Content

- Expenses Section Identifies Functional Areas

- Accountingtools

- Bookkeeping: Nonprofit Financial Statements

- Segregates Financial Activity

- How To Read Your Nonprofit Statement Of Activities Report

- Recommended Soa Internal Report Format

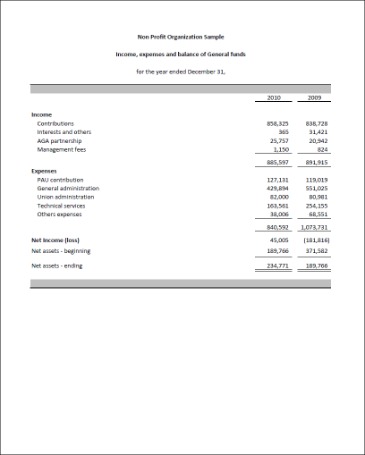

These statements are essential because after starting your nonprofit, you will need some of the information for ongoing financial compliance. Some states require these statements to be attached to Form 990, so be sure to check your local requirements.This article explores some key differences in accounting for nonprofit organizations and for-profit businesses. Expenses are reported in categories that identify specific functional areas, such as mission based programs, and support services including management and general and fundraising. The revenue section contains a breakdown of the major sources of revenue, such as contributions, program fees, membership dues, grants, investment income, and amounts released from donor restrictions. A for-profit company’s balance sheet takes a snapshot of the company’s assets and liabilities .

Expenses Section Identifies Functional Areas

The year-to-date total from the accounting software is provided as well as a calculation of the percent of the budget represented by the year-to-date totals. The annual budget as approved by the board is shown as well as a year-end forecast in lieu of frequent budget revisions. The forecast column is equal to the budget column at the beginning of the year and it is updated monthly to reflect anticipated changes from the original budget. Variances between the approved budget and the year-end forecast are shown both in dollar amounts and in percentages, and significant variances are noted and explained.

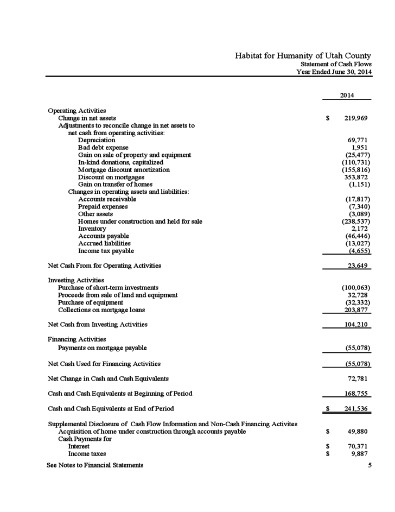

- When this total amount is added to the cash balance at the beginning of the reporting period, you will end up with the current cash balance, which will match the amount listed on the Statement of Financial Position.

- By focusing on net assets without restrictions, organizations are given the most accurate and relevant picture of the net assets available for use.

- The release shows as a negative number on the “Released to Unrestricted” line and is added as a positive number within the natural income category, for instance foundations or government grants.

- Misalignment between budget and accounting line items necessitates tedious regrouping of numbers for budget comparison reports and can lead to over-spending of accounting line items not represented in the budgeting process.

- The annual budget as approved by the board is shown as well as a year-end forecast in lieu of frequent budget revisions.

- When the award letter is received, FAN records the full $60,000 as grant income With Donor Restrictions on the income statement.

For certain not-for-profits like churches and schools, cash balances are often much lower in the summer than in December and January, and cash needs should be considered. Permanently restricted assets are those that the donor gives with the stipulation that the assets can never be used up. The organization could put the funds in a savings account never to be spent, but they could use the interest the account earns. Joseph Scarano is the CEO of Araize, Inc., developers of cloud-based FastFund Online Nonprofit accounting, fundraising and payroll software solutions to help your nonprofit become more transparent, accountable and sustainable. Whether non-profit or for-profit, the impact of inaccurate or late financial information can have a devastating effect on the organization’s long-term financial health.The financial statements to be reviewed by management and the board should include comparisons to budget and prior periods when applicable. These internal reports used for management of the organization and fiscal oversight by the board may look different than those that are used for external purposes.

Accountingtools

Additionally, a balance sheet will show what is called owner’s equity (also known as stockholder’s or shareholder’s equity). When you subtract the company’s liabilities from its assets, you are left with owner’s equity. The owner’s equity represents a company’s net worth and is a very important variable for shareholders, current investors, and potential investors. For example, when comparing the major financial statements of a for-profit to a non-profit organization, you’ll notice that even though both are reports of financial value, they differ in title and motivation.Accounting rules require a nonprofit to record all the income of a multi-year grant in the year it is received. Accurate accounting is especially important for contributions and grants with donor restrictions that are intended for use over a multi-year period.

What type of accounting do nonprofits follow?

That’s why nonprofits employ a type of accounting known as fund accounting. Fund accounting enables nonprofits to allocate their money into different groups or “funds” in order to keep them organized and only spend funds on what they’re designated for.In this webinar an HR technology expert delivers a demonstration of our updated Paycheck Protection Program Loan Forgiveness Estimator tool and shows other resources we have available to help you maximize your relief options. If the interest is stipulated by the donor to be used for a specific purpose, such as building maintenance, the interest would be classified as temporarily restricted until used. Understanding your finances and resources is extremely important to a nonprofit, because it provides insight as to whether or not you have the required resources to fulfill your mission. Today we are going to examine and learn how to understand your Statement of Activities, or Statement of Income and Expenses. Non-profit and for-profit businesses have many similarities, but they also differ in specific areas.Similar to equity, the net assets section denotes the “value” of the nonprofit. This value, however, is further divided on the Statement of Financial Position into restrictions – either temporarily restricted, permanently restricted, and unrestricted net assets. These classifications are used to segregate funding based on any restriction imposed by each donor as to how the funds can be spent. For example, if an individual donates money to a nonprofit organization and limits how the organization can use the funds, that money is considered restricted solely for that purpose. Depending on the nature of the donor-imposed restriction, these funds may be permanently restricted or temporarily restricted . On the other hand, if an individual donates money to an organization but never specifies on what or how the organization can use the funds, these funds have no restrictions and are therefore classified as “unrestricted”.

Bookkeeping: Nonprofit Financial Statements

At GrowthForce, we specialize in helping for-profit and non-profit organizations keep their finger on the financial pulse, so they can focus on what really matters – achieving their greatest potential. You will note that this report does not include the activity for the current month alone or a current month budget. This level of detail would be more appropriate for management and finance committee members to examine, but it encourages unproductive discussion at full board meetings. Organizations should also consider revising their chart of accounts to easily identify natural expenses. For example, when we talked about assets we mentioned cash, but where is this cash coming from? You will look at these donations even further to determine which ones have restrictions and which ones do not. Things like accounts payable will go under current liabilities because this is what you owe in the near future, or within one year.

First, restrictions are imposed by the donor when they make the gift or grant. Second, income must be recognized, or recorded in the accounting records, in the year that an unconditional commitment for the funds is received, regardless of when the related expenses will occur. These principles add a complexity to nonprofit financial reports due to the timing of funding, which makes accurate and reliable accounting especially important. The following examples – an income statement and balance sheet for the fictional nonprofit Family Advocacy Network – illustrate how these rules work. It is important to note when reviewing financial statements that some smaller nonprofit organizations, especially those not using a fund accounting system, may produce financial statements with the term “fund balance” instead of “net assets”. They may also fail to properly disclose the “fund balance” by restriction; however, this is usually corrected on the audited financial statements prepared by the external auditing firm.

Segregates Financial Activity

By focusing on net assets without restrictions, organizations are given the most accurate and relevant picture of the net assets available for use. For analysis, planning, and decision-making, it is important for an organization to understand what part of their net asset position is without restriction.

Which of the following is an example of a non-cash activity?

Understanding Non-Cash Items Examples of non-cash items include deferred income tax, write-downs in the value of acquired companies, employee stock-based compensation, as well as depreciation and amortization.The final and last section is the supplemental information which presents cash paid for income taxes and interest and the non-cash transactions. The statement of functional expenses is only used by nonprofit organizations based on the importance of monitoring expenditures. In general, this statement breaks down organizational expenses into common categories.Research time may be needed to properly allocate items such as employee time between program and supporting activities. Inconsistencies in allocation methods should be identified, and a line-by-line analysis of accounts may be needed.Page 2 of the Form reports on the mission and programs of the Organization for the year. In analyses where budgets or forecasts are used, the planning data most often originates from in-house Excel spreadsheet models or from professional corporate performance management (CPM/EPM) solutions. Expenses reported in categories such as major programs, fundraising, and management and general. Net assets beginning balances in each category of UR, TR, and PR are increased by each year’s surplus and decreased by each year’s deficit. Consider recasting prior-year financial information under the current-year standards to identify missing or potentially problematic areas. While this can be particularly challenging for smaller organizations with limited staff, the following considerations and best practices can help ease implementation for these organizations and the CPAs working with them.

The important thing to note with net assets is that all of these items aren’t listed line by line. Net assets considers where this item is coming from, and how it is being used by breaking the assets down into with and without donor restrictions. The net assets section is essentially residual assets from current and previous years of operations. For example, cash, investments, fixed assets, prepaid expenses, and accounts receivable all hold value. So we already have numbers on the left side of the balance sheet from your assets like cash and grants, but so far on the right side, we have only listed what you owe .This statement shows what your company owns and what it owes at a specific date. The IRS does ask for this information when you are registering your organization, as well as when filling out your 990, so it is best to have it updated before you do your annual 990. A statement of activities quantifies the revenue and expenses of a nonprofit entity for a reporting period. This is the nonprofit version of the income statement that is used to report the financial results of a for-profit business.

Recommended Soa Internal Report Format

This statement is in lieu of the Income Statement that is used by for-profit companies, and it reports the change in permanently restricted, temporarily restricted, and unrestricted net assets. As shown below, this is accomplished by listing each net asset fund in a separate column.A nonprofit’s statement of activities is issued instead of the income statement which is issued by a for-profit business. Some organizations find it more useful for internal purposes to record revenue that has been released from restriction in its natural income category. The release shows as a negative number on the “Released to Unrestricted” line and is added as a positive number within the natural income category, for instance foundations or government grants.