheet?

- Examples Of Liabilities

- Other Definitions Of Liability

- Liability In Hospitality

- Types Of Liabilities

- Accountingtools

- Definition Of Liability

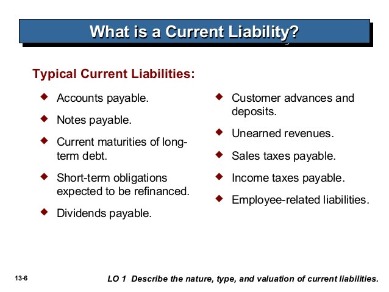

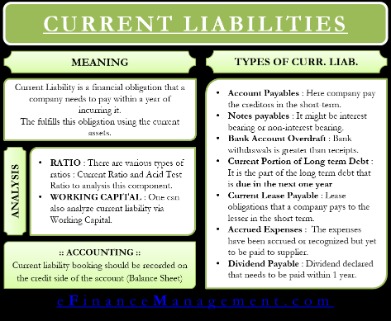

An expense is the cost of operations that a company incurs to generate revenue. Unlike assets and liabilities, expenses are related to revenue, and both are listed on a company’s income statement. Current liabilities are often loosely defined as liabilities that must be paid within a single calender year. For firms with operating cycles that last longer than one year, current liabilities are defined as those liabilities which must be paid during that longer operating cycle.

It is possible to have a negative liability, which arises when a company pays more than the amount of a liability, thereby theoretically creating an asset in the amount of the overpayment. Exactly what this means for online businesses in relation to legal liability still needs time to evolve. Capital leases are recognized as a liability when a company enters into a long-term rental agreement for equipment. The capital lease amount is a present value of the rental’s obligation. For example, if a company has more expenses than revenues for the past three years, it may signal weak financial stability because it has been losing money for those years. Companies of all sizes finance part of their ongoing long-term operations by issuing bonds that are essentially loans from each party that purchases the bonds. This line item is in constant flux as bonds are issued, mature, or called back by the issuer.

What Are Liabilities On A Balance Sheet?

When cash is deposited in a bank, the bank is said to “debit” its cash account, on the asset side, and “credit” its deposits account, on the liabilities side. In this case, the bank is debiting an asset and crediting a liability, which means that both increase. They arise from the difference between the recognized tax amount and the actual tax amount paid to the authorities. Essentially, it means that the company “underpays” the taxes in the current period and will “overpay” the taxes at some point in the future. The primary classification of liabilities is according to their due date. The classification is critical to the company’s management of its financial obligations.

- A contingent liability is a potential liability that will only be confirmed as a liability when an uncertain event has been resolved at some point in the future.

- The primary classification of liabilities is according to their due date.

- If a company takes out a mortgage or a long-term debt, it records the face value of the borrowed principal amount as a non-current liability on the balance sheet.

- Some loans are acquired to purchase new assets, like tools or vehicles that help a small business operate and grow.

- Lawsuits and the threat of lawsuits are the most common contingent liabilities, but unused gift cards, product warranties, and recalls also fit into this category.

- Since most companies do not pay for goods and services as they are acquired, AP is equivalent to a stack of bills waiting to be paid.

- Note that a long-term loan’s balance is separated out from the payments that need to be made on it in the current year.

One is listed on a company’s balance sheet, and the other is listed on the company’s income statement. Expenses are the costs of a company’s operation, while liabilities are the obligations and debts a company owes. Expenses can be paid immediately with cash, or the payment could be delayed which would create a liability. Long-term liabilities are reasonably expected not to be liquidated or paid off within the span of a single year. These usually include issued long-term bonds, notes payables, long-term leases, pension obligations, and long-term product warranties.If the company does not remit the sales tax at the end of the month, it would record a liability until the taxes are paid. The sales tax expense is considered a liability because the company owed the state the money. Liabilities expected to be settled within one year are classified as current liabilities on the balance sheet. All other liabilities are classified as long-term liabilities on the balance sheet. If a company takes out a mortgage or a long-term debt, it records the face value of the borrowed principal amount as a non-current liability on the balance sheet. The amount of promissory notes with a maturity of over one year issued by a company. Similar to bonds payable, the notes payable account on a balance sheet indicates the face value of the promissory notes.

Examples Of Liabilities

An example of an expense would be your monthly business cell phone bill. But if you’re locked into a contract and you need to pay a cancellation fee to get out of it, this fee would be listed as a liability. A debit either increases an asset or decreases a liability; a credit either decreases an asset or increases a liability.Notes payable are written agreements in which one party agrees to pay the other party a certain amount of cash. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Adam Hayes is a financial writer with 15+ years Wall Street experience as a derivatives trader.

What are liabilities give five example?

Some of the examples of Liabilities are Accounts payable, Expenses payable, Salaries Payable, Interest payable.The attorney general also argued the Texas law could expose some federal employees at different agencies across the government to civil liability for doing their jobs. At a Wednesday meeting, a law professor said the park district could be exposing itself to liability if life rings are placed in other locations. Learn financial modeling and valuation in Excel the easy way, with step-by-step training.

Other Definitions Of Liability

A better definition, however, is that current liabilities are liabilities that will be settled either by current assets or by the creation of other current liabilities. Current liabilities are expected to be paid back within one year, and long-term liabilities are expected to be paid back in over one year.

What is the difference between credit and liability?

A debit increases the balance and a credit decreases the balance. Liability accounts. A debit decreases the balance and a credit increases the balance.Gain the confidence you need to move up the ladder in a high powered corporate finance career path.

Liability In Hospitality

Examples of liabilities are accounts payable, accrued expenses, wages payable, and taxes payable. These obligations are eventually settled through the transfer of cash or other assets to the other party.There is a lot involved when making the decision to purchase insurance for your business. Maybe it’s because you bought them a drink or did a favor for them.Less common provisions are for severance payments, asset impairments, and reorganization costs. The quick ratio is a calculation that measures a company’s ability to meet its short-term obligations with its most liquid assets.Your friend is probably not keeping track of the favors they owe you, at least not on paper, but you’ll remember that they have a liability to return your favor. We have all the tools and downloadable guides you need to do your job faster and better – and it’s all free. And he is saddened that the man he helped to become leader is now considered a liability by many in his country. This new flexibility in liability management meant that banks could take a different approach to bank management. The two companies have settled their dispute with neither admitting liability.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7 & 63 licenses. He currently researches and teaches at the Hebrew University in Jerusalem. We’ll break down everything you need to know about what liabilities mean in the world of corporate finance below. It would be dangerous to try and suggest a universally applicable formula given the many statutory and other liabilities and obligations which could exist.

Accountingtools

In situations where a debt is not yet callable, but will be callable within the year if a violation is not corrected within a specified grace period, that debt should be considered current. The only conditions under which the debt would not be classified as current would be if it’s probable that the violation will be collected or waived. Current liabilities – these liabilities are reasonably expected to be liquidated within a year.

Definition Of Liability

The current ratio is a liquidity ratio that measures a company’s ability to cover its short-term obligations with its current assets. They typically deal with legal actions or litigation claims against the entity or claims an organization encounters throughout the course of business. Contingent items are accrued if the claims and their likelihood of occurring are probable, and if the relevant amount of the liability can be reasonably estimated. She plans on paying off the laptop in the near future, probably within the next 3 months. When a company deposits cash with a bank, the bank records a liability on its balance sheet, representing the obligation to repay the depositor, usually on demand. Simultaneously, in accordance with the double-entry principle, the bank records the cash, itself, as an asset. The company, on the other hand, upon depositing the cash with the bank, records a decrease in its cash and a corresponding increase in its bank deposits .