Content

- Example Of Petty Cash Accounting

- Business Checking Accounts

- Establishing Internal Controls For Petty Cash Funds

- Why Is Petty Cash Important?

- Secure The Funds

- How Does Petty Cash Management Software Work?

- Reliance On Custodians

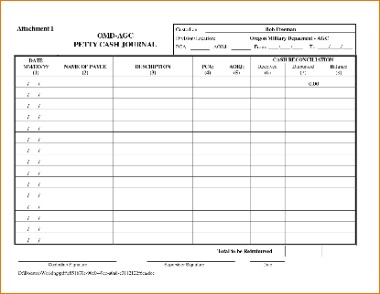

Balancing the petty cash account usually occurs when the fund needs to be replenished. The petty cash custodian brings all the slips or vouchers to the business’ bookkeeper, cashier, or accountant. The petty cash receipts are logged into the company’s General Ledger as credits to the petty cash account, and probably debits to several different expense accounts. When the petty fund is replenished, usually by drawing on a company-issued check, it’s recorded as a debit to the petty cash account and a credit to the cash account. To permit these cash disbursements and still maintain adequate control over cash, companies frequently establish a petty cash fund of a round figure such as $100 or $500. The petty cash account is a current asset and will have a normal debit balance .

- Choose which employees will be able to use this fund, then assign one person to oversee the distribution of money and tracking of expenses.

- It is important to keep accurate records of all petty cash expenditures for bookkeeping purposes.

- Integrated storage allows all records to be easily linked directly to the transaction details.

- Receipts and spending should be reconciled before the funds are replenished.

Software also provides standardized templates to ensure that petty cash funds are managed consistently across the organization. A centralized repository of all your documentation allows for an easy audit of these records by internal auditors.

Example Of Petty Cash Accounting

Although there can be minor variances, when unbalanced, the source of the discrepancy should be identified and corrected. The custodial duties generally include enforcing petty cash rules and regulations, requesting replenishments, and dispensing funds.

Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process. A cash allowance is an expense that is repaid immediately in cash, instead of being reimbursed at a later date.

Business Checking Accounts

In addition to the record, ask employees to take pictures of receipts to verify the details of petty expenses. Petty cash is physical money your business keeps around to pay for small and unplanned expenses. The amount of money kept on hand varies by organization, but most businesses establish a petty cash fund between $50 and $500. This money is typically kept in a secure location within the office, such as a locked drawer or cash register, and the business will use a system to keep track of deposits and withdrawals. A petty cash fund is a small amount of company cash, often kept on hand (e.g., in a locked drawer or box), to pay for minor or incidental expenses, such as office supplies or employee reimbursements. Sometimes, the petty cash custodian makes errors in making change from the fund or doesn’t receive correct amounts back from users. These errors cause the cash in the fund to be more or less than the amount of the fund less the total vouchers.

Once the cash has been released to the petty cash fund, you will want to secure it, most likely in a lock box, safe, or a locked drawer or file cabinet. Only the custodian and other specifically designated individuals, such as the CFO, may possess the key.

Establishing Internal Controls For Petty Cash Funds

Few small companies adopt a policy that results in the lowest balance of cash with the company as they only withdraw when it is required. For example, the company has the policy to reimburse employees every week, and hence in every week company came to know how much cash is required and that amount only withdrawn by the company. When an organization practices to operate a fixed float for cash as an organization wants, the cash should not befall below a level and should be in a range the top-up amount will always remain the same. The moment the cash touched the lower end of the scale, the cashier shall trigger and put a request for withdrawal from the bank. For example, if the float level is $20,000/- and $14,000/- has been spent, the cash balance remaining is $6,000/- and $14,000/- is needed to float balance back to the level of $20,000/-. Here $6,000/- is a lower end, and the withdrawal amount shall always be $14,000/- only.In this case, the surplus petty cash should be taken from the fund and deposited in the company bank account. You can set up your petty cash float – the maximum, fixed amount of on-hand cash – by cashing a check, usually ranging from $100 to $500 depending on the size of your business.The petty cash account should be reconciled and replenished every month to ensure the account is balanced and any variances are accounted for. The accountant should write a check made out to “Petty Cash” for the amount of expenses paid for with the petty cash that month to bring the account back up to the original amount. The check should be cashed at the company’s bank and the cash placed back in the petty cash safe or lock box.

Why Is Petty Cash Important?

Your company will also want to have a set of policies in place to establish how the petty cash funds are spent and administered. These policies will identify the sort of transactions that qualify as petty cash expenses, and it will establish guidelines for how these business expenses are to be documented. Track petty cash expenses using a records spreadsheet or accounting software. Make sure expenses are marked as they are incurred and document all relevant information.While a petty cash fund may not be necessary if you work solo, if you have even one employee, it may be worth it to set up a petty cash fund to manage those unexpected expenses properly. To record the petty cash transactions for August, you would need to record the expenses as a journal entry. When your petty cash fund starts to run dry, it’s time to record the expenses and reimburse the fund. To reconcile, you’ll need to match your receipts with the amounts recorded on the petty cash form. The petty cash log is one of the most important components of managing petty cash.There may be several petty cash locations in a larger business, probably one per building or even one per department. Petty cash, also referred to as a petty cash fund, is a small amount of funds that are kept available for companies to use for small purchases which come up from time to time in the course of business operations. That’s a long way of saying it’s “shoebox money” for expenses which are usually too small to bother using a credit card or writing a check.On the downside, the convenience of petty cash can also make it a problem, and a risk. Cash is hard to secure and impossible to track; it’s very easy for bills to disappear without a trace—even if you’ve established a careful system of receipts or vouchers.

What is the most you can claim without receipts?

Basically, without receipts for your expenses, you can only claim up to a maximum of $300 worth of work related expenses. But even then, it’s not just a “free” tax deduction. The ATO doesn’t like that.With active spending, the amount of petty cash will eventually diminish, and the funds should be replenished to support more purchases. At this point, the custodian will request a new check from the company’s bank account in an amount that will return the fund to the original balance. Petty cash is a relatively small amount of cash on hand available for employees of a business to make small, non-recurring purchases easily and quickly.BlackLine Account Reconciliations manages and reconciles all petty cash accounts via a centralized system. Templates for recording account data with customizable checklists ensure standardized petty cash records across the organization.This acts as a receipt, logging the amount of the withdrawal, the date, the purpose, and other details. Increasingly, these slips are electronic ones, entered in a digital spreadsheet or ledger. But it can be helpful to keep paper slips too, along with receipts from the purchases or payments . Petty cash is the money that a business or company keeps on hand to make small payments, purchases, and reimbursements. Either routine or unexpected, these are transactions for which writing a check or using a credit card is impractical or inconvenient. A petty cash fund will undergo periodic reconciliations, with transactions also recorded on the financial statements.Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Rosemary Carlson is an expert in finance who writes for The Balance Small Business. She was a university professor of finance and has written extensively in this area. A voucher is a document recording a liability or allowing for the payment of a liability, or debt, held by the entity that will receive that payment. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.