Content

- Principle 13: Cost Constraint Principle

- Generally Accepted Accounting Principles Gaap

- Principle 12: Consistency Principle

- What Are The Generally Accepted Accounting Principles?

- The Qualities Of Gaap

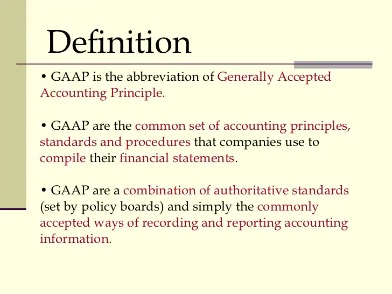

GAAP is important because it helps maintain trust in the financial markets. If not for GAAP, investors would be more reluctant to trust the information presented to them by companies because they would have less confidence in its integrity. Without that trust, we might see fewer transactions, potentially leading to higher transaction costs and a less robust economy. GAAP also helps investors analyze companies by making it easier to perform “apples to apples” comparisons between one company and another.GAAP aims to improve the clarity, consistency, and comparability of the communication of financial information. Generally Accepted Accounting Principles (GAAP or U.S. GAAP, pronounced like “gap”) is the accounting standard adopted by the U.S. While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards , the latter differ considerably from GAAP and progress has been slow and uncertain. More recently, the SEC has acknowledged that there is no longer a push to move more U.S companies to IFRS so the two sets of standards will “continue to coexist” for the foreseeable future. Accounting ProcedureThe accounting procedure is the process of standardized nature that performs a specific accounting function designed to incorporate better risk management policies to complete these functions efficiently.Investors and citizens trust financial statements that follow GAAP and use this information to assess the financial condition and determine how well an organization or government manages its resources. The Board issues a final standard and provides implementation guidance to preparers, auditors, and users of financial statements on the new standard. While non-GAAP reports may show more accurate figures for companies that experienced unusual one-time transactions, other businesses often list repeated earnings as one-time figures. Even though they appear transparent, non-GAAP figures can create confusion for investors and regulators. Many businesses believe that GAAP accounting does not accurately reflect their company’s success. Some companies include non-GAAP earnings in addition to those that follow GAAP methods. Because GAAP standards deliver transparency and continuity, they enable investors and stakeholders to make sound, evidence-based decisions.

GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission . Two laws, the Securities Act of 1933 and the Securities Exchange Act of 1934, give the SEC authority to establish reporting and disclosure requirements. However, the SEC usually operates in an oversight capacity, allowing the FASB and the Governmental Accounting Standards Board to establish these requirements.

Principle 13: Cost Constraint Principle

The focus of this principle is that there should be a consistency in the procedures used in financial reporting. If accountants are unsure about how to report an item, conservatism principle calls for potential expenses and liabilities to be recognized immediately. It directs the accountant to anticipate the losses and choose the alternative that will result in less net income and/or less asset amount. While the overall GAAP is specified by the Financial Accounting Standards Board, the Governmental Accounting Standards Board specifies GAAP for state and local government. Compliance with GAAP as well as SEC is required by publicly traded companies. The Generally Accepted Accounting Principles are a set of rules, guidelines and principles companies of all sizes and across industries in the U.S. adhere to. In the U.S., it has been established by the Financial Accounting Standards Board and the American Institute of Certified Public Accountants .According to the objectivity principle, GAAP-compliant financial statements provided by your accountant must be based on objective evidence. Most businesses exist for long periods of time, so artificial time periods must be used to report the results of business activity. Depending on the type of report, the time period may be a day, a month, a year, or another arbitrary period. Using artificial time periods leads to questions about when certain transactions should be recorded. For example, how should an accountant report the cost of equipment expected to last five years?

Is GAAP used in Canada?

Generally Accepted Accounting Principles (GAAP) of Canada provided the framework of broad guidelines, conventions, rules and procedures of accounting. … For publicly accountable enterprises, IFRS became mandatory in Canada for fiscal periods beginning after January 1, 2011.According to accounting historian Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants . Federal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, laws enforced by the U.S. Today, the Financial Accounting Standards Board , an independent authority, continually monitors and updates GAAP. This refers to emphasizing fact-based financial data representation that is not clouded by speculation. The accountant strives to provide an accurate and impartial depiction of a company’s financial situation.

Generally Accepted Accounting Principles Gaap

While each financial reporting framework aims to provide uniform procedures and principles to accountants, there are notable differences between them. Since the U.S. does not fully comply with IFRS, global companies face challenges when creating financial statements. Even though the FASB and IASB created the Norwalk Agreement in 2002, which promised to merge their unique set of accounting standards, they have made minimal progress. In an effort to move towards unification, the FASB aids in the development of IFRS. The GASB was established in 1984 as a policy board charged with creating GAAP for state and local government organizations.

However, there are certain GAAP disadvantages that cannot be overlooked. For small businesses, following all the stated principles becomes a challenging task. Moreover, as the companies go global, they need to switch from Generally Accepted Accounting Principles to International Financial Reporting Standards since the former is applicable only in the US. Financial AccountingFinancial accounting refers to bookkeeping, i.e., identifying, classifying, summarizing and recording all the financial transactions in the Income Statement, Balance Sheet and Cash Flow Statement.

Principle 12: Consistency Principle

Financial statements normally provide information about a company’s past performance. However, pending lawsuits, incomplete transactions, or other conditions may have imminent and significant effects on the company’s financial status.Financial InformationFinancial Information refers to the summarized data of monetary transactions that is helpful to investors in understanding company’s profitability, their assets, and growth prospects. Financial Data about individuals like past Months Bank Statement, Tax return receipts helps banks to understand customer’s credit quality, repayment capacity etc. Understand how a company recognizes/reports revenues, expenses, assets, liabilities, etc.

- Revenue recognition principle holds that companies should record revenue when earned but not when received.

- Even in a sole proprietorship, where your business activity appears on your personal tax return, the business entity assumption still applies.

- Accounting ProcedureThe accounting procedure is the process of standardized nature that performs a specific accounting function designed to incorporate better risk management policies to complete these functions efficiently.

- According to the cost constraint principle, the cost of reporting financial information should be less than the benefit derived from that financial information.

- It also includes relevant Securities and Exchange Commission , guidance that follows the same topical structure in separate sections in the Codification.

If you want more details, your accountant will be a valuable resource for you. Accounting, you owe it to yourself — and your employees, customers, and investors — to understand the basics of GAAP accounting. This principle states presupposes that the parties remain honest in transactions. For example, potential lawsuits may be regarded as losses and are reported but potential gains from other sources are not. A master’s in accounting opens the door to in-demand, lucrative careers. Explore our list of the best accounting master’s degree programs for 2021. To ensure the boards operate responsibly and fulfill their obligations, they fall under the supervision of the Financial Accounting Foundation.

What Are The Generally Accepted Accounting Principles?

Companies can use this information to their advantage and present totals that predict how their businesses will perform in the future. Even though the U.S. federal government requires public companies to abide by GAAP, the government takes no part in developing these principles. Instead, independent boards assume the responsibility of creating, maintaining, and updating accounting principles. The Great Depression in 1929, a financial catastrophe that caused years of hardship for millions of Americans, was primarily attributed to faulty and manipulative reporting practices among businesses.GAAP is the set of accounting principles set forth by the FASB that U.S. companies must follow when putting together financial statements. In the departure, the member must disclose, if practical, the reasons why compliance with the accounting principle would result in a misleading financial statement. GAAP standardizes the process of accounting and thus helps the company in self-analysis. These principles instruct the firms to disclose their financial statements to the shareholders. The uniformity further enables investors to interpret the organization’s financial health.The matching principle requires that businesses use the accrual basis of accounting and match business income to business expenses in a given time period. GAAP is a set of rules used for helping publicly-traded companies create their financial statements. These rules form the groundwork on which more comprehensive, complex, and legalistic accounting rules are based. High quality financial accounting and reporting standards promote better information in the marketplace. Transparent, relevant information helps investors and lenders make better decisions about where to put their money with confidence.Many groups rely on government financial statements, including constituents and lawmakers. The board’s processes and communications are available for public review. An accounting standard is a common set of principles, standards, and procedures that define the basis of financial accounting policies and practices. Revenue recognition principle holds that companies should record revenue when earned but not when received. The flow of cash does not have any bearing on the recognition of revenue.Some companies may report both GAAP and non-GAAP measures when reporting their financial results. GAAP regulations require that non-GAAP measures be identified in financial statements and other public disclosures, such as press releases. GAAP helps govern the world of accounting according to general rules and guidelines. It attempts to standardize and regulate the definitions, assumptions, and methods used in accounting across all industries.As GAAP issues or questions arise, these boards meet to discuss potential changes and additional standards. For instance, when the COVID-19 pandemic hit, the board members met to address how governments and businesses must report the financial effects of the pandemic. International Financial Reporting Standards are a set of accounting rules currently used by public companies in 166 jurisdictions. Companies trading on U.S. exchanges had to provide GAAP-compliant financial statements. In 1984 the FASB created the Emerging Issues Task Force which deals with new and unusual financial transactions that have the potential to become common (e.g. accounting for Internet-based companies). The Concepts statements still exist outside of the ASC but are not authoritative. On the contrary, the International Financial Reporting Standards are accounting guidelines recognized worldwide.She has worked in the private industry as an accountant for law firms and ITOCHU Corporation, an international conglomerate that manages over 20 subsidiaries and affiliates. Lizzette stays up to date on changes in the accounting industry through educational courses. With such a prominent difference in approach, dozens of other discrepancies surface throughout the standards.

Required Departures From Gaap

Accountants must use their judgment to record transactions that require estimation. The number of years that equipment will remain productive and the portion of accounts receivable that will never be paid are examples of items that require estimation. In reporting financial data, accountants follow the principle of conservatism, which requires that the less optimistic estimate be chosen when two estimates are judged to be equally likely. Unless the Engineering Department provides compelling evidence to support its estimate, the company’s accountant must follow the principle of conservatism and plan for a three‐percent return rate. Losses and costs—such as warranty repairs—are recorded when they are probable and reasonably estimated. To be useful, financial information must be relevant, reliable, and prepared in a consistent manner.