Content

- What Are Prepaid Expenses

- Prepaid Expenses

- What Is Prepaid Expense Amortization?

- Accounting Practices For Prepaid Accounts

- How Does Depreciation Affect Cash Flow?

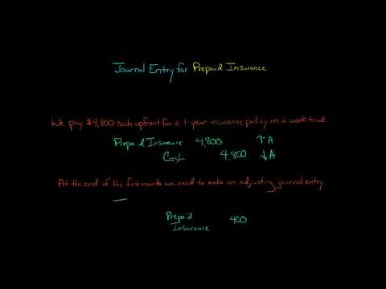

The adjusting journal entry for a prepaid expense, however, does affect both a company’s income statement and balance sheet. The adjusting entry on January 31 would result in an expense of $10,000 and a decrease in assets of $10,000 .

Partnerships are a common way to organize a business in the United States. Learn about different types and examples of partnerships and their advantages and disadvantages. Commercial Coverage Everything businesses need to protect themselves, their assets, and their people. Accrued interest refers to the interest that has been incurred on a loan or other financial obligation but has not yet been paid out. An investment and research professional, Jay Way started writing financial articles for Web content providers in 2007.

What Are Prepaid Expenses

An income statement is one of the most basic but necessary accounting documents for any company. Learn what income statements are, their purpose, and examine their components of revenue and expenses. An income statement demonstrates the company’s income and expenses over a given timeframe, used to reflect performance. Learn the operations of income statements in multi vs single-steps and the details of the line items they use.If you contract for a major job, it’s common to ask the customer for an upfront deposit. That money is unearned revenue until you start the work that will earn it. In other industries that involve regular monthly services, you might offer a discount if, say, the customer prepays for the next six months.The seller must either provide the services or return the customer’s money. By performing the services, the company earns revenue and cancels the liability. Expenses AccruedAn accrued expense is the expenses which is incurred by the company over one accounting period but not paid in the same accounting period. In the books of accounts it is recorded in a way that the expense account is debited and the accrued expense account is credited. Insurance is an excellent example of a prepaid expense, as it is customarily paid for in advance. If a company pays $12,000 for an insurance policy that covers the next 12 months, then it would record a current asset of $12,000 at the time of payment to represent this prepaid amount.

Prepaid Expenses

Then, when the expense is incurred, the prepaid expense account is reduced by the amount of the expense and the expense is recognized on the company’s income statement in the period when it was incurred. 31Supplies Expense7,000Supplies7,000To record supplies expense.Before this adjusting entry was made, the supplies asset account had a balance of $8,500. After the adjusting entry, the account balance is $1,500 and matches the amount of supplies from the physical count. Insurance is typically a prepaid expense, with the full premium paid in advance for a policy that covers the next 12 months of coverage. This is often the case for health, life, hazard, automotive, liability and other forms of coverage required by a business. The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. The most common types of prepaid expenses are prepaid rent and prepaid insurance.Asset/ expense entries will initially be recorded as assets, then as the asset is used it will become an expense. If a business knows that they will use the asset before the end of the accounting period, they will initially record it as an expense.

The BlackLine Journal Entry product is a full Journal Entry Management system that integrates with the Account Reconciliation product. It provides an automated solution for the creation, review, approval, and posting of journal entries. This streamlines the remaining steps in the process of accounting for prepaid items.

What Is Prepaid Expense Amortization?

Bonds can be issued at a discount by reducing the purchase amount, or at a premium where the return is greater than the borrowed amount. Learn the advantages and disadvantages of offering bonds at discounts and premiums.

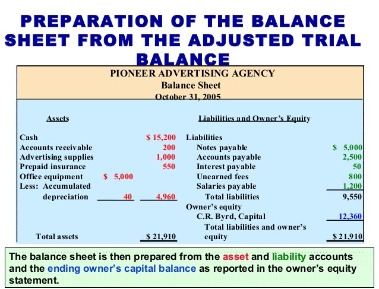

- It shows readers the value of your assets – cash, real estate, equipment – and how much the company would be worth after you pay off all your debts.

- When insurance is due, for each quarter, i.e., $2,000 will be subtracted from the prepaid account and is shown as an expense in the income statement for that reporting quarter.

- Accounting utilizes journals, which are books documenting all business transactions, and also trial balance, which is a list of all business accounts.

- The total amount of prepaid insurance is not recorded as an immediate expense at the time of the purchase when the insurance has not been used.

- Then, when the expense is incurred, the prepaid expense account is reduced by the amount of the expense and the expense is recognized on the company’s income statement in the period when it was incurred.

- As the insurance expires over time, companies debit the expense account of expired insurance and credit prepaid insurance to reduce the balance in the asset account.

Debit Credit Dec.31Depreciation Expense – Trucks750Accumulated Depreciation – Trucks750To record depreciation expense for December.MicroTrain reports depreciation expense in its income statement. And it reports accumulated depreciation in the balance sheet as a deduction from the related asset. Initially, the total insurance premium paid is a debit to prepaid expense and a credit to cash.

Accounting Practices For Prepaid Accounts

When you deliver the goods and earn the money, you erase the $10,000 in Unearned Revenue and report $10,000 in revenue on the income statement. An adjusting journal entry occurs at the end of a reporting period to record any unrecognized income or expenses for the period. A depreciable asset is a manufactured asset such as a building, machine, vehicle, or piece of equipment that provides service to a business. In time, these assets lose their utility because of wear and tear from use or obsolescence due to technological change. Since companies gradually use up these assets over time, they record depreciation expense on them. One of the important steps in the accounting cycle when preparing financial statements is the adjusted trial balance. Discover more about the definition of the adjusted trial balance, including its preparation and the trial balance worksheet, and an example of this step in practice.

What appears on a balance sheet?

The items which are generally present in all the Balance sheet includes Assets like Cash, inventory, accounts receivable, investments, prepaid expenses, and fixed assets; liabilities like long-term debt, short-term debt, Accounts payable, Allowance for the Doubtful Accounts, accrued and liabilities taxes payable; and …Thus, the amount charged to expense in an accounting period is only the amount of the prepaid insurance asset ratably assigned to that period. DateExplanationDebitCreditBalanceDec.31Adjustment200200Note that we are cycling through the second and third steps of the accounting equation again. On the income statement for the year ended December 31, MicroTrain reports one month of insurance expense, $ 200, as one of the expenses it incurred in generating that year’s revenues. It reports the remaining amount of the prepaid expense, $ 2,200, as an asset on the balance sheet. The $ 2,200 prepaid expense represents 11 months of insurance protection that remains as a future benefit. Prepaid expenses are any money your company spends before it actually gets the goods or services you’re paying for. Prepaid revenue – also called unearned revenue and unearned income – is the reverse; it’s money someone pays your company in advance of you doing the work.With amortization, the amount of a common accrual, such as prepaid rent, is gradually reduced to zero, following what is known as an amortization schedule. The expense is then transferred to the profit and loss statement for the period during which the company uses up the accrual. Accounting utilizes journals, which are books documenting all business transactions, and also trial balance, which is a list of all business accounts. Discover what goes into these meticulous ways of keeping records and the significance of journal entries and trial balance to accurate accounting. Charge the invoice from the insurance company to the prepaid expenses account. Business TransactionsA business transaction is the exchange of goods or services for cash with third parties (such as customers, vendors, etc.).Companies use two sets of journal entries to record the insurance-related transactions, involving both prepaid insurance and expired insurance. When companies initially pay for the total insurance premium, a debit is entered to the asset account of prepaid insurance and a credit entered to the cash account for the cash spent. As the insurance expires over time, companies debit the expense account of expired insurance and credit prepaid insurance to reduce the balance in the asset account. At the end of the insurance term, the account of prepaid insurance should have a zero balance.When there is a payment that represents a prepayment of an expense, a prepaid account, such as Prepaid Insurance, is debited and the cash account is credited. This records the prepayment as an asset on the company’s balance sheet. An amortization schedule that corresponds to the actual incurring of the prepaid expenses or the consumption schedule for the prepaid asset is also established. Expired insurance during a period is recorded as an insurance expense for the same period. Companies lose, or are said to have consumed, their prepaid insurance coverage over time whether or not they have actually used it by filing any claims. Companies record expired insurance periodically based on the intersection of their accounting periods and the time structure of the insurance. At the end of the insurance term, the total insurance expires and companies would have fully recorded the total prepaid insurance as expenses over multiple periods.When you make out the company financial statements, you have to put prepaid expenses and revenues in their own accounting categories. The initial journal entry for a prepaid expense does not affect a company’s financial statements. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. As the amount of prepaid insurance expires, the expired portion is moved from the current asset account Prepaid Insurance to the income statement account Insurance Expense. This is usually done at the end of each accounting period through an adjusting entry.Treating prepaid amounts differently from regular income gives anyone reading your income statement or balance sheet a better perspective. The adjusting journal entry is done each month, and at the end of the year, when the insurance policy has no future economic benefits, the prepaid insurance balance would be 0.

Balance Sheet:

You pay your insurance for the year on January 1, or pay for the next six months of office cleaning services ahead of time. The audit process generally has the objective of rendering an opinion on the accuracy of a company’s financial statements. In this lesson we’ll follow each step and show how the steps apply to a retail business. Explore the history of GAAP and learn about the accounting factors that influence GAAP. Upon signing the one-year lease agreement for the warehouse, the company also purchases insurance for the warehouse.The deferred items we will discuss are unearned revenue and prepaid expenses. Unearned revenues are money received before work has been performed and is recorded as a liability. Prepaid expenses are expenses the company pays for in advance and are assets including things like rent, insurance, supplies, inventory, and other assets. Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. When the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account.