Content

- What Is The Normal Balance Of The Sales Returns And Allowances Account?

- What Is A Normal Account Balance?

- Which Accounts Normally Have Debit Balances?

- Normal Account Balance Definition

- Attributes Of Accounting Elements Per Real, Personal, And Nominal Accounts

- Accounts Pertaining To The Five Accounting Elements

The normal balance for each account type is noted in the following table. For example, if a company borrows cash from its local bank, the company will debit its asset account Cash since the company’s cash balance is increasing. The same entry will include a credit to its liability account Notes Payable since that account balance is also increasing. Expenses normally have debit balances that are increased with a debit entry. Since expenses are usually increasing, think “debit” when expenses are incurred.Then we translate these increase or decrease effects into debits and credits. Temporary accounts include all of the revenue accounts, expense accounts, the owner’s drawing account, and the income summary account. Generally speaking, the balances in temporary accounts increase throughout the accounting year. At the end of the accounting year the balances will be transferred to the owner’s capital account or to a corporation’s retained earnings account. This use of the terms can be counter-intuitive to people unfamiliar with bookkeeping concepts, who may always think of a credit as an increase and a debit as a decrease. This is because most people typically only see their personal bank accounts and billing statements (e.g., from a utility). A depositor’s bank account is actually a Liability to the bank, because the bank legally owes the money to the depositor.A normal balance is the expectation that a particular type of account will have either a debit or a credit balance based on its classification within the chart of accounts. It is possible for an account expected to have a normal balance as a debit to actually have a credit balance, and vice versa, but these situations should be in the minority.

What Is The Normal Balance Of The Sales Returns And Allowances Account?

Liability accounts record debts or future obligations a business or entity owes to others. When one institution borrows from another for a period of time, the ledger of the borrowing institution categorises the argument under liability accounts. This lesson will introduce you to the accounts payable process, which is an internal control system designed to assure the integrity of the recording for purchase transactions. Examples will be used to illustrate the process and journal entries.The complete accounting equation based on the modern approach is very easy to remember if you focus on Assets, Expenses, Costs, Dividends . All those account types increase with debits or left side entries. Conversely, a decrease to any of those accounts is a credit or right side entry.When accounting for transactions in Australia, we need to account for the General Sales Tax . This lesson will define the GST Clearing Account and provide examples of its use.

What Is A Normal Account Balance?

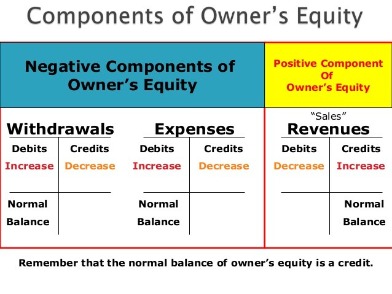

The side that increases is referred to as an account’s normal balance. Here is another summary chart of each account type and the normal balances. The exceptions to this rule are the accounts Sales Returns, Sales Allowances, and Sales Discounts—these accounts have debit balances because they are reductions to sales.

What do you mean by sales?

A sale is a transaction between two or more parties in which the buyer receives tangible or intangible goods, services, or assets in exchange for money. In some cases, other assets are paid to a seller.Recording transactions into journal entries is easier when you focus on the equal sign in the accounting equation. Assets, which are on the left of the equal sign, increase on the left side or DEBIT side. Liabilities and stockholders’ equity, to the right of the equal sign, increase on the right or CREDIT side. To determine whether to debit or credit a specific account, we use either the accounting equation approach , or the classical approach . Whether a debit increases or decreases an account’s net balance depends on what kind of account it is. The basic principle is that the account receiving benefit is debited, while the account giving benefit is credited.

Which Accounts Normally Have Debit Balances?

The chart of accounts is the table of contents of the general ledger. Totaling of all debits and credits in the general ledger at the end of a financial period is known as trial balance.The Profit and Loss report is important in that it shows the detail of sales, cost of sales, expenses and ultimately the profit of the company. Most companies rely heavily on the profit and loss report and review it regularly to enable strategic decision making. The Equity section of the balance sheet typically shows the value of any outstanding shares that have been issued by the company as well as its earnings. All Income and expense accounts are summarized in the Equity Section in one line on the balance sheet called Retained Earnings. This account, in general, reflects the cumulative profit or loss of the company.A debit to one account can be balanced by more than one credit to other accounts, and vice versa. For all transactions, the total debits must be equal to the total credits and therefore balance.

Expenses decrease retained earnings, and decreases in retained earnings are recorded on the left side. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues , and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

Normal Account Balance Definition

Debit cards and credit cards are creative terms used by the banking industry to market and identify each card. From the cardholder’s point of view, a credit card account normally contains a credit balance, a debit card account normally contains a debit balance. A debit card is used to make a purchase with one’s own money. A credit card is used to make a purchase by borrowing money.

Which account has a normal credit balance?

An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases. Therefore, asset, expense, and owner’s drawing accounts normally have debit balances. Liability, revenue, and owner’s capital accounts normally have credit balances.Petty cash is an important method of running an effective organization. In this lesson, we’ll review what petty cash is used for and describe how it should be accounted for with journal entries. The normal balance of the Sales Returns and Allowances account is a debit balance. Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit. A journal entry was incorrectly recorded in the wrong account. In this lesson, we’ll explore the world of stock options. A simple example will be used to illustrate the accounting and journal entries for them.On the other hand, increases in revenue, liability or equity accounts are credits or right side entries, and decreases are left side entries or debits. Accountants record increases in asset, expense, and owner’s drawing accounts on the debit side, and they record increases in liability, revenue, and owner’s capital accounts on the credit side.Liability, revenue, and owner’s capital accounts normally have credit balances. To determine the correct entry, identify the accounts affected by a transaction, which category each account falls into, and whether the transaction increases or decreases the account’s balance. Balance Sheet accounts are assets, liabilities and equity.

- The asset account above has been added to by a debit value X, i.e. the balance has increased by £X or $X.

- The basic principle is that the account receiving benefit is debited, while the account giving benefit is credited.

- The Equity section of the balance sheet typically shows the value of any outstanding shares that have been issued by the company as well as its earnings.

- Each of the following accounts is either an Asset , Contra Account , Liability , Shareholders’ Equity , Revenue , Expense or Dividend account.

- Because the rent payment will be used up in the current period it is considered to be an expense, and Rent Expense is debited.

- Recording transactions into journal entries is easier when you focus on the equal sign in the accounting equation.

- This lesson will define the GST Clearing Account and provide examples of its use.

Nominal accounts relate to expenses, losses, incomes or gains. The first known recorded use of the terms is Venetian Luca Pacioli’s 1494 work, Summa de Arithmetica, Geometria, Proportioni et Proportionalita .Thus, when the customer makes a deposit, the bank credits the account (increases the bank’s liability). At the same time, the bank adds the money to its own cash holdings account. But the customer typically does not see this side of the transaction. Sales is a revenue account and like all revenue accounts sales also has credit balance as normal balance and cash or accounts receivable are debit against it. The debit and credit rules are instructed by the golden rules of accounting for each account that is used to record a journal entry. These accounts include personal accounts, real accounts, and nominal accounts. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance.Accounting of inventory purchases, or merchandise that is stored to be sold directly to customers, involves calculating far more than simple stock and unit costs. Learn how the original price, discounts, returns/allowances, transportation, and ownership/transfer fees are all factored into accounting for inventory purposes. This lesson introduces you to the sales returns and allowances account. Journal entries for this account allows returns and allowances to be tracked and reveal trends. Easy-to-follow examples illustrate these journal entries. Asset, liability, and most owner/stockholder equity accounts are referred to as permanent accounts . Permanent accounts are not closed at the end of the accounting year; their balances are automatically carried forward to the next accounting year.

Accounts Pertaining To The Five Accounting Elements

An offsetting entry was recorded prior to the entry it was intended to offset. An entry reverses a transaction that was in a prior year, and which has already been zeroed out of the account. Employees are compensated for their work with money and benefits, which can sometimes be difficult to account for. Learn how salaries, wages, benefits, leave, and bonuses are all factored into accounting for payroll and taxes. Merchandise may need to be returned for a variety of reasons, including defects, damages or wrong sizes.These daybooks are not part of the double-entry bookkeeping system. The information recorded in these daybooks is then transferred to the general ledgers.