Content

- How To Remove An Entry From Craigslist

- Use A Suspense Account For Questionable Transactions

- Reconciliation: How To Reconcile Suspense Accounts?

- How To Use Suspense Accounts

- How Do You Clear A Suspense Account In Quickbooks?

- Partial Payments

A suspense account could also be a liability if it holds accounts payables that you don’t know how to classify. As the name suggests, a suspense account is an account that temporarily records amounts that are yet to have their proper accounts determined. In balance sheet terms, a suspense account is not ideal, as it can prevent you from accurately balancing the books.In case the customer sends in partial payments then you can connect your customer directly to know for which invoice and items they have paid you. When you work with the trial balance, it is allowed to open a suspense account in order to hold the discrepancies until you identify them. However, such accounts are temporary which should be closed by the end of the accounting cycle. About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.The unclassified transactions temporarily “parked” in this account are a “suspense” that we need to investigate and relocate into their correct accounts accordingly. In short, a suspense account is the point of last resort when you need a short-term holding bay for financial items that will end up somewhere else once their final resting place is decided. Book-keepingBookkeeping is the day-to-day documentation of a company’s financial transactions.

It is like a temporary shelf where all the “miscellaneous” items can be parked until the time their actual nature can be ascertained. When we record uncertain transactions in permanent accounts, then it might create balancing issues. But in the end, we should make sure to reduce the suspense account balance to zero and transfer all the entries in their respective accounts to give a better representation of our books.

How To Remove An Entry From Craigslist

Transactions will be more difficult to clear as time passes, especially if there is minimal documentation as to why the transaction was initially placed in the account. Learn more about how you can improve payment processing at your business today. Suspense accounts are also used by lenders, such as mortgage providers, when borrowers accidentally or intentionally break up their regular payment obligations. Deposits or withdrawals are made for transactions that are yet to be completed.Sometimes, amounts or costs are put into a clearing account, and then those respective payments are moved or transferred into a more appropriate account afterward. Clearing accounts are also used to verify the endless amounts of expenses and income. Both of these amounts are recorded promptly to make the accounting as accurate as possible.

Suspense accounts are cleared by reviewing each individual transaction in the account. The objective for reviewing items is to shift the transaction to the appropriate account as soon as possible. Save money without sacrificing features you need for your business. Remember to consider issues like an inaccurate recording of funds and unrecorded expenses, which can be traced back to their invoices. As soon as possible, the amount in the suspense account should be moved to the proper account. If you want to set up the suspense account in your QuickBooks, you can do it from the List menu.

Use A Suspense Account For Questionable Transactions

Also, you avoid failing to keep the transaction due to missing details. Once you save the details, you can use the suspense account so that you can work on a trial balance. An example of a suspense account is when a person has more than one item or multiple outstanding items that send a payment without defining which item the payment is for. So, rather than leaving these payments off the bookkeeping records, you can put that transaction into a suspense account until you decide where it belongs. Their balances can be reviewed, which can include the material amounts.

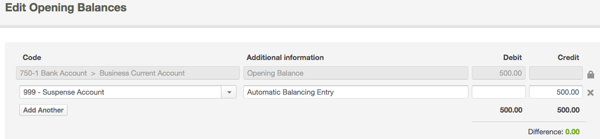

If there is a one-sided error that is corrected by the journal entries then you can use the suspense account for credit or debit either. A suspense account is used to record the balance or transactions temporarily that cannot be identified. It helps to keep track of your transactions from your mobile phone with invoicing software and online accounting. To know more about suspense account in QuickBooks, stick through this guide till the end. When a transaction with no valid document is recorded, it causes a mismatch in the account balances. These kinds of transactions are recorded under a temporary account called the Suspense Account.This allows all suspense accounts to be monitored and reported on from one centralized location. For suspense account journal entries, open a suspense account in your general ledger. The format of suspense account entries will be either a credit or debit. Also, enter the same amount with an opposite entry in another account.Clearing accounts are more simple accounts where you easily enter cash received as a clearing amount until the money is acknowledged, verified, and deposited in your bank. Clearing accounts can also be used in a way for accounts receivable. General LedgerA general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements. The double-entry bookkeeping requires the balance sheet to ensure that the sum of its debit side is equal to the credit side total. A general ledger helps to achieve this goal by compiling journal entries and allowing accounting calculations. If it’s an asset in question, the suspense account is a current asset because it holds payments related to accounts receivable.

Reconciliation: How To Reconcile Suspense Accounts?

It can be a repository for monetary transactions entered with invalid account numbers. If one of these conditions applies, the transaction should be directed to a suspense account. A suspense account is an account used temporarily to carry doubtful entries and discrepancies pending their analysis and permanent classification. A customer paid $1,000 in cash without specifying which invoice the payment relates to. Let’s suppose you have been alerted that a remittance someone sent you from abroad is ready for withdrawal. Until you actually make the withdrawal from the agent or financial institution, the remittance money may be stored in their suspense account. He will move the amount from the Suspense account to the appropriate account as soon as he gets more information about the nature of the transaction.However, in your day-to-day business activities, using a suspense account in accounting is much like placing a document on a “to file” pile. The suspense account is recorded on the trial balance which is located under the Other Assets heading.

How To Use Suspense Accounts

As a result, having a suspense account presented on the financial statements with a balance is generally viewed negatively and can weaken the statement to outside investors. Thus, effort should be made to clear suspense accounts at the end of each financial period. Suspense accounts allow transactions to be posted before there is sufficient information available to create an entry to the correct account or accounts. Without posting such transactions, there may be transactions that are not recorded by the end of a reporting period, resulting in inaccurate financial results. When you record uncertain transactions in permanent accounts, you might have incorrect balances.

- This allows all suspense accounts to be monitored and reported on from one centralized location.

- An accountant was asked to record a few journal entries written by the finance head of a large corporation.

- A customer paid an outstanding $1,000 invoice in two partial payments of $500.

- When you find out which customer made the payment, debit the Suspense Account for $500 and credit your Account Receivable customers account for $500.

- Before posting the payment, call your customer to verify the payment is correct.

- As a requirement under Sarbanes-Oxley , these accounts must be analyzed by type of product, aging category, and business justification in order to understand what is still in the account.

Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account. A suspense account is used to store the transactions temporarily when you are unsure if the payment should be recorded. However, larger unreported transactions might not be kept by the end of the reporting time which results in inaccurate financial results. When you receive a payment, it requires you to open a suspense account. You cannot find out which customer has sent the payment and for which invoice.

How Do You Clear A Suspense Account In Quickbooks?

If the credits in the trial balance exceed the debits, record the difference as a debit–and vice versa–to make both columns of the trial balance report balance. The suspense account can hold the difference that led to the trial balance not balancing until the discrepancy is rectified. Another instance in which having a suspense account comes in handy is when a trial balance is out of balance, meaning the debit and credit columns do not match. TheBlackLine Account Reconciliationsproduct, a full account reconciliation solution, includes a suspense template which serves as a complete solution for managing suspense accounts.

How do you create a suspense account?

Open a suspense account by recording the full amount in question. For example, you might receive an unknown payment for $500. To account for the payment, open a Suspense Account and credit the account with the full $500. To balance the transaction, make a debit to Cash for $500.Use a suspense account when you buy a fixed asset on a payment plan but do not receive it until you fully pay it off. After you make the final payment and receive the item, close the suspense account and open a separate asset account. List the suspense account under “Other Assets” on your trial balance sheet. After you make corrections, close the suspense account so that it’s no longer part of the trial balance. A suspense account is a general ledger account in which amounts are temporarily recorded. The suspense account is used because the appropriate general ledger account could not be determined at the time that the transaction was recorded.Also, if the debits of the trial balance are larger than your credits then this difference records as a credit in your suspense account. An accountant was asked to record a few journal entries written by the finance head of a large corporation. There was one transaction whose nature could not be ascertained at the time of recording. To complete the assignment by the deadline, the accountant recorded the “unclassified” amount in the general ledger suspense account. The suspense account is listed on the trial balance under the Other Assets heading. It remains there until the reasons for the imbalance are discovered and corrected.Conversely, if the trial balance credits are larger than the debits, the difference is recorded in the suspense account as a debit. Once you find the reason for the trial balance and correct it, the account is closed and removed from the trial balance. A suspense account helps to maintain and organize your accounting books. The suspense account has a vital role in ensuring that your account for the transaction is correctly in the books. If you record dubious transactions in your permanent accounts, you may receive an inaccurate balance.