Content

- How Dividends Become A Liability Of A Corporation

- Journal Entry

- Forms Of Payment

- Financial Analyst Training

- Dividend Dates

- What Is The Effect Dividend Payments Have On A Corporation’s Balance Sheet?

Helstrom attended Southern Illinois University at Carbondale and has her Bachelor of Science in accounting. Asymmetric information is, just as the term suggests, unequal, disproportionate, or lopsided information. It is typically used in reference to some type of business deal or financial arrangement where one party possesses more, or more detailed, information than the other.Others contend that dividend policy is ultimately irrelevant, since investors are indifferent between selling stock and receiving dividends. Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. In the United States and many European countries, it is typically one trading day before the record date. This is an important date for any company that has many shareholders, including those that trade on exchanges, to enable reconciliation of who is entitled to be paid the dividend.Note that dividends are distributed or paid only to shares of stock that are outstanding. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares. Regardless of the type of dividend, the declaration always causes a decrease in the retained earnings account. Apple’s board of directors has declared a cash dividend of $0.22 per share of the Company’s common stock.While a few companies may use a temporary account, Dividends Declared, rather than Retained Earnings, most companies debit Retained Earnings directly. Ultimately, any dividends declared cause a decrease to Retained Earnings. Is the date that payment is issued to the investor for the amount of the dividend declared. The significance of investors’ dividend preferences is a contested topic in finance that has serious implications for dividend policy. The distribution of profits by other forms of mutual organization also varies from that of joint-stock companies, though may not take the form of a dividend. In many countries, the tax rate on dividend income is lower than for other forms of income to compensate for tax paid at the corporate level.

How Dividends Become A Liability Of A Corporation

A company that does not have enough cash may choose to pay a stock dividend in lieu of a cash dividend. In other words, a cash dividend allows a company to maintain its current cash position. Cash dividends are immediately taxable as income, while stock dividends are only taxed when they are actually sold by the shareholder. Cash dividends provide steady payments of cash that can be used to reinvest in a company, if the shareholder desires.

Change in a firm’s dividend policy may cause loss of old clientele and gain of new clientele, based on their different dividend preferences. Signaling took root in the idea of asymmetric information, which says that in some economic transactions, inequalities in access to information upset the normal market for the exchange of goods and services. An information asymmetry exists if firm managers know more about the firm and its future prospects than the investors. Established firms with little more room to grow do not have pressing needs for all their cash earnings, so they are more likely to give cash dividends. There are a number of factors, such as psychology, taxes, and information asymmetries tied into this puzzle, which further complicate the matter.

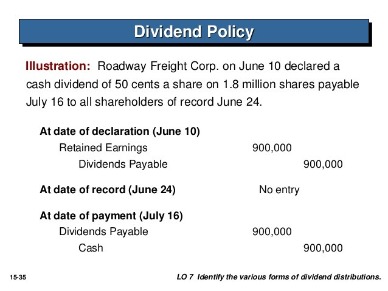

Journal Entry

A common technique for “spinning off” a company from its parent is to distribute shares in the new company to the old company’s shareholders. Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects. The practice can cast doubt on the company’s management and subsequently depress its stock price. The market may perceive a stock dividend as a shortage of cash, signaling financial problems. Market participants may believe the company is financially distressed, as they do not know the actual reason for management issuing a stock dividend. As noted above, a stock dividend increases the number of shares while also decreasing the share price. By lowering the share price through a stock dividend, a company’s stock may be more “affordable” to the public.

The accounting for large stock dividends differs from that of small stock dividends because a large dividend impacts the stock’s market value per share. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. The journal entry to record the declaration of the cash dividends involves a decrease to Retained Earnings (a stockholders’ equity account) and an increase to Cash Dividends Payable . Costs of taxes can also play a role in choosing between cash or stock dividends.

Forms Of Payment

The current year profit as well as the retained earnings of previous years are available for distribution; a corporation is usually prohibited from paying a dividend out of its capital. Distribution to shareholders may be in cash or, if the corporation has a dividend reinvestment plan, the amount can be paid by the issue of further shares or by share repurchase.

- The corporation does not receive a tax deduction for the dividends it pays.

- The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value.

- As noted above, a stock dividend increases the number of shares while also decreasing the share price.

- When a split occurs, the market value per share is reduced to balance the increase in the number of outstanding shares.

- To illustrate, assume that Duratech Corporation’s balance sheet at the end of its second year of operations shows the following in the stockholders’ equity section prior to the declaration of a large stock dividend.

There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. Both types of stock dividends impact the accounts in stockholders’ equity. A stock split causes no change in any of the accounts within stockholders’ equity. The impact on the financial statement usually does not drive the decision to choose between one of the stock dividend types or a stock split.

Financial Analyst Training

Generally, a capital gain occurs where a capital asset is sold for an amount greater than the amount of its cost at the time the investment was purchased. A dividend is a parsing out a share of the profits, and is taxed at the dividend tax rate. If there is an increase of value of stock, and a shareholder chooses to sell the stock, the shareholder will pay a tax on capital gains . If a holder of the stock chooses to not participate in the buyback, the price of the holder’s shares could rise , but the tax on these gains is delayed until the sale of the shares. A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a proportion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-invested in the business .

What must be passed to declare final dividend?

Board Resolution and Ordinary Resolution must be passed to declare Final Dividend.Cash dividends are the most common form of payment and are paid out in currency, usually via electronic funds transfer or a printed paper check. Such dividends are a form of investment income of the shareholder, usually treated as earned in the year they are paid . Thus, if a person owns 100 shares and the cash dividend is 50 cents per share, the holder of the stock will be paid $50. Dividends paid are not classified as an expense, but rather a deduction of retained earnings.

Account

Stock investors are typically driven by two factors—a desire to earn income in the form of dividends and a desire to benefit from the growth in the value of their investment. Members of a corporation’s board of directors understand the need to provide investors with a periodic return, and as a result, often declare dividends up to four times per year. However, companies can declare dividends whenever they want and are not limited in the number of annual declarations. They are not considered expenses, and they are not reported on the income statement. They are a distribution of the net income of a company and are not a cost of business operations.

How do you record dividends declared?

The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a stockholders’ equity account) and an increase (credit) to Cash Dividends Payable (a liability account).In a 2-for-1 split, for example, the value per share typically will be reduced by half. As such, although the number of outstanding shares and the price change, the total market value remains constant. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. The total value of the candy does not increase just because there are more pieces. Is the date on which the dividends become a legal liability, the date on which the board of directors votes to distribute the dividends. Cash and property dividends become liabilities on the declaration date because they represent a formal obligation to distribute economic resources to stockholders. On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared.

Dividend Dates

For example, consider an investor with $1,000 looking to invest in Stock A or Stock B. Stock A is priced at $2,000 while Stock B is priced at $500. Stock A would be deemed “unaffordable” for the investor since he only has $1,000 to invest. Decides on when to declare a dividend and in what form the dividend will be paid. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License 4.0 license. This book is Creative Commons Attribution-NonCommercial-ShareAlike License 4.0 and you must attribute OpenStax. Producer cooperatives, such as worker cooperatives, allocate dividends according to their members’ contribution, such as the hours they worked or their salary. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

What Is The Effect Dividend Payments Have On A Corporation’s Balance Sheet?

A capital gain is an increase in the value of an asset or investment resulting from the price appreciation of the asset or investment. In other words, the gain occurs when the current or sale price of an asset or investment exceeds its purchase price. Although commonly used in reference to dividend or coupon rates, the clientele effect can also be used in the context of leverage , changes in line of business, taxes, and other management decisions. Certain types of specialized investment companies (such as a REIT in the U.S.) allow the shareholder to partially or fully avoid double taxation of dividends. The effect of a dividend payment on share price is an important reason why it can sometimes be desirable to exercise an American option early. 1)The effect of the declaration of a cash dividend by the board of directors is to …It is separate from the regular cycle of dividends and is usually abnormally larger than a company’s typical dividend payment. To see the effects on the balance sheet, it is helpful to compare the stockholders’ equity section of the balance sheet before and after the small stock dividend. Accounting for stock dividends is essentially a transfer from retained earnings to paid-in capital. The amount is transferred into a separate dividends payable account and this is debited on payment day.