Content

- Inventory Turnover Analysis

- General And Administrative Costs

- Other Managerial Accounting Reports

- Cost Managerial Accounting Reports

- Lean Accounting Accounting For Lean Enterprise

Both lifecycle costing and activity-based costing recognize that, in the typical modern factory, the avoidance of disruptive events is of far greater importance than reducing the costs of raw materials. Activity-based costing also de-emphasizes direct labor as a cost driver and concentrates instead on activities that drive costs, as the provision of a service or the production of a product component. This also means that managerial accounting is not as simple as learning the income statement, statement of stockholder’s equity, balance sheet and statement of cash flows . In managerial accounting, if you can come up with something you want to measure, we can usually create a report for it. Appropriately managing accounts receivable can have positive effects on a company’s bottom line. An accounts receivable aging report categorizes AR invoices by the length of time they have been outstanding.

- Because the reports generated are for internal management, there are no reporting rules in managerial accounting.

- This may include the use of historical pricing, sales volumes, geographical locations, customer tendencies, or financial information.

- Raw materials used in the production process that are easily traced to the product.

- It is important to understand the key accounting and finance positions within a typical company and how each position fits into the organizational structure.

- By failing to record the inventory loss, Rite Aid overstated inventory on the balance sheet by $9,000,000 and understated cost of goods sold by $9,000,000 on the income statement.

- What are the three categories of product costs that flow through the work-in-process inventory account?

- The university’s MSW program has been accredited by CSWE since 1991.

If the company is carrying an excessive amount of inventory, there could be efficiency improvements made to reduce storage costs and free up cash flow for other business purposes. Managerial accountants perform cash flow analysis in order to determine the cash impact of business decisions. Most companies record their financial information on the accrual basis of accounting. Although accrual accounting provides a more accurate picture of a company’s true financial position, it also makes it harder to see the true cash impact of a single financial transaction. A managerial accountant may implement working capital management strategies in order to optimize cash flow and ensure the company has enough liquid assets to cover short-term obligations. Managerial accounting encompasses many facets of accounting aimed at improving the quality of information delivered to management about business operation metrics.

Inventory Turnover Analysis

Many companies are made up of a number of different brands but all of those brands are reported together in one set of financial statements. GAP not only owns all the GAP branded stores, but also Banana Republic, Old Navy, Piperlime, Athleta, and Intermix. All of these brands are lumped together into a single set of financial statements. Fortunately, managerial accounting is very different from financial accounting. I have had a number of students in the past who hated financial accounting but really liked managerial accounting.

Constraint analysis indicates the limitations within a sales process or production line. Managerial accountants find out where the constraints occur and calculate the impact on cash flow, profit and revenue. Managerial accounting analyzes the incremental benefit of increased production – this is called margin analysis.

General And Administrative Costs

Owners and managers in merchandising, manufacturing and service industries would have a difficult time operating without managerial accounting. As a result, real-life examples of management accounting exist in every type of business whose goal is to make a profit. Financial reporting rules state that reports are created quarterly and annually. Because managerial accounting reports are created for planning, decision making, and controlling, reports are created whenever these functions need to take place. Many financial reports are created on a daily basis as part of the controlling function. Because the reports generated are for internal management, there are no reporting rules in managerial accounting. In this course, we discuss best practices for obtaining the information that managers need to plan and make decisions.

What is Management accounting explain by giving examples?

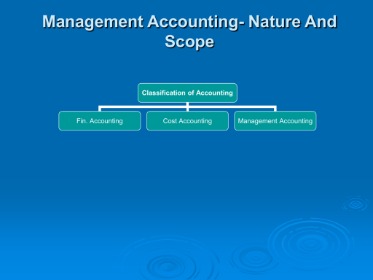

Definition: Management accounting, also called managerial accounting or cost accounting, is the process of analyzing business costs and operations to prepare internal financial report, records, and account to aid managers’ decision making process in achieving business goals.Managerial accounting uses basic math just like financial accounting. If you can add, subtract, multiply, and divide, you have all the math skills needed for this course. Want a financial analysis of future marketing costs and projected return on investment? After taking financial accounting, many students dread the idea of another semester of journal entries, debits, and credit. To avoid this dread, check out our topics on financial accounting or all of our accounting topics. This information is intended for use by the internal management of a company and can be prepared varyingly depending upon the user preferences.

Other Managerial Accounting Reports

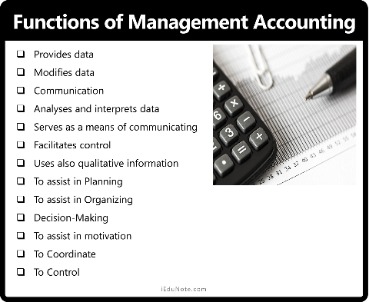

The ultimate objective is, however, to record, interpret, analyze, and present this data to the higher management for better decision making. The following are the main functions of management accounting.

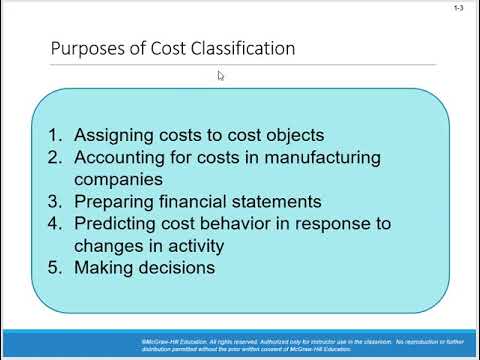

Management accountants look at the events that happen in and around a business while considering the needs of the business. Cost accounting is the process of translating these estimates and data into knowledge that will ultimately be used to guide decision-making. Everyday, Raj deals with financial decisions that could make or break the company. As a result, he advises the business from the perspective of its profits, cash standing, and costs. It deals with the preparation of budgets and forecasting. Also, based on the estimates made by management accountants, key performance indicators are set for the business’s future performance.

Cost Managerial Accounting Reports

Learn how to set up a small business accounting systems with this step-by-step guide. GPK is published in cost accounting textbooks, notably Flexible Plankostenrechnung und Deckungsbeitragsrechnung and taught at German-speaking universities. A modern approach to close accounting is continuous accounting, which focuses on achieving a point-in-time close, where accounting processes typically performed at period-end are distributed evenly throughout the period.

The cost of completed goods transferred from work-in-process inventory into finished goods inventory. If management has a need for more detailed and complex financial information—other than processing checks, invoices, and payroll—then a low-end ERP system might be appropriate. However, the benefits derived from such a system must outweigh the costs. Notice how the symphony does not have any of the formal positions identified in Figure 1.1 “A Typical Organization Chart”, with the exception of the treasurer. This illustrates how financial constraints and reporting requirements may require an organization to be creative in establishing its organizational structure.Here are some of the common areas that are targeted by management accountants to fetch the desired results. Management accounting encircles the process of identifying, analyzing, and capturing all the information that can aid the management decisions.This allows for the evaluation of whether income and expense goals were achieved. The planning function would involve establishing income and expense goals for next month. Possible sources of income include wages, scholarships, or student loans. Expenses might include rent, textbooks, tuition, food, entertainment, and transportation. Managers continually plan and control operations within organizations.

What is accounting in accounting?

Accounting is the process of recording financial transactions pertaining to a business. … The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company’s operations, financial position, and cash flows.For instance, this data can include the past trends of a particular operation, project, or product line of a business. It should include all the costs incurred on that particular project, all the revenue earned from that project and the performance trends of that project i.e. whether it was successful or not. This data is then organized and translated to make it easy to analyze. Cost-volume-profit analysis looks at the impact that varying levels of sales and product costs have on operating profit. Full costing is a managerial accounting method that describes when all fixed and variable costs are used to compute the total cost per unit. Budgets are extensively used as a quantitative expression of the company’s plan of operation.The cost of materials necessary to manufacture a product that are not easily traced to the product or not worth tracing to the product. The costs of materials necessary to manufacture a product that are not easily traced to the product or that are not worth tracing to the product. Raw materials used in the production process that are easily traced to the product. A system designed to record and share information across functional and geographical areas to meet the needs of internal and external users.Capital Budgeting refers to the process of evaluating potential investments and projects, such as real estate, new equipment, or repairs to determine whether they are worth pursuing. Accountants use a variety of calculations to assess the value and return on investment the proposed capital investment offers. The Internal Rate of Return is the discount rate that makes the net present value of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.Management accounting concepts and techniques include a few pieces of information that are somewhat standard. Sales, costs, profits, available cash, accounts receivable and payable, assets, liabilities, inventories, and certain statistical analyses. Additionally, they contain business or industry specific factors. In a contracting firm, stats will include work-in process, raw materials, and more. For an e-commerce store, website statistics will be of utmost importance.Management accounting refers to the collection, processing, refining, and quantifying of data for reporting to the key management of a business. It helps in analyzing business performance and making better decisions. One major difference between both management and financial accounting originates from different intended users of the information. Financial accounting aims to keep the external stakeholders in loop.

Financial Versus Management Accounting

Flexible and not required to conform with accounting regulations. Includes items such as sales commission, anticipated delivery costs, office supplies, etc. Use our Excel inventory turnover calculator to determine what your business’s inventory turnover rate is. Other approach is the German Grenzplankostenrechnung costing methodology.