Content

- When You’re Considering ~alternate~ Forms Of Payment:

- When Your Friends Are Excited To Get Refunds But You Owe Money This Year:

- Hate Paying Income Tax? Blame William H Taft

- The Irs Isnt A Real Government Agency

- Funny Tax Quotes

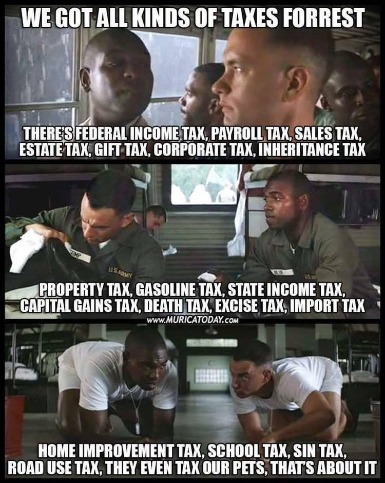

Doing taxes when you’re self-employed or doing gig work can be tricky. While it would absolutely, unquestionably suck to get audited, your odds of facing jail time over your taxes are pretty slim. If you make an honest mistake on your taxes, it’s far more likely that you’ll end up getting fined . From travel, food and lifestyle to product reviews and deals, we’re here to show you how to save and what’s worth saving for. Taxes on products or services that are considered harmful are referred to as sin taxes. Some examples include taxes on alcohol, gambling, and even fast food.

- In 2006, Anderson entered a guilty plea in which he admitted to hiding approximately $365 million worth of income.

- If the call is not about setting up an appointment or providing details about a return in progress, the policy is to tell them we can’t help them.

- In 2007, he was charged with felony tax evasion for reportedly filing false corporate tax returns.

- The IRS is indeed a legitimate part of the government—just ask the 30,000 employees ordered to work without pay during the 2019 government shutdown.

- According to the government, a taxpayer is someone who has what it takes.

- In Roman times, urine and the ammonia within it were collected for uses such as tanning and laundering.

Avoiding taxes is legal and understandable, but tax evasion comes with tough consequences. As we can see from the troubles of these five people, what you may save now will not be worth what you have to pay later. In 1989, Helmsley was convicted on three counts of tax evasion. Coincidentally, she was ordered to report to prison on income tax deadline day for that year, April 15, 1992. In a nutshell, deductions are expenses that you can subtract from your taxable income that lower the amount of taxes that you’ll have to pay. When you file your taxes, you can choose between itemizing your deductions or taking what’s called a standard deduction . If you don’t know which option is right for you, this guide might answer some questions — or you can always talk to a pro.

When You’re Considering ~alternate~ Forms Of Payment:

In general, the art of government consists of taking as much money as possible from one party of the citizens to give to the other. Foreign aid might be defined as a transfer of money from poor people in rich countries to rich people in poor countries. A politician will consider every way of reducing taxes except cutting expenses. A “slight tax increase” costs you about $300, while a “substantial tax cut” lowers your taxes by about $30. Now politicians have arranged to spend taxes before they collect them. Regardless of who wins the election they have to raise taxes to pay for the damage.

She rings the tax office up, and after about an hour on the telephone, she finally gets through to them. If the call is not about setting up an appointment or providing details about a return in progress, the policy is to tell them we can’t help them. He’s right that it’s fake, but… frankly, it entertains the clients, it’s none of his business, and some of the choice words he uses in his hours-long lectures upset me. I have a habit of making educated guesses about clients and, when I’m correct, saying that I’m mildly psychic.I was referred to tax facts when I started my GA business in 2008. Six years later my children and I are customers, even though we live in three different states.

When Your Friends Are Excited To Get Refunds But You Owe Money This Year:

We won’t actually file your taxes for you, but we’ll take care of all the messy financial admin your accountant needs. Before you start claiming cat food on your business tax return, make sure you’ve deducted more traditional business expenses first. Take a look at our list of popular small business deductions here for ideas about where to start. Playing cards were taxed as early as the 16th century, but in 1710, the English government dramatically raised taxes on playing cards and dice.

How is taxation not theft?

Liam Murphy and Thomas Nagel assert that since property rights are determined by laws and conventions, of which the state forms an integral part, taxation by the state cannot be considered theft. … Taxation does not take from people what they already own.According to the Tax Policy Center, the top 1% of earners in the United States paid 37.3% of all federal individual income tax in 2020. Some people believe that moving into a higher tax bracket will net them less money in the end. But the United States uses marginal tax brackets, meaning the higher rate applies only to the earnings that fall within the higher bracket. If only a single dollar bumps a taxpayer into a higher bracket, only that one dollar is taxed at the marginal rate for that bracket. According to some Fundamentalist Christians, the answer is yes. But you don’t get to volunteer whether to pay any taxes at all. Our advice for how you can prevent last-minute taxes in the future?She served 18 months in federal prison, one month in a halfway house and two months on house arrest. During her trial, many of Helmsley’s disgruntled hotel employees testified against her. One former housekeeper said she overheard the “queen of mean” say, “We don’t pay taxes. Only the little people pay taxes.” On Feb. 9, 1995, the former New York Mets outfielder pleaded guilty to a single count of tax evasion and was sentenced to three months in prison and three months of house arrest. He was originally indicted on three counts of evasion and conspiracy. Federal prosecutors have accused the “Blade” star of many offenses.

Hate Paying Income Tax? Blame William H Taft

According to the transcript of the moment he realized his mistake, the crew on the ground thought he was joking, but Swigert was seriously asking how to file an extension. No matter what the day has in store for you, we here at Ripley’s wish you all the best of luck in completing your taxes. Citizens of the Inca Empire paid their taxes in the form of physical work. A month later, she realises she still has not received this cheque.Today, the highest marginal income tax bracket is 37%, but it has been much higher. The Individual Income Tax Act of 1944 raised tax rates to the point where the highest bracket was 94%. For tax year 2021, these deductions will rise to $12,550 and $25,100. As of March 19, the average income tax refund was $2,902, according to the Internal Revenue Service. With nearly 76 million individual returns processed, the IRS has paid out more than 56 million refunds.

He was right and I have been with Penny and Tax Facts ever since (19 years!) I’ve never had the pleasure of even meeting Penny, but that’s because I lived in MD until recently. The income tax forms have been simplified beyond all understanding. Almost all of the tax preparation shops you see springing up around tax time are completely unregulated by the IRS.

The Irs Isnt A Real Government Agency

These taxes are largely known as “Google taxes,” though they apply to any large Internet-based company. When most people think taxes, usually the first word that comes to mind isn’t “logical.” It appears that is true outside of the United States as well. Countries across the globe have justified deductions, extra percentages and wacky ways of coming up with tax revenue. Here’s a countdown of the strangest tax laws around the world. He said that he had become aware in 2008 of the fact that the service valued at more than $250,000 over three years. In 2008, the actor was convicted of three misdemeanor counts for failing to file tax returns from 1999 to 2001, cheating the government out of $7 million.And if you have a simple return (think just a W-2 form, an unemployment form, or if you’re a student) then lots of tax prep companies, like H&R Block for one, will let you file online for free. Several states, primarily in the southeastern part of the country, have annual sales tax holidays. Depending on the state and date, clothing, footwear, guns, school supplies, energy-efficient appliances, and other select items are exempt from sales tax for two to three days a year. The IRS pays peopleto provide information on someone who did not pay taxes. The whistleblower can get up to 30% of what the IRS collects in back taxes, penalties, and interest. All winners of more than $5,000 in a lottery are subject to a 24% federal withholding tax, but state withholding taxes vary. In some states, such as California and Delaware, the withholding rate is zero.He then used that money to fund his activities that were aimed against the Royalists. In 1885, Canada created the Chinese Head Tax, which taxed the entry of Chinese immigrants into Canada.

Where in the world would you pay a tax on blueberries?

Maine: Blueberry Tax. It’s no wonder, then, that the state of Maine chose to implement a blueberry tax for anyone who grows, purchases, sells, handles, or processes blueberries. This tax is meant to fund research efforts that keep Maine competitive among other states and provinces in Canada that produce the berries.Many clients are bringing in returns from all sorts of years. This year, last year, three years ago, fourteen years ago… I’ve been letting all of my clients know that this year is the year where the due date is coming up, and I’m only doing this year’s taxes. Prior years can wait till tomorrow when we are still open but don’t have a deadline. It’s filed separately from your normal tax return, and the due date is August 27th of the next year.Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. If you are expecting a refund or if you’re still owed a stimulus payment from last year, filing sooner rather than later will put that cash in your pocket faster. If you don’t already, it’s a good idea to use a self-employed tax calculator to figure out how much your quarterly tax payments should be. And if you’re ever feeling overwhelmed or really confused about your taxes, then it can be totally worth it to go see a pro. Isn’t it weird how 2020 was the longest year in the history of time, but it still feels like this tax season just snuck up on us?

Taxes Rising

If you were working a job that gave you a W-2 for 2020, you already paid some taxes last year. But if you file your tax return, at least you’ll have a chance at getting some of your money back. Plus, like I mentioned before, if you’re owed a stimulus that you didn’t get in 2020, filing your tax returns can help you get that cash too. That said, this person makes a really valid point. Filing taxes doesn’t feel so great for a lot of us this year, but hopefully you can get some money back out of it.Compentent, Caring, & Professional – that is the experience I have known. The tenth now paid $49 instead of $59 (16% savings). The ninth now paid $14 instead of $18 (22% savings). The eighth now paid $9 instead of $12 (25% savings). The group still wanted to pay their bill the way we pay our taxes so the first four men were unaffected.Some tax cheats have claimed that the price of becoming too rich and too high-profile garnered unwanted and undue attention to their finances. Then again, some taxpayers cheated the IRS deliberately and repeatedly — until they got caught. Helmsley and her husband, Harry, accumulated a multi-billion dollar real estate portfolio. Despite their immense wealth, they were accused of billing millions of dollars in personal expenses to their business in order to escape taxes. The IRS conceded taxes and penalties from three years included in Anderson’s case, however, Anderson is still responsible for $23 million owed to the government of the District of Columbia. These famous tax evaders found ingenious ways to avoid paying up. Find out how much they owed, and how they were caught.

In Alaska, eligible whaling captains can deduct up to $10,000 for whaling-related expenses. In Hawaii, property owners may be able to deduct up to $3,000 in expenses related to maintaining a tree with historic or cultural value. Madison Square Garden, the iconic New York sports, music, and entertainment venue, has not had to pay property taxes since 1982.

You Do The Crime, You Pay The Tax

A typographical error in the amount of the federal government’s judgment against Anderson has prevented him from having to pay the majority of the taxes owed. Talk about taxes’ ability to darken a day — in 1696, a window tax was introduced in England and Wales. It was assessed as a flat property tax plus a tax based on the number of windows a home had. As a result, some people bricked up their windows and new buildings sometimes were designed with fewer windows.CA also has a tax on vending machine purchases, such as candy or drinks. New York City places a special tax on prepared foods, so sliced bagels are taxed once as food and again as prepared food, thus creating a sliced bagel tax.