Content

- Is It Posible For Dividends To Exceed Net Income?

- What Does The Statement Of Retained Earnings Include?

- What Is The Statement Of Retained Earnings?

- How To Include Inventory And Receivables On An Income Statement

- Which Financial Statement Is Used By Corporations Instead Of A Statement Of Retained Earnings?

- Retained Earnings Impact Other Financial Statements

There are periodic adjustments to the account that started at the time the business was initially formed. Your net profit for year 20XZ is $175,000 and you owe $75,000 in dividends to your shareholders. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.They are the amount of income after expenses that is not given out to stockholders in the form of dividends. Retained earnings are added to the owner’s or stockholders’ equity account depending on the type of organization.

Is It Posible For Dividends To Exceed Net Income?

This analysis may include calculating the business’ retention ratio. The retention ratio is the percentage of net profits that the business owners keep in the business as retained earnings. Although preparing the statement of retained earnings is relatively straightforward, there are often a few more details shown in an actual retained earnings statement than in the example. The par value of the stock is sometimes indicated as a deeper level of detail.

- The company typically maintains a retention ratio in the 70-75% range.

- I did not include aprior period adjustmentin this example because they aren’t typically very common.

- Companies use retained earnings to fund ways in which they can grow, be more efficient, or contribute to the mission of the organization.

- Investors watch for the business’s stock price to increase because this means the latter’s management is focused on maximizing the wealth of shareholders.

The statement ofretained earningsis a short report because there aren’t very many business events that change the balance in the RE account. The report typically lists thenet incomeor loss for the period,dividendspaid to shareholders in the period, and any prior period adjustments that occurred. Then, add or subtract prior period adjustments, which equals the adjusted beginning balance. From there, add the net income or subtract net loss, subtract cash dividends given to stockholders. If your company earns a profit, you can choose to either distribute the profits as dividends to owners or reinvest the profits in your business. The amount of profit you’ve kept since your company’s beginning is called your retained earnings. Your statement of retained earnings shows the change of your retained earnings account between two periods and the items that affect the change.Investors regard some mature, established firms, as reliable sources of dividend income. Dividends declared must be subtracted from retained earnings, not added. The notes on the Statement of Retained Earnings is very simple and straight forward.

What Does The Statement Of Retained Earnings Include?

In order to track the flow of cash through your business — and to see if it increased or decreased over a given period of time — you will need to review your statement of cash flows. Retained earnings represent a useful link between the income statement and the balance sheet, as they are recorded under shareholders’ equity, which connects the two statements. This reinvestment into the company aims to achieve even more earnings in the future. The statement of retained earnings is also known as a statement of owner’s equity, an equity statement, or a statement of shareholders’ equity. Boilerplate templates of the statement of retained earnings can be found online. It is prepared in accordance with generally accepted accounting principles . The Statement of retained earnings is the shortest of the four primary financial accounting statements, but it provides the clearest illustration of the interrelated nature of these statements.

Does Excel have a balance sheet template?

Empower your business finances with a balance sheet template that shows year-to-year comparisons, increases or decreases in net worth, assets and liabilities, and more. … This Excel balance sheet template, lets you do more in less time. This is an accessible template.It’s also sometimes called the statement of shareholders’ equity or the statement of owner’s equity, depending on the business structure. The amount of retained earnings that a corporation may pay as cash dividends may be less than total retained earnings for several contractual or voluntary reasons. These contractual or voluntary restrictions or limitations on retained earnings are retained earnings appropriations.

What Is The Statement Of Retained Earnings?

Mark’s Ping Pong Palace is a table tennis sports retail shop in downtown Santa Barbara that was incorporated this year with Mark’s initial stock purchase of $15,000. During the year, the company made a profit of $20,000 and Mark decided to take $15,000 dividend from the company. The statement of retained earnings would calculate an ending RE balance of $5,000 (0 + $20,000 – $15,000). Notice that the initial investment in stock isn’t taken into consideration. A statement of retained earnings shows the changes in a business’ equity accounts over time. Equity is a measure of your business’s worth, after adding up assets and taking away liabilities. Knowing how that value has changed helps shareholders understand the value of their investment.

What are the 3 most important financial statements?

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company’s financial strength and provide a quick picture of a company’s financial health and underlying value.Sometimes when a company wants to reward its shareholders with a dividend without giving away any cash, it issues what’s called a stock dividend. This is just a dividend payment made in shares of a company, rather than cash. Once you have all of that information, you can prepare the statement of retained earnings by following the example above. When you’re through, the ending retained earnings should equal the retained earnings shown on your balance sheet.

How To Include Inventory And Receivables On An Income Statement

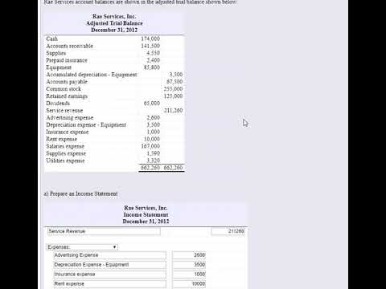

The complete set also includes examples of the Income Statement, Balance Sheet, and Statement of Changes in Financial Position . The article Dividend explains in more depth the role of dividends in financial statements. Firstly, how net income from the current period adds retained earnings to the firm’s total retained earnings. This total appears on both the Balance sheet and the Statement of retained earnings. The statement of retained earnings provides helpful information to managers and investors while also showing the limit for the amount of treasury stock that a company can purchase for that year.The retention ratio is the percentage of net income that is retained. For example, if 60% of net income is paid out as dividends, that means 40% of net income is retained. The dividend payout ratio is the opposite of the retention ratio.

This statement of retained earnings can appear as a separate statement or as an inclusion on either a balance sheet or an income statement. The statement is a financial document that includes information regarding a firm’s retained earnings, along with the net income and amounts distributed to stockholders in the form of dividends. An organization’s net income is noted, showing the amount that will be set aside to handle certain obligations outside of shareholder dividend payments, as well as any amount directed to cover any losses. Each statement covers a specified time period, as noted in the statement.These laws ensure that companies do not take more income than they make in a year and give it to stockholders when they are not doing well financially. Write “Beginning retained earnings” in the first column and its amount in the second column on the first line of the statement of retained earnings. In this example, write “Beginning retained earnings” in the first column and “$50,000” in the second. Let’s say that in March, business continues roaring along, and you make another $10,000 in profit. Since you’re thinking of keeping that money for reinvestment in the business, you forego a cash dividend and decide to issue a 5% stock dividend instead. Dividends paid out during the period should appear as a use of cash under Cash Flows from Financing Activities on the cash flow statement. You can usually find this information on the previous year’s balance sheet or the opening balance of the retained earnings account in your general ledger.If you have a net loss greater than your beginning retained earnings, you will end up with a negative ending retained earnings balance. The third line should present the schedule’s preparation date as “For the Year Ended XXXXX.” For the word “year,” any accounting time period can be entered, such as month, quarter, or year. A statement of retained earnings should have a three-line header to identify it. A statement of retained earnings consists of a few components and takes a series of steps to prepare. Businesses need to prepare a statement of retained earnings for both internal decision making and for the dissemination of information to external interested parties. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.While a t-shirt can remain essentially unchanged for a long period of time, a computer or smartphone requires more regular advancement to stay competitive within the market. Hence, the technology company will likely have higher retained earnings than the t-shirt manufacturer. The purpose of releasing a statement of retained earnings is to improve market and investor confidence in the organization.The statement is most commonly used when issuing financial statements to entities outside of a business, such as investors and lenders. When financial statements are developed strictly for internal use, this statement is usually not included, on the grounds that it is not needed from an operational perspective. Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.Instead, the retained earnings are redirected, often as a reinvestment within the organization. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. According to the provisions in the loan agreement, retained earnings available for dividends are limited to $20,000.The statement of retained earnings is a financial statement that summarizes the changes in the amount of retained earnings during a particular period of time. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. If you have used debt financing, you have creditors or institutions that have loaned you money. A statement of retained earnings shows creditors that the firm has been prosperous enough to have money available to repay your debts. At the end of the period, you can calculate your final Retained Earnings balance for the balance sheet by taking the beginning period, adding any net income or net loss, and subtracting any dividends.