Content

- Bond Example

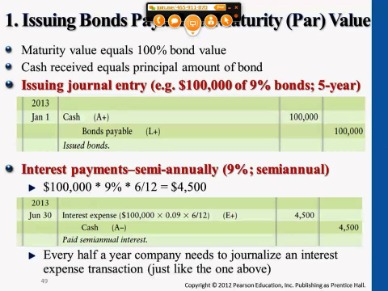

- Bonds Payable

- What Is A Bond?

- What Does Discount On Bonds Payable Mean?

- Calculation Of Interest Expense, Interest Payment And Amortization

- How Do Bonds Work?

Investors who want a higher coupon rate will have to pay extra for the bond in order to entice the original owner to sell. The increased price will bring the bond’s total yield down to 4% for new investors because they will have to pay an amount above par value to purchase the bond. Likewise, if interest rates soared to 15%, then an investor could make $150 from the government bond and would not pay $1,000 to earn just $100. This bond would be sold until it reached a price that equalized the yields, in this case to a price of $666.67. Convertible bonds are debt instruments with an embedded option that allows bondholders to convert their debt into stock at some point, depending on certain conditions like the share price. For example, imagine a company that needs to borrow $1 million to fund a new project.As long as nothing else changes in the interest rate environment, the price of the bond should remain at its par value. The price of a bond changes in response to changes in interest rates in the economy.The interest expense on bonds issued at premium equals the product of the carrying amount of the bonds payable and the market interest rate. The premium account balance represents the difference between the cash received and the principal amount of the bonds. The premium account balance of $1,246 is amortized against interest expense over the twenty interest periods. Unlike the discount that results in additional interest expense when it is amortized, the amortization of premium decreases interest expense. The total interest expense on these bonds will be $10,754 rather than the $12,000 that will be paid in cash. However, if interest rates begin to decline and similar bonds are now issued with a 4% coupon, the original bond has become more valuable.Bonds represent an obligation to repay a principal amount at a future date and pay interest, usually on a semi‐annual basis. Unlike notes payable, which normally represent an amount owed to one lender, a large number of bonds are normally issued at the same time to different lenders. These lenders, also known as investors, may sell their bonds to another investor prior to their maturity. Bonds are a type of security sold by governments and corporations, as a way of raising money from investors. From the seller’s perspective, selling bonds is therefore a way of borrowing money. From the buyer’s perspective, buying bonds is a form of investment because it entitles the purchaser to guaranteed repayment of principal as well as a stream of interest payments. Some types of bonds also offer other benefits, such as the ability to convert the bond into shares in the issuing company’s stock.

Bond Example

The three distinctions are largely arbitrary, based on how far in the future each debt will mature. The same general concept is true when determining whether a debt is a bond or a note payable. Bonds derive their value primarily from two promises made by the borrower to the lender or bondholder. Bonds that can be exchanged for a fixed number of shares of the company’s common stock. In most cases, it is the investor’s decision to convert the bonds to stock, although certain types of convertible bonds allow the issuing company to determine if and when bonds are converted. Bonds that require the issuer to set aside a pool of assets used only to repay the bonds at maturity.However, imagine a little while later, that the economy has taken a turn for the worse and interest rates dropped to 5%. Now, the investor can only receive $50 from the government bond, but would still receive $100 from the corporate bond. The bottom line is that notes payable and bonds are, for all practical purposes, essentially the same thing.

Are bonds assets or liabilities for banks?

Government bonds are low-risk because the government is virtually certain to pay off the bond, albeit at a low rate of interest. These bonds are an asset for banks in the same way that loans are an asset: The bank will receive a stream of payments in the future.For example, most bonds are structured so that the company pays back the entire balance of the debt at one point in the future — that is, on its maturity date. The company will pay its interest expense periodically over time, typically monthly. In October 20X2, Company P initiated issue of 1,000 5-year $100-par bonds paying a 10% annual coupon. By the time the bonds were ready for issue on 1 January 20X3, the market rate dropped to 8%. Having a registered bond allows the owner to automatically receive the interest payments when they are made.

Bonds Payable

Purchasing one of these allows investors to earn a rate of return and then receive their money back when the term has expired. Businesses can go about raising funds for various enterprises in a number of ways. Two methods are borrowing the money in the form of a loan or through the issuance of bonds. When accounting for these borrowed funds, businesses use a bonds payable or a notes payable account to keep track of the repayment.

- These two types of debt are very similar, but there are important differences.

- From the seller’s perspective, selling bonds is therefore a way of borrowing money.

- These bonds have a higher risk of default in the future and investors demand a higher coupon payment to compensate them for that risk.

- For example, zero-coupon bonds do not pay interest payments during the term of the bond.

- A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments.

These bonds reduce the risk that the company will not have enough cash to repay the bonds at maturity. While governments issue many bonds, corporate bonds can be purchased from brokerages. You can take a look at Investopedia’s list of the best online stock brokers to get an idea of which brokers best fit your needs. We can also measure the anticipated changes in bond prices given a change in interest rates with a measure known as the duration of a bond. Duration is expressed in units of the number of years since it originally referred to zero-coupon bonds, whose duration is its maturity. A puttable bond allows the bondholders to put or sell the bond back to the company before it has matured.

What Is A Bond?

These bonds have a higher risk of default in the future and investors demand a higher coupon payment to compensate them for that risk. Most bonds can be sold by the initial bondholder to other investors after they have been issued.

They could borrow by issuing bonds with a 12% coupon that matures in 10 years. Two features of a bond—credit quality and time to maturity—are the principal determinants of a bond’s coupon rate. If the issuer has a poor credit rating, the risk of default is greater, and these bonds pay more interest. Bonds that have a very long maturity date also usually pay a higher interest rate. This higher compensation is because the bondholder is more exposed to interest rate and inflation risks for an extended period. A bond is a fixed-income instrument that represents a loan made by an investor to a borrower .

What Does Discount On Bonds Payable Mean?

Amortization of the discount may be done using the straight‐line or the effective interest method. Currently, generally accepted accounting principles require use of the effective interest method of amortization unless the results under the two methods are not significantly different. If the amounts of interest expense are similar under the two methods, the straight‐line method may be used.On maturity, the book or carrying value will be equal to the face value of the bond. Both of these statements are true, regardless of whether issuance was at a premium, discount, or at par. This would be fine except that the bond market fluctuates everyday just like the stock market.Instead, duration describes how much a bond’s price will rise or fall with a change in interest rates. Bonds that are not considered investment grade, but are not in default, are called “high yield” or “junk” bonds.The yield-to-maturity of a bond is another way of considering a bond’s price. YTM is the total return anticipated on a bond if the bond is held until the end of its lifetime. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. In other words, it is the internal rate of return of an investment in a bond if the investor holds the bond until maturity and if all payments are made as scheduled.A bond could be thought of as an I.O.U. between the lender and borrower that includes the details of the loan and its payments. Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. An analyst or accountant can also create an amortization schedule for the bonds payable. This schedule will lay out the premium or discount, and show changes to it every period coupon payments are due.

What Are Bonds Payable?

The duration can be calculated to determine the price sensitivity to interest rate changes of a single bond, or for a portfolio of many bonds. In general, bonds with long maturities, and also bonds with low coupons have the greatest sensitivity to interest rate changes. A bond’s duration is not a linear risk measure, meaning that as prices and rates change, the duration itself changes, and convexity measures this relationship. Up to this point, we’ve talked about bonds as if every investor holds them to maturity. It’s true that if you do this you’re guaranteed to get your principal back plus interest; however, a bond does not have to be held to maturity. At any time, a bondholder can sell their bonds in the open market, where the price can fluctuate, sometimes dramatically. A bond’s price changes on a daily basis, just like that of any other publicly traded security, where supply and demand in any given moment determine that observed price.