Content

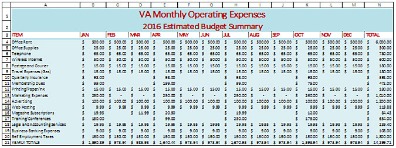

- Operating Expense

- Examples Of Operating Expenses

- Formula

- Accountingtools

- What Are Operating Expenses?

- Ready To See What Bigcommerce Can Do For Your Business?

It is critical to note that operational activities differ greatly among industries. A business activity can be classified as operational in one industry, but financing or investing in another. For instance, buying a building is typically an investing activity in most industries. However, it is an operational activity for real-estate companies, given that the purchased building is intended for resale. In the meantime, start building your store with a free 14-day trial of Shopify. ScaleFactor is on a mission to remove the barriers to financial clarity that every business owner faces. Most cities and counties require business operators to obtain various licenses or permits to show compliance with local regulations.

What are general expenses examples?

Examples of general expenses include rent, utilities, postage, supplies and computer equipment. General expenses are categorized as indirect expenses on a company’s income statement because they do not contribute directly to the making of a product or delivery of a service.On an income statement, “operating expenses” is the sum of a business’s operating expenses for a period of time, such as a month or year. There may be more such expenses depending on the nature of the store’s business. Operating costs may add up to a hefty total and the storeowner should consider all operating expenses before going into business. Many people consider them as costs to the store before even opening the doors and indicate the minimum income the store will need to generate in becoming a viable business. While operating expenses work as a catch-all of sorts, it does not include somekey expenses, like interest, depreciation, or marketing costs. You are an accounting clerk at Systems Meds Inc and your manager has just asked to ? The more the operating expenses are, the less cash the business keeps.

Operating Expense

Operating expenses are necessary and unavoidable for most businesses. Some firms successfully reduce operating expenses to gain a competitive advantage and increase earnings. However, reducing operating expenses can also compromise the integrity and quality of operations. Finding the right balance can be difficult but can yield significant rewards.

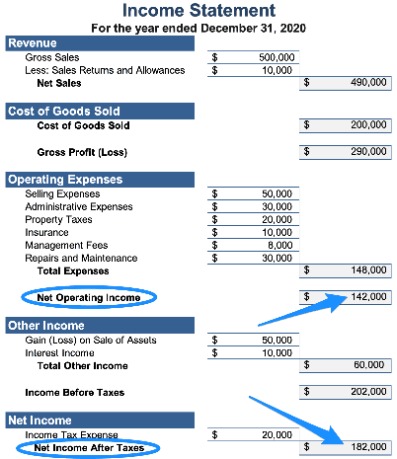

However, businesses must capitalize capital expenses/costs or write them off over time. The IRS has guidelines related to how businesses must capitalize assets, and there are different classes for different types of assets. The Internal Revenue Service allows businesses to deduct operating expenses if the business operates to earn profits. However, the IRS and most accounting principles distinguish between operating expenses and capital expenditures. No, operating expenses and cost of goods sold are shown separately on a company’s income statement.

Examples Of Operating Expenses

Operating expenses, meanwhile, are ordinary costs that have to get paid for a firm to trade. That’s an important distinction and is one of which the IRS takes note.

There’s no end to the different strings a business owner must have to their bow. As well as staff management and business strategy, you also need a good grounding in accountancy. That’s so you can avoid falling foul of tax rules or accruing unnecessary debts. OER can also be used to gauge the difference in operating costs between two properties. For instance, if a company owns two similar plants in Michigan, with similar outputs, and one’s OER is 15% more than the other, management should investigate the reasons why. Operating income is the amount of revenue left after deducting the operational direct and indirect costs from sales revenue.

Formula

Operating Expenses are reflected on a company’s income statement. The operating activities primarily cover the commercial activities of the company. Operating expenses reflect the operational activities, not the investing or financing activities of a company. Administrative expenses are the costs an organization incurs not directly tied to a specific function such as manufacturing, production, or sales. An expense is the cost of operations that a company incurs to generate revenue. Pareto Labs offers engaging online courses in business fundamentals, like how to read financial statements. Sign up for a course today and get the first 3 lessons for free.

What is operating expenses in income statement?

In business, operating expenses are day-to-day expenses such as sales and administration. … For larger businesses, operations may also include the cost of workers and facility expenses such as rent and utilities. On an income statement, operating expenses include: accounting expenses.Operational activities are a company’s key commercial activities in generating revenue. Cost of goods sold is defined as the direct costs attributable to the production of the goods sold in a company. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. Is this expense directly related to production (i.e. materials, production labor, etc.)? Their fees will range according to their expertise, and the location and size of their practices. Tara received her MBA from Adams State University and is currently working on her DBA from California Southern University.

Accountingtools

Check out the 36 other accounting terms we think business owners should familiarize themselves with. Administrative expenses are the necessary expenses that are incurred in the course of running a business and are not directly tied to a specific product or service. The result is a percentage, which represents the portion of revenue that is spent on core operation of the business. Analysts want to see operating ratio decrease over time, as that suggests that a company is becoming more efficient and retaining a higher percentage of every dollar of revenue. Operating expenses are the amount of money a company spends on business operations. The first step to robust financial management is understanding the area’s lexicon. After all, many different terms and phrases can be tough to get your head around.With there being a limit on the cutting of operating costs before feeling a negative effect, the store may consider trying to increase revenue as an alternative. Reducing the bottom line of costs may affect the good name of the store while a small increase in prices may be understandable if the quality of goods in store stay the same. In short, overheads are ongoing, whereas operating expenses stop when production stops. Examples of overhead expenses include things like utilities, rent, and insurance. Operating expenses are expenses a business incurs in order to keep it running, such as staff wages and office supplies. Operating expenses do not include cost of goods sold or capital expenditures .

These expenses, unlike operating expenses, can be capitalized for tax purposes. In general, businesses are allowed to write off operating expenses for the year in which the expenses were incurred; alternatively, businesses must capitalize capital expenses/costs. A downside to this is that there will be less people selling, delays in helping customers or even a need to increase security with fewer eyes on the store sales area. The store may lose business as a result and sometimes the loss may outstrip the initial savings of reducing the payroll bill.While this is a short list of common operating expenses, every company will have operating expenses that are unique to its needs. These expenses would be added to the list of operating expenses on the income statement and calculated with the other costs. Every company will have different expenses based on their operations.In business, an operating expense is a day-to-day expense such as sales and administration, or research & development, as opposed to production, costs, and pricing. In short, this is the money the business spends in order to turn inventory into throughput. Operating expenses appear below the line on a company’s income statement. They are sometimes represented as a single line item, or they may be broken out into multiple line items for different types of expenses. Another key distinction between OPEX and overheads is the fact that overhead expenses can be tweaked over time. If you negotiate a lease for a smaller workspace, for example, your overheads will go down as you’ll start paying less rent. By contrast, operating expenses are unavoidable, and are likely to increase as demand for your product or service increases.Operating expenses can get written off for the year in which they’re incurred. Capital expenses must get capitalized or written off over a more extended period. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes. The disadvantage of looking at a company’s opex is that it is an absolute number, not a ratio. Therefore it is unreasonable to be used as a metric to compare between firms even if they are in the same industry. However, they can be highly instrumental in the horizontal analysis since it can reflect the company’s current performance in the past.Understanding and managing your operating expenses is critical. These costs must get covered, or you won’t be able to survive day-to-day. However, you may choose to try and save money by limiting the expenses where possible. An operating expense is an expense you incur through your regular business operations. They’re the costs you face merely for doing what you have to do day-to-day to trade. As such, what counts as an operating expense differs from one firm to the next.Because operating expenses speak to the core needs of your business to run well, keeping a close eye on them is vital. If you are operating at a loss, you’ll need to find a way to either spend less or bring in more revenue. This may involve trimmingpayrollor cutting spending and taking a deep dive into your operating expenses. When you keep a close eye on this number each month, you will be better prepared to head off problems before they become a crisis. Like equipment, inventory requirements vary from business to business. Some businesses, such as retail stores, are inventory-intensive, whereas others, such as personal shopping services, don’t require any inventory at all except office supplies.

- That’s an important distinction and is one of which the IRS takes note.

- It highlights the level of cost that a company needs to make to generate revenue, which is the main goal of a company.

- In the meantime, start building your store with a free 14-day trial of Shopify.

- The most common that get incurred through day-to-day operations are called operating expenses.

All operating costs will need paying, regardless of whether the store is open or closed. The storeowner must also budget for when a store closes over holidays or in the event of an emergency such as a fire or flood. The storeowner will also have to consider how to reduce the operating costs of the store without impacting directly on the smooth running of the business.

Ready To See What Bigcommerce Can Do For Your Business?

Understanding the distinction can help managers to better control the operating expenses while considering the timeframe. For example, fixed costs are things such as rent, lease payments and insurance expense, and labour, raw materials and sales commissions are variable costs.Operating expenses can greatly impact the profitability of a business and how much cash it has. Operating expenses are the costs a company incurs that are not related to the production of a product. These expenses include items like payroll, rent, office supplies, utilities, marketing, insurance and taxes. Operating expenses are essentially the costs to keep the business running. Operating expenses are all of the costs of doing business and can be found on a company’s income statement.To determine your costs, list all the equipment you must have to efficiently operate your business. The business case below will help you practice identifying and calculating operating expenses. Reduce your operating expenses while maintaining turnover, and your profit margin will improve. You always have to consider the impact cutting these costs may have, though. Capital expenses are costs firms incur while making an investment. For instance, they may upgrade some equipment or acquire a patent for new VoIP technology.