Content

- Do You Report Inventory At Cost Or Retail?

- Categories Of Period Costs And Product Costs

- Product Costs And Period Costs

- Module 6: Cost Behavior Patterns

Accountants, human resources, sales and marketing teams, are it’s examples. Product cost, as the names suggest it is derived from the production of products and major types of products manufactured by the business. Product cost is only incurred in the business only when some product is acquired or produced. Accurately calculating product costs also assists with more in-depth analysis, such as per-unit cost.Your management and business development skills can build an understanding of your staff’s performance, and you’ll know how your organization can improve and where to allocate available capital. Product Cost is included in the inventory valuation, which is just opposite in the case of Period Cost. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

Do You Report Inventory At Cost Or Retail?

Sales and manufacturing are vital components in creating products for your organization. However, there are a variety of costs that can be incurred during this process, including product and period costs. Being mindful of these costs is beneficial in calculating them on your financial statements and showing them to stakeholders. Speaking of financial statements, it’s important that you take the time to review your financial statements on a regular basis. As an owner, you rely on their accuracy to make key management decisions. This can be particularly important for small business owners, who have less room for error.

Product costs, also known as direct costs or inventoriable costs, are directly related to production output and are used to calculate the cost of goods sold. Direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if Company A is a toy manufacturer, an example of a direct material cost would be the plastic used to make the toys. Cost Of Goods SoldThe Cost of Goods Sold is the cumulative total of direct costs incurred for the goods or services sold, including direct expenses like raw material, direct labour cost and other direct costs. Manufacturing companies need to track both product costs and period costs.Cost analysis is critical to analyze the position of the business and how much revenue the business needs to generate to bring economies of scale in the business is often derived from the cost analysis of the company. Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Certification program, designed to transform anyone into a world-class financial analyst. Take another close look at annual performance reviews from your staff to see if their performance aligns with your short-term and long-term goals.A period cost is any cost consumed during a reporting period that has not been capitalized into inventory, fixed assets, or prepaid expenses. Period Cost is the cost which relates to a particular accounting period. Period cost is generally recorded in the books of accounts with the inventory assets.The costs are not related to the production of inventory and are therefore expensed in the period incurred. In short, all costs that are not involved in the production of a product are period costs.Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

Categories Of Period Costs And Product Costs

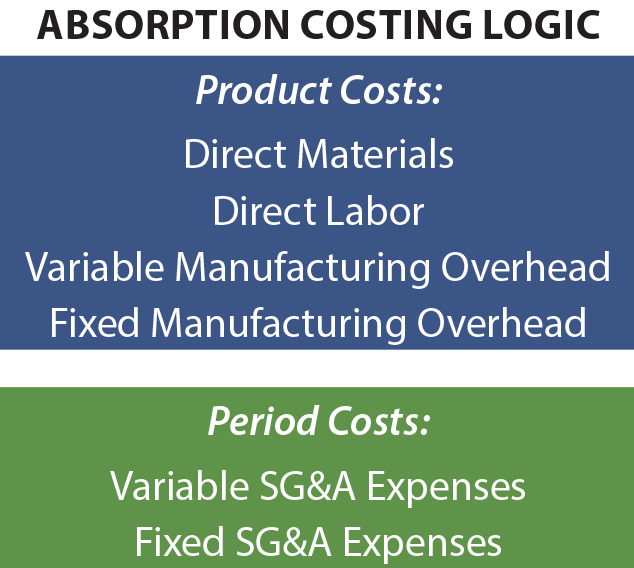

It is important to understand through the accrual method of accounting, that expenses and income should be recognized when incurred, not necessarily when they are paid or cash received. A manufacturer’s product costs are the direct materials, direct labor, and manufacturing overhead used in making its products. Both product costs and period costs directly affect your balance sheet and income statement, but they are handled in different ways. Product costs are always considered variable costs, as they rise and fall according to production levels. Inventory is an asset because goods for sale have an economic value that will be converted to cash when the goods are sold. Inventory is always reported based on the cost of obtaining it, not on the potential revenue it may generate. Once an item is sold, the product cost, including inventory cost, becomes the cost of sold and is reported on the income statement as cost of goods sold under current expenses.

Why is it important to differentiate between product and period costs?

The distinction between product costs and period costs is important to: Properly measure a company’s net income during the time specified on its income statement, and. To report the proper cost of inventory on the balance sheet.These costs include direct materials, direct labor, and factory overhead. From a financial perspective, inventory is the cost of obtaining those goods. When manufacturing overhead is added to inventory cost, you get the product cost. For retailers, product cost doesn’t include manufacturing overhead but may include an allowance for losses such as spoilage.

Product Costs And Period Costs

The costs that are not included in product costs are known as period costs. Usually, these costs are not part of the manufacturing process and are therefore treated as expense for the period in which they arise. Period costs solely account for sales, general and administrative (SG&A) costs for your organization. If your company operates in a corporate setting and has a separate manufacturing facility, then the cost of the corporate office is a period cost. Any costs for the sales and marketing department on a product also under this category. Again, time is the leading metric for tasks to be completed for sales and the administration. In general, the variable cost is considered as product cost because they change with the change in the activity level.

Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser.

Module 6: Cost Behavior Patterns

Period costs are sometimes broken out into additional subcategories for selling activities and administrative activities. Administrative activities are the most pure form of period costs, since they must be incurred on an ongoing basis, irrespective of the sales level of a business.Business often segregates these costs based on fixed, variable, or direct or indirect, which is often necessary for the business. Each business should ponder upon the various kinds of the cost it is incurring over the period, which makes the business more self-reliant and helps in bringing cost savings in the company.Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments.The period cost a firm reports on its financial statements includes all expenses other than product cost. For most kinds of business, expenses break down into product cost — including inventory — and period cost.

- Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team.

- Though it may be tempting to just lump your expenses together, there are three great reasons why you need to separate product and period costs for your business.

- Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money.

- On the other hand Period, the cost is not a part of the manufacturing process, and that is why the cost cannot be assigned to the products.

- For example, you receive a utility bill each month that is not directly tied to production levels, but the amount can vary from month to month, making it a semi-variable expense.

Sales commissions, administrative costs, advertising and rent of office space are all period costs. These costs are not included as part of the cost of either purchased or manufactured goods, but are recorded as expenses on the income statement in the period they are incurred. If advertising happens in June, you will receive an invoice, and record the expense in June, even if you have terms that allow you to actually pay the expense in July. The cash may actually be spent on an item that will be incurred later, like insurance.Selling costs can vary somewhat with product sales levels, especially if sales commissions are a large part of this expenditure. Overall, calculating product and period costs are critical to finding out the impact of sales and manufacturing on your organization’s profits. In a nutshell, we can say that all the costs which are not product costs are period costs.

Examples Of Product Costs And Period Costs

Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses.