3.3.2022 by Ron PearsonIf you do not qualify for the abatement, you will get lower penalties for late payment than for late filing. But don’t forget that interest begins to accrue the day after the due date and compounds daily, so it may not be worth it to follow tha... Read more

3.3.2022 by Ron PearsonGetting your name out there can score you some self-employment tax deductions. You can offer your employees up to $5,000 in dependent-care benefits. If your spouse is your employee, that $5,000 can be used for child care for your own children. These ... Read more

2.3.2022 by Ron PearsonJennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. There is an IRS tool that you can use to calculate your own standard deduction. Within about five minutes, you’ll ... Read more

2.3.2022 by Ron PearsonHowever, an enrolled agent is a federally-authorized tax practitioner rather than a state-licensed professional. An enrolled agent can provide tax consultations, file federal and state returns, and represent taxpayers to the IRS in an audit. NAEA mem... Read more

1.3.2022 by Ron PearsonThe entry-level jobs are that of a cashier, stocker, and custom framer. A part-time employee usually gets 35 hours or less of work hours every week. A full-time worker at Hobby Lobby is supposed to be given at least 36 hours of work every week. Depen... Read more

28.2.2022 by Ron PearsonAn activity is presumed carried on for profit if it produced a profit in at least 3 of the last 5 tax years, including the current year. Activities that consist primarily of breeding, training, showing, or racing horses are presumed carried on for pr... Read more

28.2.2022 by Ron PearsonTrusted by hundreds of merchants around the world, we’re on a mission to make online selling easier, efficient and cost-effective. Add-on custom automated business rules to modify product data such as merge fields, add new content, markup prici... Read more

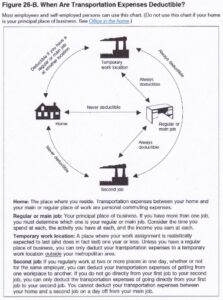

25.2.2022 by Ron PearsonMost taxpayers are not, but if they are, the company hiring the independent contractor will need to withhold income tax from that contractor's pay at a flat rate of 24% (for tax years 2018–2025) and send it to the IRS. Most employers will pay indepen... Read more

25.2.2022 by Ron PearsonThe revised form aims to make the process of determining how much an employer should withhold easier. If you are single or have a spouse who doesn't work, don't have any dependents, only have income from one job, and aren’t claiming tax credits... Read more

24.2.2022 by Ron PearsonHowever, it’s not unheard of for careless lenders to forget to file a UCC-3, even after the borrower has repaid the full amount. States usually have pretty strong protections in place for borrowers’ personal assets. For example, creditors... Read more