Content

- Difference Between Net Working Capital And Liquidity

- Add Up Current Assets

- Definition And Examples Of Net Working Capital

- Management Of Working Capital

- Accounting Topics

- Can Working Capital Be Negative?

If this negative number continues over time, the business might be required to sell some of its long-term, income producing assets to pay for current obligations like AP and payroll. Expanding without taking on new debt or investors would be out of the question and if the negative trend continues, net WC could lead to a company declaring bankruptcy.

Decisions relating to working capital and short-term financing are referred to as working capital management. These involve managing the relationship between a firm’s short-term assets and its short-term liabilities.

Difference Between Net Working Capital And Liquidity

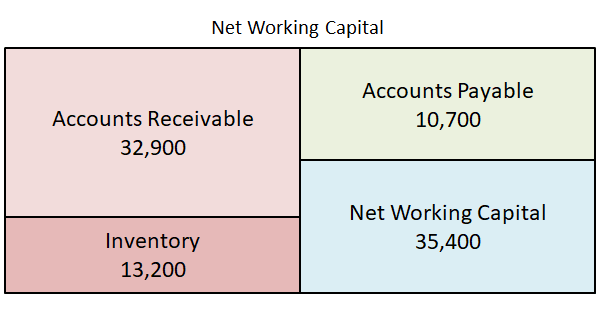

Net working capital is directly related to the current ratio, otherwise known as the working capital ratio. The current ratio is a liquidity and efficiency ratio that measures a firm’s ability to pay off its short-term liabilities with its current assets. You’ll use the same balance sheet data to calculate both net working capital and the current ratio. A business’s net working capital refers to its current assets minus its current liabilities. The result measures the current liquidity of the company and its ability to repay creditors over the coming weeks and months. Net working capital gives you a quick sense of a business’s ability to cover all short-term obligations.Generally, the larger the net working capital figure is, the better prepared the business is to cover its short-term obligations. Businesses should at all times have access to enough capital to cover all their bills for a year. Next, add up all the current liabilities line items reported on the balance sheet, including accounts payable, sales tax payable, interest payable and payroll. When a company’s working capital is a negative, it means the company has more liabilities than assets, which is generally a problem. For example, if your business has $98,000 in short-term liabilities and only $60,000 in current assets, you’ll have a hard time making ends meet. However, a very high working capital isn’t always ideal, either, because it could mean the company isn’t reinvesting its money to improve the business. Working capital refers to the difference between current assets and current liabilities, so this equation involves subtraction.This can lead decreased operations, sales, and may even be an indicator of more severe organizational and financial problems. Net working capital is most helpful when it’s used to compare how the figure changes over time, so you can establish a trend in your business’s liquidity and see if it’s improving or declining. If your business’s net working capital is substantially positive, that’s a good sign you can meet your financial obligations in the future. If it’s substantially negative, that suggests your business can’t make its upcoming payments and might be in danger of bankruptcy. If the figure is substantially negative, then the business may not have sufficient funds available to pay for its current liabilities, and may be in danger of bankruptcy. The net working capital figure is more informative when tracked on a trend line, since this may show a gradual improvement or decline in the net amount of working capital over an extended period.

Add Up Current Assets

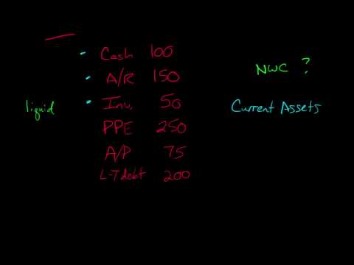

Subtract the latter from the former to create a final total for net working capital. If the following will be valuable, create another line to calculate the increase or decrease of net working capital in the current period from the previous period. If a company stretches itself too thin while trying to increase its net working capital, it could sacrifice long-term stability.Use the net working capital formula to subtract current liabilities from current assets. Current assets will include anything that can be liquidated within a year’s time. If a company has positive working capital, then it has money to invest and grow the business. However, when the working capital is negative, this is an indication that it is in debt. Current liabilities refer to outstanding debts like accounts payable and accrued expenses. Current assets include items such as cash, accounts receivable, and inventory items. Extending the number of days before accounts payable are paid, though this will likely annoy suppliers.

What is WC cycle?

What is the Working Capital Cycle? Working Capital Cycle (WCC) is the time it takes to convert net current assets and current liabilities (e.g. bought stock) into cash. Long cycles means tying up capital for a longer time without earning a return.Accrual basis accounting creating deferred revenue while the cost of goods sold is lower than the revenue to be generatedE.g. A software as a service business or newspaper receives cash from customers early on, but has to include the cash as a deferred revenue liability until the service is delivered. The cost of delivering the service or newspaper is usually lower than revenue thus, when the revenue is recognized, the business will generate gross income. From an analyst’s perspective, this is why it’s important to balance the net working capital with another measurement that accounts for long-term finances. The debt-to-equity is one such measurement—it compares company ownership to total debt. The difference is that, whereas the net working capital is a subtraction equation, the current ratio is a division equation. Instead of subtracting the current liabilities from the current assets, you divide current assets by current liabilities.

Definition And Examples Of Net Working Capital

Generally, the larger your net working capital balance is, the more likely it is that your company can cover its current obligations. It is a measure of a company’s liquidity and its ability to meet short-term obligations, as well as fund operations of the business. The ideal position is to have more current assets than current liabilities and thus have a positive net working capital balance. One measure of cash flow is provided by the cash conversion cycle—the net number of days from the outlay of cash for raw material to receiving payment from the customer.

Since liabilities are amounts owed by a business, this is usually expressed as a subtraction equation. Rosemary Carlson is an expert in finance who writes for The Balance Small Business.A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses. The working capital cycle , also known as the cash conversion cycle, is the amount of time it takes to turn the net current assets and current liabilities into cash. The longer this cycle, the longer a business is tying up capital in its working capital without earning a return on it. Companies strive to reduce their working capital cycle by collecting receivables quicker or sometimes stretching accounts payable. Net working capital is often cited as one of the indicators of a company’s liquidity. However, the amount of net working capital alone does not assure a company of the liquidity necessary to pay its current liabilities when they come due.

Management Of Working Capital

The management of working capital involves managing inventories, accounts receivable and payable, and cash. Depending on the analyst, there are slightly different definitions of current assets and current liabilities. Some analysts may exclude cash and debt from the calculation, while others include those figures in their measurements. If a company can’t meet its current obligations with current assets, it will be forced to use it’s long-term assets, or income producing assets, to pay off its current obligations.

- Decisions relating to working capital and short-term financing are referred to as working capital management.

- A business may have a large line of credit available that can easily pay for any short-term funding shortfalls indicated by the net working capital measurement, so there is no real risk of bankruptcy.

- Learn more about how you can improve payment processing at your business today.

- Common examples of current assets include cash, accounts receivable, and inventory.

- Net working capital is intended to represent those assets and liabilities that are expected to have a short-term impact on cash and equity.

- This makes sense because although it stems from a long-term obligation, the current portion will have to be repaid in the current year.

These will be used later to calculate drivers to forecast the working capital accounts. There are a few different methods for calculating net working capital, depending on what an analyst wants to include or exclude from the value. The offers that appear in this table are from partnerships from which Investopedia receives compensation. NWC that is in line with or higher than the industry average for a company of comparable size is generally considered acceptable.

Accounting Topics

It might indicate that the business has too much inventory or is not investing its excess cash. Full BioPete Rathburn is a freelance writer, copy editor, and fact-checker with expertise in economics and personal finance. Net working capital is closely related to the current ratio, which expresses the same information as a ratio.Third, the company can negotiate with vendors and suppliers for longer accounts payable payment terms. Each one of these steps will help improve the short-term liquidity of the company and positively impact the analysis of net working capital. The net working capital ratio measures a business’s ability to pay off its current liabilities with its current assets. This ratio provides business owners with an idea of their business’s liquidity, and helps them determine its overall financial health. Net working capital is the difference between a business’s current assets and its current liabilities. Net working capital is calculated using line items from a business’s balance sheet.Current assets are generally those that are expected to generate cash within twelve months. Current liabilities are generally those that are expected to use cash within the same timeframe. This is because there is a natural interplay between cash and other items on the balance sheet that might be subject to change through a purchase price adjustment.

The Current Ratio

A positive working capital cycle balances incoming and outgoing payments to minimize net working capital and maximize free cash flow. For example, a company that pays its suppliers in 30 days but takes 60 days to collect its receivables has a working capital cycle of 30 days. This 30-day cycle usually needs to be funded through a bank operating line, and the interest on this financing is a carrying cost that reduces the company’s profitability.