Content

- Deductions For Adjusted Gross Income

- Types Of Taxable Income

- How To Reduce Your Taxable Income

- Determine Your Gross Annual Income

- How Is Taxable Income Calculated For An Individual Tax Return?

- How Much Difference Does An Additional Allowance Make On The Federal Withholding Amount?

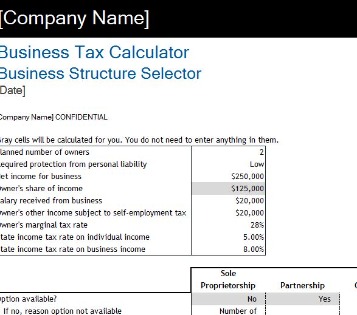

Itemized deductions are comprised of individual deductions based on potential eligible expenses. It’s up to the taxpayer to decide which deduction to claim, so it’s important to know which deduction lowers your tax burden most. Unearned income considered to be taxable income includes canceled debts, government benefits , strike benefits, and lottery payments. Taxable income also includes earnings generated from appreciated assets that have been sold during the year and from dividends and interest income. Uncle Sam provides a substantial break on taxable income in the form of the standard deduction on U.S. individual and spousal tax forms.Whether youmake an appointmentwith one of our knowledgeable tax pros or choose one of ouronline tax filingproducts, we’ll help you determine your taxable income as part of preparing your return. Plus, you can count on H&R Block to help you get back the most money possible. Your total gross income is determined by adding up all types of income that you have received during the calendar/tax year. There are different lines on the front of the Form 1040 and Schedule 1 for different types of income, but by the time you get to the end, you will have added it all up.Gross income includes income earned in the United States and from foreign sources. Under a global system of taxation, both citizens and residents are taxed on income regardless of where it is earned. Income earned in foreign territories is usually taxed by the foreign country as well. To prevent double taxation, United States tax law allows various deductions and credits to offset taxes paid to other countries.

For 2013, the standard deduction is $12,200 for married couples filing jointly, $8,950 for heads of household and $6,100 if you are single or married filing separately. Deduct this number from your gross income to determine your taxable income if you are claiming the standard deduction. Basically, taxpayers can claim either the standard deduction when filing taxes, or they can itemize their qualifying individual deductions. The standard deduction cuts your taxable income by a specific amount ($12,200 for the 2019 tax year for single filers, $18,350 for heads of household and $24,200 for married couples filing jointly).CAA service not available at all locations. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply.

Deductions For Adjusted Gross Income

Taxable income consists of both earned and unearned income. Julia Kagan has written about personal finance for more than 25 years and for Investopedia since 2014. The former editor of Consumer Reports, she is an expert in credit and debt, retirement planning, home ownership, employment issues, and insurance. She is a graduate of Bryn Mawr College (A.B., history) and has an MFA in creative nonfiction from Bennington College. Fully Exempted Taxable – Some of the Fully Exempted Allowances are Allowances of High Court & Supreme court Judges, Foreign Allowances. Based on the Category a particular allowance falls under, it is deducted from the gross income.

If you claim deductions, these can lower your taxable income, and the adjusted number after you’ve claimed all of your deductions is your federal taxable income. There’s no specific formula for calculating your taxable income.To determine your corporation’s income, add all of your profits or revenues. Depending on your business, these may include your gross profit, dividends, interest, gross rents, gross royalties, capital gain net income, net gain and other revenues. The 2nd type of deduction from adjusted gross income is the personal and dependency exemptions. Each taxpayer that provides more than ½ of his own support can claim a personal exemption.

Types Of Taxable Income

Operating net income is typically the figure lenders and investors will consider before making financial decisions as it shows how profitable the company is. Laws and regulations change frequently, and are subject to differing legal interpretations. Beyond providing financial planning advice, what does a financial advisor do? Find out more about financial advisory services and the value advisors can bring. To see what tax credits you might qualify for, check out The Big List of U.S. If you’ve got lots of deductions, you’ll probably want to itemize.

- Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details..

- Taking all of that into account, your gross annual income should be $66,500.

- You can claim a Recovery Rebate Credit when you file your 2020 taxes if you did not receive your full authorized $1,200 Economic Impact Payment in 2020.

- Simply we can divide the Income like below.

- Type of federal return filed is based on your personal tax situation and IRS rules.

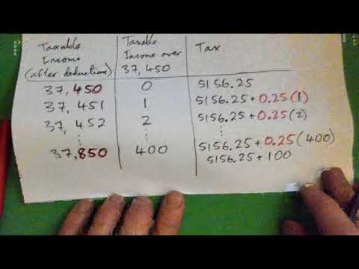

- After you’ve determined your tax bracket, multiply the percentage by your adjustable gross earnings to get your total federal tax liability.

Taxable income is the amount of money, in earned income and unearned income, that creates a potential tax liability. For the final step in calculating your taxable income, you will need to take your AGI, calculated above, and subtract all applicable deductions.

How To Reduce Your Taxable Income

See Online and Mobile Banking Agreement for details. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice.

Determine Your Gross Annual Income

Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of bookkeeping.

How do I claim 80CCD?

Eligibility to claim tax deduction under Section 80CCD Deduction can be claimed up to the limit of Individuals 10% basic annual salary (basic + dearness allowance) or 10% of gross annual income (in case self-employed). Upper limit on the quantum of claim under Section 80CCD (1) and Section 80CCD (2) is up to 1.5 lakh.Starting in 2018, under the new tax package passed by the Republicans at the end of 2017, known as the Tax Cuts and Jobs Act, the personal and dependency exemption is completely eliminated, . However, the standard deduction is nearly doubled. Taxable income is your federal tax liability. Fortunately, there are good ways to lower that number. The IRS considers almost every type of income to be taxable, but a small number of income streams are nontaxable. This is on the W-2 form if you work for an employer. If you are an independent contractor, then you will need a record of the estimated tax payments that you made quarterly throughout the year.Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. As part of the American Rescue Plan, student loan forgiveness issued from Jan. 1, 2021, to Dec. 31, 2025, will not be taxable to the recipient. You can deduct the amount of unreimbursed medical expenses that exceed 7.5% of your AGI (the threshold is typically between 7.5% and 10% of AGI in any normal tax year).Using Schedule 1, you may be able to reduce your income with the help of contributions to a traditionalIRA, student loan interest, self-employment deductions, and other expenses. Adding these up on line 22 of Schedule 1 gives you the total adjustments. Your Adjusted Gross Income is then calculated by subtracting the adjustments from your total income.

Post deduction is the net income. In India, a person’s income that crosses the maximum amount limit is collected as Income tax based on the rate set by the Indian income tax department. It is based on the Individual Resident Status of the taxpayer too.Your taxable income minus your tax deductions equals your gross tax liability. Gross tax liability minus any tax credits you’re eligible for equals your total income tax liability. Federal taxable income is an individual’s or a corporation’s gross income minus the applicable deductions, exemptions and payments.

How Much Difference Does An Additional Allowance Make On The Federal Withholding Amount?

To defer income, wait until the end of the year to send invoices. You won’t have to claim the income on your tax return until you receive the cash or checks early in the next calendar year. A company’s cost of goods sold is the total costs used to create its products or services. If you sell wool socks, COGS includes things like the wool and the wages of the sewers. To illustrate, say Stark Industries had gross sales of $500,000, allowed returns and discounts totaling $20,000, and earned $10,000 in interest from its bank.