Content

- Operational Internal Controls

- What Is Segregation Of Duties?

- Personal Tools

- Examples Of Intentional Segregation Of Duties Violations

- Business Purpose Documentation

- Examples Of Segregation Of Duties For Specific Functions

Book inventory accounting is based on the last physical inventory conducted within a business unit. The count is used as a basis to add purchases and subtract cost of sales in order to calculate the current ‘ending’ inventory. Use the “roles and responsibilities” function within software applications wherever possible, and maintain an SOD workbook of each framework for all key processes.

What is the most serious limitation of internal controls?

Some of the most common limitations of internal controls include providing reasonable assurance, collusion, human error, control override, poor judgment, cost and benefit consideration, improper communication to or training of employees, and unforeseen circumstances.In general, the flow of transaction processing and related activities should be designed so that the work of one individual is either independent of, or serves to check on, the work of another. Such arrangements reduce the risk of undetected error and limit opportunities to misappropriate assets or conceal intentional misstatements in the financial statements. Implementing good internal controls in a small business is important and can be done. Owners should also be monitoring user access rights in accounting and information systems. Employees should only be granted access rights necessary to complete their duties and should not have full access rights to all aspects of a system.

Operational Internal Controls

She needs to establish effective internal control, ideally ensuring that at least two people are involved in each financial process. Increased protection from fraud and errors must be balanced with the increased cost/effort required. Obviously, as said before, duties maintains an efficient balance of work that ensure the accuracy and correctness of jobs. Overall, this keeps a company or organization running as smoothly as possible. If one person was expected to be responsible for multiple jobs, then there would most certainly be fewer jobs for others. In addition, it allows for more available responsibilities for others to take. Having unlimited access to assets, accounting records and computer terminals and programs.

- For instance, one person can make an order from a supplier, but a different person needs to record the transaction for that order.

- Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

- In order to ensure the propriety of submitted hours, employee time cards/records are to be approved by their supervisor as certification that the hours/work were actually performed as reported.

- Internal controls should be designed to safeguard assets and help prevent or detect losses from employee dishonesty or error; the owner’s involvement in a small organization is important in maintaining good internal controls.

- The example below is related to purchasing but can also be applied to cash management, petty cash, payroll, inventory, fixed assets and keeping accounting records.

- In turn, management decided to call the sales rep’s company to discuss the matter.

These will aid in the orientation of new employees, help ensure business continuity in the event of turnover, and help ensure compliance with applicable laws and regulations. It refers to a concept that leads to greater internal control within a company. The accounting separation of duties definition is a theory that the job of an employee should provide a reasonable evaluation for the job of another employee. In layman’s terms, no one person has too many responsibilities rested on him/her.This simple model grows more complex when the “Push to Production” or release management phase comes into play. Validate the business appropriateness of items purchased.If questionable transactions are identified, contact the cardholder for an explanation of the transaction. Examples of the separation of duties are noted below for a variety of functional areas. To compensate mistakes or intentional failures by following a prescribed procedure, independent reviews are recommended. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. 4.Information and transaction security may be compromised if computer access passwords are shared. We are the American Institute of CPAs, the world’s largest member association representing the accounting profession.

What Is Segregation Of Duties?

Authorization roles—individuals who evaluate and approve transactions should be segregated from recording, reconciling, or reviewing those transactions. A misconception about the separation of duties is that it reduces the amount of accounting errors. This only happens if there is duplicate data entry, or if multiple people verify each others’ work. One person records cash received from customers, and another person creates credit memos to customers. This reduces the risk that an employee will divert an incoming payment from a customer and cover the theft with a matching credit to that customer’s account. • Purchasing – one person places orders to buy goods and equipment and another person prepares the payment and records it in the accounting records. This might seem efficient because it reduces the number of people needed to manage financial operations and this one person has all the information they need at their fingertips.Smaller organizations tend to have limited staffing and, therefore, owners find it difficult to implement adequate segregation of duties. Here are some examples of how owners of small organizations can mitigate the risk of having limited employees and a lack of segregation of duties. The primary purpose of the SoD model is to prevent intentional violations—unethical or criminal actions by company employees, usually for personal gain. Even trusted employees may mistakenly perform incorrect transactions, or their credentials may be compromised and provide bad actors with a privileged account to gain access to critical applications.

As job responsibilities change over time, access rights should be reviewed periodically and updated to reflect those responsibilities. In those instances where duties cannot be fully segregated, mitigating or compensating controls must be established. Mitigating or compensating controls are additional procedures designed to reduce the risk of errors or irregularities. Segregation of duties is more difficult to achieve in a centralized, computerized environment. Compensating controls in that arena include passwords, inquiry only access, logs, dual authorization requirements, and documented reviews of input/output. In accordance with University Policy 2701 – Internal Control Policy management is responsible for establishing, maintaining and promoting effective business practices and effective internal controls.

Personal Tools

The person who requisitions the purchase of goods or services should not be the person who approves the purchase. One person compiles the gross pay and net pay information for a payroll, and another person verifies the calculations. This keeps a payroll clerk from artificially increasing the compensation of some employees, or from creating and paying fake employees. One person orders goods from suppliers, and another person logs in the received goods in the accounting system. This keeps the purchasing person from diverting incoming goods for his own use.

What is an example of SoD?

SoD involves breaking down tasks that might reasonably be completed by a single individual into multiple tasks so that no one person is solely in control. Payroll management, for example, is an administrative area in which both fraud and error are risks.The revenue was based on selling access to a large customer base to potential advertisers and then broadcasting advertising messages to those customers. Perform periodic surprise cash counts by an administrative business officer or designee .The software was purchased and implementation was quickly put on track to enable production over the next several months. A detailed supervisory review of related activities is required as a compensating control activity if these functions cannot be separated in smaller departments. Reconciliation roles —individuals who control and check that transactions have been correctly completed should be segregated from requesting or approving transactions. An employee with multiple functional roles within an organization can exploit their knowledge and power. This is why SoD should be a key part of any effective risk management approach in any enterprise.The operations manager suggested that the annual inventory be coordinated with the transition to the new accounting software. In turn, the general manager accepted this suggestion as a pragmatic solution. During the supervisory review and approval of the replenishment request, ensure that receipts are included and appear appropriate.When it is difficult to sufficiently segregate duties, unit management should increase review and oversight functions. The person who approves the purchase of goods or services should not be the person who reconciles the monthly financial reports. A member of the finance team moves to another department—the new role may have nothing to do with their prior position in finance. Inventory—one individual completes an order of goods from a supplier, while another individual records the acquired goods in the accounting system. This is not an exhaustive presentation of the software development life cycle, but a list of critical development functions applicable to separation of duties.

Examples Of Intentional Segregation Of Duties Violations

Responsibility for undertaking financial processes needs to be shared – with no employee having responsibilities for a whole process alone. This protects everyone in a team and removes the temptation to misuse funds. The separation of duties matrix helps a team to structure this approach. The example below is related to purchasing but can also be applied to cash management, petty cash, payroll, inventory, fixed assets and keeping accounting records. Companies in all sizes understand not to combine roles such as receiving cheques and approving write-offs, depositing cash and reconciling bank statements, approving time cards and have custody of pay cheques, etc.Proper segregation of duties helps ensure that errors, omissions, or misstatements, whether intentional or unintentional, will be detected by another person. Where segregation of duties is not possible or practical, deploy alternative controls. Pathlock provides a robust, cross-application solution to managing SoD conflicts and violations. Finance, internal controls, audit, and application teams can rest assured that Pathlock is providing complete protection across their enterprise application landscape.

The Division Of Financial Affairs

The separation of duties concept prohibits the assignment of responsibility to one person for the acquisition of assets, their custody, and the related record keeping. For example, one person can place an order to buy an asset, but a different person must record the transaction in the accounting records. By separating duties, it is much more difficult to commit fraud, since at least two people must work together to do so – which is far less likely than if one person is responsible for all aspects of an accounting transaction. In order to ensure the propriety of submitted hours, employee time cards/records are to be approved by their supervisor as certification that the hours/work were actually performed as reported.

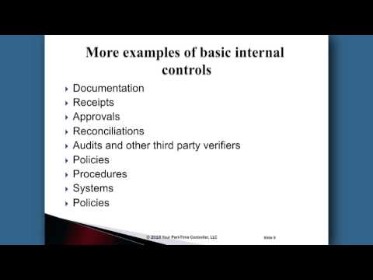

Without this separation in key processes, fraud and error risks are far less manageable. Segregation of duties is a basic, key internal control and often one of the most difficult to achieve, especially in a small operation. The basic concept for segregating duties is that no single individual should have control over all phases of a transaction. Ideally, the incompatible functional responsibilities of authorizing transactions, custody of assets and record-keeping should be the responsibility of separate individuals.

Business Purpose Documentation

This policy maintains that the accountant should not update the cash balance on the cash as well as keep track of the cash on his person. Contrarily, the cashier should not have both those responsibilities either. It upholds that the accountant should keep track of the cash books while the cashier accepts responsibility for the cash that’s on hand.

Examples Of Segregation Of Duties For Specific Functions

The company doesn’t have standard procedures to make sure that these workers will be given the same privileges in the two systems. Accounts receivable—one individual makes a record of cash accepted from the customer, and another individual completes credit memos for the customer. This minimizes the likelihood that an employee will redirect a payment from a customer and hide the theft with an equal credit to the customer’s account. Cash—one individual opens envelopes containing checks, while another individual enters the checks into the accounting system. This minimizes the risk that an individual will deposit the money into another account.The accounting profession has invested significantly in separation of duties because of the understood risks accumulated over hundreds of years of accounting practice. This fraudulent activity went undetected until the trading partner was sold to another corporation. The new management of the trading partner was presented with insertion orders that did not have proper supporting documentation. In turn, management decided to call the sales rep’s company to discuss the matter.