Content

- You Can’t Afford To Ignore Your Burn Rate

- Who Needs To Worry About Burn Rate?

- Companies That Succeeded With Bootstrapping

- High Burn Rates Are Bad For Business

- How To Reduce Burn Rate

- Calculating Burn Rate

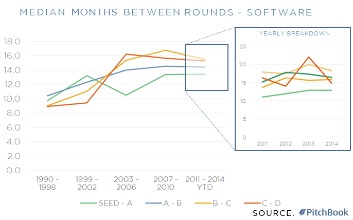

Mark Suster suspects that most startups will spend any VC money within 12 – 18 months of investment. Burn rate will vary significantly depending on company stage, pricing model, and industry.

Gross burn rate measures your monthly operating expenses without taking revenue into account. Net burn rate, on the other hand, tells you how much money you’re spending per month, but includes revenue in the equation. For funded startups, the relationship of burn rate to revenue is especially important.You’re still spending $3,500 a month to stay in business, but last month you made $2,000. Burn rate can be an anxiety-provoking statistic in the early stages of a funded startup.

You Can’t Afford To Ignore Your Burn Rate

The burn rate tells you how much cash the company is burning through, but it doesn’t address whether the burn rate is reasonable. It’s up to each analyst to carefully assess the business plan and determine whether the burn rate is justified or troubling. The burn rate tells companies how much money they’re spending and how quickly they’re spending it. The term is usually used in the context of a new company that’s trying to ramp up its operations and become profitable.

Recall that the gross burn rate takes into account solely the cash losses. In this scenario, we are assuming that this start-up had $500k in its bank account and just raised $10mm in equity financing – for a total cash balance of $10.5mm. By dividing the current cash balance by the burn rate, the runway can be calculated, which again is the number of months a company has left until the cash balance drops to zero. The burn rate is the pace at which a new company is running through its startup capital ahead of it generating any positive cash flow. For a startup or early-stage business, it’s important to highlight the monthly burn rate and the runway until the next financing is required.In this case, you divide your operating income by the amount of cash initially invested in the business. Alternatively, you can use your total cash at any point in time when looking for your burn rate over a specific period of time. When you need to make a big change like this, you’re operating a lot like a new business. You need to know how long you have to develop and test ways to increase revenue before the bank’s money runs out. You also need to budget for interest payments once you do start making a profit again.

Who Needs To Worry About Burn Rate?

Beyond that, responsible growth and planning are not possible without knowing how much money is left after expenses to reinvest in your company. And if you’re running a startup, you’re almost certainly overspending somewhere. These are numbers you’ll want to have ready if investors inquire .

- If you’re burning through $100,000 a month, it’s going to take a significant amount of revenue just to break even.

- The calculation of the gross burn rate only takes into account the total cash outflows for the period into consideration.

- It will also help make sure your calculations aren’t skewed by an extraordinarily good sales month.

- For example, if your company has a burn rate of $10,000 then that means you are spending approximately $10,000 per month in excess of your revenues.

Layoffs often occur in larger start-ups that are pursuing a leaner strategy or that have just agreed to a new financing deal. As you can see from the information above, keeping your burn rate as low as possible is always a good idea. They know how important numbers are to the success of a business. They also know that your burn rate is a key indicator of your startup’s sustainability. Your startup’s burn rate is a key indicator of the strength of both your business plans and business practices. It’s no wonder, then, that the sharks on the television show Shark Tank make it a point to ask each entrepreneur about their burn rate.

Companies That Succeeded With Bootstrapping

When you hear someone talking about burn rate, always assume they are referring to net burn rate unless they say otherwise. This is because net burn rate is by far the more descriptive of the two terms. Company X is reviewing the burn rate for early April, the first quarter of the year. You should expect a measure of fluctuation as you scale and as you deal with bumps in the road, but it should remain steady and in the shade of your revenue. And if the burn is coming from that corner office, it might be time to move back to the basement for a while. Pilot is not a public accounting firm and does not provide services that would require a license to practice public accountancy. As a result, the “Monthly Gross Burn” can just be linked to the “Total Monthly Cash Expenses”, ignoring the $625k made in sales each month.Your burn rate is intimately tied to almost all commercial activity in your business. This means that, in case the burn needs to die down, strategies to reduce it can come from a number of different angles. Burn rate calculation is not quite as tough as Fermat’s Last Theorem, but a robust understanding of both the core burn formula and its variation is critical for business success. Presuming you spot it fast enough, a high burn rate due to factors like these can be a blessing in disguise, pointing you toward more effective replacements for needless expenses.

But there are a few situations in which your burn rate may come back as negative. Say you just scored a round of funding — your burn rate might show as negative for that month because you appear to be gaining money overall. In other words, you subtract revenue from spending and use that number to calculate your net burn rate. Net burn rate helps you understand how much more revenue you’d need to break even and how much longer you have until you run out of money if nothing changes. Use the calculator below to figure out your burn rate and months of runway based on the cash balance in your bank account for the last few months. Enter at least 3 months, but you can get a more accurate answer if you enter more .Therefore, understanding both your burn rate and cash runway will reveal how long your business can survive with the cash you have available. Burn rate is the amount of money your business needs in a certain period—usually a month—to cover all expenses. In other words, burn rate tells you how quickly your business “burns through” capital.

High Burn Rates Are Bad For Business

You should look at burn rate as it relates to cash runway, CAC, churn, and overall financial projections. It’s equal to your Net Income on the P&L statement, and usually stated monthly. To calculate it from scratch, add all expenses for the month and subtract all income for the month. If you’ve spent $500k this month, and brought in $250k in cash income, your monthly burn rate is $250k. Note that this cash income needs to actually be in your hand – not deferred revenue from future bookings. Burn rate refers to the amount of cash your business spends in a month.

Net Burn Rate Runway

For example, many food delivery start-ups are in a loss-generating scenario. However, forecasts in growth and economies of scale encourage investors to further fund these companies in hopes of achieving future profitability. Figuring out your gross burn rate is simply a matter of adding up your expenses for the month.She has consulted with many small businesses in all areas of finance. She was a university professor of finance and has written extensively in this area. While an unsustainable rate over the long run can become a cause for concern to management and investors, it ultimately depends on the given company’s specific surrounding circumstances. Variable overhead is the indirect cost of operating a business, which fluctuates with manufacturing activity. Khadija Khartit is a strategy, investment, and funding expert, and an educator of fintech and strategic finance in top universities. She has been an investor, entrepreneur, and advisor for more than 25 years. Not only can you choose from open-concept spaces, dedicated desks, and private offices, but you can also access conference rooms, meeting spaces, and reception areas.If your burn rate’s up because of overspend on branding, consider organic means of building your brand profile instead of paid advertisements. If it’s because you’re getting a bad rate from a vendor, use it as an opportunity to shake things up. Want someone to hand you a burn rate report, rather than doing it yourself? If your burn rate seems high compared to your peers, or if the amount of runway left makes you nervous, it’s worth looking at what’s causing your burn rate.For this calculation, it’s more accurate to use your average burn rate . Taking that average burn rate, divide the amount of money you have now by your burn rate. The easiest place to find the information you need is in a cash flow statement . If you want to know your burn rate while including VC funding, then you don’t need to make any adjustments to the numbers you see.In this article, the experts at Bond Collective will tell you everything you need to know about this important concept. It will come as no surprise that growth and annual recurring revenue make an impact on burn rate, and companies with faster growth and high ARR will have a lower burn rate. To calculate your burn rate, simply subtract your incoming cash from outgoing cash. Read on to learn how to calculate burn rate, burn rate benchmarks, and more. Although it can be uncomfortable to face the reality of a high burn rate , it is much better to know these metrics in your business and address them before they become a problem.

Calculating Burn Rate

It’s the same calculation, but you should first subtract any recent funding from your total cash, when relevant. The burn rate doesn’t breakdown expenses and qualify them individually, either. A business owner might know their burn rate is troubling, but that won’t help them figure out where spending could be cut, how profits could be increased, or where alternate funding could be found. They’ll compare the burn rate to the business plan to see if the business has a realistic chance of becoming profitable.