Content

- What Tax Breaks Do You Lose Under The Amt?

- Will You Have To Pay The Amt?

- Beware Of These Amt Triggers

- Turbotax Online

- File

- Credit Resources

The AMT is designed to ensure that everybody pays their fair share of taxes, but it doesn’t affect most households. Discounted offers are only available to new members. Stock Advisor will renew at the then current list price. Stock Advisor list price is $199 per year.

- Stock Advisor list price is $199 per year.

- Enrolled Agents do not provide legal representation; signed Power of Attorney required.

- However, if you file a paper tax return, you’ll calculate your alternative minimum taxable income and your AMT, if applicable, on IRS Form 6251.

- You may have to pay some AMT if your adjusted gross income is greater than the AMT exemption amount for your filing status.

- The difference between the exercise price of the ISO shares and the trading price on the exercise date was $50,000.

- When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator.

- Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.

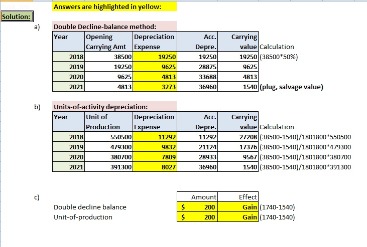

They’ll owe the regular tax amount of $5,979. So, the new law benefits this couple. Unfortunately, the Tax Cuts and Jobs Act retains the individual AMT.Compare the Tentative Minimum Tax to your regular tax to see how close you were to paying the AMT. The Alternative Minimum Tax was designed to keep wealthy taxpayers from using loopholes to avoid paying taxes. But because it was not automatically updated for inflation, more middle-class taxpayers were getting hit with the AMT each year. Congress traditionally passed an annual “patch” to address this until, in January 2013, they passed a permanent patch to the AMT. The child tax credit totals at $2,000 per qualifying child and is not adjusted for inflation.

What Tax Breaks Do You Lose Under The Amt?

Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. These and other changes made by the TCJA are in place temporarily through 2025, and truthfully, had the effect of greatly reducing the number of taxpayers who pay AMT. According to IRS statistics, the number of taxpayers who paid AMT dropped from over 5 million in 2017 to under 250,000 in 2018.Emerald Card Retail Reload Providers may charge a convenience fee. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank®. For a full schedule of Emerald Card fees, see your Cardholder Agreement.. Available at participating offices and if your employer participate in the W-2 Early AccessSM program.To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account?A solution for reducing this risk is obtaining an advance from the ESO Fund to cover the entire cost of exercising your stock options, including the tax. You retain unlimited upside potential without risking any of your personal capital. The Alternative Minimum Tax can apply to current and former employees of privately held companies when they exercise their incentive stock options if the fair market value is higher than the exercise price. The AMT tax can have a significant cash impact on those who exercise their ISOs. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. Thanks to another tax law change (the 2019 “SECURE” Act), children who are subject to the “According to IRS statistics” use the same AMT exemption as other taxpayers.

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. Certain items in Line 2 of the Form 6251 are simply not deductible for AMT purposes, such as taxes, home equity mortgage interest and miscellaneous deductions. Those that are considered exclusion items. Will not provide a tax credit for AMT. Your basis in this stock is now $300 ($3 x 100) for regular tax purposes, but $3,300 ($33 x 100) for AMT purposes. When you later sell the stock, you will have an entry on Line 18, Disposition of Property Difference, to account for the difference in your tax basis for regular and AMT purposes.

Will You Have To Pay The Amt?

Gradually, as inflation caused incomes to rise, the middle class started to get hit with this tax. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. State e-file not available in NH. E-file fees do not apply to NY state returns. Terms and conditions apply; seeAccurate Calculations Guaranteefor details.Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. Obviously, there’s no way to know for sure if you’ll be affected by the AMT in 2018 and 2019 until you get your year-end income total and file your tax return. The alternative minimum tax, or AMT, was implemented in 1969 to ensure that all Americans pay their fair share of taxes — particularly high-income individuals with a lot of tax deductions. Under the tax law, certain tax benefits can significantly reduce a taxpayer’s regular tax amount. The alternative minimum tax applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

Beware Of These Amt Triggers

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. After you subtract the exemption amount from AMTI, the remaining income will be subject to the AMT rate.

Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

Turbotax Online

Now you calculate the Tentative Minimum Tax . You compare this figure to the tax you calculated under the regular tax system on Form 1040.Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.

Credit Resources

The tax rates will either be a flat rate of 26% or 28%, depending on the income level. With the exception of married filing separately taxpayers, the rates below apply for all taxpayers subject to AMT.If you’re close to the AMT thresholds, you can use IRS Form 6251 to see if you’re at risk. You can also run your own projections using tax preparation software or hire a tax professional to calculate it for you. Exercising stock options.Normally, exercising qualified employee stock options to buy stock at a discounted price isn’t a taxable event until you sell the shares for a profit. The AMT, however, creates a paper profit that’s taxable even though you won’t receive the actual profit until you sell the shares. In general, start by calculating your ordinary taxable income using IRS Form 1040. Then, on IRS Form 6251, add back some types of income and drop certain deductions. Starting price for simple federal return.For both individuals and corporations, taxable income differs from—and is less than—gross income. A tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. On a yearly basis the IRS adjusts more than 40 tax provisions for inflation. Originally, the AMT was intended to crack down on wealthy people who weren’t paying any income taxes.Any amount of income over the applicable AMT exemption amount may be taxed at the AMT rates. You can use nonrefundable credits to decrease the AMT that you owe. The alternative minimum tax was enacted back in 1969 to ensure that high-income individuals don’t take advantage of multiple tax breaks and avoid paying federal tax.