Content

- How Do Fixed Costs And Variable Costs Affect Gross Profit?

- Impact Of Absorption Costing And Variable Costing On Profit

- Chapter 6: Variable And Absorption Costing

- What Is A Variable Cost?

- The Beginner’s Guide To Product Photography

- Physical Materials

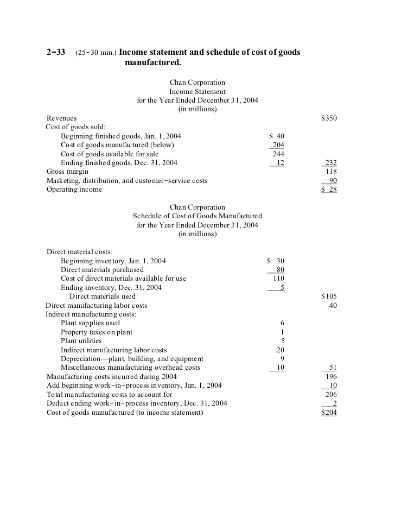

- Cost Of Goods Sold Cogs

However, book and tax amounts may differ under some systems. Where the market value of goods has declined for whatever reasons, the business may choose to value its inventory at the lower of cost or market value, also known as net realizable value. This may be recorded by accruing an expense (i.e., creating an inventory reserve) for declines due to obsolescence, etc. Current period net income as well as net inventory value at the end of the period is reduced for the decline in value. Calculate the projected operating profit for the option assigned, and determine whether the option is acceptable. Calculate the break-even point in units assuming that the labor-intensive process is used, and the automated process is used. Contribution Margin with Resource Constraints.

- Refer to panel B of Figure 5.7 “Traditional and Contribution Margin Income Statements for Bikes Unlimited” as you read Susan’s comments about the contribution margin income statement.

- Riviera Incorporated produces flat panel televisions.

- Generally speaking, COGS will always have a fixed and variable component.

- The remaining 10,000 units are in finished goods inventory at the end of year 2.

- If she uses average cost, her costs are 22 ( (10+10+12+12)/4 x 2).

- If a company follows the first in, first out methodology, it assigns the earliest cost incurred to the first unit sold from stock.

The salary is paid even if no sales are made, but commission depends on the sales volume. In this example, the commission is a variable cost and salary is fixed. The variable cost per unit is the amount of labor, materials, and other resources required to produce your product. For example, if your company sells sets of kitchen knives for $300 but each set requires $200 to create, test, package, and market, your variable cost per unit is $200. It is clear from the definition of fixed versus variable costs that the COGS figure is comprised of both types of expenses. Some businesses consider COGS to include all variable expenses, leaving all fixed expenses to be accounted for under overhead costs.

How Do Fixed Costs And Variable Costs Affect Gross Profit?

Classify your costs as either fixed or variable. Fixed costs are those that will remain constant even when production volume changes.At the start of 2009, she has no machines or parts on hand. She buys machines A and B for 10 each, and later buys machines C and D for 12 each. All the machines are the same, but they have serial numbers. Jane sells machines A and C for 20 each.Rent and administrative salaries are examples of fixed costs. If you’re selling an item for $200 but it costs $20 to produce , you divide $20 by $200 to get 0.1.

Impact Of Absorption Costing And Variable Costing On Profit

Increase the sales price for each raft by 10 percent, which will cause a 5 percent drop in sales volume. Although sales volume will drop 5 percent, the group believes the increased sales price will more than offset the drop in rafts sold. Calculate the weighted average contribution margin ratio. I have never come across the formula, but one reason your profs says there is a fixed variable in COGS might be some time delay. For instance, although labor costs are clearly variable, they are obviously fixed in the short run. This may be one reasons why your prof includes previous year’s cogs in his formula.

What is an example of a fixed cost?

Common examples of fixed costs include rental lease or mortgage payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.Only the direct materials cost is a variable cost that fluctuates with revenue levels, and so is an undisputed component of the cost of goods sold. Direct labor can be considered a fixed cost, rather than a variable cost, since a certain amount of staffing is required in the production area, irrespective of production levels. After year end, Jane decides she can make more money by improving machines B and D. She buys and uses 10 of parts and supplies, and it takes 6 hours at 2 per hour to make the improvements to each machine.Riviera Incorporated produces flat panel televisions. The company has annual fixed costs totaling $10,000,000 and variable costs of $600 per unit. Each unit of product is sold for $1,000. Riviera expects to sell 70,000 units this year .Using the information provided, prepare a contribution margin income statement for the month similar to the one in Figure 6.5 “Income Statement for Amy’s Accounting Service”. Ideally, the company should strive to strike a balance between risk and profitability by adjusting their fixed and variable costs. These represent the variable costs for each month. You can subtract this from the total monthly cost to get the fixed cost, which is $3,000 in both cases.

Chapter 6: Variable And Absorption Costing

The contribution margin minus fixed costs equals operating profit. This statement provides a clearer picture of which costs change and which costs remain the same with changes in levels of activity. Target Profit Measured in Sales Dollars . Martis Company has annual fixed costs totaling $4,000,000 and variable costs of $300 per unit. Each unit of product is sold for $400.Ask your community college professor if the CEO’s salary would be foregone if the company didn’t have any sales activity. Though I am not an expert on accounting, I assume COGS to be variable.Your average variable cost crunches these two variable costs down to one manageable figure. Throughput accounting, under the Theory of Constraints, under which only Totally variable costs are included in cost of goods sold and inventory is treated as investment. Most businesses make more than one of a particular item. Thus, costs are incurred for multiple items rather than a particular item sold. Determining how much of each of these components to allocate to particular goods requires either tracking the particular costs or making some allocations of costs.Variable costs probably include cost of sales and a portion of selling and general and administrative costs (e.g., the cost of hourly labor). Cost of sales alone represents 65 percent of net sales . Retail companies like Lowe’s tend to have higher variable costs than manufacturing companies like General Motors and Boeing. What would the operating profit be if total fixed costs increase five percent?Although fixed selling and administrative costs will increase by $200,000, the group believes the increase in rafts sold will more than offset the increase in advertising costs. Using the base case information, prepare a contribution margin income statement for the month similar to the one in Figure 6.5 “Income Statement for Amy’s Accounting Service”. Use the three steps described in the chapter to determine the sales dollars required to earn an annual profit of $1,000,000 after taxes. Use the three steps described in the chapter to determine the sales dollars required to earn an annual profit of $150,000 after taxes.

What Is A Variable Cost?

Another advantage of using variable costing internally is that it prevents managers from increasing production solely for the purpose of inflating profit. For example, assume the manager at Bullard Company will receive a bonus for reaching a certain profit target but expects to be $15,000 short of the target. The company uses absorption costing, and the manager realizes increasing production will increase profit. The manager decides to produce 20,000 units in month 4, even though only 10,000 units will be sold. At some point, this will catch up to the manager because the company will have excess or obsolete inventory in future months. However, in the short run, the manager will increase profit by increasing production.

However, only 50,000 labor hours are available each year, and the Bicycle product requires 4 labor hours per unit while the Tricycle model requires 2 labor hours per unit. The only difference between absorption costing and variable costing is in the treatment of fixed manufacturing overhead. Using absorption costing, fixed manufacturing overhead is reported as a product cost. Using variable costing, fixed manufacturing overhead is reported as a period cost. Figure 6.8 “Absorption Costing Versus Variable Costing” summarizes the similarities and differences between absorption costing and variable costing. Both fixed and variable costs have a large impact on gross profit and on its more comprehensive counterpart, operating profit. An increase in the expenses required to produce goods for sale means a lower gross profit.Each unit of product is sold for $25 . Assume Nellie Company expects to sell 24,000 units of product this coming month. The contribution margin income statement shows fixed and variable components of cost information. Revenue minus variable costs equals the contribution margin.Hi-Tech Incorporated produces two different products with the following monthly data. The company will have to sell fewer units than a comparable company with low operating leverage to break even. The company will have to sell more units than a comparable company with low operating leverage to break even. Sensitivity Analysis, Sales Price.This cost advantage could be due to cheaper resources, cheaper labor, or greater manufacturing efficiency. On the other hand, a company that is able to produce the same goods at a lower cost realizes a competitive advantage by being able to undercut the rest of the market on price. All of HubSpot’s marketing, sales CRM, customer service, CMS, and operations software on one platform. Depending on the COGS classification used, ending inventory costs will obviously differ. None of these views conform to U.S.Generally speaking, COGS will always have a fixed and variable component. Using percentages to forecast materials provides a good proxy, but supervisor salaries, operating lease payments and utilities are fixed and should be forecast accordingly.Hope this helps. Using percentages to forecast materials provides a good proxy, but supervisor salaries, operating lease payments and utilities are fixed and should be forecast accordingly.F Variable costing always treats fixed manufacturing overhead as a period cost. F Variable costing treats fixed manufacturing overhead as a period cost.