Content

- Temporary Accounts: How To Use Them Properly

- How To Close A General Ledger

- What Is The Drawings Account?

- Business Checking Accounts

- Free Financial Statements Cheat Sheet

- What Does Temporary Account Mean?

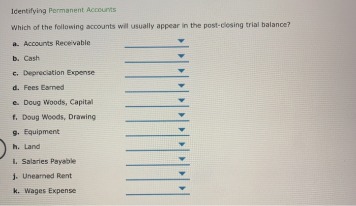

Temporary account balances do not have opening balances as they are zeroed out before the new period starts, for the new balances to flow in. These accounts include revenue accounts, expenses accounts, and withdrawal accounts. The assets, liabilities, and capital accounts have permanent balances. The purpose of temporary accounts is to show how any revenues, expenses, or withdrawals have affected the owner’s equity accounts. The accounts that fall into the temporary account classification are revenue, expense, and drawing accounts. Expenses are temporary accounts that illustrate a company’s cost of conducting business.

Among its many complexities are the accounts used for categorizing the flow of money. Most business owners are familiar with the core account types, such as revenue and expenses. However, financial professionals also use temporary and permanent accounts to ensure they record financial transactions accurately. We see from the adjusted trial balance that our revenue accounts have a credit balance.ABC Limited recorded revenues of $600,000 for the financial year 2017. Then, $400,000 worth of revenues were recorded in 2018, as well as $800,000 in 2019. It only takes one mistake for your accounts to be thrown off completely. When this happens, it can cause the company to miscalculate everything else, which could lead to overpaying or underpaying other financial obligations. Answer the following questions on closing entries and rate your confidence to check your answer.

Temporary Accounts: How To Use Them Properly

Our priority at The Blueprint is helping businesses find the best solutions to improve their bottom lines and make owners smarter, happier, and richer. That’s why our editorial opinions and reviews are ours alone and aren’t inspired, endorsed, or sponsored by an advertiser. Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. Looking for the best tips, tricks, and guides to help you accelerate your business? Use our research library below to get actionable, first-hand advice.

Is rent a debit or credit?

Why Rent Expense is a Debit Rent expense (and any other expense) will reduce a company’s owner’s equity (or stockholders’ equity). Owner’s equity which is on the right side of the accounting equation is expected to have a credit balance.Assume a company has a $500 debit balance in its drawings account. In this case, the company must close the drawings account by drafting a $500 debit in the capital or retained earnings account and a $500 credit in the drawings or dividends account. This allows the company to take the drawings account off the books and start the next accounting cycle with a zero balance in the drawings account. Temporary accounts in accounting are used to record financial transactions for a specific accounting period.

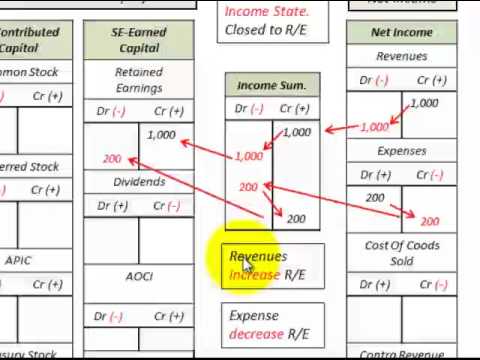

How To Close A General Ledger

Get clear, concise answers to common business and software questions. Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Closing the Income Summary account—transferring the balance of the Income Summary account to the Retained Earnings account. Accounts Receivable Analysis Shelby Stores Company and Landon Stores, Inc. are large retail department stores. Both companies offer credit to their customers through their own credit card operations. I used to think that maybe one day I would get one, but then I chickened out.Once all the temporary accounts are closed to the income summary account or profit & loss account, the net balance determines the financial performance of the business. If the profit & loss account is having a debit balance, it means that the business has made a loss & a credit balance means that the business has made a profit. Any dividends that are to be distributed to the owners will be debited from the profit and loss account & the net balance will be transferred to retained earnings which becomes part of the owner’s capital. The balance in your company’s income summary account after revenues and expenses are closed indicates net income. For example, a company with $10,000 in revenue and $5,000 in expenses has a net income of $5,000. The balance in the income summary account is closed to the company’s capital account.Write a corresponding credit to the expense account to balance the entry. Therefore, if your company debits income summary for $5,000, you must credit expenses for $5,000. When the trial balance is prepared at the end of the period, it contains all the accounts both temporary and permanent in it with their balances. Once the closing entries are passed in all the temporary accounts, a post-closing trial balance may be prepared which contains only the summary of the balances in real accounts or permanent accounts. Here the retained earnings account will be properly adjusted with the current year’s profit/loss.The capital account indicates the amount of money that has not been distributed to owners of your company. Let’s say your company has a $5,000 credit balance in the income summary account. In this case, you must debit income summary for $5,000 and credit the capital account for $5,000. This transfers the income summary balance to the company’s capital account.

What Is The Drawings Account?

At the end of that period, all balances in temporary accounts must be transferred to permanent accounts. Accounting is one of the most complex areas of business management.The closing process aims to reset the balances of revenue, expense, and withdrawal accounts and prepare them for the next period. Unlike permanent accounts, temporary accounts are measured from period to period only. At the end of a fiscal year, the balances in temporary accounts are shifted to the retained earnings account, sometimes by way of the income summary account.

Business Checking Accounts

Learn more about the effect that inventory errors can have on businesses. A business impact analysis determines crucial business operations and compiles information for planning against unexpected events that can halt these operations. Identify the processes of data collection, analysis, prioritization of unit, and the importance of gaining approval. While it’s pretty easy to figure out what is an asset and what is a liability, it is quite a bit harder to determine just how much each is worth. In this lesson, we look at the challenges of measurement in accounting. Show bioRebekiah has taught college accounting and has a master’s in both management and business. DividendDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity.

- Learn accounting fundamentals and how to read financial statements with CFI’s free online accounting classes.

- This lesson discusses differences between GAAP and tax accounting – known in practice as permanent and temporary differences – and the interperiod tax allocation issue resulting from temporary differences.

- All the balances in the income statement are closed to the retained earnings in the balance sheet.

- Temporary accounts, like temporary tattoos, are only around for a little bit, while permanent accounts, like permanent tattoos, are there forever.

- To close the revenue account, the accountant creates a debit entry for the entire revenue balance.

- It is shown as the part of owner’s equity in the liability side of the balance sheet of the company.

- In this case, the company must close the drawings account by drafting a $500 debit in the capital or retained earnings account and a $500 credit in the drawings or dividends account.

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. Any gain or loss made through capital transactions is usually recorded through a nominal account.That same concept can be used to explain temporary and permanent accounts in accounting. Temporary accounts, like temporary tattoos, are only around for a little bit, while permanent accounts, like permanent tattoos, are there forever. Hence, entries with the nature of such adjustments are considered as closing entries, and they are passed in the temporary accounts. For example, ABC company was able to make $500,000 sales in 2019. If the sales account was not closed, it will be carried over to the next accounting period.

Product Reviews Unbiased, expert reviews on the best software and banking products for your business. Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day.Business owners should make a decision based on what they need to measure and for what time period. It is possible for accounts that were once treated as permanent to become temporary due to selling the business or reorganizing the accounts. In this lesson, we’ll review the differences between managerial and financial accounting as it pertains to audience, purpose, and statement preparation. Ledgers, which are used to record final accounting entries, and charts of accounts, which list all of the accounts of a business, are vital financial management tools. Explore the definitions, uses, and types of ledgers and charts of accounts, and discover how they relate to one another.

What Are Temporary Accounts?

The examples include Short-Term Investments, Prepaid Expenses, Supplies, Land, equipment, furniture & fixtures etc. Sage 50cloud is a feature-rich accounting platform with tools for sales tracking, reporting, invoicing and payment processing and vendor, customer and employee management. Instead, why not look at automating the entire process with the use of accounting software? If you’re looking for information on what application would be right for your business, be sure to check out The Blueprint’s accounting software reviews.