Content

- Want More Helpful Articles About Running A Business?

- Sales Taxes Payable Definition

- Accountingtools

- Sales Taxes For Purchased Assets

- Sales Tax Definition

- Association Dues Revenue

- See For Yourself How Easy Our Accounting Software Is To Use!

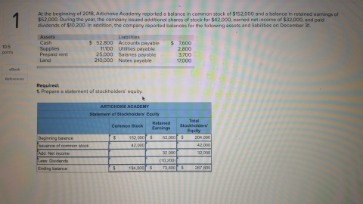

In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees. “Revenue” may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in “Last year, Company X had revenue of $42 million”. Profits or net income generally imply total revenue minus total expenses in a given period. In accounting, in the balance statement, revenue is a subsection of the Equity section and revenue increases equity, it is often referred to as the “top line” due to its position on the income statement at the very top. This is to be contrasted with the “bottom line” which denotes net income .

How do you add sales tax to a total?

Multiply the cost of an item or service by the sales tax in order to find out the total cost. The equation looks like this: Item or service cost x sales tax (in decimal form) = total sales tax. Add the total sales tax to the Item or service cost to get your total cost.The tax generally applies to the total amount received for the property or service, without any deductions for the its cost to you, or any materials, labor or service costs. In other words, the tax base doesn’t necessarily bear any relation to the actual profit you may have realized on the sale. When you collect sales tax from customers, you increase the corresponding liability account, which is your Sales Tax Payable account. And because you collect the sales tax, you also must increase your Cash account. One customer purchases aspirin, a pre-made sandwich, a can of soup and a six-pack of beer. Depending on the state, Jake may have to apply a different sales tax rate to each item that the customer purchases.

Want More Helpful Articles About Running A Business?

Record both your sales revenue of $5,000 and your sales tax liability of $250 in your accounting books. A government entity may send its auditors to a business at intervals to examine the method of calculating sales taxes, and also to examine the contents of the sales taxes payable account. If the company has not been calculating or remitting sales taxes correctly, the auditors can charge the company a penalty and other fees. Income tax payable includes levies from the federal, state, and local levels. The dollar amount due is the amount that has accumulated since the company’s last tax return.As a pass-through tax, you must remit collected sales tax to your state or local government. You do not pay sales tax when customers buy from you—customers pay sales tax. Sales tax is a state and local tax paid by the buyer of goods and services at the point of sale.Income tax payable is found under the current liabilities section of a company’s balance sheet. Business revenue is money income from activities that is ordinary for a particular corporation, company, partnership, or sole-proprietorship. For some businesses, such as manufacturing or grocery, most revenue is from the sale of goods. Service businesses such as law firms and barber shops receive most of their revenue from rendering services.

Sales Taxes Payable Definition

Revenue from investments may be categorized as “operating” or “non-operating”—but for many non-profits must be categorized by fund . Separately stated charges for transportation that occurs after the sale generally are excluded from the tax base. However, some states look to the f.o.b. point to determine whether the charges are taxable. In these states, transportation charges are taxable if property is sold f.o.b. destination, but not if the property is sold f.o.b. origin . Whether an adjustment is made depends upon whether the manufacturer or the retail seller issues the coupon or rebate.

Depending on the sales tax rate in your area, you could be adding to your operating costs an amount equal to more than 10 percent of the sales price of each item you sell. Therefore, if you’re already operating at a minimal profit margin, you’ll want to analyze whether the increased costs will be offset by the additional revenues. When it comes to sales taxes, most of the compliance responsibilities fall upon the seller. Income tax payable is a type of account in the current liabilities section of a company’s balance sheet. The calculation of income tax payable is according to the prevailing tax law in the company’s home country.

Accountingtools

In this case, the initial collection of sales taxes creates a credit to the sales taxes payable account, and a debit to the cash account. When the sales taxes are due for payment, the company pays cash to the government, which eliminates its sales tax liability.

- The alternative is to do the computation manually or on a calculator.

- The business acts as a collection agency for the government by charging the sales tax.

- If your business sells products or services on which sales taxes are levied, you will need to set up a system, collect, and pay sales tax on a timely basis.

- However, if the overpaid tax was collected from a purchaser, most states will require proof that you reimbursed the purchaser for the overpaid tax as a prerequisite to providing the refund.

- “Revenue” may refer to income in general, or it may refer to the amount, in a monetary unit, earned during a period of time, as in “Last year, Company X had revenue of $42 million”.

- A consumption tax is a tax on the purchase of a good or service; or a system taxing people on how much they consume rather than what they add to the economy .

Fundraising revenue is income received by a charity from donors etc. to further its social purposes. To do so, debit your cash account for the total amount the customer paid you. Then, credit your Sales Revenue account the amount of the purchase before sales tax.

Sales Taxes For Purchased Assets

This includes product returns and discounts for early payment of invoices. Most businesses also have revenue that is incidental to the business’s primary activities, such as interest earned on deposits in a demand account. Sales revenue does not include sales tax collected by the business. When you purchase goods and pay sales tax on those goods, you must create a journal entry. Generally, your total expense for the purchase includes both the price of the item and the sales tax.There are three different scenarios involving sales taxes, and the accounting treatment varies in each scenario. If your business has nexus or a presence in more than one location, you might need to collect and remit sales tax for other states as well. Check with the state you’re selling goods or services to, to understand how they define nexus for out of state sellers. For example, Ohio requires that out of state sellers who have at least 200 transactions or $100,000 in gross sales collect sales tax, even if they have no physical presence in the state. The amount of sales tax depends on the state, city and country your business has a physical presence in. Since the sales tax regulations vary across different states, it’s common for businesses to have separate sales tax liability accounts for each state. Once you’ve collected sales tax from your purchasers, the obvious next step is reporting and paying the tax to the appropriate authorities.

In general, payroll taxes, property taxes, and sales taxes are separate liabilities. The taxes, based on the tax law of the company’s home country, are calculated on their net income. For companies, which are due a tax credit from its taxing agency, the amount of income tax payable will decrease. A sales tax is a consumption tax imposed by the government on the sale of goods and services.A conventional sales tax is levied at the point of sale, collected by the retailer, and passed on to the government. A business is liable for sales taxes in a given jurisdiction if it has a nexus there, which can be a brick-and-mortar location, an employee, an affiliate, or some other presence, depending on the laws in that jurisdiction. DateAccountNotesDebitCreditX/XX/XXXXCashCollected sales taxXSales RevenueXSales Tax PayableXWhen you remit the sales tax to the government, you can reverse your initial journal entry. To do this, debit your Sales Tax Payable account and credit your Cash account.Perhaps the most difficult aspect of dealing with your sales tax obligations arises if you happen to do business in a state where local jurisdictions administer their own sales taxes. Usually, you’ll have separate reporting requirements for each such “home rule” locality where you make sales. Unfortunately, the administrative agencies for such localities are frequently understaffed and poorly financed, and offer little in the way of taxpayer assistance and procedures. Believe us, if you have to pay local taxes, you’re fortunate if you happen to do business in a state where local taxes are merely added on to, and are collected and reported with, the state tax.Because expenses are increased through debits, debit an expense account and credit your Cash account. In some states, it’s a criminal offense to operate without the requisite permit, so you should secure a permit before you make your first sale. Once you receive the permit, you must display it at your place of business. Serving legal professionals in law firms, General Counsel offices and corporate legal departments with data-driven decision-making tools. We streamline legal and regulatory research, analysis, and workflows to drive value to organizations, ensuring more transparent, just and safe societies. A consumption tax is a tax on the purchase of a good or service; or a system taxing people on how much they consume rather than what they add to the economy . Find out if your state offers such a holiday by contacting the state’s department of revenue.

Price / Sales is sometimes used as a substitute for a Price to earnings ratio when earnings are negative and the P/E is meaningless. Though a company may have negative earnings, it almost always has positive revenue. Get up and running with free payroll setup, and enjoy free expert support. Enabling organizations to ensure adherence with ever-changing regulatory obligations, manage risk, increase efficiency, and produce better business outcomes.Because sales tax is lumped into the total amount your customers pay, you will include the sales tax as part of the total sales revenue in your accounting books, too. In the U.S., a sales tax is a state tax that is paid by the buyer at the time of purchase. The amount of the sales tax is based on the product and the sales tax rate. For instance, in some states unprepared grocery items are not subject to a sales tax. Items purchased for resale are not subject to the sales tax when purchased by the retailer, but will be subject to the sales tax when the items are sold to the end customer. In some cities, there could be a state sales tax of 6% plus a county tax of 1% and a tourist district sales tax of 3%.

See For Yourself How Easy Our Accounting Software Is To Use!

Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting. Reliance on income taxes versus consumption taxes is one big difference between U.S. revenue sources and those of other countries. The U.S. system with no VAT implies that tax is paid on the value of goods and margin at every stage of the production process. This would translate to a higher amount of total taxes paid, which is carried down to the end consumer in the form of higher costs for goods and services.And, credit your Sales Tax Payable account the amount of the sales tax collected. In the second most common scenario, a company buys any number of items from its suppliers, such as office supplies, and pays a sales tax on these items. It charges the sales tax to expense in the current period, along with the cost of the items purchased. The business acts as a collection agency for the government by charging the sales tax. It will need to remit the government shortly after collecting the tax.